|

市场调查报告书

商品编码

1642187

塑胶薄膜:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Plastic Film - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

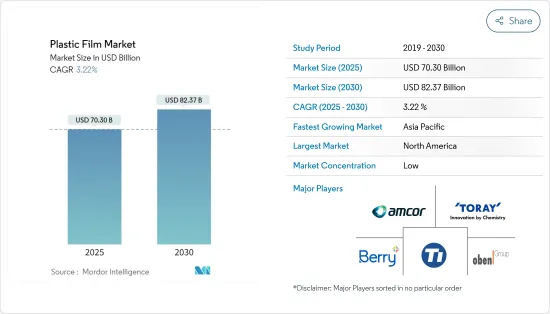

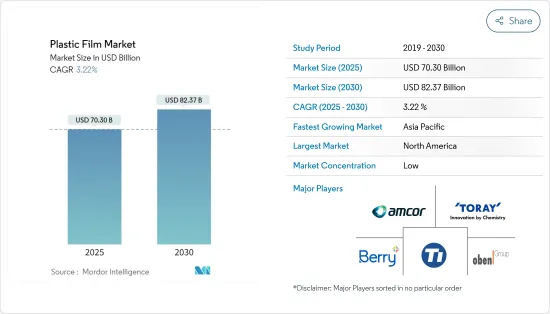

预计 2025 年塑胶薄膜市场规模为 703 亿美元,到 2030 年预计将达到 823.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 3.22%。

主要亮点

- 塑胶薄膜是一层连续的薄塑胶材料,通常捲在捲芯上或切成薄片。它们由多种塑胶树脂製成,每种树脂都具有独特的物理特性,适用于特定的应用。这些薄膜经常用于包装,以保护和维护产品的完整性,并满足各种工业和消费者用途。塑胶薄膜具有透明性、柔韧性、耐用性和防潮性等优良特性,适用于多种用途。

- 永续性和轻量化的趋势导致塑胶薄膜变得更薄。这些调整是必要的,以支持那些因聚合物价格下跌而面临利润紧缩的供应商,并满足消费者因环境问题和生活方式改变而对减少包装的需求。日益增强的环保意识和对包装废弃物的担忧正在影响消费者的购买行为。作为回应,品牌正在开发永续的包装选择,例如生物分解性和水溶性薄膜,以应对这些环境挑战。

- 食品业对各种创新塑胶薄膜的需求不断增加,预计将在未来几年推动市场成长。饮食习惯的改变,尤其是对加工食品的日益偏好,预计将增加对塑胶薄膜的需求。主要行业参与者正在积极生产各种类型的塑料,以满足消费者需求和食品易腐性。预计美国、印度和中国等国家对食品业的投资增加将大幅促进市场成长。

- 此外,由于其柔韧性、机械强度和稳定性,塑胶是一种适应性很强的材料,广泛应用于包括製药在内的多个行业的包装系统製造。这种塑胶薄膜由于其透气性、清洁剥离性能和优异的微生物阻隔性,特别适合无菌医疗和药品包装。预计全球对製药业的投资增加将推动市场成长。

- 预计德国政府的倡议将对推动医药塑胶包装市场的发展至关重要。针对2023年,德国政府推出了一项新的製药策略,详见战略文件4.0。该战略旨在透过提高研发和生产能力来增强国内製药业。此外,该地区的许多公司正在进行大量投资以扩大生产活动,预计将为市场参与企业创造机会。

- 同样,对方便、营养早餐食品的持续需求预计将推动高密度聚乙烯薄膜市场的扩张。 HDPE 薄膜的防潮性能使其成为包装早餐用麦片谷类(尤其是薄片)的理想选择。此外,电子商务的成长也极大地促进了对塑胶薄膜和包装等保护性包装解决方案的需求。预计这一趋势将在未来几年推动市场发展。

- 许多公司正在大力投资该市场,预计这将增加市场潜力。例如,2023年11月,奥本集团透露计划在美国扩大其BOPA薄膜业务,并与AdvanSix Inc.建立战略合作伙伴关係,以获得树脂供应。此外,2023 年 8 月,Amcor PLC 同意收购 Phoenix Flexibles,加强其在印度市场的影响力。此次收购预计将提高生产能力以满足需求并使先进的薄膜技术得以采用。

