|

市场调查报告书

商品编码

1642150

伺服器微处理器:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Server Microprocessor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

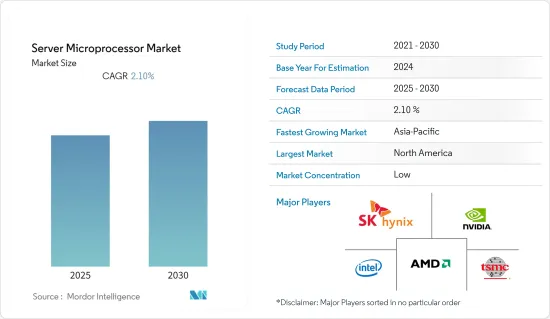

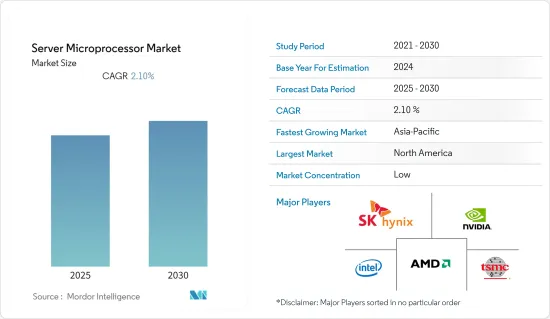

预测期内伺服器微处理器市场预计复合年增长率为 2.1%

关键亮点

- 伺服器微处理器技术革新日新月异,为企业带来品质调整挑战。衡量微处理器品质的重要特性包括核心、执行绪、基本频率、涡轮频率、快取大小和热设计功率。预计在预测期内,功耗和效能仍将是微处理器的重点。

- 根据美国消费美国美国科技产业零售额将达到创纪录的4,870亿美元,与前一年同期比较成长7.5%。其他国家也出现了类似的趋势。智慧型手机、平板电脑和其他智慧家庭设备的需求旺盛是推动微处理器需求的主要因素之一。

- 除此之外,智慧家庭产品的日益普及也推动了对微处理器的需求。智慧锁、火灾和烟雾警报系统以及智慧扬声器等设备正越来越多地融入人们的生活。特别是在印度和巴西等新兴国家,随着中阶消费能力的提高,市场预计将进一步成长。

- 据Cloudscene称,截至今年,光是北美(美国和加拿大)就拥有约3,029个资料中心,是伺服器微处理器的主要市场。

- 此外,物联网的快速崛起是推动微处理器(IoT)使用的关键原因之一。物联网技术使微处理器成为可能,因为现在从技术和经济上来说,从比以前更广泛的事物中收集资料都是可行的。公司往往低估物联网产品和平台产生的资料的复杂性和数量,需要解决方案来帮助他们管理和解释现在收集的所有资料。

- COVID-19 疫情对全球微处理器市场产生了多方面影响。儘管各国大规模封锁严重扰乱了微处理器製造商的供应链和製造能力,但医疗和消费性电子领域对这些半导体设备的需求却大幅增加。预计预测期内伺服器微处理器市场复合年增长率为 2.1%。预计预测期内伺服器微处理器市场复合年增长率为 2.1%。伺服器微处理器正在扩大资料中心的覆盖范围,而云端服务供应商的需求正在推动伺服器微处理器市场的成长。由英特尔和AMD两大巨头主导的伺服器微处理器市场正在经历快速的产品创新。公司正在认识到资料分析、机器学习和人工智慧等现代工作负载的性能需求,并相应地改进其设计。

关键亮点

- 伺服器微处理器技术革新日新月异,为企业带来品质调整挑战。衡量微处理器品质的重要特性包括核心、执行绪、基本频率、涡轮频率、快取大小和热设计功率。在接下来的几年里,微处理器将继续成为人们关注的焦点,重点在于它的功耗和效能。

- 根据美国消费科技协会(CTA)预测,美国消费科技零售额将达到创纪录的4,870亿美元,与前一年同期比较成长7.5%。其他国家也出现了类似的趋势。智慧型手机、平板电脑和其他智慧家庭设备的需求旺盛是推动微处理器需求的主要因素之一。

