|

市场调查报告书

商品编码

1642183

精简型用户端:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Thin Client - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

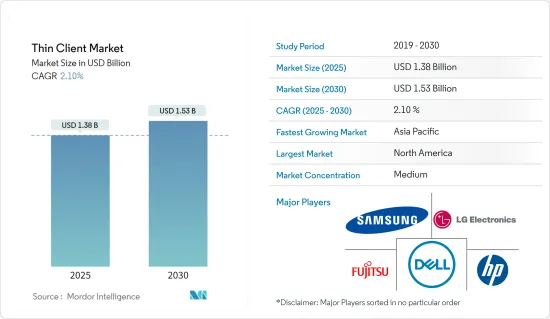

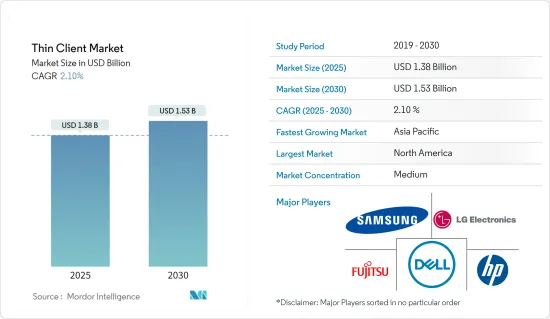

精简型用户端市场规模预计在 2025 年为 13.8 亿美元,预计到 2030 年将达到 15.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 2.1%。

预计精简型用户端市场将在预测期内扩大,这主要归因于这些设备所提供的优势,即降低成本和能耗、易于集中和管理以及提高基础设施安全性。

主要亮点

- 许多行业都在寻找能够显着减少办公桌空间并易于替换或升级旧系统的低成本设备。精简型用户端系统满足这些要求。精简型用户端系统还能够在一段时间内减少能源消费量,这是各行各业对其需求不断增加的主要原因。

- 由于其安全优势,医疗保健行业也越来越多地采用该设备作为计算解决方案。同时,IT和通讯业主要部署这些设备以促进虚拟网路的发展。将精简型用户端设备引入企业和其他领域可以提高安全性,因为用户入侵可以透过本地机器设定来限制。此应用程式使您的系统更加安全。

- 大学、研究机构和实验室等各类教育机构越来越多地采用精简型用户端解决方案来集中监控管理并降低 IT 部门的能源消耗。这些设备还可以降低系统升级的成本以及每次登入时设定 PC 或笔记型电脑所需的时间。

- 云端处理的日益普及也推动了市场的成长。组织正在转向云端处理来降低成本并存取未安装在电脑或伺服器上的资料和应用程式。云端已经成为一种基础设施,能够以动态可扩展和虚拟的方式快速提供运算资源作为公共事业。世界各地的组织正在转向混合云和多重云端环境。精简型用户端正在推动市场成长,因为它们提供了相对便宜且安全的硬体解决方案。

- 预计在预测期内,越来越多的企业采用即服务(WaaS) 将推动市场需求。 WaaS 是虚拟桌面解决方案,组织使用它来允许员工远端存取应用程式。然而,新兴国家云端运算的网路问题预计会抑制所调查市场的成长。

- 能源公司属于地缘政治敏感产业,经常成为网路攻击的目标,尤其是来自外国政府的攻击。但是,透过使用云端作为虚拟桌面的基础,您可以集中储存敏感资讯并设定身份验证策略来保护您的云端环境。预计这些因素将会推动精简型用户端市场的需求。

- 过去几十年来,远距工作的趋势日益增长。然而,新冠肺炎疫情的影响在很短的时间内急剧加速了这一趋势,迫使大大小小的企业迅速适应世界各国政府要求的自我隔离措施。疫情导致更多人远距办公,引发了人们对员工之间资料共用安全性的担忧。这推动了对精简型用户端设备的需求。

精简型用户端市场趋势

医疗保健领域有望推动市场成长

- 医疗保健提供者严格提供最高标准的患者照护。他们对所使用的技术非常敏感,以改善每个护理阶段的患者体验。从急诊室入院到復健再到门诊护理,科技对患者的治疗结果有着深远的影响,并对医疗保健提供者的生产力和营运成本有着关键的影响。

