|

市场调查报告书

商品编码

1642170

工业显示器:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Industrial Monitor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

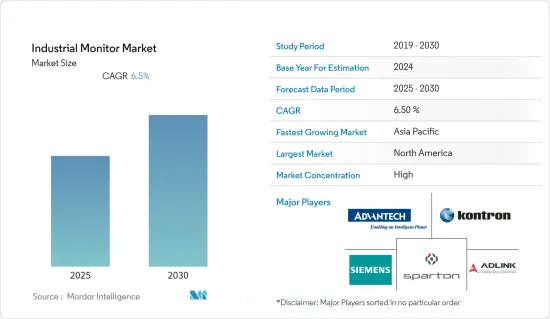

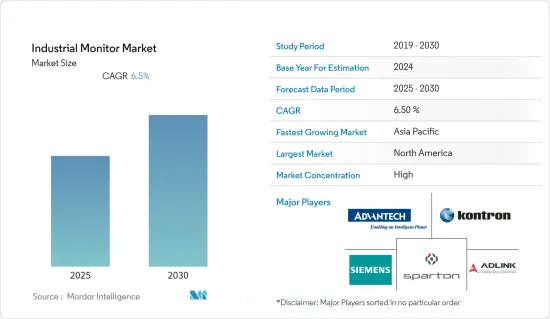

预计预测期内工业显示器市场复合年增长率为 6.5%。

主要亮点

- 工业显示器用于各种工业领域,包括製造业、采矿业、石油和天然气、物流、安全和医疗保健。这些监视器透过高品质的流程简化了劳动力并提高了工人的生产效率。结果是,劳动变得更加轻鬆并且工时生产力转向高品质的业务。为了满足生产目标和工业显示器的改进,市场竞争日益激烈,这对全球工业显示器市场产生了正面影响。

- 此外,预计工业显示器市场成长的主要驱动力将是第四次工业革命。显示技术、工业自动化技术的发展以及製造和製程行业人机介面 (HMI) 的快速采用都促进了市场的扩张。

- 工业监视器在单一平台上提供多种功能,无需安装多个库存。因此,工业企业正在采用自动化系统,从而需要安装此类工业监视器。

- 工业显示器产业投入大量资金研发,开发LED、LCD、OLED等显示技术,实现高解析度与亮度。 IP 认证的边框和出色的工业高级 LCD 和 LED 显示器使操作员能够在各种环境中使用工业显示器。预计这将推动全球工业显示器市场的扩张。

- 此外,具有 IP 等级和触控萤幕的大型工业级 LCD 和 LED 显示器的发展,正在增加其在采矿、金属和石油工业等危险环境中的使用。工业监视器还具有允许其在危险环境中运行的温度等级。

- 关于工业显示器製造和销售的法规因地区和国家而异。例如,欧盟《限制使用有害物质指令》(RoHS)规定,电子设备中镉、铅、汞、六价铬以及多溴二苯基醚(PBDEs)和多溴联苯(PBBs)等阻燃剂的使用在一定程度上受到限制。

- 然而,企业购买工业显示器所需的高额前期成本可能会限制市场扩张。工业显示器市场面临的主要问题之一是製造商对不同设备和零件供应商的依赖。

工业监视器市场趋势

LCD 占据很大份额

- 液晶的光控能力被利用在平面显示器:液晶显示器。 LCD 显示器使用背光或反射镜而不是直接产生光来产生彩色或单色影像。液晶显示器大致可分为电脑用液晶显示器和电子手錶、视讯播放器等电子设备用液晶显示器。

- 当工业技术用于工业用途时,预计其效率将非常高。人们需要能够在各种情况和环境下发挥作用的 LCD 显示技术。显示器经常用于通讯、安全和工业任务执行。然而,许多显示器无法在恶劣的工业环境中使用,这导致对LCD技术的需求增加。随着液晶萤幕的流行,坚固的「工业」级显示器也随之流行。

- LCD 是汽车显示应用的一种流行技术,可满足所有温度和耐用性要求。製造商根据车载显示应用的用途和温度范围,使用 LCD 和 TFT 的组合进行显示应用。 LCD 数位仪錶丛集和中控台是商用车的标准配备。这导致液晶显示器领域的需求增加。

- 此外,由于采用了 LCD 技术,它们的品质标准比普通萤幕高得多。值得注意的是,工业级 LCD 的背光半衰期比标准显示器更长,如果保养得当,其使用寿命可以比传统 LCD 长 100,000 小时。

