|

市场调查报告书

商品编码

1642156

全Flash阵列:市场占有率分析、产业趋势与成长预测(2025-2030)All Flash Array - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

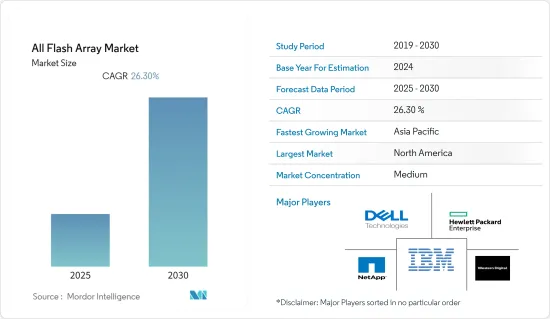

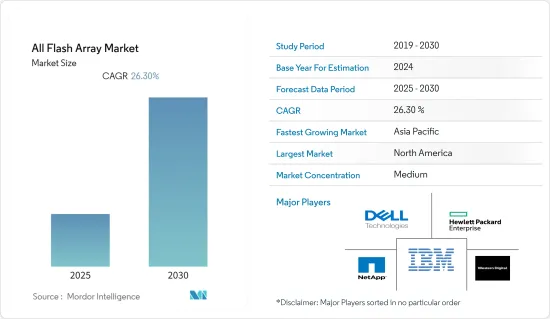

预计预测期内全Flash阵列市场复合年增长率将达到 26.3%。

主要亮点

- 企业产生的资料的增加,加上云端技术的日益普及,预计将推动市场的发展。此外,巨量资料和分析推动了资料存取和处理模式,需要更高的储存效能和更高的并发性(巨量资料加剧了资料移动性问题)。

- 快闪记忆体的采用主要受到其功耗、效能提升和易于维护等效用的推动,这些优势推动了其采用率。此外,包括即时分析和要求苛刻的资料库系统在内的关键任务应用程式可以透过快闪记忆体储存系统轻鬆实现。

- SCM 可能会部署为全Flash阵列的快取层。这些新进展可望优化工作负载效能,同时降低储存成本。

- 此外,非挥发性记忆体规范 (NVMe) 等改进实现了比传统通讯协定更快的效能和更高的密度,从而扩展了企业全快闪储存产业。

- 预计到 2022 年,印度等地区将见证医疗保健、保险和通讯垂直领域的企业快闪记忆体储存的积极成长。印度的成长将主要受到物联网、人工智慧和巨量资料创新的推动。各组织正在寻求自动化技术和基于消费的定价。

全Flash阵列(AFA) 市场趋势

资料中心预计将占很大份额

- 不断增长的资料中心工作负载产生了新的储存效能要求,而硬碟 (HDD) 无法轻易满足此要求。使用快闪记忆体作为持久性储存技术解决了这些挑战。

- 据NASSCOM称,到2025年印度资料中心市场的投资预计将达到46亿美元。主要原因是印度互联网使用量不断增长、云端运算需求不断增加、政府数位化努力以及数位服务供应商的在地化。与更成熟的市场相比,在印度开发和营运的成本效益是我们最大的优势。

- 此外,根据 CloudScene 的数据,截至 2021 年,全球约有 8,000 个资料中心,可提供 110 个国家的资讯。其中六个国家占据资料中心的大部分:美国(占总数的33%)、英国(5.7%)、德国(5.5%)、中国(5.2%)、加拿大(3.3%)和荷兰(3.4%)。

- 根据WSTS预测,2021年记忆体元件销售收入将达到约1,538亿美元,较2020年的1,175亿美元成长约31%。

北美预计将占据主要市场占有率

- 多种产品的供应显示北美占有较大的市场占有率。此外,美国也是该市场其他知名参与者的总部,例如戴尔公司、IBM 公司和 Net App 公司。受巨量资料和相关应用支出增加的推动,全Flash阵列的采用正在推动该地区的成长。

- 由于资料中心数量最多且医疗保健、IT、BFSI、零售和媒体行业快速成长,该地区占据全Flash阵列市场的大部分份额。据Cloudscene称,美国和加拿大拥有全球最多的资料中心,共3,029个,预计将推动全Flash阵列的需求。

