|

市场调查报告书

商品编码

1642198

IT 服务 -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)IT Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

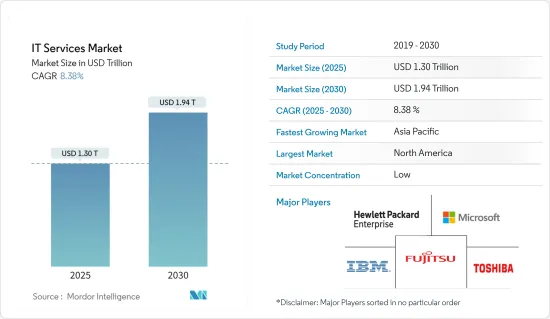

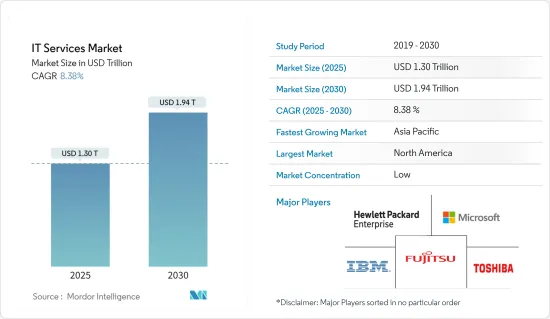

2025 年 IT 服务市场规模预估为 1.3 兆美元,预计到 2030 年将达到 1.94 兆美元,预测期内(2025-2030 年)的复合年增长率为 8.38%。

全球 IT 支出不断增加,加上软体即服务 (SaaS) 的采用日益广泛以及云端解决方案的成长,都证明了 IT 服务需求的激增。随着IT基础设施变得越来越强大,资料外洩的频率不断上升,这极大地推动了市场的成长机会。

关键亮点

- 由于几个关键因素,IT 服务市场正在经历强劲成长。第一个驱动力是数位转型,企业采用数位技术来提高效率、改善客户体验并推动创新。此外,云端运算的应用正在蓬勃发展,为企业提供可扩展且经济高效的 IT 解决方案。巨量资料和分析的兴起凸显了对先进 IT 服务来管理资料和从中获取见解的需求。

- 此外,5G、区块链、AR 和 AI 等技术进步的兴起可能会对 IT 服务的提供产生正面影响。 5G技术的出现将使企业能够在自己的场所内建立网路。爱立信预计,到2029年终,全球5G用户数预计将超过53亿,占所有行动用户的58%。到2028年,5G将成为主导行动接取技术。值得注意的是,光是 2023 年第四季,5G 用户数就激增 1.54 亿,总合达到 15.7 亿。

- 物联网设备的普及,加上远距办公的激增,增加了对强大IT基础设施和支援的需求。同时,随着IT环境变得越来越复杂并且需要更多专业技能,企业越来越多地转向外包IT服务,从而刺激市场扩张。

- 然而,诸如控制力减弱和关键目标不明确等业务挑战不断增加、资料外洩不断增加以及产品客製化和资料迁移的成本问题等因素可能在整个预测期内仍然是重大问题。

IT服务市场的趋势

随着云端基础平台的出现,云端服务占据主导地位

- 在数位时代,企业正在透过采用新技术来寻求敏捷性,主要是透过转向云端基础的环境。在云端操作意味着嵌入式的连接性和智慧。这将有利于实现智慧营运的无缝集成,并为云端连结数位服务奠定坚实的基础。据 Flexera Software 称,到 2024 年,49% 的受访者将在 Amazon Web Services (AWS) 上运行关键工作负载。

- 云端基础的基础设施提供了灵活的、按需的存取资源的能力,支撑着这些新的数位业务解决方案。随着云端基础平台IT营运的进步,IT服务越来越资料主导、即时化,为企业创造更大的价值,特别是在优化营运效率、发掘商机、远端存取等方面。

- 由于云端解决方案提供了多种显着的优势,云端运算近年来取得了长足的发展。未来几年对云端服务的需求预计会不断增长,随着不断增长的企业部门对 IT 和通讯行业的巨大需求,来自这些最终用户的IT基础设施服务范围预计将迅速扩大。

- 2024年4月,云端软体集团公司与微软公司承诺透过广泛的、为期八年的策略伙伴关係关係加强合作。此次合作旨在扩大 Citrix虚拟应用程式和桌面平台的市场占有率。此外,它为透过统一的产品蓝图支援共同创造创新的云端和人工智慧解决方案铺平了道路。