- 预计未来几年有关塑胶可回收性的严格法规的日益实施将阻碍市场的成长。此外,市场上还有替代材料,这可能会阻碍市场的进步。此外,随着各行各业采用「中国+1」策略来降低供应链风险,企业越来越注重扩大在印度、越南和其他亚洲国家的业务。这一趋势可能会对该地区的塑胶薄膜市场产生重大影响。

塑胶薄膜产业细分

聚丙烯市场可望强劲成长

- 用于包装的低密度塑胶薄膜称为聚丙烯包装薄膜。这种适应性极强的薄膜由于其高光泽度和优异的抗拉强度,正在获得各行各业的认可。一般来说,聚丙烯包装薄膜不含酸、塑化剂和重金属,因此是比其他塑胶薄膜更永续的替代品。多个产业对流延聚丙烯 (CPP) 和双轴延伸聚丙烯(BOPP) 薄膜的需求不断增长,预计将推动该领域的成长。

- CPP 在各种传统软包装应用中越来越受欢迎,因为其优异的透明度、光泽度、耐热性和平整性使其能够有效替代聚乙烯。此外,CPP 还具有优异的抗撕裂和抗衝击性能、在寒冷条件下增强的性能以及改善的热封性。这些包装解决方案有助于延长食品的保质期。此外,生活方式的改变和繁忙的日程安排也导致对方便食品的需求不断增长,极大地推动了市场的成长。

- 例如,考虑到各个地区包装食品行业的成长情况,该行业可能会蓬勃发展。有机贸易协会预测,美国有机包装食品的市值将从 2023 年的 232.1 亿美元增加到 2025 年的 250.6 亿美元。因此,许多公司都专注于包装行业的创新技术,这直接导致对此类包装解决方案的需求增加。

- BOPP 薄膜以其坚韧、透明和长寿命而闻名,适用于食品包装和产品标籤等各种应用。报导将介绍BOPP薄膜的复杂性能、主要亮点以及生产方法。 BOPP薄膜因其防潮性、光学透明度和优异的拉伸强度,广泛应用于医疗包装、食品和饮料包装等领域。

- 电子商务的快速扩张推动了对防篡改和防刺穿包装的需求。 BOPP薄膜有效地满足了这些条件,使其适合包装网销产品,促进了市场的成长。美国、德国、印度、中国等国家的电子商务收益均显着成长。这些关键因素预计将大幅促进 BOPP 薄膜市场的发展。

- 根据美国人口普查局的数据,美国零售电子商务销售额预计将从 2022 年的 2.53 亿美元成长到 2023 年的 2.75 亿美元。电子商务的显着成长是由于科技越来越多地融入日常生活。预测显示,美国电子商务用户数量将大幅成长,从 2023 年的 2.54 亿增加到 2028 年的 3.16 亿以上。此外,主要行业参与者的存在及其投资预计将进一步促进该地区电子商务行业的成长。

- 此外,2024 年 1 月,Forop 正式推出并正在运作由布鲁克纳机械製造公司提供的最先进的多层 BOPP 生产线,该生产线宽 8.7 米,生产线速度为每分钟 600 米。这条先进的生产线提高了生产效率,同时降低了消费量。供应商为提高 BOPP 生产能力而进行的大规模投资预计将极大地刺激需求。

亚太地区预计成长最快

- 预计亚太地区将经历最快的成长,这主要归功于中国和印度的庞大人口。根据世界银行的资料,在消费需求復苏的推动下,中国GDP成长率预计将在2023年达到5.2%。两国可支配收入的增加预计将推动食品饮料、医药、宠物食品和化妆品等各行业的扩张,从而促进塑胶薄膜市场的繁荣。

- 随着越来越多的消费者选择方便的包装方式,对包装食品的需求不断增加,加上塑胶产量不断上升,推动了塑胶薄膜包装市场的扩张。预计到 2025 年,印度包装食品产业将翻倍。作为世界第二大粮食生产国,印度拥有巨大的产能提升潜力,最终成为世界领先的粮食生产国之一。

- 亚太地区塑胶薄膜产业的扩张主要受到食品和医药包装产业的推动。印度迅速壮大的中阶,加上有组织的零售业的兴起,对塑胶包装市场的成长做出了巨大贡献。此外,出口的快速成长需要更高的包装标准来满足国际要求,从而进一步刺激包装产业的发展。因此,这些因素预计将推动亚太地区的市场成长。