- 此外,现今使用最常见、用途最广泛的电子平板技术是工业液晶显示器。工业液晶显示器通常与工业电脑一起使用,但它们也可用于显示当今几乎任何视讯来源的视讯影像。早期在工业显示器中使用多年的阴极射线管(CRT)技术几乎完全被 LCD 技术所取代。

- 这些 LCD 技术已在高阶面板中得到应用,预计未来将继续改进并变得更加实惠。这些技术包括更大的萤幕、更高的解析度、与影格速率同步的更高刷新率以实现流畅的播放、高动态范围照明和色域与每像素背光相结合,以便在明亮的阳光下准确观看并且不会出现烧屏。由于目前尚无可行液晶面板替代品,因此市场正在扩大。

- 我们的坚固工业液晶萤幕的品质与零售店和家庭常用的液晶萤幕不同。工业级显示器在品质方面已经超越了普通液晶显示器,而且由于薄膜电晶体技术,真正的工业液晶显示器现在更加耐用并提供卓越的图像品质。这些坚固的显示器专为承受工业工作环境而製造,可承受极端温度、灰尘和碎片。

北美是工业显示器市场的主要动力

- 北美地区包括美国、加拿大等已开发国家、新兴经济体。近年来,它已成为汽车製造中心。购买力的上升刺激了该地区对汽车的需求。该地区汽车产业的扩张也得益于北美新兴经济体对半自动汽车的需求稳定成长。预计北美汽车智慧显示器市场将受到显示器成本下降和豪华汽车兴起的推动。

- 按地区划分,北美目前占据全球工业显示器市场的主导地位。预计该区域市场将在预测期内保持领先地位,而该地区的工业部门预计对 HMI、远端监控解决方案、互动式显示模组和其他基于物联网的技术的需求将快速增长。

- 由于企业对数位电子看板应用显示重要资讯的需求不断增加,工业显示器市场正在成长。由于多项技术进步和自动化工业流程的引入,工业监控市场正在不断扩大。

- 通用电气、斯巴达、艾伦布拉德利和希望工业系统是该领域的一些领先公司。此外,该地区拥有几家大型汽车製造商,并且是世界上最大的汽车市场之一。汽车业是该地区製造业最大的收益来源。该地区提供了巨大的市场扩张机会,主要由于汽车行业采用工业显示器。

- 据估计,美国拥有北美最大的工业显示器市场,主要受远端监控、HMI 和互动式显示应用的需求所推动。该地区对工业显示器的需求主要由製造业和发电业推动。此外,由于工业自动化的广泛采用、对IIoT应用和多功能HMI设备的支出增加,该地区工业显示器的产能可能会加速成长。

工业显示器产业概况

工业监视器市场竞争激烈,由几家大公司组成。从市场占有率来看,其中少数几家公司占据着市场主导地位。由于显示技术发展迅速,且显示器产业出现了多家专注于研发创新解决方案的公司,导致过去几年市场竞争异常激烈。这些公司正在利用策略合作措施来增加市场占有率和盈利。

- 2022 年 5 月-罗克韦尔自动化推出全新工业监视器系列,帮助机器製造商区分他们的机器并满足广泛的应用需求。新款 Allen-Bradley ASEM 6300M 工业显示器属于原先称为 VersaView 6300 的产品系列的一部分,提供多种设计选择。这些选项使机器製造商能够根据成本、性能和外观等因素自由地自订他们的显示器。

- 2022 年 3 月-Oizom 推出 AQBot,一款智慧且价格实惠的工业空气品质监测器。这款全面的工业级空气品质监测设备有 14 种型号,可检测各种空气污染物和颗粒物,为各种工业需求提供即时、可操作的见解。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- 技术简介

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 对 HMI 设备的需求不断增加

- 物联网的普及率不断提高

- 市场挑战

- 企业购置工业显示器的初始投资较高

第六章 市场细分

- 按下显示技术

- LCD

- LED

- OLED

- 按行业

- 车

- 物流与运输

- 石油和天然气

- 医疗保健

- 金属与矿业

- 其他行业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 其他拉丁美洲和中东地区

- 北美洲

第七章 竞争格局

- 公司简介

- Advantech Co., Ltd.

- Kontron S&T AG

- ADLINK Technology Inc.

- Sparton Inc.

