|

市场调查报告书

商品编码

1642168

行动电话半导体:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Mobile Phone Semiconductor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

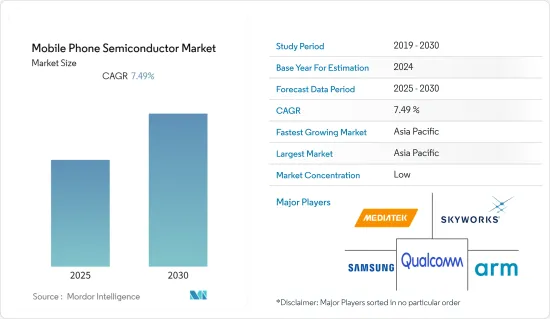

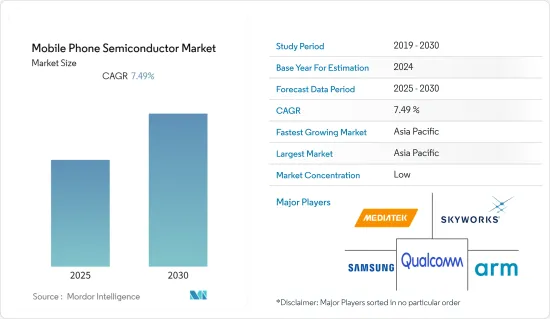

预计预测期内行动电话半导体市场复合年增长率为 7.49%。

主要亮点

- 半导体产业整体成长乏力,智慧型手机业务也出现波动。不过,由于智慧型手机中射频应用的采用越来越多,行动电话半导体市场得以略微成长。在许多地区,尤其是亚太地区,智慧型手机业务是半导体产业的最大消费者。

- 过去一年,智慧型手机产业日趋成熟,这对行动电话半导体产业正在产生影响。然而,随着5G技术的出现和政府对其采用的核准,智慧型手机用户预计将从支援4G和LTE技术的行动电话迁移到5G技术,这将为研究市场创造巨大的机会。

- 平板电脑、智慧型手机和电子阅读器等行动装置的出货量正在增加,推动了这些装置中使用的各种半导体元件的成长,包括应用处理器、数据机、MEMS 感测器、无线连接 IC 和音讯 IC。

- 射频收入的成长得益于更多频宽、更多电信商和更高阶 MIMO 配置的广泛采用,以及智慧型手机平均售价的上涨。预计这一趋势将在2019年持续下去,部分5G行动电话将增加5G的6GHz以下中频频段和mmWave模组。

- 由于半导体供应链的变化、美国贸易战、俄乌战争以及经营模式的变化而导致的市场波动为一些製造商创造了机会,同时也对其他製造商构成了威胁。

- 然而,全球新冠疫情扰乱了供应链和生产,尤其是在亚太地区。由于亚太地区过去几十年一直是全球製造业中心,核心半导体製造业受到了严重影响。

行动电话半导体市场趋势

记忆体是市场的主要推动力

- 该领域的成长将主要受到云端运算和智慧型手机等终端设备的虚拟实境等持续技术进步的推动。此外,动态随机存取记忆体(DRAM)和NAND快闪记忆体晶片的平均销售价格(ASP)的大幅上涨也将为收益带来显着的成长。

- 一般来说,预期的价格下跌将被快闪记忆体和 DRAM 的新容量所抵消,从而导致这些设备的供需更加平衡,以支援更多现代应用,如企业固态硬碟 (SSD)、增强智慧和虚拟实境、人工智慧、图形和其他复杂的即时工作负载功能。

- 然而,新兴记忆体技术即将蚕食该行业大量的 DRAM 需求。 2022年8月,美光科技公司宣布计画在2030年投资400亿美元扩大在美国的半导体製造产能。

- 美光的 DRAM 晶片广泛应用于从智慧型手机到资料中心伺服器等设备的各种应用。该公司扩建美国製造工厂的计画预计将获得《晶片与科学法案》下各种信贷和津贴的支持。该公司的这些倡议预计将在预测期内对行动电话半导体市场产生积极推动作用,推动市场对记忆体的需求。

亚太地区主导行动电话半导体市场

- 亚太地区是行动电话和半导体技术的主要市场之一。该地区在半导体和智慧型手机製造业占据主导地位。这两个市场的主要企业大多位于亚太地区,其他参与者也正在向该地区扩张。