- 对于医疗保健领域无处不在的桌面运算基础设施来说尤其如此。在传统的桌上型电脑模型中,资料和应用程式驻留在分布在网路上的各个电脑上,通常会形成单独配置和管理的电脑丛集。这些与敏感的患者资料有关,并且参数通常不太统一。

- 然而,使用精简型用户端,资料和应用程式可以在资料中心或云端基础架构中远端系统管理。精简型用户端只是一个存取门户,允许管理员和临床医生根据凭证即时存取应用程式和患者资料。

- 精简型用户端,就其架构性质而言,提供了多种安全优势,有助于最大限度地减少安全威胁,同时确保遵守 HIPAA 和其他医疗保健法规。透过使用者身份验证和权限检验严格控制授权使用者对云端基础的资料和应用程式的存取。 USB/连接埠保护、智慧卡和防火墙进一步加强了这些安全措施。

- 众所周知,该行业目前正在数位化转型,但却不愿改变,因为不可靠的技术故障可能会导致影响患者健康的问题。任何偏离预定义工作流程的行为都可能对医院营运产生负面影响。儘管存在这种犹豫,该行业仍必须加快采用技术,以遵守不断变化的法规和协议。

- 这些需求推动着围绕着最大化交付能力而设计的强劲伙伴关係结构。例如,2023 年 3 月,现代工作空间安全管理端点的先驱 Stratodesk 宣布,多款 LG Business Solutions精简型用户端已通过 Stratodesk NoTouch OS 认证,使 IT 团队有信心和灵活性在私有云和公共云端环境中部署承包系统。

北美预计将占据主要市场占有率

- 预计北美将主导市场,关键因素包括云端技术的采用日益广泛,以及需要动态且灵活部署的高度技术导向的产品。该地区的大多数企业都可以获得 IT 支援。市场领导的存在、大量的云端服务供应商以及不断增加的託管伺服器数量是推动该地区市场成长的关键因素。

- 该地区的组织是新技术的早期采用者,这是该地区优势的关键驱动因素。大型云端服务供应商在该地区云端基础的精简型用户端部署的成长中发挥关键作用。

- 云端处理和虚拟在广播中发挥着越来越重要的作用。可透过网路通讯协定远端控制的虚拟机器或电脑可以成为现场实体设备的理想补充。

- 北美的IT和通讯业是全球最大的区域市场之一。处理大量敏感资讯的行业(例如银行、医疗保健和政府机构)正在寻求采用精简型用户端解决方案。这是因为他们比胖客户端更能维护其智慧财产权的完整性。

- 这一强势地位也得益于该国有多家精简型用户端解决方案提供商。特别是,惠普公司和 Citrix 最近合作旨在提供安全高效的精简型用户端解决方案,专注于增强远端工作能力和对所有虚拟桌面和应用程式的无缝存取。

精简型用户端产业概览

精简型用户端市场竞争激烈且复杂,许多大公司都在国内外提供产品。市场集中度适中,主要企业采用产品和服务创新、联盟、併购等策略来扩大其地理覆盖范围并获得相对于竞争对手的优势。市场的主要参与者包括戴尔公司、惠普开发公司、三星集团和 LG 电子公司。

- 2023 年 11 月-AWS 宣布推出 Amazon WorkSpaces Thin Client,彻底改变企业工作空间。

- 2023 年 8 月 - LG 电子公司将于 2023 年推出名为 CQ 的薄客户端系列,该系列将简化扩展并延长精简型用户端寿命、提供卓越的安全性、高性能、轻鬆连接和显着的能源节省,以提高效率和生产力。这款精简型用户端为医疗机构提供了一个具有可靠性能、强大的资料保护、安全的虚拟桌面体验且易于部署和管理的端点。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 加强网路基础设施安全

- 降低成本和能源消耗

- 市场挑战

- 新兴国家的云端运算网路问题

第六章 市场细分

- 按类型

- 硬体

- 软体服务

- 按最终用户

- BFSI

- 资讯科技/通讯

- 卫生保健

- 政府

- 其他最终用户(零售、製造、教育)

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Dell Inc.

