|

市场调查报告书

商品编码

1642148

超大规模资料中心:市场占有率分析、产业趋势与成长预测(2025-2030 年)Hyperscale Datacenter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

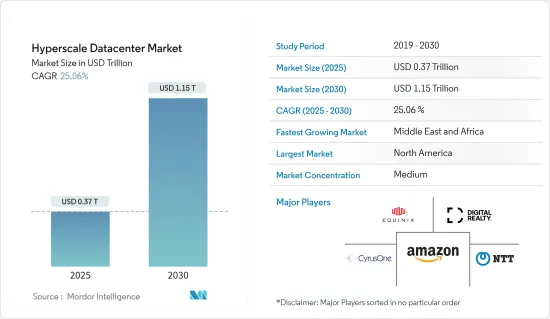

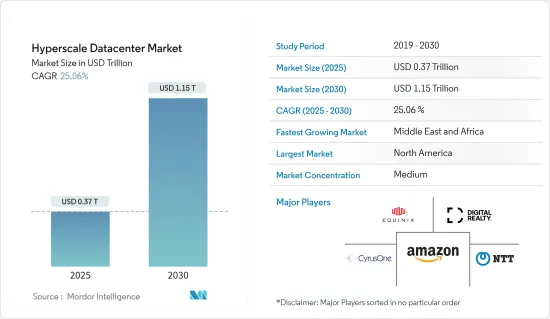

超大规模资料中心市场在 2025 年的价值预估将达到 3,700 亿美元,预计到 2030 年将达到 1.15 兆美元,在预测期内(2025-2030 年)的复合年增长率为 25.06%。

近年来,由于满足高端应用的运算和储存需求不断增长,超大规模资料中心变得极其强大。业务关键型应用程式的激增增加了资料中心的复杂性。随着网路、电子商务、社交媒体、巨量资料、运算、线上游戏託管和 Hadoop 的普及,对提高应用程式速度、能源效率和伺服器密度的基础设施的需求也日益增长。

主要亮点

- 近年来,资料被认为是新兴经济体的基础。几乎每个企业现在使用的资料都比以前多,而且未来可能会消耗资料。这种指数级增长的资料生成需要储存在某个地方并从某个地方存取。据Cisco称,全球 IP资料流量从 2016 年的每月 96,054 Petabyte增长到 2018 年的每月 150,910 Petabyte,去年达到每月 278,108 Petabyte。

- 此外,透过网路提供的应用程式和服务对Over-The-Top(OTT) 应用的需求日益增长,正在绕过传统的分销方式。 Over-The-Top服务与媒体和通讯领域高度相关,且成本低廉,促进了资料的大规模成长,从而推动了市场发展。

- 此外,作为数位转型策略的一部分,许多企业迅速采用物联网、云端运算、巨量资料和分析技术,也为资料中心带来了越来越大的压力,从而促进了全球超大规模资料中心的成长。

- 提供大规模云端服务、电子商务、先进药物研究、石油和天然气、航太、股票交易所等的公司正在投资必要的网路基础设施。然而,现有的新一代防火墙 (NGFW) 必须满足超大规模架构的大规模和效能需求,因此寻找能够满足这些需求的安全解决方案成为一项挑战。

- 随着最近的 COVID-19 疫情,资料中心的需求在超大规模公司和云端平台之间分化。相较之下,许多商业用户的支出却放缓了。疫情导致租赁需求集中在关键的云端市场。疫情过后,随着数位化应用的增加以及企业转向混合和远端工作模式,市场实现了蓬勃发展。

超大规模资料中心市场趋势

对云端运算和其他高效能技术的需求不断增长,推动着市场

- 由于科技的应用和消费者对云端的偏好日益增长,对云端基础的解决方案的需求正在激增。这项技术允许用户从远端位置存取资料。企业越来越意识到将资料迁移到云端而不是建置和维护内部基础设施对于节省成本和资源的重要性,这推动了对云端基础的解决方案的需求。

- 这些优势使得大大小小的企业越来越多地采用云端基础的解决方案。未来几年,云端运算和虚拟可能会透过分解软体来降低设定成本,最终减少硬体使用。

- 世界各地的企业和政府机构正在将其测试环境和更多业务关键型工作负载和运算实例迁移到云端。同样,对于消费者而言,云端服务可以透过多种装置随时随地轻鬆存取内容和服务。

- 预计整个印尼对资料储存和託管服务的需求将大幅增加。雅加达的两个资料中心将满足客户的需求,特别是云端服务供应商和金融业,他们需要灵活的设施设计来帮助他们实现业务目标。领先的IT基础设施和服务公司之一 NTT Corporation 今年 4 月扩大了其超大规模资料中心的足迹,在印尼推出了其最大的资料中心(雅加达 3资料中心),以支援东南亚日益增长的数位经济。

- 企业使用云端运算最常见的方式之一是透过许多全球领先的科技公司提供的许多「即服务」替代方案。这些服务使企业无需内部基础设施即可获得运算能力、软体和其他与云端相关的业务。据 Flexera Software 称,截至今年 3 月,46% 的受访者已经在 Amazon Web Services 上运行大量工作负载。