- 除此之外,智慧家庭产品的日益普及也推动了对微处理器的需求。智慧锁、火灾和烟雾警报系统以及智慧扬声器等设备正越来越多地融入人们的生活。特别是在印度和巴西等新兴国家,随着中阶消费能力的提高,市场预计将进一步成长。

- 据Cloudscene称,截至今年,光是北美(美国和加拿大)就拥有约3,029个资料中心,是伺服器微处理器的主要市场。

- 此外,物联网的快速崛起是推动微处理器(IoT)使用的关键原因之一。物联网技术使微处理器成为可能,因为现在从技术和经济上来说,从比以前更广泛的事物中收集资料都是可行的。公司往往低估物联网产品和平台产生的资料的复杂性和数量,需要解决方案来帮助他们管理和解释现在收集的所有资料。

- COVID-19 疫情对全球微处理器市场产生了多方面影响。儘管各国大规模封锁严重扰乱了微处理器製造商的供应链和製造能力,但医疗和消费性电子领域对这些半导体设备的需求却大幅增加。

伺服器微处理器市场趋势

消费性电子领域可望推动市场需求

- 由于处理速度快、体积小、维护方便,微处理器越来越多地被应用于桌上型电脑、智慧型手机、平板电脑和伺服器等消费性电子应用。这种通用电子处理设备可配置为每秒执行多达30亿次操作,在记忆体区域之间快速传输资料,并执行浮点运算等高级数学计算。消费性电子领域的成长预计将对微处理器市场产生积极影响,促进该市场的成长和发展。

- 亚太地区的通讯业者正在利用其行动网路和服务的规模和实用性,帮助大大小小的企业采用新的数位解决方案来实现其工业 4.0 目标。根据 GSMA 去年发布的《行动经济报告》,印度、印尼和马来西亚随着 5G 网路部署的第二阶段开始,正在进行一些与 5G 相关的活动。该地区不断扩展的5G网路能力将推动智慧型手机、平板电脑、电视、AR/VR和其他消费性电子产品市场的发展,从而促进该地区的研究市场。

- 在包括美国、加拿大、西班牙、德国和法国在内的已开发国家,智慧家庭的普及将推动智慧家庭科技产品的采用,并推动产业发展。根据美国消费科技协会去年 7 月发布的新闻稿,美国智慧家居设备销量超过 1 亿台,累计达 150 亿美元。去年,家用机器人、智慧音箱等智慧家居技术在美国已广泛应用。这些设备大量采用了微处理器,在预期时间内提升了市场前景。

- 类比 AI 处理器公司 Mythic 今天发布了 M1076 类比矩阵处理器,该处理器可提供低功耗 AI 处理。该公司使用类比电路而非数位电路製造处理器,这使得将记忆体整合到处理器中变得更加容易,所需的记忆体比典型的系统晶片或图形处理单元(GPU) 要少10 倍。可以与功耗。

- 综合 IT 解决方案供应商 Supermicro, Inc. 今天宣布推出基于下一代第四代英特尔至强可扩展处理器的业界最全面的伺服器和储存系统产品组合。

亚太地区致力于发展关键微处理器能力

- 亚太地区是成长最快的地区之一,各领域的成长率都超过北美和欧洲等发达地区。例如,对微处理器的需求大幅增加的汽车产业在亚太地区呈现最高的成长率。

- 根据OICA统计,中国去年的汽车产量居世界首,达2,600万辆。日本以784万台位居第三,印度以439万台位居第四。

- 随着汽车产业快速向自动驾驶汽车转变,预计亚太地区对微处理器的需求将进一步上升。例如,今年7月,中国主要汽车製造商百度推出了自动驾驶计程车RT6。

- 此外,亚太地区消费性电子产业也呈现上升趋势,受数位化进程加速、高科技设备日益普及等因素影响,需求每年都创下历史新高。在预测期内,预计该区域市场将受到物联网 (IoT) 日益普及、政府大量 IT 投资以及对云端基础的服务不断增长的需求的推动。

