|

市场调查报告书

商品编码

1642124

印度容器玻璃:市场占有率分析、行业趋势和成长预测(2025-2030 年)India Container Glass - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

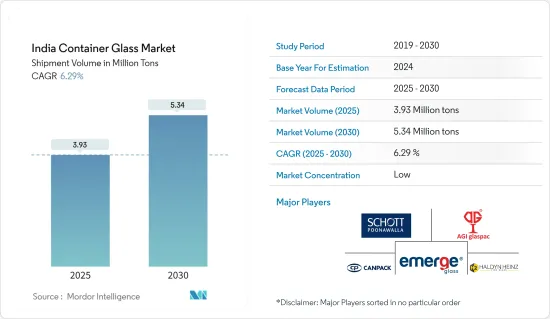

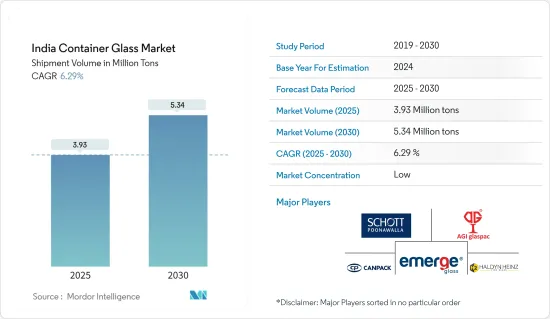

以出货量为准,印度容器玻璃市场规模预计将从 2025 年的 393 万吨增长到 2030 年的 534 万吨,预测期内(2025-2030 年)的复合年增长率为 6.29%。

关键亮点

- 由于酒精消费量的增加,印度的包装玻璃市场正在经历显着的成长。对玻璃容器依赖程度较高的白酒产业,直接影响市场的成长速度。

- 据加拿大农业和食品部称,印度的啤酒消费量正在上升。预计2022年啤酒消费量将达27.8亿公升,2026年将上升至36亿公升。深色玻璃瓶适合用来包装啤酒,因为它们可以保护啤酒免受紫外线造成的腐败。

- 印度软性饮料市场预计将保持强劲成长。根据百事印度公司瓶装合作伙伴 Varun Beverages Ltd 的报告,到 2021 年,印度人均年瓶装饮料消费量预计将达到 84 瓶左右,并在 2022 年进一步成长。百事公司致力于减少软性饮料的塑胶包装,到 2025 年将消除多达 670 亿个宝特瓶。收购 SodaStream 预计将导致该公司产品的玻璃瓶包装的使用增加。

- 印度和其他国家的塑胶禁令极大地促进了玻璃容器使用量的增加。作为塑胶容器的直接替代品,玻璃已成为领先的替代包装材料。儘管人均消费量较低,但由于当地饮料、酒精、食品、製药和化妆品行业的需求,市场正在经历强劲增长。

- 市场成长的主要障碍是玻璃生产产生的高二氧化碳排放。玻璃製造需要密集型过程,炉温范围为 1,300°C 至 1,650°C,火焰温度高达 2,000°C。此外,玻璃包装比纸盒包装重 12 倍。根据 Thinkstep 的一项研究,材料重量对从生产到零售分销的碳足迹有很大影响。

印度玻璃容器市场趋势

酒精饮料占了很大的市场占有率

- 葡萄酒和烈酒等酒精饮料通常储存在玻璃杯中。玻璃瓶是包装葡萄酒的最受欢迎的方式,尤其是彩色玻璃瓶,因为葡萄酒不应该暴露在阳光下。暴露在阳光下会导致葡萄酒变质。预测期内,葡萄酒消费量的增加预计将带动玻璃包装的需求。

- 过去十年来,印度的酒精消费量增加了一倍。市场有两个主要优先事项:扩大高端市场以增加人均消费量,以及扩大日常类别的渗透率。供应商注意到葡萄酒和烈酒行业的需求日益增长。例如,为帝亚吉欧、百加得和保乐力加等知名品牌提供产品的皮拉马尔玻璃公司 (Piramal Glass) 报告称,对快速週转烈酒专用瓶的需求有所增加。

- 印度是世界上成长最快的酒精饮料市场之一。此外,印度国际经济关係研究理事会 (ICRIER) 预测,未来 10 年,印度酒精消费成长的 70% 以上将由中低收入和高所得阶层推动,而且趋势产品的优质化趋势将持续下去。这种趋势正在变得更加强劲。