- Siemens AG

- Rockwell Automation Inc.(Allen-Bradley)

- Hope Industrial System Inc.

- Pepperl+Fuchs Inc.

- AAEON Technology Inc.

- Axiomtek Co. Ltd

- National Instruments Corporation

第八章投资分析

第九章 市场机会与未来趋势

The Industrial Monitor Market is expected to register a CAGR of 6.5% during the forecast period.

Key Highlights

- Industrial monitors are used in many different industrial sectors, including manufacturing, mining, oil & gas, logistics, security, and healthcare. These monitors streamline labor and improve worker productivity over high-quality processes. As a result, it makes labor easier and shifts man-hour productivity toward quality operations. The worldwide industrial monitor market is positively impacted by increased market competitiveness to match production targets and improved industrial monitors.

- The main driver of the industrial monitor market growth is also projected to be the fourth industrial revolution. The development of display technologies, automated technologies in the industry, and the quick adoption of human-machine interfaces (HMIs) in the manufacturing and process sectors all contribute to the market's expansion.

- As industrial monitor provides multi functionalities on an individual platform, the installation of multiple inventories is diminished. Thus, industrial firms are adopting automated systems, and industrial monitor creates one such need for installation.

- The industrial monitor industry has invested much in research and development, which has developed display technologies, including LED, LCD, and OLED, that provide higher resolution and greater brightness. The IP-certifiedified bezel and outstanding industrial high-grade LCD and LED display allow operators to use industrial monitors in various settings. This is expected to propel the industrial monitor market's expansion on a global scale.

- Moreover, the development of sizeable industrial-grade LCD and LED displays with IP ratings and touch panels has increased their use in hazardous settings, including the mining, metals, and oil industries. Industrial monitors are also given temperature ratings that enable them to operate in dangerous environments.

- Regulations governing the production and sale of industrial displays differ by region or nation. For instance, the use of cadmium, lead, mercury, hexavalent chromium, and flame retardants, such as polybrominated diphenyl ethers (PBDE) or polybrominated biphenyls (PBB), in electronic equipment has been somewhat restricted by the European Union Law on the Restriction of Hazardous Substances (RoHS).

- However, the high initial expenditure required by enterprises to purchase industrial monitors may limit the market's expansion. One of the main issues facing the industrial display market is manufacturers' reliance on different suppliers for equipment and components.

Industrial Monitor Market Trends

LCD to Hold Significant Share

- The ability of liquid crystals to regulate light is used in liquid crystal displays, which are flat panel displays. Liquid crystal displays employ a backlight or reflector rather than producing light directly to produce images in color or monochrome. LCDs fall into two main categories: those used in computers and those used in electronic gadgets like digital clocks and video players.

- Industrial technology must be highly effective when used for industrial applications. The need for LCD equipment technology that can function in various settings and circumstances grows. Displays are frequently required for communication, safety, and the performance of industrial tasks. However, many monitors cannot be used in harsh industrial environments, which increases the demand for LCD technology. Rugged, "industrial" grade monitors followed the widespread adoption of LCD screens.

- LCD is a frequently utilized technology in car display applications and satisfies all temperature and durability requirements. Manufacturers use a combination of LCD and TFT in display applications, depending on the purpose of the vehicle display application and the temperature range. LCD digital instrument clusters and center stacks are standard features in commercial vehicles. Thus, increasing the demand for the LCD segment.

- Moreover, Due to LCD technology, these meet quality criteria that are much higher than what a regular screen would ever need to withstand. It's interesting to note that industrial-grade LCDs have a longer backlight half-life than standard displays and that, with proper care, they can last up to 100,000 hours longer than traditional LCDs.

- Additionally, the most popular and versatile electronic flat-screen technology currently in use is an industrial LCD monitor, which is typically used in conjunction with an industrial computer but can also be utilized to display video images from virtually any video source that is currently available. The earlier cathode ray tube (CRT) technology, used for industrial monitors for many years, has almost entirely been superseded by LCD technology.

- These LCD technologies are already present in high-end panels, and it is anticipated that they will get better and more affordable. They include higher resolution with larger screens, higher refresh rates with frame rate synchronization for fluid playback, high dynamic range lighting, and color gamut combined with per-pixel backlighting for precise viewing in bright sunlight and zero burn-in. The market is expanding because a realistic substitute for LCD panels has yet to exist.