- 据IBEF称,印度去年家用电子电器产品产量为7,051.5亿印度卢比。此外,亚太地区连网穿戴装置数量预计也将从 2021 年的 2.582 亿大幅成长至今年的 3.11 亿。 (图片来源:思科系统公司)预计这些趋势将在预测期内推动亚太地区市场的成长。

伺服器微处理器产业概况

过去几年,伺服器微处理器市场一直由英特尔主导,其最接近的竞争对手是 AMD,参与企业包括 SK 海力士公司和 Nvidia 公司。市场需要在研发和技术合作方面进行大量投资,以满足伺服器和资料中心的需求。鑑于 AMD 新产品的推出和具有竞争力的定价策略,AMD 很可能会蚕食英特尔在伺服器微处理器市场的较小份额。在这个市场中,供应商正在致力于为下一代资料中心产品推出。近期市场发展趋势如下:

- 2022 年 11 月-AMD 宣布推出 Epyc 伺服器处理器,针对需要高效能运算的云端供应商、企业和组织。第四代 AMD Epyc 处理器可以帮助企业释放资料中心资源来处理更多工作并更快地交付输出。

- 2022 年 4 月-微软开始提供搭载基于 Arm 的 Ampere Altra 伺服器处理器的新型 Azure虚拟机器。它专为高效运行横向扩展工作负载、Web 伺服器、应用程式伺服器、开放原始码资料资料库、云端原生和丰富的 .NET、Java 应用程式、游戏伺服器、媒体伺服器和开放原始码资料库而建置。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场概况

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 价值链分析

- COVID-19 工业影响评估

第五章 市场动态

- 市场驱动因素

- 对高效能、节能处理器的需求不断增加

- 市场限制

- 个人电脑需求下降

第六章 市场细分

- 按类型

- APU

- CPU

- GPU

- FPGA

- 按应用

- 消费性电子产品

- 企业 - 电脑和伺服器

- 车

- 工业的

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 供应商市场占有率(独立伺服器微处理器供应商)

- 公司简介

- Intel Corporation

- Advanced Micro Devices, Inc.

- SK Hynix Inc.

- Taiwan Semiconductor Manufacturing Company Limited

- Nvidia Corporation

- Samsung Technologies

- Qualcomm Technologies

- Broadcom Inc.

- Micron Technology

- Sony Corporation

第八章投资分析

第九章 市场机会与未来趋势

The Server Microprocessor Market is expected to register a CAGR of 2.1% during the forecast period.

Key Highlights

- The server microprocessors are bound to rapid technological change, which results in challenging quality adjustments for the companies. Some of the significant characteristics for measuring the quality of microprocessors include cores, threads, base frequency, turbo frequency, cache size, and thermal design power. Power consumption and performance are expected to remain the focus for microprocessors over the forecast period.

- According to the Consumer Technology Association (CTA), retail sales revenue for the consumer technology industry in the United States was forecasted to reach a record-breaking USD 487 billion in the previous year-a 7.5% increase compared to the previous years. A similar trend has been observed in other countries as well. The rapidly expanding demand for smartphones, tablets, and other smart home devices is among the major factors driving the demand for microprocessors, as microprocessors optimize the performance of these devices by improving speed and efficiency.

- Apart from this, the increasing penetration of smart home products also drives the demand for microprocessors. Devices like smart locks, fire and smoke alarm systems, smart speakers, etc. are increasingly taking their place in people's lives. Coupled with the increasing spending capacity of the middle class, especially across developing countries such as India and Brazil, this is expected to support further market growth.

- The growth of big data analytics and cloud computing, as well as the expansion of mobile broadband, drive the demand for new data center infrastructures.According to Cloudscene, North America alone (US and Canada) houses around 3029 data centers as of this year, making it a prominent market for server microprocessors.

- Furthermore, the rapid rise of the Internet of Things is one significant reason for promoting microprocessor usage (IoT). IoT technologies enable microprocessors because it is now technically and economically feasible to collect data from a far wider range of things than was previously conceivable. Companies frequently misjudge the complexity and volume of data generated by IoT products and platforms, necessitating the deployment of solutions to help them manage and interpret all of the data they are now collecting.