- 该地区也主导全球半导体市场。智慧型手机和半导体产量的增加(尤其是在新兴国家)也推动了该地区对行动半导体的需求。越来越多的来自印度、越南、泰国和新加坡等国家的智慧型手机製造商正在该地区建立製造厂。

- 例如,2022 年 11 月,苹果宣布计划根据印度政府的「印度製造」计划在印度开设其最大的製造部门之一。该新製造工厂预计将成为苹果在该地区最大的製造工厂。该公司在该地区采取的此类倡议有望促进该地区的行动电话半导体市场的发展。

- 中国、韩国、日本、新加坡和台湾是该地区一些高度发展的半导体生产国家。然而,马来西亚和印度等国家也正在成为潜在市场。这些国家的智慧型手机市场也非常庞大,因此对受访市场而言,这意味着巨大的机会。马来西亚已成为重要的半导体出口市场之一。

- 2021年5月,韩国宣布了雄心勃勃的计划,未来10年投资约4,500亿美元,打造全球最大的晶片製造基地。此外,各大公司也纷纷转向行动电话半导体。

行动电话半导体产业概况

行动电话半导体市场是一个高度分散的市场,由几家大公司主导。各种收购以及与大公司的联盟已经完成或即将完成,并且专注于技术创新。市场的主要企业包括三星电子和高通科技公司。这些公司正在利用策略合作计划来增加市场占有率并提高盈利。

- 2022 年 8 月-美光科技公司宣布计画在 2030 年投资 400 亿美元扩大在美国的半导体製造产能。新的製造部门预计将帮助该公司提高其在市场上的製造能力。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素与限制因素简介

- 市场驱动因素

- 快速引入下一代行动通讯标准LTE或4G

- “MultiCom”解决方案的出现

- 市场限制

- 製造复杂性

- 消费者需求超过工厂产能

- 产业吸引力-波特五力分析

- 买家的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- COVID-19 市场影响评估

第五章 市场区隔

- 依组件类型

- 行动处理器

- 记忆

- 逻辑晶片

- 模拟

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第六章 竞争格局

- 公司简介

- Samsung Electronics

- Qualcomm Technologies, Inc.

- MediaTek Inc.

- NXP Semiconductors NV

- Broadcom Inc.

- Skyworks Solutions Inc.

- Intel Corporation

- Huawei Technologies Co. Ltd

- Micron Technology Inc.

- Qorvo Inc.

第七章投资分析

第八章 市场机会与未来趋势

The Mobile Phone Semiconductor Market is expected to register a CAGR of 7.49% during the forecast period.

Key Highlights

- The overall semiconductor industry witnessed lesser growth, and the smartphone business was also fluctuating. However, the mobile phone semiconductor market was able to witness marginal growth, owing to the increasing adoption of RF-based applications in smartphones. In many regions, especially Asia-Pacific, the smartphone business was the largest consumer of the semiconductor industry.

- Since the past year, the smartphone industry has been witnessing a nearing maturity state which is affecting the mobile phone semiconductor industry. However, with the advent of 5G technology and the government's approval for the adoption of 5G technology, it is expected to enable smartphone users to shift from phones supporting 4G and LTE technology to 5G technology which would create huge opportunities for the studied market.

- With the increasing shipments of mobile devices such as tablets, smartphones, and e-book readers have been growing and are driving the growth for a range of semiconductor components, including applications processors, modems, MEMS sensors, wireless connectivity ICs, and audio ICs in these devices.

- The increased revenue of RF was generated from its growing adoption among more bands, a larger number of carriers aggregated, and higher-order MIMO configurations supported by an increase in smartphone ASPs. This trend was expected to continue in 2019, with the addition of the mid-band spectrum for sub-6GHz 5G and mmWave modules in some 5G phones.

- Changes in the semiconductor supply chain, the market fluctuation due to the US-China trade war, the Russia-Ukrain war, and the shifting business models created opportunities for some manufacturers while posing a threat to others.

- However, the significant outbreak of the COVID-19 pandemic globally disrupted the supply chain and production, especially in the Asia-Pacific region. Major semiconductor manufacturing industries have been significantly affected as a result of Asia-Pacific being a world production center over the past two to three decades.