- 由于拥有着名的资讯科技产业和主要供应商,北美正在大力投资IT基础设施。该地区的 BFSI 产业蓬勃发展,各组织愿意投资IT基础设施来满足客户需求。

- 该地区还占全球云端解决方案支出的最大份额。据经济战略研究所(ESI)称,美国经济将受益于企业在云端服务(云端处理、资料分析和物联网)方面的支出。到2025年,预计将产生1.7兆美元的新支出,为GDP增加3兆美元,并为美国经济创造800万个就业机会。

全Flash阵列(AFA) 产业概览

全Flash阵列市场竞争激烈,有许多地区和全球参与者。产品创新正在推动市场发展,供应商也正在投资技术创新。主要参与者包括戴尔科技、西部资料公司、惠普企业、NetApp Inc. 和 IBM 公司。

- 2022 年 2 月—IBM 宣布推出 IBM FlashSystem Cyber Vault,以协助侦测勒索软体和其他网路攻击并快速復原。此外,IBM 也宣布推出基于 IBM Spectrum Virtualize 的全新 FlashSystem 储存模型,提供单一、一致的营运环境,旨在提高混合云环境中的网路弹性和应用程式效能。

- 2022 年 3 月 - NetApp 和 Cisco 宣布推出 FlexPod XCS,从而实现 FlexPod 的演进,为现代应用程式、资料和混合云端服务提供一个自动化平台。 FlexPod 采用经过 Cisco 和 NetApp 预先检验的储存、网路和伺服器技术建置。此外,新的 FlexPod XCS 平台旨在加速混合云环境中现代应用程式和资料的交付。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场动态

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- 选择全Flash阵列的先决条件/注意事项

- 评估新冠肺炎对市场的影响

第五章 市场动态

- 市场驱动因素

- 资料中心数量不断增加

- 易于管理和维护

- 市场限制

- 初始成本

- 写入周期缓慢

第六章 市场细分

- 按类型

- 传统的

- 自订

- 按最终用户应用

- 资讯科技和通讯业

- BFSI

- 卫生保健

- 政府

- 其他最终用户应用程式

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 其他亚太地区

- 世界其他地区

- 拉丁美洲

- 中东和非洲

- 北美洲

第七章 竞争格局

- 公司简介

- Silk Platform

- Dell Inc.

- Hewlett Packard Enterprise Development LP

- NetApp Inc.

- Violin Systems LLC

- IBM Corporation

- Fujitsu Ltd.

- Pure Storage, Inc.

- Western Digital Corporation

- Huawei Technologies Co., Ltd.

第八章投资分析

第九章:市场的未来

简介目录

Product Code: 66997

The All Flash Array Market is expected to register a CAGR of 26.3% during the forecast period.

Key Highlights

- The gain in data generated by the enterprise, coupled with the increasing adoption of cloud technology, is anticipated to drive the market. Moreover, with big data and analytics, data access and processing patterns demand a higher storage performance and improved concurrency (Big Data aggravates the data mobility issues).

- Flash storage adoption mainly depends on its usefulness, such as power consumption, improving performance, and ease of maintenance, which have raised the adoption rate. Moreover, mission-critical applications, including real-time analytics and demanding database systems, can be achieved easily with flash storage systems.

- SCMs will likely be deployed as a caching layer for an all-flash array. These new evolutions are expected to provide optimized workload performance while decreasing storage costs.

- Furthermore, improvements such as Non-Volatile Memory Express (NVMe) have increased the enterprise all-flash storage industry, allowing faster performance and more density than conventional protocols.

- Territories like India anticipate positive growth for enterprise flash storage from healthcare, insurance, and telecommunications verticals across 2022. India's growth is primarily due to IoT, AI, and big data innovation. Organizations are looking ahead to automation technologies and consumption-based pricing.

All-flash Array (AFA) Market Trends

Data centers is Expected to Hold Significant Share

- Growing data center workloads create new storage performance requirements that are very difficult to address with hard disk drives (HDDs). Using flash as a persistent storage technology resolves these challenges.

- According to NASSCOM, India's data center market investment is expected to reach USD 4.6 billion by 2025, mainly due to India's growing internet usage, increased cloud computing demands, digitalization initiatives by the government, and localization by digital service providers. India's higher cost efficiency in development and operation is its biggest advantage compared to more mature markets.