- 亚太地区的製药业正在经历显着的成长,这主要归功于人们医疗保健意识的不断增强,以及不受地域限制的先进治疗选择的普及。医药市场的扩张预计将促进塑胶薄膜产业的发展。根据印度品牌资产基金会的报告,预计2023年印度医药市值将达到497.8亿美元,到2030年将达到1,300亿美元。此外,印度製药业满足了英国约25%的药品需求和美国约40%的学名药需求。

- 尤其是自疫情过后,该地区的创业投资、併购和各种扩大策略都出现了激增。这一趋势对于亚洲塑胶薄膜的成长和发展来说是一个非常令人鼓舞的指标,该地区已准备好利用持续的扩张机会。例如,2023年3月,科思创宣布计画增加其全球特种聚碳酸酯(PC)薄膜产能,以满足亚太地区和全球日益增长的需求。

- 此外,印度等各国对BOPP薄膜的需求也预计将大幅成长。例如,印度经济的快速扩张推动了 BOPP 市场的显着成长,这得益于製药、零售、化妆品、食品和饮料等行业的强劲发展。此外,BOPP自黏胶带优异的机械和光学性能使电子商务领域成为印度最重要的应用之一。

- 2024年3月,凸版印刷与印度凸版特殊薄膜公司(TSF)合作,推出了基于双轴延伸聚丙烯(BOPP)的阻隔膜「GL-SP」。创新的 GL-SP 薄膜由 BOPP 製成,满足了对永续包装解决方案日益增长的需求。它具有出色的阻隔氧气和水蒸气的性能,是包装干燥产品的理想选择,同时其透明度和薄度有助于最大限度地减少塑胶消费量,从而有效地服务一系列市场。该地区此类引人注目的供应商倡议预计将推动市场成长。

塑胶薄膜产业概况

塑胶薄膜市场由于全球参与者和本地製造商的存在而本质上是分散的,例如 Amcor PLC、Berry Global Group Inc.、Toray Advanced Films、Oben Holding Group、Taghleef Industries LLC 和 Copol International Ltd.。伙伴关係、合併和收购是跨国公司为维持其市场地位而采用的主要成长策略。

- 2024 年 4 月:双轴延伸聚丙烯薄膜製造商 Inteplast BOPP Films 与永续食品包装解决方案专家 VerdaFresh 合作,开发一种高阻隔柔性薄膜,旨在延长食品的保质期,同时最大限度地减少包装废弃物。据该公司称,该倡议旨在透过永续的包装方法减少食物废弃物。

- 2023 年 9 月,Orben Group 宣布已同意收购 Tredegar Corporation 的软包装薄膜业务 Terfan。

- 2023 年 5 月,INEO 开发了一种由一半以上的再生塑胶製成的薄而坚硬的薄膜。这是首次将如此大量的再生废弃塑胶用于包装产品。透过将 Hosokawa Alpine 先进的 MDO(机器方向取向)技术与 INEO 的聚合物结合,超过 50% 的再生塑胶 Recycl-IN 树脂转化为聚乙烯薄膜。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 购买者/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 市场驱动因素

- 各产业需求旺盛带来成长潜力

- 对轻量化包装解决方案的需求不断增加

- 市场挑战

- 严格的政府法规

第五章 市场区隔

- PP薄膜市场

- 按类型

- BOPP

- CPP

- 按最终用户产业

- 食物

- 饮料

- 药品

- 工业的

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 波兰

- 比荷卢

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 其他亚太地区

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 其他拉丁美洲国家

- 中东和非洲

- 按类型

- BOPET 薄膜市场

- 按类型

- 薄型 BOPET

- 重量级 BOPET

- 按最终用户产业

- 封装和金属化

- 饮食

- 药品

- 个人护理

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 波兰

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 泰国

- 印尼

- 其他亚太地区

- 拉丁美洲

- 中东和非洲

- 按类型

- PE薄膜市场

- 按材质

- LDPE

- HDPE

- 按最终用户产业

- 食物

- 饮料

- 农业

- 建造

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 拉丁美洲

- 中东和非洲

- 按材质

- PVC薄膜市场

- 按最终用户产业

- 饮食

- 药品

- 电气和电子

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 其他亚太地区

- 拉丁美洲

- 中东和非洲

- 按最终用户产业

- 其他塑胶薄膜类型

- 聚苯乙烯(PS)

- 生物基塑胶薄膜

- 聚偏二氯乙烯(PVDC)

- 乙烯 - 乙烯醇(EVOH)

第六章 竞争格局

- 公司简介

- Toray Advanced Film Co. Ltd

- Oben Holding Group

- Taghleef Industries

- Vitopel do Brasil Ltda

- Cosmo Films Inc.