- 为了提高生产力、管治和控制力,许多组织都希望在云端部署核心系统。各类市场供应商都在增加投资,以加速数位转型。例如,2024 年 5 月,Telefonica 和 Google Cloud 将扩大合作,向市场推出一流的云端解决方案。两家公司有一个共用的目标:加速企业的数位转型。新的伙伴关係涉及透过 Telefonica Tech 扩展可用的 Google Cloud 服务,并且专门针对 B2B 领域量身定制。此次合作也强调了共同关注先进创新,特别是人工智慧(AI)和生成人工智慧(Gen AI)。

预计预测期内北美市场将显着成长

- 技术的快速进步、云端运算应用的激增以及对网路安全解决方案的需求不断增长,正在推动北美 IT 服务市场的发展。企业正在加大数位转型力度,以提高效率和竞争力。物联网设备的广泛使用和巨量资料分析的激增进一步推动了市场的发展。此外,由于新冠疫情的爆发,远距办公的转变也凸显了弹性IT基础设施和託管服务的整体重要性。人工智慧和机器学习技术的兴起进一步丰富了市场前景。

- 受银行业成长加速和经济基本面改善的推动,美国银行和金融机构正在加快资讯科技服务的支出。该地区的许多企业已开始采用新方法和新流程来获得竞争优势,从而产生了人工智慧、物联网、机器学习(ML)、区块链、机器人、资料科学等新技术。增加。随着商业和工业领域数位化和连网型设备的日益普及,该地区的物联网应用和销售正在激增。这项变更为该地区IT服务的扩张铺平了道路。

- 市场正面临参与企业企业和新兴参与企业的激烈竞争。这些市场参与企业正在采用有机和无机策略相结合的策略来加强竞争,从而增强市场的成长前景。例如,2023 年 10 月,云端商务市场 Pax8 与 CyberFOX 合作,为託管服务供应商(MSP) 提供专门从事特权存取管理 (PAM) 的身份存取管理 (IAM) 解决方案。 CyberFOX 拥有帮助超过 2,000 家 MSP 的成功经验,并致力于帮助其主要中小型企业 (SMB) 客户提高效率、提高生产力并创造新的收益来源。

- Cognizant 也于 2024 年 3 月与荷兰企业集团 Pon Holdings 的子公司 Pon IT 续签了长期伙伴关係关係。透过此次扩展,Cognizant 巩固了其作为 Pon IT 多元化营业单位的云端託管服务供应商的地位。随着合作的进展,Cognizant 计划推出进一步的增强功能,以使 Pon IT 能够利用更灵活、直觉和整合的云端基础架构。

IT服务业概况

IT服务市场的特点是竞争激烈,主要由广泛的参与企业推动。这些参与企业目前占有相当大的市场占有率,但这种情况正在改变。先进 IT 咨询服务的兴起为新参与企业提供了强大的力量,使他们能够巩固自己的地位,尤其是在新兴经济体中。

- 2024 年 5 月,CrowdStrike 与塔塔咨询服务公司 (TCS) 建立策略伙伴关係关係,透过 AI 原生的 CrowdStrike Falcon XDR 平台增强 TCS 的扩展託管侦测和回应 (XMDR) 产品。此次伙伴关係将使 TCS 能够利用 Falcon 平台的全面安全功能。这包括云端安全和下一代 SIEM,促进 SOC 的 AI主导转型,以更好地预防违规行为。

- 2023 年 7 月,IT 託管服务供应商Windstream Enterprise推出由 ATSG 提供的全新 IT 託管服务组合,为承包客户提供控制和增强的虚拟整体空间、数位基础架构和网路安全需求。服务。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

- 市场驱动因素

- 越来越重视透过外包非核心活动来发挥核心竞争力

- 获得更多人才和创新空间(相对于入职专业知识)

- 云端基础平台的出现使云端服务成为人们关注的焦点

- 市场问题

- 营运挑战(例如失去控制的感觉、确定关键目标等)

第五章 市场区隔

- 按服务类型

- 专业(系统整合及咨询)

- 託管

- 按尺寸

- 中小企业

- 大型企业

- 按最终用户产业

- BFSI

- 通讯

- 医疗

- 零售

- 製造业

- 政府

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 亚洲

- 中国

- 日本

- 印度

- 新加坡

- 印尼

- 马来西亚

- 越南

- 泰国

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

- 北美洲

第六章 竞争格局

- 公司简介

- Citrix Systems Inc.

- Cisco Systems Inc.

