|

市场调查报告书

商品编码

1642121

电动工具电池:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Power Tool Batteries - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

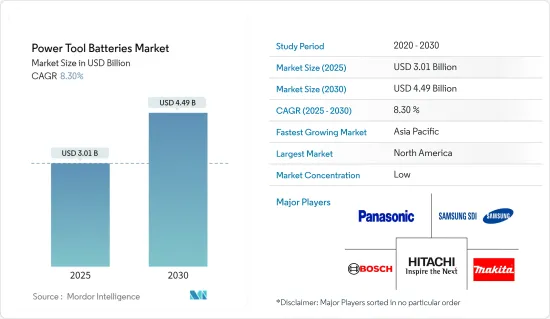

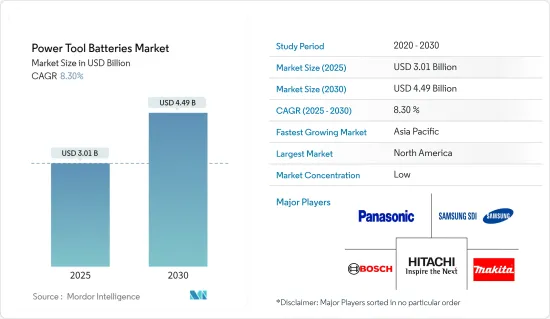

预计 2025 年电动工具电池市场规模为 30.1 亿美元,预计到 2030 年将达到 44.9 亿美元,预测期内(2025-2030 年)的复合年增长率为 8.3%。

主要亮点

- 从中期来看,预计电池供电电动工具的普及率提高以及汽车行业的快速增长等因素将在预测期内推动电动工具电池市场的发展。

- 然而,与无线电动工具设备相关的高成本可能会在预测期内抑制市场的成长。

- 然而,对紧固工具的需求不断增长以及能源和汽车领域的智慧互联电动工具的发展预计将为市场创造巨大的机会。

- 预计北美将主导市场,大部分需求来自美国和加拿大等国家。

电动工具电池市场趋势

锂离子电池可望占据市场主导地位

- 锂离子电池是电动工具中使用的先进电池解决方案。锂离子电池重量轻、能量密集且环保。预计建筑、汽车和工业等终端用户领域的需求不断增长将推动市场的发展。

- 此外,锂离子电池是可充电电池,具有安全电路,防止过热、易于使用、工作时间长、充电灵活等特性。锂离子电池通常用于可携式电子设备,并在无线电动工具中越来越普遍。

- 自推出以来,锂离子电池迅速成为电动工具的首选电池,取代了传统的镍镉 (Ni-Cd) 和镍氢 (Ni-MH) 电池。电池技术的进步也促进了无线电动工具的普及,这种工具采用高密度电池,一次充电可使用更长时间。

- 例如,2023年1月,博世电动工具宣布推出32款新型18V无线工具,这些工具将于2023年加入其CORE18V平台。该品牌的最新产品扩大了其 18V 工具的范围,并由 CORE18V 电池平台供电,为其最新创新提供动力。

- 此外,2022年经历了前所未有的价格飙升的电池价格今年一直呈下降趋势。根据彭博新能源财经(BNEF)的研究,锂离子电池组的成本已大幅下降14%,达到每度电(kWh)139美元的历史低点。

- 成本降低是由于电池价值链各个环节的生产能力提高,推动了原材料和零件价格的下降。需求成长低于产业预期也是此次价格调整的原因之一。

- 因此,鑑于上述情况,预计锂离子技术类型在预测期内将出现惊人的成长。

北美可望主导市场

- 北美地区是美国、加拿大和墨西哥紧密结合的市场,多年来已发展成为世界上最强大的经济体之一。包括美国和加拿大在内的北美继续成为电动工具电池市场研究和创新的先驱。

- 受电动车普及、家电支出增加以及消费者和製造业活动增加等因素推动,北美地区继续成为电动工具系统最大的消费地区之一。

- 包括美国和加拿大在内的北美是世界上最大的电动工具市场。预计电动工具的需求将来自建设产业。该地区的电动工具製造业预计也会强劲成长。

- 例如,2023 年 7 月,高品质专业工具和配件製造商 Makita 美国推出了三种电池供电的物料输送解决方案,以协助满足工作现场的运输需求。

- 预计建设产业将受到基础设施公共支出增加的推动,并受到住宅和非住宅领域持续积极成长的支持。

- 受全球资源长期扩张的推动,加拿大建设活动在过去十年经历了非凡的成长,目前已进入稳定阶段。除了石油、天然气和采矿等资源产业的发展之外,加拿大的建筑业也受益于对大型发电和输电以及其他关键基础设施的同步投资。这些投资共同帮助加拿大超越其他国家,成长为世界十大建筑市场之一。

- 因此,预计预测期内北美将成为电动工具电池市场的主导地区。

电动工具电池产业概况

电动工具电池市场比较分散。主要企业(不分先后顺序)包括博世有限公司、日立有限公司、牧田株式会社、松下株式会社和三星SDI。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 2029 年市场规模与需求预测(美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 电池供电的电动工具的采用率不断提高

- 蓬勃发展的汽车产业

- 限制因素

- 无线电动工具高成本

- 驱动程式

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 依技术类型

- 锂离子

- 镍镉

- 其他技术类型

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 智利

- 南美洲其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 卡达

- 南非

- 埃及

- 其他中东和非洲地区

- 北美洲

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Bosch Ltd

- Hitachi Ltd

- Makita Corporation

- Panasonic Corporation

- Ryobi Limited

- Samsung SDI Co. Ltd

- Sony Group Corporation

- Stanley Black & Decker Inc.