- HP Development Company LP

- Samsung Group

- LG Electronics Inc.

- NEC Corporation

- Fujitsu Ltd

- Lenovo Group Limited

- Cisco Systems Inc.

- Advantech Co. Ltd

- Siemens AG

- IGEL Technology GmbH

第八章投资分析

第九章 市场机会与未来趋势

The Thin Client Market size is estimated at USD 1.38 billion in 2025, and is expected to reach USD 1.53 billion by 2030, at a CAGR of 2.1% during the forecast period (2025-2030).

The market for thin clients is expected to increase in the forecast period mainly because of its advantages, i.e. cost savings and reduced energy consumption, centralisation and ease of management as well as increased infrastructure security offered by these devices.

Key Highlights

- Various industries seek low-cost devices that significantly decrease desk space and offer an easy replacement/upgrade for conventional systems. The thin client systems qualify for these requirements. They can also reduce energy consumption over a period, which is the primary reason for the increasing demand for devices across various industries.

- The healthcare industry is also witnessing an extensive adoption of devices as a computing solution, owing to their security benefits. In contrast, the IT and telecom industry is installing these devices primarily to facilitate the development of a virtual network. Implementing thin client devices in enterprises or other areas can provide better security-related advantages, as they limit the user from any intrusion in a local machine setting. This application renders the system more secure and protected.

- Various educational institutions, such as colleges, research institutes, and labs, are increasingly adopting thin client solutions to control the monitors centrally at the IT control department, thereby reducing energy consumption. These devices also decrease the cost of system upgrades and the time consumed in setting up the PC or laptop at each login.

- The increasing growing adoption of cloud computing is also driving market growth. Several organizations use cloud computing to reduce costs and access the data and applications not installed on the computers or servers. Clouds emerged as an infrastructure that may enable the rapid delivery of computing resources as a utility in a dynamically scalable and virtual manner. Various organizations across the world are moving to a hybrid and multi-cloud environment. A thin client contributes to a comparatively less expensive and secure hardware solution, driving the market's growth.

- With the rising adoption of workspace-as-a-service (WaaS) in several enterprises, the market is anticipated to witness augmented demand during the forecast period. WaaS is a desktop virtualization used by multiple organizations to provide their employees access to applications remotely. However, network issues in developing countries for cloud computing are expected to restrain the growth of the studied market.

- Energy companies operating in a geopolitically sensitive industry face frequent cyberattack targets, especially from foreign governments. However, using the cloud as a base for desktop virtualization allows sensitive information to be stored centrally, and authentication policies can be set to secure the cloud environment. This factor is anticipated to generate demand for the thin client market.

- Over the last decades, there has been an increasing trend of remote work. But the effect of COVID-19, which has dramatically accelerated this trend during a very brief period but forced companies regardless of size to adjust quickly to selfisolation measures called for by governments around the world, is rapidly accelerating it. With the pandemic requiring more people to be working remotely, the concern regarding the security of data sharing among employees increased. This has been driving the adoption of the demand for thin-client devices.

Thin Client Market Trends

The Healthcare Segment is Expected to Drive the Market's Growth

- Healthcare providers are stringent in offering the highest standards of patient care. They are acutely attuned to the technologies they use to improve the patient experience at every stage of care. From admissions to the emergency room to rehabilitation and outpatient care, the technology can significantly impact patient outcomes and critically impact providers' productivity and operational costs.

- This holds especially true for the ubiquitous desktop computing infrastructure across the healthcare domain. The legacy desktop PC model, data, and applications reside locally on individual PCs distributed across the network, often yielding a cluster of individually configured and managed PCs. These are associated with sensitive patient data, often with little to no parameter uniformity.

- However, with thin clients, data and applications are remotely administered, stored, and centralized in the data center or cloud infrastructure. The thin client is simply the access portal, giving administrators and clinicians immediate access to their applications and patient data as their credentials allow.