- The quality of rugged, industrial LCD screens differs from those often utilized in retail or household settings. Industrial-grade displays beat regular LCDs in terms of quality, and due to thin-film transistor technology, real industrial LCD monitors are now more durable and provide superior picture quality. These tough displays are resilient to industrial work settings and can survive harsh temperatures, dust, and debris.

North America Significantly Drives the Industrial Monitor Market

- The North American area includes developed countries like the United States and Canada and growing economies. The area has been a center for the manufacture of automobiles in recent years. The increase in purchasing power has sparked the region's demand for cars. The expansion of the automotive industry in the area is also attributed to the steady rise in demand for semi-autonomous vehicles in North America's developing economies. The automotive smart display market in North America is anticipated to be driven by declining display costs and an increase in luxury automobiles.

- Geographically speaking, North America currently dominates the world market for industrial monitors. Over the projected period, the regional market is anticipated to hold onto its top position while also experiencing a sharp increase in demand for HMIs, remote monitoring solutions, interactive display modules, and other IoT-based technologies in the area's industrial sector.

- The market for industrial monitors is experiencing growth due to the increasing demand in the area for digital signage applications in businesses for presenting essential information. The industrial monitor market is expanding due to the introduction of several technological advancements and automated industrial processes.

- General Electric, Sparton Inc., Allen-Bradley, Hope Industrial System Inc., etc., are a few of the top companies active in the sector. Additionally, the area is home to several major auto manufacturers and has one of the largest automobile marketplaces in the world. One of the largest revenue producers in the region's manufacturing sector has been the automotive industry. The area presents a significant opportunity for market expansion as the automotive industry is primarily responsible for adopting industrial monitors.

- According to estimates, the U.S. has the most significant industrial display market in the entire of North America, which drives considerable demand for remote monitoring, HMI, and interactive display applications. The manufacturing and power-generating sectors are primarily responsible for driving the need for industrial displays in the area. Furthermore, industrial display capabilities in this area may be accelerated by the increased prevalence of industrial automation, rising spending on IIoT applications, and multifeatured HMI devices.

Industrial Monitor Industry Overview

The Industrial Monitor Market is highly competitive and consists of several major players. In terms of market share, several of these players majorly control the market. The market has become highly competitive in the past few years owing to the rapid pace of development of display technologies and the presence of several companies that are focused on research and development efforts aimed at the development of innovative solutions in the monitor industry. These firms are leveraging strategic collaborative initiatives to increase their market share and profitability.

- May 2022 - Rockwell Automation, Inc. announced the release of a new line of industrial monitors that can help machine builders differentiate their machines and meet a wide range of application needs. The new Allen-Bradley ASEM 6300M industrial monitors, part of the product family formerly known as VersaView 6300, offer several design options. These options give machine builders significant freedom to customize the monitors based on factors like cost, performance, and look and feel.

- March 2022 - Oizom launched AQBot, a smart, affordable Industrial air quality monitor. The comprehensive, industrial-grade air quality monitoring device comes in 14 variants and helps detect a wide range of air pollutants and particulate matter, providing real-time actionable insights for diverse industrial needs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of SubstituteProdcuts

- 4.4 Technology Snapshot

- 4.5 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 The Increasing Demand for HMI Devices

- 5.1.2 The Augmented Adoption of IoT

- 5.2 Market Challenegs

- 5.2.1 High Primary Investment in Getting Industrial Monitors by the Businesses

6 MARKET SEGMENTATION

- 6.1 By Display Technology

- 6.1.1 LCD

- 6.1.2 LED

- 6.1.3 OLED

- 6.2 By Industry Vertical

- 6.2.1 Automotive

- 6.2.2 Logistics and Transportation

- 6.2.3 Oil and Gas

- 6.2.4 Medical and Healthcare

- 6.2.5 Metal and Mining

- 6.2.6 Other Industry Verticals

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Rest of the World (Latin America & Middle East )

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Advantech Co., Ltd.

- 7.1.2 Kontron S&T AG

- 7.1.3 ADLINK Technology Inc.

- 7.1.4 Sparton Inc.

- 7.1.5 Siemens AG

- 7.1.6 Rockwell Automation Inc. (Allen-Bradley)

- 7.1.7 Hope Industrial System Inc.

- 7.1.8 Pepperl+Fuchs Inc.

- 7.1.9 AAEON Technology Inc.

- 7.1.10 Axiomtek Co. Ltd

- 7.1.11 National Instruments Corporation