预计德国将占据较大市场占有率

- 全球疫情导致电子交易、系统和数位资讯激增,导致欧洲数位流量大幅增加。新兴企业的迅速崛起和人口的成长正在推动对超大规模资料中心的需求。

- 过去几年,受超大规模资料中心发展和GDPR实施的推动,德国资料中心市场取得了显着成长,刺激了德国的投资和区域云端网路的发展。

- 云端运算的使用和投资不断增加,正在鼓励德国许多参与者改善其云端基础设施,从而推动市场成长。例如,2021年8月,Google宣布将在2030年前投资10亿欧元,用于增加可再生能源的使用并在德国发展云端运算基础设施。

- 今年 6 月,Vantage资料中心宣布在柏林和华沙启动两个待开发区园区。新地点是 Vantage 斥资 20 亿美元在欧洲扩张计划的一部分,旨在为两个热门市场的超大规模资料中心业者和云端供应商提供资料中心园区。

- 今年 2 月,美国和欧洲超大规模资料中心开发商和营运商 Cloud HQ 宣布将在德国法兰克福东南部的奥芬巴赫建造一个 112 兆瓦、120 万平方英尺(108,000平方公尺)的超大规模资料中心园区。 CloudHQ 法兰克福资料中心园区总投资 11 亿欧元(11.5 亿美元),建成后将成为德国最大的超大规模资料中心之一。

超大规模资料中心产业概览

超大规模资料中心市场相当分散,既有全球参与者,也有规模较小的参与者。此外,超大规模资料中心正在被各行各业所应用,为供应商提供了成长机会。市场参与者正在采取联盟和收购等策略来加强其产品供应并获得永续的竞争优势。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

- 研究框架

- 二次调查

- 初步调查

- 资料三角测量与洞察生成

第三章执行摘要

第四章 市场洞察

- 市场概况

- 市场动态

- 市场驱动因素

- 对云端运算和其他高效能技术的需求不断增加

- 生成式人工智慧能力的崛起推动对超大规模设施的需求

- 市场限制

- 资料中心安全问题

- 能源消耗过多和容量规划不高效

- 市场驱动因素

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场区隔

- 依资料中心类型

- 企业/超大规模自建

- 超大规模主机託管

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 英国

- 德国

- 荷兰

- 法国

- 爱尔兰

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 新加坡

- 日本

- 澳洲

- 印尼

- 其他亚太地区

- 中东和非洲

- 南美洲

- 北美洲

第六章 竞争格局

- 公司简介

- Digital Realty Trust, Inc.

- Equinix, Inc.

- CyrusOne, Inc.

- NTT Ltd

- Quality Technology Services

- Vantage Data Centers, LLC

- Amazon Web Services, Inc.

- Microsoft Corporation

- Alphabet Inc.

- Meta Platforms Inc.

第七章投资分析

第八章 市场机会与未来趋势

第 9 章:关于发布者

The Hyperscale Datacenter Market size is estimated at USD 0.37 trillion in 2025, and is expected to reach USD 1.15 trillion by 2030, at a CAGR of 25.06% during the forecast period (2025-2030).

Hyperscale data centers have become highly powerful in recent years due to the increased computing and storage requirements to serve high-end applications. Business-critical apps are increasing, resulting in greater data center complexity. With the rising popularity of the web, e-commerce, social media, big data, computing, online gaming hosting, and Hadoop, the infrastructure needs to improve application speed, energy efficiency, and server density are increasing.

Key Highlights

- In the recent past, data was considered the foundation of an emerging economy. Almost all enterprises use more data than before and will probably consume even more data in the future. This rapidly increasing data generation must be stored and accessed from somewhere. According to Cisco Systems, the global IP data traffic increased from 96,054 petabytes per month in 2016 to 150,910 petabytes per month in 2018, and it reached 278,108 petabytes per month last year.

- Moreover, the rising demand for over-the-top (OTT) applications through an app or service that can be availed over the internet bypass traditional distribution practices. Services available for over-the-top services are significantly related to the media and communication sector, which can be accessed at a lower cost and contributes to massive data growth, thereby driving the market.

- Furthermore, owing to the rapidly increasing adoption of IoT, cloud, and Big Data, analytics across multiple enterprises as a part of their digital transformation strategy, the burden on the data centers is also increasing, leading to growth in the hyperscale data centers globally.

- Enterprises that offer large cloud services, e-commerce, advanced research of pharmaceuticals, oil and gas, aerospace, stock exchange, and others have invested in the network infrastructure they require. However, sourcing security solutions to meet these needs presents a challenge since existing next-generation firewalls (NGFWs) still need to meet the massive scale and performance needs of hyperscale architectures.

- With the recent outbreak of COVID-19 worldwide, the demand for the data center is bifurcated with strong buying by hyperscale companies and cloud platforms. In contrast, there was a slowdown in spending by many enterprise users. Pandemic-driven leasing activity was concentrated in significant cloud markets. After the pandemic, the market is growing rapidly with the increased adoption of digitization and enterprises moving toward hybrid and remote working models.