- The global outbreak of COVID-19 had a mixed impact on the worldwide microprocessor market. While the widespread lockdown across various countries significantly disrupted microprocessor manufacturers' supply chains and manufacturing capabilities, the demand for these semiconductor devices increased substantially across the healthcare and consumer electronics sectors. The server microprocessor market is expected to register a CAGR of 2.1% over the forecast period. They are increasing their data center footprint, and demand from cloud service providers prompts the growth of the server microprocessor market. Dominated by the duopoly of Intel and AMD, the market for server microprocessors is undergoing product innovations. Companies realize the performance needs for modern workloads such as data analytics, machine learning, and artificial intelligence and are improving their designs accordingly.

- The server microprocessors are bound to rapid technological change, which results in challenging quality adjustments for the companies. Some of the significant characteristics for measuring the quality of microprocessors include cores, threads, base frequency, turbo frequency, cache size, and thermal design power. Over the next few years, microprocessors will likely continue to focus on how much power they use and how well they work.

- According to the Consumer Technology Association (CTA), retail sales revenue for the consumer technology industry in the United States was forecasted to reach a record-breaking USD 487 billion in the previous year-a 7.5% increase compared to the previous years. A similar trend has been observed in other countries as well. The rapidly expanding demand for smartphones, tablets, and other smart home devices is among the major factors driving the demand for microprocessors, as microprocessors optimize the performance of these devices by improving speed and efficiency.

- Apart from this, the increasing penetration of smart home products also drives the demand for microprocessors. Devices like smart locks, fire and smoke alarm systems, smart speakers, etc. are increasingly taking their place in people's lives. Coupled with the increasing spending capacity of the middle class, especially across developing countries such as India and Brazil, this is expected to support further market growth.

- The growth of big data analytics and cloud computing, as well as the expansion of mobile broadband, drive the demand for new data center infrastructures.According to Cloudscene, North America alone (US and Canada) houses around 3029 data centers as of this year, making it a prominent market for server microprocessors.

- Furthermore, the rapid rise of the Internet of Things is one significant reason for promoting microprocessor usage (IoT). IoT technologies enable microprocessors because it is now technically and economically feasible to collect data from a far wider range of things than was previously conceivable. Companies frequently misjudge the complexity and volume of data generated by IoT products and platforms, necessitating the deployment of solutions to help them manage and interpret all of the data they are now collecting.

- The global outbreak of COVID-19 had a mixed impact on the worldwide microprocessor market. While the widespread lockdown across various countries significantly disrupted microprocessor manufacturers' supply chains and manufacturing capabilities, the demand for these semiconductor devices increased substantially across the healthcare and consumer electronics sectors.

Key Highlights

Server Microprocessor Market Trends

Consumer electronics Segment is Expected to Drive the Market Demand

- Microprocessors are increasingly being used in consumer electronics applications, such as desktop PCs, smartphones, tablets, and servers, because of their fast processing speed, small size, and ease of maintenance. This multipurpose electronic processing device may be configured to accomplish 3 billion activities per second, transport data swiftly between memory regions, and conduct sophisticated mathematical calculations, such as floating-point operations. The rising consumer electronic segment will favor the microprocessor market, contributing to market growth and progress for the market under consideration.

- Operators around the Asia-Pacific are leveraging the scale and utility of mobile networks and services to help large and small businesses implement new digital solutions to meet Industry 4.0 goals, in which 5G and the IoT will play significant roles. According to the GSMA's Mobile Economy Report of the last year, the second phase of 5G network rollouts has commenced in the area, marked by several 5G-related activities in India, Indonesia, and Malaysia. The region's expanding 5G network capabilities will enhance the smartphone, tablet, TV, AR/VR, and other consumer electronics markets, thus boosting the researched market in the region.

- The widespread use of smart homes in industrialized economies, including the United States, Canada, Spain, Germany, and France, will expedite the adoption of intelligent home technology goods, hence advancing the industry. According to a Consumer Technology Association news release from July last year, over 100 million smart home gadgets were supplied in the United States, accounting for USD 15 billion in sales. In the last year, smart home technologies, such as house robots and smart speakers, have been widely used in the United States. These gadgets are heavily embedded with microprocessors, propelling market prospects during the anticipated period.