- Dell EMC

- IBM Corporation

- Hewlett Packard Enterprise

- Microsoft Corporation

- TCS Limited

- Toshiba Corporation

- Verizon Communications Inc.

- Fujitsu Ltd

第七章 主要厂商定位

第八章 市场机会与未来趋势

The IT Services Market size is estimated at USD 1.30 trillion in 2025, and is expected to reach USD 1.94 trillion by 2030, at a CAGR of 8.38% during the forecast period (2025-2030).

The rising IT expenditures throughout the world, alongside the growing embrace of software-as-a-service and expanding cloud solutions, underscore a surging demand for IT services. With an enhanced IT infrastructure, the frequency of data breaches is on the rise, driving the market growth opportunities significantly.

Key Highlights

- The IT Services market is witnessing robust growth, driven by several key factors. Primary among these is digital transformation, where businesses are leveraging digital technologies to boost efficiency, enhance customer experiences, and foster innovation. Moreover, the surge in the adoption of cloud computing is providing businesses with scalable and cost-efficient IT solutions. The rise in big data and analytics underscores the need for sophisticated IT services to manage and derive insights from data.

- Also, the rise in technological advancements like 5G, Blockchain, AR, and AI are likely to have a positive impact on the offerings of IT services. With 5G technology on its way, it is likely to ensure that companies may set up networks on their premises. According to Ericsson, by the end of 2029, global 5G subscriptions are projected to surpass 5.3 billion, representing 58% of all mobile subscriptions. 5G is set to take the lead as the primary mobile access technology by 2028. Notably, in Q4 2023 alone, 5G subscriptions surged by 154 million, reaching a total of 1.57 billion.

- The rise in IoT device adoption, coupled with the surge in remote work setups, is amplifying the demand for robust IT infrastructure and support. Simultaneously, as IT landscapes grow more intricate and demand specialized skills, organizations are increasingly turning to outsourcing for IT services, fuelling market expansion.

- However, factors like increasing operational challenges such as perceived loss of control and identification of key goals, as well as growing data breaches, cost concerns over product customization, and data migration, are some of the reasons that can act as a significant matter of concern, further restricting the market's growth throughout the forecast period.

IT Services Market Trends

Cloud Services is Gaining Traction Due to the Emergence of Cloud-based Platform

- Companies in this digital age are striving for agility through the adoption of new technologies, primarily by transitioning to cloud-based environments. Operating in the cloud involves establishing embedded connections and intelligence. This fosters the seamless integration of smart operations and lays a robust foundation for cloud-linked digital services. According to Flexera Software, in 2024, 49 percent of respondents are already running significant workloads on Amazon Web Services (AWS).

- Cloud-based infrastructure provides flexible, on-demand access to the resources underlying these new digital business solutions. Due to advancements in IT operation across the cloud-based platform, IT services have become more data-driven and real-time, creating greater value for the business, especially in operational efficiency, business opportunity discovery, and remote access optimization.

- There has been a significant breakthrough in cloud computing over the past few years, as cloud solutions offer various significant advantages. As the demand for cloud services is expected to grow over the next few years, with immense demand from the IT and telecommunication industry across the ever-growing corporate sector, the scope for IT infrastructure services from these end users is expected to grow rapidly.

- In April 2024, Cloud Software Group, Inc., and Microsoft Corp. declared that they are strengthening their collaboration plans through an extensive eight-year strategic partnership. This collaboration aims to bolster the market presence of Citrix's virtual application and desktop platform. Furthermore, it will pave the way for the joint creation of innovative cloud and AI solutions underpinned by a unified product roadmap.

- To increase productivity, governance, and control, many organizations aim to deploy their systems' core to the cloud. Various market vendors are driving their investments to accelerate digital transformation. For instance, in May 2024, Telefonica and Google Cloud broadened their collaboration, aiming to deliver top-tier cloud solutions to the market. Their shared goal is to empower businesses to expedite their digital evolution. This renewed partnership entails the expansion of Google Cloud services, available through Telefonica Tech, specifically tailored for the B2B sector. The collaboration also emphasizes a joint focus on advanced innovations, notably in artificial intelligence (AI) and generative AI (Gen AI).

North America is Expected to Register Significant Market Growth During the Forecast Period

- Rapid technological advancements, a surge in cloud computing adoption, and a rising demand for cybersecurity solutions propel North America's IT services market. Businesses are ramping up digita l transformation efforts to boost their efficiency and competitive edge. The market is further bolstered by the widespread adoption of IoT devices and the surge in big data analytics. Moreover, the shift to remote work, hastened by the COVID-19 pandemic, has emphasized the overall significance of resilient IT infrastructure and managed services. The ascent of AI and machine learning technologies further enriches the market's landscape.