Mobile Phone Semiconductor Market Trends

Memory to Significantly Drive the Market

- A large portion of the growth in this segment would be driven by ongoing technological advancements such as cloud computing and virtual reality in end devices such as smartphones. Sharply higher average selling prices (ASPs) for dynamic random access memory (DRAM) and NAND flash chips also substantially generate revenues.

- In general, the expected price decreases would be offset by new capacity for flash memory and for DRAM, which would result in a better balance of supply and demand for these devices to support more latest applications such as enterprise solid-state drives (SSDs), augmented and virtual reality, artificial intelligence, graphics, and other complexes, real-time workload functions.

- However, emerging memory technologies are poised to cannibalize huge chunks of the DRAM demand in the industry. In August 2022, Micron Technology Inc., announced its plan to spend USD 40 billion through 2030 to expand its semiconductor production capacity in the United States.

- Micron's DRAM chips are used for applications in a variety of devices ranging from smartphones to data center servers. The company's plan to expand its manufacturing unit in the United States is expected to be supported by various credits and grants under the CHIPS and Science Act. Such initiatives by the company is expected to promote the demand for memory in the market providing a positive push to the mobile phone semiconductor market during the forecast period.

Asia-Pacific to Hold a Dominant Position in the Mobile Phone Semiconductor Market

- Asia-Pacific is one of the major markets for mobile phone and semiconductor technologies. The region is dominating semiconductor and smartphone manufacturing fields. Most of the major companies, in both the markets, are based in the Asia-Pacific region, while the remaining companies have a presence in the region.

- The region also dominates the global semiconductor market. The increasing smartphone and semiconductor production, especially in emerging countries, is also augmenting the mobile semiconductor demand in the region. Countries like India, Vietnam, Thailand, and Singapore, among others, are witnessing an increasing number of smartphone manufacturers setting up their manufacturing plants in the region.

- For instance, in November 2022, Apple announced its plan to open one of its largest manufacturing unit in India under the 'Make in India' initiative by the Indian Government. The new manufacturing unit is expected to be Apple's largest manufacturing unit in the region. Such initiatives by the company in the region are expected to ppromote the mobile pone semiconductor market in the region.

- China, South Korea, Japan, Singapore, and Taiwan are some of the highly developed semiconductor producers in the region. However, countries, like Malaysia and India, are also emerging as potential markets. The smartphone market is also massive in these countries; hence, they can offer enormous opportunity for the market studied too. Malaysia is emerging as one of the vital semiconductor export markets.

- In May 2021, South Korea announced its ambitious plans to spend roughly USD 450 billion to build the world's biggest chipmaking base over the next decade. joining China and the U.S. in a global race to dominate the key technology. Moreover, with the shift of various major companies to the

Mobile Phone Semiconductor Industry Overview

The Mobile Phone Semiconductor Market is a highly fragmented market, dominated by several major players. Various acquisitions and collaborations of large companies have taken place and are expected to take place shortly, which focus on innovation. Some of the key players in the market are Samsung Electronics and Qualcomm Technologies, Inc. These companies are leveraging strategic collaborative initiatives to increase their market share and increase their profitability.

- August 2022 - Micron Technology Inc. announced its plan to spend USD 40 billion through 2030 to expand its semiconductor production capacity in the United States. The new manufacturing unit is expected to help the company to increase its manufacturing capabilities in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Rapid Introduction of Next-generation Mobile-communications Standard, LTE or 4G

- 4.3.2 Emergence of 'Multicom' Solutions

- 4.4 Market Restraints

- 4.4.1 Complexity Regarding Manufacturing

- 4.4.2 Consumer Demand Exceeding Factory Capacity

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Buyers

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Industry Value Chain Analysis

- 4.7 Assessment of Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 Component Type

- 5.1.1 Mobile Processors

- 5.1.2 Memory

- 5.1.3 Logic Chips

- 5.1.4 Analog

- 5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia Pacific

- 5.2.4 Latin America

- 5.2.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Samsung Electronics

- 6.1.2 Qualcomm Technologies, Inc.

- 6.1.3 MediaTek Inc.

- 6.1.4 NXP Semiconductors N.V.

- 6.1.5 Broadcom Inc.

- 6.1.6 Skyworks Solutions Inc.

- 6.1.7 Intel Corporation

- 6.1.8 Huawei Technologies Co. Ltd

- 6.1.9 Micron Technology Inc.

- 6.1.10 Qorvo Inc.