- By the nature of their architecture, thin clients offer various security advantages to help ensure compliance with HIPAA and other healthcare regulations while minimizing exposure to security threats. Authorized user access to cloud-based data and applications is strictly controlled via user authentication and permissions verification. USB/port protections, smart cards, and firewalls can further augment these security measures.

- Although the industry is currently transitioning into digitization, it has been notoriously recognized to be resistant to changes since any failure of unreliable technology translates into issues that affect patient health. Any deviation from predetermined workflows can adversely affect a hospital's operations. Despite the hesitancy, the industry must accelerate technology adoption to remain compliant with the constantly changing regulations and agreements.

- Such needs have encouraged robust partnership structures designed around maximizing offering capabilities. For instance, in March 2023, Stratodesk, the pioneer of securely managed endpoints for modern workspaces, announced that several LG Business Solutions Thin Clients are now certified with Stratodesk NoTouch OS, providing IT teams with The confidence and flexibility to deploy turnkey systems in both private and public cloud environments.

North America is Expected to Hold a Major Market Share

- North America is expected to dominate the market, primarily due to the main factors such as the increasing adoption of cloud technology and highly technology-oriented products, which require activity and flexibility. IT support is available to the majority of companies in the region. The presence of market leaders, a significant number of cloud service providers, and an increasing number of hosted servers in the area are essential contributors to the market's growth in the region.

- The organizations in the region are early adopters of new technologies, which is the primary driving force behind the region's dominance. Large cloud service providers play a significant role in the region's growth of cloud-based thin client deployment.

- In broadcasting, cloud computing and virtualization are playing an increasing role. Virtual machines and computers that can be remotely controlled through network protocols may provide an optimum complement to the physically available equipment on site.

- The North American IT and telecommunications industry is one of the largest among other regional markets. Industries such as banking, healthcare, and government organizations, which handle a large amount of sensitive information, are looking forward to adopting thin client solutions. They can preserve the integrity of the intellectual property better than a fat client.

- This strong position can be attributed to the presence of several well-established thin client solution providers within the country. Notably, a recent partnership between HP Inc. and Citrix aims to deliver secure and efficient thin client solutions, focusing on enhancing remote work capabilities and seamless access to all virtual desktops and applications.

Thin Client Industry Overview

The thin client market is fragemented and highly competitive due to the presence of many large players in the market providing products in the domestic and international markets. The market appears to be mildly concentrated, with the key players adopting strategies like product and service innovations, partnerships, mergers, and acquisitions to extend their geographic reach and stay ahead of the competitors. Some of the major players in the market are Dell Inc., H.P. Development Company LP, Samsung Group, and L.G. Electronics Inc.

- November 2023 - AWS has announced the launch of Amazon WorkSpaces Thin Client to Revolutionize Enterprise Workspaces and offers quick and reliable access to business applications, catering to customer service, technical support, and healthcare sectors.

- August 2023 - LG Electronics Inc In addition to simplifying expansion, it has launched a series of thin clients in 2023 called CQ which are designed for extended product life, superior safety, high performance, easy connectivity and substantial energy savings that can improve efficiency and productivity. The thin client provides healthcare facilities with an endpoint which delivers reliable performance, strong data protection and a secure virtual desktop experience that can be easily implemented and managed.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Enhanced Network Infrastructure Security

- 5.1.2 Reduction of Cost and Energy Consumption

- 5.2 Market Challenges

- 5.2.1 Network Issues in Developing Countries for Cloud Computing

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Hardware

- 6.1.2 Software and Services

- 6.2 By End User

- 6.2.1 BFSI

- 6.2.2 IT and Telecom

- 6.2.3 Healthcare

- 6.2.4 Government

- 6.2.5 Other End Users (Retail, Manufacturing, Education)

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Dell Inc.

- 7.1.2 HP Development Company LP

- 7.1.3 Samsung Group

- 7.1.4 LG Electronics Inc.

- 7.1.5 NEC Corporation

- 7.1.6 Fujitsu Ltd

- 7.1.7 Lenovo Group Limited

- 7.1.8 Cisco Systems Inc.

- 7.1.9 Advantech Co. Ltd

- 7.1.10 Siemens AG

- 7.1.11 IGEL Technology GmbH