- Uflex Corporation

- Jindal Poly Films Ltd

- Dupont Tejin Films

- Amcor Plc

- Berry Global Inc

- Tekni-Plex Inc.

第七章投资分析

第八章 市场机会与未来趋势

The Plastic Film Market size is estimated at USD 70.30 billion in 2025, and is expected to reach USD 82.37 billion by 2030, at a CAGR of 3.22% during the forecast period (2025-2030).

Key Highlights

- Plastic film is a continuous, thin layer of plastic material, typically rolled onto a core or cut into sheets. It can be produced from a variety of plastic resins, each possessing distinct physical attributes that cater to specific applications. These films are frequently used in packaging to safeguard and maintain the integrity of products and serve various industrial and consumer purposes. The advantageous properties of plastic films, including transparency, flexibility, durability, and moisture resistance, render them appropriate for numerous applications.

- The ongoing trends in sustainability and lightweighting are leading to a reduction in the thickness of plastic films. This adjustment is necessary to support suppliers facing diminished profit margins due to low polymer prices and meet consumer demands for less packaging driven by environmental considerations and shifts in lifestyle. Heightened awareness of environmental issues and concerns about packaging waste have influenced consumers' purchasing behaviors. In response, brands are developing sustainable packaging options, including biodegradable and water-soluble films, to tackle these environmental challenges.

- The increasing demand from the food industry for various innovative plastic films is expected to drive the market's growth in the future. Alterations in eating patterns, particularly an increasing inclination towards processed foods, are anticipated to enhance the demand for plastic films. Key industry participants are actively manufacturing diverse types of plastics tailored to consumer needs and the perishability of food items. The rising investments in the food industry in countries such as the United States, India, and China are projected to substantially propel the market's growth.

- Moreover, plastic is a highly adaptable material with extensive application in manufacturing packaging systems across multiple industries, including pharmaceuticals, owing to its flexibility, mechanical strength, and stability. Plastic films are particularly suitable for sterile medical and pharmaceutical packaging due to their breathability, clean peel characteristics, and excellent microbial barriers. The increasing investments in the pharmaceutical sector globally are anticipated to propel the market's growth.

- Government initiatives in Germany are anticipated to be crucial in advancing the pharmaceutical plastic packaging market. In 2023, the German government introduced a new Pharmaceutical Strategy, detailed in Strategy Paper 4.0. This strategy aims to strengthen the country's pharmaceutical industry by enhancing research and production capabilities. Additionally, numerous companies in the area are making substantial investments to enhance production activities, which is expected to create opportunities for market participants.

- Similarly, the consistent demand for convenient and nutritious breakfast items is anticipated to drive the expansion of the HDPE films market. The moisture barrier characteristics of HDPE films render them ideal for packaging breakfast cereals, particularly flakes. Furthermore, the growth of e-commerce is contributing significantly to the demand for protective packaging solutions, such as plastic films and wraps. This trend is likely to bolster the market's development in the coming years.

- Numerous companies are making substantial investments in the market, which is anticipated to boost its potential. For example, in November 2023, Oben Group revealed plans to expand its BOPA film operations in the United States, forming a strategic partnership with AdvanSix Inc. for resin supply. Additionally, in August 2023, Amcor PLC enhanced its footprint in the Indian market by agreeing to acquire Phoenix Flexibles. This acquisition is expected to enable the company to increase its capacity to meet demand and incorporate advanced film technology.

- The increasing implementation of strict regulations concerning plastic recyclability is anticipated to impede the market's growth in the coming years. Additionally, the presence of alternative materials in the market may obstruct the market's advancement. Furthermore, as industries adopt the China plus one strategy to mitigate supply chain risks, there is a growing emphasis on expanding operations in India, Vietnam, and other Asian countries. This trend is likely to significantly influence the plastic film market within the region.

Plastic Film Industry Segmentation

The Polypropylene Segment is Expected to Grow Significantly

- Low-density plastic films utilized for packaging are referred to as polypropylene packaging films. These adaptable films are increasingly being embraced by a variety of industries, attributed to their high gloss finish and superior tensile strength. Typically, polypropylene packaging films do not contain acids, plasticizers, or heavy metals, rendering them more environmentally sustainable and suitable alternatives to other plastic films. The rising demand for cast polypropylene (CPP) and biaxially oriented polypropylene (BOPP) films across multiple sectors is expected to propel the growth of this segment.