- The analog AI processor company Mythic launched its M1076 Analog Matrix Processor today to provide low-power AI processing. The company uses analog circuits rather than digital to create its processor, making it easier to integrate memory into the processor and operate its device with ten times less power than a typical system-on-chip or graphics processing unit (GPU).

- Supermicro, Inc., a total IT solution provider, announced the launch of the industry's most comprehensive portfolio of servers and storage systems based on the upcoming 4th generation Intel Xeon Scalable processor in November of this year.

Asia-Pacific Making Efforts to Develop Key Competence in Microprocessors

- The Asia-Pacific region is among the fastest-growing regions and is even outpacing developed regions, such as North America and Europe, in terms of growth rate across various sectors. For instance, the automotive industry, where the demand for microprocessors has been increasing significantly, has witnessed the highest growth rate in the Asia-Pacific region.

- According to OICA, China was the leading producer of motor vehicles last year, with about 26 million vehicles. Japan and India were in the third and fourth spots, with 7.84 million and 4.39 million vehicles produced, respectively.

- With the automotive industry fast moving toward autonomous vehicles, the demand for microprocessors is expected to grow further in the Asia-Pacific region. In July of this year, for example, Baidu, a major automaker in China, showed off the self-driving taxi RT6.

- Furthermore, the consumer electronics industry in the Asia-Pacific region is also witnessing an upward trend, with demand touching record heights every year due to factors such as fast digitalization and increased penetration of high-tech gadgets. During the projection period, the regional market is expected to be driven by increased use of the Internet of Things (IoT), large IT investments by the government, and rising demand for cloud-based services.

- According to IBEF, the value of consumer electronics production in India was INR 705.15 billion last year. Furthermore, the number of connected wearable devices in the Asia-Pacific region is also expected to significantly increase from 258.2 million in 2021 to 311 million in the current year. (Source: Cisco Systems). Such trends are expected to drive the growth of the market studied in the Asia-Pacific region during the forecast period.

Server Microprocessor Industry Overview

The server microprocessor market has been dominated by Intel for the past few years, with AMD as the closest competitor and other players like SK Hynix Inc. and Nvidia Corporation, among others. The market demands strong investments in R&D and technology partnerships to address the needs of servers and data centers. AMD will likely cut through a small share of Intel in the server microprocessor market, considering the new product rollouts and competitive pricing strategy. Vendors in the market have been involved in the launch of new microprocessors for next-generation data centers. Following are the recent developments in the market:

- November 2022 - AMD announced the launch of Epyc server processors for cloud providers, enterprises, and organizations that require high-performance computing. The fourth generation of AMD Epyc processors could help businesses free up data center resources to handle more work and speed up output.

- April 2022 - Microsoft has launched its new Azure virtual machines powered by the Arm-based Ampere Altra server processors. It is made to run scale-out workloads, web servers, application servers, open-source databases, cloud-native and rich.NET and Java applications, gaming servers, media servers, and open-source databases in an efficient way.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGTHS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in Demand for High-performance and Energy-efficient Processors

- 5.2 Market Restraints

- 5.2.1 Decrease in Demand for PCs

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 APU

- 6.1.2 CPU

- 6.1.3 GPU

- 6.1.4 FPGA

- 6.2 By Application

- 6.2.1 Consumer Electronics

- 6.2.2 Enterprise - Computer and Servers

- 6.2.3 Automotive

- 6.2.4 Industrial

- 6.2.5 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Vendor Market Share(for standalone server microprocessor vendors)

- 7.2 Company Profiles

- 7.2.1 Intel Corporation

- 7.2.2 Advanced Micro Devices, Inc.

- 7.2.3 SK Hynix Inc.

- 7.2.4 Taiwan Semiconductor Manufacturing Company Limited

- 7.2.5 Nvidia Corporation

- 7.2.6 Samsung Technologies

- 7.2.7 Qualcomm Technologies

- 7.2.8 Broadcom Inc.

- 7.2.9 Micron Technology

- 7.2.10 Sony Corporation