- The banking and financial institutions in the United States are accelerating spending on information technology services, which is helped by higher growth in the banking sector and improving economic fundamentals. Many enterprises in the region have begun adhering to newer methods and processes to gain a competitive advantage, resulting in the increasing adoption of emerging technologies, like AI, IoT, machine learning (ML), Blockchain, robotics, and data science. The region is witnessing a surge in IoT applications and sales, propelled by the increasing digitalization and adoption of connected devices in business and industry. This shift is paving the way for the expansion of IT services in the region.

- The market witnessed intense competition, fuelled by both established and emerging players. These industry participants deploy a mix of organic and inorganic strategies to enhance their competitive edge, consequently amplifying market growth prospects. For instance, in October 2023, Pax8, a cloud commerce marketplace, teamed up with CyberFOX to offer managed service providers (MSPs) specialized identity access management (IAM) solutions, with a focus on privileged access management (PAM) via their exclusive product, AutoElevate. CyberFOX, with a track record of assisting more than 2000 MSPs, is dedicated to enhancing efficiencies, boosting productivity, and creating new revenue avenues for its clientele, primarily comprising small and medium-sized businesses (SMBs).

- Also, in March 2024, Cognizant renewed its enduring partnership with Pon IT, a subsidiary of the Dutch conglomerate Pon Holdings. This extension solidifies Cognizant's role as the provider of cloud-managed services for Pon IT's diverse operating entities. As the collaboration progresses, Cognizant is set to introduce additional enhancements, paving the way for Pon IT to leverage a more agile, intuitive, and integrated cloud infrastructure.

IT Services Industry Overview

The IT services market, characterized by intense competition, is primarily led by a wide range of market players. While these players currently hold significant market shares, the landscape is shifting. The rise of advanced IT consultancy services is empowering new entrants, enabling them to bolster their positions, particularly in emerging economies.

- May 2024: CrowdStrike and Tata Consultancy Services (TCS) signed a strategic partnership to power TCS' extended managed detection and response (XMDR) services with the AI-native CrowdStrike Falcon XDR platform. This partnership enables TCS to leverage the comprehensive security features of the Falcon platform. This includes cloud security and next-gen SIEM, facilitating an AI-driven transformation of their SOC to enhance breach prevention.

- July 2023: Windstream Enterprise, an IT-managed service provider, launched a new portfolio of IT Managed Services powered by ATSG, providing enterprise customers access to an entire range of turnkey services to control and power their virtual workspace, digital infrastructure, and cybersecurity needs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the market

- 4.4 Market Drivers

- 4.4.1 Growing Emphasis on Leveraging the Core Competencies by Outsourcing Non-core Operations

- 4.4.2 Greater Access to a Larger Pool of Talent and Scope for Innovation (As Opposed to Onboarding Expertise)

- 4.4.3 Cloud Services is Gaining Traction Due to the Emergence of Cloud-based Platform

- 4.5 Market Challenges

- 4.5.1 Operational Challenge (Such As Perceived Loss of Control and Identification of Key Goals)

5 MARKET SEGMENTATION

- 5.1 By Service Type

- 5.1.1 Professional (System Integration and Consulting)

- 5.1.2 Managed

- 5.2 By Size

- 5.2.1 Small and Medium Enterprises

- 5.2.2 Large Enterprises

- 5.3 By End-user Industry

- 5.3.1 BFSI

- 5.3.2 Telecommunication

- 5.3.3 Healthcare

- 5.3.4 Retail

- 5.3.5 Manufacturing

- 5.3.6 Government

- 5.3.7 Other End-user Industries

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.3 Asia

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Singapore

- 5.4.3.5 Indonesia

- 5.4.3.6 Malaysia

- 5.4.3.7 Vietnam

- 5.4.3.8 Thailand

- 5.4.4 Australia and New Zealand

- 5.4.5 Latin America

- 5.4.6 Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Citrix Systems Inc.

- 6.1.2 Cisco Systems Inc.

- 6.1.3 Dell EMC

- 6.1.4 IBM Corporation

- 6.1.5 Hewlett Packard Enterprise

- 6.1.6 Microsoft Corporation

- 6.1.7 TCS Limited

- 6.1.8 Toshiba Corporation

- 6.1.9 Verizon Communications Inc.

- 6.1.10 Fujitsu Ltd