- CPP has become increasingly popular in various traditional flexible packaging applications, largely due to its exceptional clarity, gloss, heat resistance, and lay-flat properties, which allow it to effectively replace polyethylene. In addition, CPP offers superior tear and impact resistance, enhanced performance in cold conditions, and improved heat-sealing abilities. These packaging solutions contribute to extending the shelf life of food products. Furthermore, the rising demand for convenience foods, driven by evolving lifestyles and busy schedules, has significantly accelerated the market's growth.

- For instance, it is expected that the packaged food industry is likely to thrive, considering the growth of the sector in various regions. The Organic Trade Association projects that the market value of organic packaged food in the United States is expected to rise from USD 23.21 billion in 2023 to USD 25.06 billion by 2025. Consequently, numerous companies are focusing on innovative technologies within the packaging industry, which correlates directly with the rising demand for these packaging solutions.

- BOPP film is known for its robustness, clarity, and longevity, making it suitable for a variety of applications, including food packaging and product labeling. This article examines the complexities of BOPP film, highlighting its key attributes and the production methods involved. Due to its resistance to moisture, optical transparency, and exceptional tensile strength, BOPP film is extensively used in sectors such as medical packaging and food and beverage packaging.

- The swift expansion of e-commerce has led to a heightened demand for packaging that is both tamper-evident and puncture-resistant. BOPP films effectively fulfill these criteria, rendering them suitable for packaging products sold online and aiding in the growth of the market. Countries such as the United States, Germany, India, and China are experiencing notable increases in e-commerce revenues. These critical factors are anticipated to substantially propel the market for BOPP films.

- According to the US Census Bureau, in 2023, it is estimated that retail e-commerce sales in the United States reached USD 275 million, an increase from USD 253 million in 2022. The remarkable rise in e-commerce can be attributed to the increasing incorporation of technology into everyday life. Forecasts suggest a substantial growth in the number of e-commerce users in the United States, projected to rise from 254 million in 2023 to over 316 million by 2028. Furthermore, the presence of major industry players and their investments is anticipated to further propel the growth of the e-commerce sector in the region.

- Moreover, in January 2024, Forop officially launched and is now operating a cutting-edge, multi-layer BOPP line that measures 8.7 meters in width and boasts a line speed of 600 meters per minute, supplied by Bruckner Maschinenbau. This advanced line enhances productivity while simultaneously lowering energy consumption. The substantial investments made by suppliers to enhance BOPP production capabilities are anticipated to stimulate demand significantly.

Asia-Pacific is Expected to Witness the Fastest Growth

- Asia-Pacific is projected to experience the most rapid growth, primarily due to the significant populations of China and India. Data from the World Bank indicates that China's GDP growth reached 5.2% in 2023, driven by a resurgence in consumer demand. In both nations, the rise in disposable income is expected to bolster the expansion of various industries, including food and beverages, pharmaceuticals, pet food, and cosmetics, thereby contributing to the prosperity of the plastic film market.

- The increasing demand for packaged food, coupled with the rise in plastic production, has led many consumers to choose convenient packaging options, thereby driving the expansion of the plastic film packaging market. Significantly, the Indian packaged food sector is projected to double by 2025. As the second-largest food producer globally, India possesses substantial potential to enhance its capabilities and ultimately become the leading food producer in the world.

- The expansion of the plastic film industry in Asia-Pacific is primarily propelled by the food and pharmaceutical packaging sectors. The burgeoning middle class in India, coupled with the rise of organized retailing, is significantly contributing to the growth of the plastic packaging market. Additionally, the swift increase in exports necessitates higher packaging standards to meet international requirements, further stimulating the packaging industry. Consequently, these factors are anticipated to enhance market growth in Asia-Pacific.

- The pharmaceutical sector in Asia-Pacific is experiencing significant growth, largely fueled by an increase in healthcare awareness among the population and the availability of advanced treatment options without geographical limitations. This expanding pharmaceutical market is anticipated to bolster the plastic film industry. As reported by the India Brand Equity Foundation, the Indian pharmaceutical market was valued at USD 49.78 billion in 2023 and is expected to reach USD 130.0 billion by 2030. Furthermore, approximately 25% of the medicine requirements in the United Kingdom are met by the Indian pharmaceutical industry, which also supplies around 40% of the generic medication needs in the United States.