- 该领域也向外国投资开放,许多邦为国内生产提供补贴(例如马哈拉斯特拉邦和卡纳塔克邦为葡萄酒提供补贴)。在需求方面,快速的都市化、消费者偏好的变化以及购买力增强的中阶人口的增长都推动了对酒精饮料的需求不断增长。

- 此外,政府应致力于逐步降低关税和其他税费,印度企业应鼓励出口以改善贸易平衡。降低中间产品的关税可以增加印度的附加价值并增强国内製造业的潜力。

- 酒精饮料,尤其是高级酒精饮料,通常使用玻璃容器,因为玻璃美观、耐用,且具有惰性,能保持内容物的品质。随着出口量的增加,对于烈酒、葡萄酒和啤酒的高品质玻璃瓶的需求预计将增加,以满足国际标准和消费者偏好。

- 据印度农业和加工食品出口发展局(APEDA)称,2024 财年印度酒精饮料出口额将达 3.75 亿美元,高于上年度。

製药业正在快速成长

- 印度是世界领先的学名药供应国之一。随着出口的增加,符合国际标准的高品质玻璃包装的需求也日益增加。这促使製造商扩大生产以满足国内和全球市场的需求,从而推动玻璃容器市场的成长。

- 医疗产业的成长推动了研发的投资,特别是在永续、轻质和耐用的玻璃包装解决方案方面。这与医疗产业对于高效、安全包装的需求相吻合,推动了玻璃容器市场先进包装的发展。

- 根据印度品牌资产基金会统计,2023年印度医疗保健产业的市场规模约为3,720亿美元。与 2020 年相比,这是一个增长,表明增长显着。该行业是该国收入和就业最大的贡献者之一。

- 此外,印度已成为医疗旅游中心,透过多项具有里程碑意义的改革和规定,提供最先进、经济高效的治疗。印度是世界领先的低成本药品供应国之一。印度药品因其价格低廉、品质优良,受到全球青睐,堪称名副其实的「世界药局」。

- 医疗服务和製药业的扩张直接推动了对玻璃容器的需求,特别是用于包装药品、疫苗和医用管瓶的需求。玻璃通常用于这些应用,因为它不具有反应性,有助于保持药物的品质和效力,这对医疗行业至关重要。

印度玻璃容器产业概况

印度玻璃包装市场由几家主要企业组成。製造商包括 SCHOTT POONAWALLA PRIVATE LIMITED、AGI glaspac(HSIL 公司旗下一家公司)、CANPACK SA、Emerge Glass India Pvt Ltd。这些公司对市场动态有重大影响。为了保持竞争力,印度包装玻璃市场的供应商正在采取各种策略,包括业务扩张、併购和产品创新。

这些活动旨在加强我们在印度市场的地位,满足当地需求并适应当地监管和永续性要求。印度容器玻璃製造商也致力于提高生产能力和开发环保玻璃解决方案,以解决日益严重的环境问题。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 容器玻璃进出口资料

- PESTEL 分析 – 印度容器玻璃产业

- 包装玻璃容器行业标准及法规

- 包装玻璃的原料分析及材料考量

- 玻璃包装的永续性趋势

- 印度容器玻璃熔炉的产能和位置

第五章 市场动态

- 市场驱动因素

- 酒精消费量增加,玻璃瓶装饮料偏好

- 严格的监管促使印度采用玻璃作为永续替代品

- 市场问题

- 由于玻璃容器易碎且物流复杂,运输成本较高

- 印度亚太容器玻璃市场现况分析

- 贸易情景-印度容器玻璃产业进出口模式的历史与现况分析

第六章 市场细分

- 按最终用户产业

- 饮料

- 酒精饮料

- 啤酒和苹果酒

- 葡萄酒和烈酒

- 非酒精饮料

- 碳酸饮料

- 汁

- 水

- 乳类饮料

- 调味饮料

- 化妆品

- 药品

- 其他最终用户产业

- 饮料

第七章 竞争格局

- 公司简介

- SCHOTT POONAWALLA PRIVATE LIMITED

- AGI glaspac(A HSIL Company)

- CANPACK SA

- Emerge Glass India Pvt Ltd.