Hyperscale Data Center Market Trends

Growing Demand for Cloud Computing and Other Hight Performance Technologies Driving the Market

- The demand for cloud-based solutions is surging, owing to the growing application of technology and consumer propensity towards the cloud. This technology allows the user to access the data from remote locations. The increasing realization among companies about the importance of saving money and resources by moving their data to the cloud rather than building and maintaining on-premise infrastructure is driving the demand for cloud-based solutions.

- Owing to these benefits, large enterprises and SMEs are increasingly adopting cloud-based solutions. Over the next few years, cloud computing and virtualization will be able to save the setup cost of software by dividing it, ultimately leading to decreasing the use of hardware.

- Enterprises and government organizations worldwide are moving from test environments to placing more work-critical workloads and compute instances into the cloud. Similarly, for consumers, cloud services offer anywhere and easy access to content and services on multiple devices.

- The demand for data storage and managed hosting services is expected to increase dramatically across Indonesia. Jakarta's two Data Centers will accommodate clients' needs, particularly cloud service providers and the financial industry, which require flexible facility designs to help them achieve their business objectives. In April this year, NTT Ltd, one of the leading IT infrastructure and services companies, expanded its hyperscale data center footprint by launching the largest data center in Indonesia (Jakarta's third data center) to support the growing digital economy in Southeast Asia.

- One of the most common methods for businesses to use cloud computing is to use the numerous "as-a-service" alternatives provided by many major global technology corporations. These services give businesses access to computing power, software, and other cloud-related operations without the need for on-premises infrastructure. According to Flexera Software, as of March this year, 46% of respondents are already running significant workloads on Amazon Web Services.

Germany is Expected to Hold Major Market Share

- European digital traffic increased tremendously due to the surge in electronic transactions, systems, and digital information during the global pandemic. When paired with the rapid rise of new firms and the ever-increasing population, this boosts demand for hyperscale data centers.

- Over the past few years, the German data center market has grown notably with the rise in the development of hyperscale data centers, and owing to the implementation of GDPR, which has been driving investments and the regional cloud network development in Germany.

- The growing usage of the cloud and investments encourage many players in the country to improve cloud infrastructure in Germany, which drives the market's growth. For instance, in August 2021, Google announced it would invest EUR 1 billion by 2030 to enhance renewable energy use and develop its cloud computing infrastructure in Germany.

- In June this year, Vantage data centers announced the start of operations at two greenfield campuses in Berlin and Warsaw. The new sites are part of Vantage's USD 2 billion European expansion to offer hyperscalers and cloud providers with data center campuses in two sought-after markets.

- Moreover, in February this year, A 112-megawatt, 1.2 million sqft (108k sqm), hyper-scale data center campus is being built by Cloud HQ, a hyper-scale data center developer and operator in the US and Europe, in Offenbach, Germany, a city that borders Frankfurt to the southeast. With a total investment of EUR 1.1 billion (USD 1.15 billion), CloudHQ's Frankfurt data center campus will be one of Germany's biggest hyperscale data centers once fully constructed.

Hyperscale Data Center Industry Overview

The hyperscale data center market is moderately fragmented, with the presence of both global players and small and medium-sized enterprises. Moreover, hyperscale data centers are used in various industries to provide vendors with growth opportunities. Players in the market are adopting strategies, such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions And Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Research Framework

- 2.2 Secondary Research

- 2.3 Primary Research

- 2.4 Data Triangulation and Insight Generation

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Market Dynamics

- 4.2.1 Market Drivers

- 4.2.1.1 Growing Demand for Cloud Computing and Other High-Performance Technologies

- 4.2.1.2 Rising Generative AI capabilities driving the demand for hyperscale facilities

- 4.2.2 Market Restraints

- 4.2.2.1 Data Center Security Challenges

- 4.2.2.2 Excessive Energy Consumption and Inefficient Capacity Planning

- 4.2.1 Market Drivers

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Data Center Type

- 5.1.1 Enterprises/ Hyperscale Self-builds

- 5.1.2 Hyperscale Colocation

- 5.2 By Region

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 United Kingdom

- 5.2.2.2 Germany

- 5.2.2.3 Netherlands

- 5.2.2.4 France

- 5.2.2.5 Ireland

- 5.2.2.6 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Singapore

- 5.2.3.4 Japan

- 5.2.3.5 Australia

- 5.2.3.6 Indonesia

- 5.2.3.7 Rest of Asia-Pacific

- 5.2.4 Middle East and Africa

- 5.2.5 South America

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Digital Realty Trust, Inc.

- 6.1.2 Equinix, Inc.

- 6.1.3 CyrusOne, Inc.

- 6.1.4 NTT Ltd

- 6.1.5 Quality Technology Services

- 6.1.6 Vantage Data Centers, LLC

- 6.1.7 Amazon Web Services, Inc.

- 6.1.8 Microsoft Corporation

- 6.1.9 Alphabet Inc.

- 6.1.10 Meta Platforms Inc.