- The region has experienced significant activity in venture capital, mergers and acquisitions, and various expansion strategies, particularly since the post-pandemic era. This trend is a highly encouraging indicator for the growth and development of plastic films in Asia, which are well-positioned to capitalize on ongoing expansion opportunities. For example, in March 2023, Covestro announced its plans to enhance its global production capacity for specialty polycarbonate (PC) films in response to the rising demand in Asia-Pacific and worldwide.

- Moreover, the demand for BOPP films across various countries like India is also expected to witness significant growth. For instance, the rapid expansion of the Indian economy is contributing to significant growth in the BOPP market, driven by the robust development of sectors such as pharmaceuticals, retail, cosmetics, and food and beverages. Additionally, the e-commerce sector represents one of the most substantial applications for BOPP self-adhesive tapes in the nation, owing to their excellent mechanical and optical properties.

- In March 2024, Toppan, in collaboration with Toppan Speciality Films (TSF) based in India, introduced GL-SP, a barrier film utilizing biaxially oriented polypropylene (BOPP) as its substrate, with production and sales commencing in April 2024. This innovative GL-SP film, crafted from BOPP, addresses the increasing demand for sustainable packaging solutions. Its exceptional barrier properties against oxygen and water vapor render it ideal for packaging dry products, while its transparency and reduced thickness contribute to minimizing plastic consumption, effectively catering to a variety of markets. Such notable vendor initiatives in the region are expected to propel the market's growth.

Plastic Film Industry Overview

The plastic film market is fragmented in nature because of the presence of global players and local manufacturers such as Amcor PLC, Berry Global Group Inc., Toray Advanced Film Co Ltd, Oben Holding Group, Taghleef Industries LLC, and Copol International Ltd. Partnerships, mergers, and acquisitions are the prime growth strategies global players adopt to sustain in the market.

- April 2024: Inteplast BOPP Films, a producer of biaxially oriented polypropylene films, partnered with VerdaFresh, a company specializing in sustainable food packaging solutions, to develop a high-barrier flexible film designed to prolong the shelf life of food products while minimizing packaging waste. The initiative, as stated by the company, aims to combat food waste through sustainable packaging methods.

- September 2023: Oben Group announced its agreement to acquire Terphane, a flexible packaging films business part of Tredegar Corporation, which will help the company expand its footprint in the market.

- May 2023: INEO created a thin, inflexible film that is made from over half recycled plastic. This is the first occasion that such a large amount of recycled waste plastic has been employed for packaging products. By combining INEO's polymer savvy with the advanced Machine-Direction Orientation (MDO) technology of Hosokawa Alpine, Recycl-IN resins with more than 50% recycled plastic were converted into polyethylene film.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.4.1 High Demand from Various Industries Offers Potential Growth