- Haldyn Heinz Fine Glass Pvt Ltd

- Hindustan National Glass & Industries Limited

- PGP Glass Private Limited

- Haldyn Glass Ltd

- Sunrise Glass Industries Pvt. Ltd.

- Ajanta Bottle Pvt. Ltd.

第八章 补充资料-印度主要玻璃容器工厂的主要窑炉供应商分析

第九章:未来市场展望

The India Container Glass Market size in terms of shipment volume is expected to grow from 3.93 million tons in 2025 to 5.34 million tons by 2030, at a CAGR of 6.29% during the forecast period (2025-2030).

Key Highlights

- The container glass market in India has experienced substantial growth due to increased alcohol consumption. The liquor industry, which heavily relies on glass containers, directly influences the market's growth rate.

- According to Agriculture and Agrifood Canada, beer consumption in India has been rising. In 2022, beer consumption reached 2.78 billion liters, with projections indicating an increase to 3.6 billion liters by 2026. Dark-colored glass bottles are preferred for beer packaging to protect contents from UV light spoilage.

- The Indian soft drink market is expected to maintain strong growth. Varun Beverages Ltd, PepsiCo India's bottling partner, reported that annual per-capita bottle consumption was anticipated to reach approximately 84 by 2021, with further increases in 2022. PepsiCo aims to reduce plastic packaging in its soft drinks, targeting a reduction of up to 67 billion plastic bottles by 2025. The company's acquisition of SodaStream is expected to increase the use of glass bottle packaging in its product offerings.

- Plastic bans in India and other countries have significantly contributed to increased glass container usage. As a direct substitute for plastic containers, glass has become a primary alternative packaging material. Despite low per capita consumption, the market is experiencing robust growth due to demand from local beverage, alcohol, food, pharmaceutical, and cosmetic industries.

- The main obstacle to market growth is the higher carbon footprint associated with glass production. Glass manufacturing requires an energy-intensive process with furnace temperatures ranging from 1,300°C to 1,650°C and flames up to 2,000°C. Additionally, glass packaging is 12 times heavier than carton-based alternatives. A Thinkstep study revealed that material weight significantly contributes to the carbon footprint from production to retail distribution.

India Glass Container Market Trends

Alcoholic Segment to Hold Significant Market Share

- Alcohol, such as wine and spirits, is usually stored in glass. The glass bottle is most favored in wine packaging, especially colored glass because wine should not be exposed to sunlight. If exposed to sunlight, the wine will get spoiled. The increasing consumption of wine is expected to spearhead the glass packaging demand during the forecast period.

- India's alcohol consumption has doubled over the past decade. The market is experiencing a dual focus: expansion of the premium segment and increased penetration of the routine category, both aimed at boosting per capita consumption. Vendors are noting a growing demand from the wine and spirits industry. For example, Piramal Glass, which supplies to major brands like Diageo, Bacardi, and Pernod Ricard, reports an uptick in demand for short-run specialty bottles for spirits.

- India is one of the fastest-growing alcoholic beverage markets globally. Moreover, ICRIER (Indian Council for Research on International Economic Relations) said that over 70% of the growth in alcoholic beverage consumption in India in the next decade would be driven by the lower middle and upper middle-income groups, and there is a growing trend toward product premiumization.

- The sector is open to foreign investments, and many states offer subsidies for local manufacturing (for example, Maharashtra and Karnataka for wines). From the demand side, factors such as rapid urbanization, changing consumer preferences, and a sizeable and growing middle-class population with increased purchasing power have contributed to the growth in demand for alcoholic beverages.

- In addition, the government should focus on phased tariffs and other duties reductions, and Indian companies should be encouraged to export to improve the trade balance. Duty reduction for intermediate products can enhance value addition in India and boost domestic manufacturing potential.

- Alcoholic beverages, particularly premium products, often use glass containers due to their aesthetic appeal, durability, and inert nature, which preserves the quality of the contents. As export volumes rise, demand for high-quality glass bottles for spirits, wines, and beers will likely increase to meet international standards and consumer preferences.

- According to the Agricultural and Processed Food Products Export Development Authority (APEDA), in financial year 2024, the export value of alcoholic beverages from India reached USD 375 million, marking an increase from the previous year.