- Moreover, as per CloudScene, with 110 countries' available information, as of 2021, there were around 8,000 data centers globally. Among these, six countries hold a majority of data centers: the United States (33% of total), the UK (5.7%), Germany (5.5%), China (5.2%), Canada (3.3%), and the Netherlands (3.4%).

- According to WSTS, in 2021, revenue from memory component sales was about USD 153.8 billion, an increase from the USD 117.5 billion in revenue recorded in 2020, which shows an approximately 31% increase in revenue.

North America is Expected to Hold Major Market Share

- Multiple product launches suggest that North America holds a significant market share. Moreover, the United States acts as headquarters for other prominent players in the market, such as Dell Inc., IBM Corporation, Net App Inc., etc. Adopting the all-flash array enhances the growth of this region, fueled by increased expenditures in big data and related applications.

- The region holds a significant share of the all-flash array market due to the presence of the highest number of data centers and booming healthcare, information technology, BFSI, retail, and media industries. According to Cloudscene, the number of data centers in the US and Canada is 3029, the highest in the world, and expected to drive the demand for the all-flash array market.

- North America spends a significant amount on IT infrastructure, owing to the presence of prominent information technology industry and key vendors' companies. The region is home to a thriving BFSI industry where organizations are ready to spend on IT infrastructure to cater to the needs of their customers.

- The region also accounts for significant global spending on cloud solutions. According to Economic Strategy Institute (ESI), the US economy will benefit from corporation spending on cloud services (cloud computing, data analysis, and the Internet of Things). It is expected to contribute USD 1.7 trillion in new spending, add USD 3 trillion to GDP, and create 8 million jobs for the US economy by 2025.

All-flash Array (AFA) Industry Overview

The All Flash Array Market is moderately competitive, with many regional and global players. Innovation drives the market in product offerings, and each vendor invests in innovation. Key players include Dell Technologies, Western Digital Corporation, Hewlett Packard Enterprise, NetApp Inc., and IBM Corporation.

- February 2022 - IBM introduced IBM FlashSystem Cyber Vault to support companies in better detecting and recovering quickly from ransomware and other cyberattacks. In addition, the company also revealed new FlashSystem storage models, based on IBM Spectrum Virtualize, to deliver a single and consistent operating environment designed to improve cyber resilience and application performance within a hybrid cloud environment.

- March 2022 - NetApp and Cisco announced the evolution of FlexPod with the introduction of FlexPod XCS, providing one automated platform for modern applications, data, and hybrid cloud services. FlexPod comprises pre-validated storage, networking, and server technologies from Cisco and NetApp. Moreover, the new FlexPod XCS platform is designed to accelerate the delivery of modern applications and data in a hybrid cloud environment.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Industry Attractiveness - Porter's Five Force Analysis

- 4.1.1 Bargaining Power of Suppliers

- 4.1.2 Bargaining Power of Consumers

- 4.1.3 Threat of New Entrants

- 4.1.4 Intensity of Competitive Rivalry

- 4.1.5 Threat of Substitute Products

- 4.2 Pre-requisites/Consideration for choosing All-Flash Array

- 4.3 Assessment of covid -19 impact on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Number of Data Centers

- 5.1.2 Ease of Management and Maintenance

- 5.2 Market Restraints

- 5.2.1 Initial Cost Involved

- 5.2.2 Lower Write Cycles

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Traditional

- 6.1.2 Custom

- 6.2 By End-User Application

- 6.2.1 IT and Telecom Industry

- 6.2.2 BFSI

- 6.2.3 Healthcare

- 6.2.4 Government

- 6.2.5 Other End-User Applications

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 South Korea

- 6.3.3.4 India

- 6.3.3.5 Rest of Asia-Pacific

- 6.3.4 Rest of the World

- 6.3.4.1 Latin America

- 6.3.4.2 Middle-East & Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Silk Platform

- 7.1.2 Dell Inc.

- 7.1.3 Hewlett Packard Enterprise Development LP

- 7.1.4 NetApp Inc.

- 7.1.5 Violin Systems LLC

- 7.1.6 IBM Corporation

- 7.1.7 Fujitsu Ltd.

- 7.1.8 Pure Storage, Inc.

- 7.1.9 Western Digital Corporation

- 7.1.10 Huawei Technologies Co., Ltd.

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219