- 4.4.2 Increasing Demand for Lightweight Packaging Solution

- 4.5 Market Challenge

- 4.5.1 Stringent Government Regulations

5 MARKET SEGMENTATION

- 5.1 PP Films Market

- 5.1.1 By Type

- 5.1.1.1 BOPP

- 5.1.1.2 CPP

- 5.1.2 By End-user Industry

- 5.1.2.1 Food

- 5.1.2.2 Beverage

- 5.1.2.3 Pharmaceuticals

- 5.1.2.4 Industrial

- 5.1.2.5 Other End-user Industries

- 5.1.3 By Geography

- 5.1.3.1 North America

- 5.1.3.1.1 United States

- 5.1.3.1.2 Canada

- 5.1.3.2 Europe

- 5.1.3.2.1 United Kingdom

- 5.1.3.2.2 Germany

- 5.1.3.2.3 France

- 5.1.3.2.4 Italy

- 5.1.3.2.5 Spain

- 5.1.3.2.6 Poland

- 5.1.3.2.7 Benelux

- 5.1.3.2.8 Rest of Europe

- 5.1.3.3 Asia-Pacific

- 5.1.3.3.1 China

- 5.1.3.3.2 India

- 5.1.3.3.3 Japan

- 5.1.3.3.4 Rest of Asia-Pacific

- 5.1.3.4 Latin America

- 5.1.3.4.1 Brazil

- 5.1.3.4.2 Argentina

- 5.1.3.4.3 Mexico

- 5.1.3.4.4 Rest of Latin America

- 5.1.3.5 Middle East and Africa

- 5.1.1 By Type

- 5.2 BOPET Films Market

- 5.2.1 By Type

- 5.2.1.1 Thin BOPET

- 5.2.1.2 Thick BOPET

- 5.2.2 By End-user Industry

- 5.2.2.1 Packaging and Metallizing

- 5.2.2.1.1 Food and Beverage

- 5.2.2.1.2 Pharmaceuticals

- 5.2.2.1.3 Personal Care

- 5.2.2.1.4 Other End-user Industries

- 5.2.3 By Geography

- 5.2.3.1 North America

- 5.2.3.1.1 United States

- 5.2.3.1.2 Canada

- 5.2.3.2 Europe

- 5.2.3.2.1 United Kingdom

- 5.2.3.2.2 Germany

- 5.2.3.2.3 France

- 5.2.3.2.4 Italy

- 5.2.3.2.5 Spain

- 5.2.3.2.6 Poland

- 5.2.3.2.7 Rest of Europe

- 5.2.3.3 Asia-Pacific

- 5.2.3.3.1 China

- 5.2.3.3.2 India

- 5.2.3.3.3 Japan

- 5.2.3.3.4 South Korea

- 5.2.3.3.5 Thailand

- 5.2.3.3.6 Indonesia

- 5.2.3.3.7 Rest of Asia-Pacific

- 5.2.3.4 Latin America

- 5.2.3.5 Middle East and Africa

- 5.2.1 By Type

- 5.3 PE Films Market

- 5.3.1 By Material

- 5.3.1.1 LDPE

- 5.3.1.2 HDPE

- 5.3.2 By End-user Industry

- 5.3.2.1 Food

- 5.3.2.2 Beverage

- 5.3.2.3 Agriculture

- 5.3.2.4 Construction

- 5.3.2.5 Other End-user Industries

- 5.3.3 By Geography

- 5.3.3.1 North America

- 5.3.3.1.1 United States

- 5.3.3.1.2 Canada

- 5.3.3.2 Europe

- 5.3.3.2.1 United Kingdom

- 5.3.3.2.2 Germany

- 5.3.3.2.3 France

- 5.3.3.2.4 Italy

- 5.3.3.2.5 Spain

- 5.3.3.2.6 Rest of Europe

- 5.3.3.3 Asia-Pacific

- 5.3.3.3.1 China

- 5.3.3.3.2 India

- 5.3.3.3.3 Japan

- 5.3.3.3.4 South Korea

- 5.3.3.3.5 Rest of Asia-Pacific

- 5.3.3.4 Latin America

- 5.3.3.5 Middle East and Africa

- 5.3.1 By Material

- 5.4 PVC Films Market

- 5.4.1 By End-user Industry

- 5.4.1.1 Food and Beverage

- 5.4.1.2 Pharmaceuticals

- 5.4.1.3 Electrical/Electronics

- 5.4.1.4 Other End-user Industries

- 5.4.2 By Geography

- 5.4.2.1 North America

- 5.4.2.1.1 United States

- 5.4.2.1.2 Canada

- 5.4.2.2 Europe

- 5.4.2.2.1 United Kingdom

- 5.4.2.2.2 Germany

- 5.4.2.2.3 France

- 5.4.2.2.4 Rest of Europe

- 5.4.2.3 Asia-Pacific

- 5.4.2.3.1 China

- 5.4.2.3.2 India

- 5.4.2.3.3 Japan

- 5.4.2.3.4 Rest of Asia-Pacific

- 5.4.2.4 Latin America

- 5.4.2.5 Middle East and Africa

- 5.4.1 By End-user Industry

- 5.5 Others Plastic Films Types

- 5.5.1 Polystyrene (PS)

- 5.5.2 Bio-Based Plastic Films

- 5.5.3 Polyvinylidene Chloride (PVDC)

- 5.5.4 Ethylene Vinyl Alcohol (EVOH)

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Toray Advanced Film Co. Ltd

- 6.1.2 Oben Holding Group

- 6.1.3 Taghleef Industries

- 6.1.4 Vitopel do Brasil Ltda

- 6.1.5 Cosmo Films Inc.

- 6.1.6 Uflex Corporation

- 6.1.7 Jindal Poly Films Ltd

- 6.1.8 Dupont Tejin Films

- 6.1.9 Amcor Plc

- 6.1.10 Berry Global Inc

- 6.1.11 Tekni-Plex Inc.