Pharmaceutical Industry to Register Significant Growth

- India is one of the major suppliers of generic medicines worldwide. As exports increase, demand for high-quality glass packaging that meets international standards also rises. This stimulates growth in the glass container market, as manufacturers ramp up production to cater to both domestic and global markets.

- The healthcare sector's growth encourages investments in R&D, especially for more sustainable, lightweight, and durable glass packaging solutions. This aligns with the healthcare industry's need for efficient and safe packaging, promoting advancements in the glass container market.

- According to India Brand Equity Foundation, in 2023, India's healthcare sector was valued at roughly USD 372 billion. It was an increase in comparison to 2020, showcasing significant growth. The sector is one of the largest contributors in terms of revenue and employment in the country.

- Moreover, India has emerged as a medical tourism hub, providing cost-effective treatments with the latest technology enabled by several pathbreaking reforms and provisions. India is one of the biggest suppliers of low-cost medicines in the world. Because of their low price and high quality, Indian medicines are preferred worldwide, rightly making the country the 'Pharmacy of the World'.

- The expansion in healthcare services and pharmaceuticals directly boosts demand for glass containers, especially for packaging medicines, vaccines, and medical vials. Glass is commonly used in these applications due to its non-reactive nature, helping preserve the quality and efficacy of medicines, which is crucial for the healthcare industry.

India Glass Container Industry Overview

The glass packaging market in India is fragmented, featuring several key players. Manufacturers include SCHOTT POONAWALLA PRIVATE LIMITED, AGI glaspac (A HSIL Company), CANPACK S.A., and Emerge Glass India Pvt Ltd. These companies significantly influence market dynamics. To maintain their competitive edge, vendors in the Indian container glass market are pursuing various strategies such as expansion, mergers and acquisitions, and product innovations.

These activities aim to strengthen their positions within the Indian market, address local demand, and adapt to regional regulations and sustainability requirements. Indian container glass manufacturers are also focusing on enhancing their production capabilities and developing eco-friendly glass solutions to meet the country's growing environmental concerns.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Export-Import Data of Container Glass

- 4.3 PESTEL ANALYSIS - Container Glass Industry in India

- 4.4 Industry Standard and Regulation for Container Glass Use for Packaging

- 4.5 Raw Material Analysis and Material Consideration for Packaging

- 4.6 Sustainability Trends for Glass Packaging

- 4.7 Container Glass Furnace Capacity and Location in India

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Alcohol Consumption and the Growing Preference for Glass Bottles

- 5.1.2 Regulatory Push Drives Adoption of Glass as a Sustainable Alternative in India

- 5.2 Market Challenges

- 5.2.1 Fragility and Complex Logistics Increase Transportation Costs for Glass Containers

- 5.3 Analysis of the Current Positioning of India in the Asia Pacific Container Glass Market

- 5.4 Trade Scenerio - Analysis of the Historical and Current Export Import Paradigm for Container Glass Industry in India

6 MARKET SEGMENTATION

- 6.1 By End-user Vertical

- 6.1.1 Beverages

- 6.1.1.1 Alcoholic Beverages

- 6.1.1.1.1 Beer and Cider

- 6.1.1.1.2 Wine and Spirits

- 6.1.1.2 Non-alcoholic Beverages

- 6.1.1.2.1 Carbonated Soft Drinks

- 6.1.1.2.2 Juices

- 6.1.1.2.3 Water

- 6.1.1.2.4 Dairy Based Drinks

- 6.1.1.2.5 Flavored Drinks

- 6.1.2 Cosmetics

- 6.1.3 Pharmaceutical

- 6.1.4 Other End-user Verticals

- 6.1.1 Beverages

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 SCHOTT POONAWALLA PRIVATE LIMITED

- 7.1.2 AGI glaspac (A HSIL Company)

- 7.1.3 CANPACK S.A.

- 7.1.4 Emerge Glass India Pvt Ltd.

- 7.1.5 Haldyn Heinz Fine Glass Pvt Ltd

- 7.1.6 Hindustan National Glass & Industries Limited

- 7.1.7 PGP Glass Private Limited

- 7.1.8 Haldyn Glass Ltd

- 7.1.9 Sunrise Glass Industries Pvt. Ltd.

- 7.1.10 Ajanta Bottle Pvt. Ltd.