- Techtronic Industries Company Limited

- Hilti Corporation

- Market Ranking/Share(%)Analysis

第七章 市场机会与未来趋势

- 能源和汽车产业对紧固工具的需求不断增加

简介目录

Product Code: 66741

The Power Tool Batteries Market size is estimated at USD 3.01 billion in 2025, and is expected to reach USD 4.49 billion by 2030, at a CAGR of 8.3% during the forecast period (2025-2030).

Key Highlights

- Over the medium term factors such as the increasing adoption of battery-powered power tools and the rapidly growing automotive industry are expected to drive the power tool batteries market during the forecast period.

- On the other hand, the high cost associated with cordless power tool equipment is likely to restrain the growth of the market during the forecast period.

- Nevertheless, the rising demand for fastening tools and the evolution of smart and connected power tools in the energy and automotive sectors are expected to provide immense opportunities for the market.

- North America is expected to dominate the market, with the majority of the demand coming from countries like the United States, Canada, etc.

Power Tool Battery Market Trends

The Lithium-ion Type is Expected to Dominate the Market

- Lithium-ion batteries are the advanced battery solutions used in power tools. Li-ion batteries are lightweight, have high energy density, and are environment-friendly. The increasing demand from end-user sectors like construction, automotive, and industrial is expected to drive the market.

- Moreover, Li-ion batteries are rechargeable batteries equipped with safety circuits to protect them from overheating, ease of use, longer run times, flexible charging, etc. Lithium-ion batteries are commonly used for portable electronic applications, and cordless power tools have been growing in prominence.

- Lithium-ion batteries, since their introduction, have quickly replaced conventional nickel-cadmium (Ni-Cd) and nickel-metal hydride (Ni-MH) as a power source for power tools. Advancements in battery technologies are also contributing to the increasing adoption of cordless power tools with high-density batteries that can last longer once charged.

- For instance, in January 2023, Bosch Power Tools announced the launch of 32 new 18V Cordless tools to join the CORE18V platform in 2023. The brand's latest offerings expand the 18V line of tools, and the CORE18V battery platform powers the newest innovations.

- Furthermore, after experiencing unprecedented price surges in 2022, battery prices are witnessing a decline in the current year. According to research conducted by BloombergNEF (BNEF), the cost of lithium-ion battery packs has notably decreased by 14%, reaching a historic low of USD 139 per kilowatt-hour (kWh).

- This reduction is attributed to the fall in raw material and component prices, facilitated by an increase in production capacity across various segments of the battery value chain. The observed decline in demand growth, which did not meet certain industry expectations, has also contributed to this price adjustment.

- Therefore, owing to the above points, the lithium-ion technology type is expected to witness dominant growth during the forecast period.

North America is Expected to Dominate the Market

- Over the years, the North American region has emerged as one of the strongest economies in the world, with the United States, Canada, and Mexico being tightly integrated markets. North America, including the United States and Canada, remains a pioneer in the research and innovation in the power tool batteries market.

- The North American region also remains one of the largest consumers of power tool systems due to factors such as increased electric vehicle deployment, increased spending on consumer electronics, and increased consumer and manufacturing activities.

- North America, including the United States and Canada, is the world's largest market for electric power tools. Demand for power tools is expected from the construction industry. The manufacturing industry for power tools in the region is also expected to grow significantly.

- For instance, in July 2023, Makita U.S.A., Inc., a manufacturer of high-quality professional tools and accessories, released three new battery-powered material handling solutions to assist with transportation needs on the job site.

- An increase in public spending on infrastructure is expected to be a significant driver, supported by continued positive growth in the residential and non-residential sectors in the construction industry.

- Construction activity in Canada continues to level off, following the last ten years of extraordinary growth driven by a protracted global resource expansion. In addition to the resource-sector development in oil and gas and mining, Canada's construction sector benefited from coinciding investments in mega electric power generation and transmission and other significant infrastructure. These combined investments propelled growth well ahead of other countries, elevating Canada to one of the top 10 construction markets in the world.

- Therefore, North America is expected to be the dominant region in the power tool batteries market during the forecast period, supported by increasing adoption in numerous end-user applications.

Power Tool Battery Industry Overview

The power tool batteries market is fragmented. Some of the major companies (in no particular order) are Bosch Ltd, Hitachi Ltd, Makita Corporation, Panasonic Corporation, and Samsung SDI Co. Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Adoption Of Battery-Powered Power Tools

- 4.5.1.2 Rapidly Growing Automotive Industry

- 4.5.2 Restraints

- 4.5.2.1 High Cost Associated With Cordless Power Tool Equipment

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Technology Type

- 5.1.1 Lithium-ion

- 5.1.2 Nickel-cadmium

- 5.1.3 Other Technology Types

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 France

- 5.2.2.3 United Kingdom

- 5.2.2.4 Italy

- 5.2.2.5 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Japan

- 5.2.3.4 Australia

- 5.2.3.5 Rest of Asia Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Chile

- 5.2.4.4 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 United Arab Emirates

- 5.2.5.2 Saudi Arabia

- 5.2.5.3 Qatar

- 5.2.5.4 South Africa

- 5.2.5.5 Egypt

- 5.2.5.6 Rest of Middle East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Bosch Ltd

- 6.3.2 Hitachi Ltd

- 6.3.3 Makita Corporation

- 6.3.4 Panasonic Corporation

- 6.3.5 Ryobi Limited

- 6.3.6 Samsung SDI Co. Ltd

- 6.3.7 Sony Group Corporation

- 6.3.8 Stanley Black & Decker Inc.

- 6.3.9 Techtronic Industries Company Limited

- 6.3.10 Hilti Corporation

- 6.4 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Demand For Fastening Tools In The Energy And Automotive Sectors

02-2729-4219

+886-2-2729-4219