|

市场调查报告书

商品编码

1851155

内容分析:市场占有率分析、产业趋势、统计数据、成长预测(2025-2030)Content Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

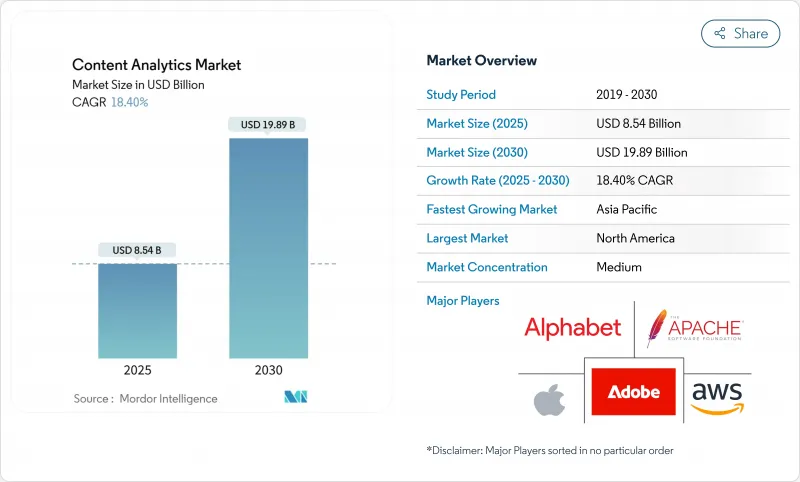

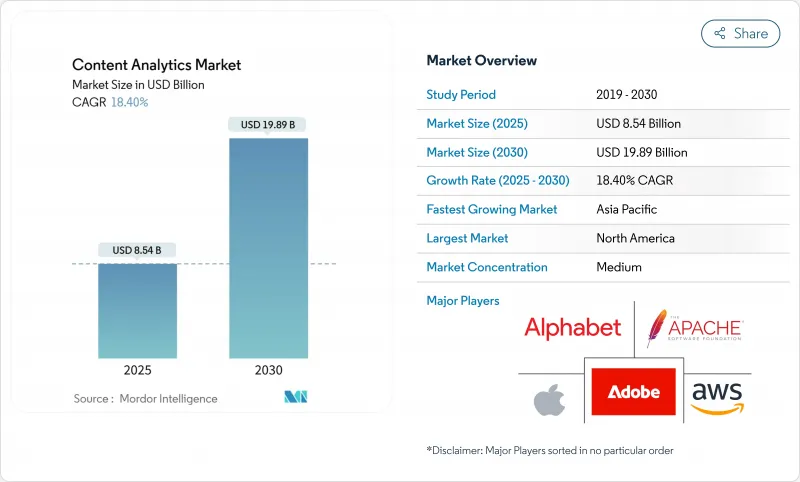

内容分析市场规模预计在 2025 年达到 85.4 亿美元,预计到 2030 年将达到 198.9 亿美元,预测期(2025-2030 年)复合年增长率为 18.40%。

云端迁移加速、多模态人工智慧的快速普及以及向量搜寻和语义嵌入技术的融合正在重塑企业从非结构化资讯中提取价值的方式。公共云端的采用、即时社交聆听以及大规模语言模型驱动的「知识挖掘」管道正在降低准入门槛,并鼓励企业进行实验。同时,市场对能够平衡资料主权和超大规模人工智慧平台规模经济效益的混合架构的需求也在不断增长。零售、媒体和银行、金融服务及保险(BFSI)行业现有企业之间日益激烈的竞争,正促使供应商转向垂直化解决方案,以期更快地实现价值并带来可衡量的生产力提升。这些因素共同表明,在整个预测期内,内容分析市场将继续超过更广泛的企业软体支出。

全球内容分析市场趋势与洞察

非结构化企业资料的指数级成长

非结构化资讯已占据企业记忆体的很大一部分,预计到2025年,175Zetta位元组的资料中,80%将产生于关係系统之外。例如,医疗机构正在将数百万张图像和图表数位化,以获取即时临床讯息,同时降低实体储存成本。这些资料量正推动企业采用湖屋架构,将向量函数嵌入到熟悉的SQL引擎中,使知识工作者能够在同一查询中跨文件、聊天记录和医学扫描等多种资料提出语义问题。

云端基础分析平台的采用率激增

公共云端人工智慧服务使企业能够按需租用变压器级规模的模型,从而避免在专用硬体上投入资本支出。亚马逊云端服务 (AWS) 2025 年第一季的营收年增 17%,达到 335 亿美元,主要得益于分析工作负载的成长。混合模式正变得越来越普遍,企业将工作负载分散到不同的服务供应商,以优化延迟、成本和合规性。 Google BigQuery 和微软知识挖掘管道 (Microsoft Knowledge Mining Pipeline) 透过开放向量搜寻API 并抽象化基础设施,为此转变提供了支援。

数据素养人才短缺与变革管理差距

只有37%的技术领导者认可生成式人工智慧的价值,这主要是因为企业难以将原型转化为可扩展的工作流程。联准会的一项调查发现,各公司采用人工智慧的比例从5%到40%不等,凸显了资料工程、模型管治和特定领域提示设计的技能差异。如果没有有针对性的技能提升计划,即使供应商提供了丰富的解决方案,企业在实现分析价值方面仍可能面临停滞不前的风险。

细分市场分析

到2024年,随着企业寻求无缝存取变压器级模型,公共云端服务将占56.2%的营收份额。这一份额印证了云端超大规模营运商持续提升的成本效益和弹性优势。受託管特征储存、模型中心和企业提示库的推动,公共云端工作负载的内容分析市场规模预计将大幅成长。混合云端和多重云端用例的复合年增长率(CAGR)为21.3%。在受监管行业,对于需要确定性吞吐量和自主控制的工作负载而言,本地部署设备仍然至关重要。

透过将向量索引部署在边缘,并将繁重的嵌入生成任务卸载到云端GPU,越来越多的企业能够在不牺牲洞察力的前提下实现策略合规性。供应商现在将可观测性仪表板捆绑在一起,用于评估私有和公共端点的管道健康状况,这一趋势使内容分析市场更能抵御单一提供者的故障。

社群媒体监测在2024年将维持33.6%的市场份额,这反映出品牌监听套件和影响者追踪模组的成熟应用。然而,客服中心自动化、即时转录和语音生物辨识技术将推动语音分析领域达到20.5%的复合年增长率,成为所有追踪细分领域中成长最快的。随着语音助理在银行、旅游和医疗保健自助服务终端的普及,以语音为中心的工具的内容分析市场规模正在扩大。高品质的自动语音辨识能够创建多模态仪錶盘,透过语气、情绪和意图评分来触发客服人员培训和升级工作流程。

文字分析对于合约验证和合规性标记至关重要,而以影片为中心的流程则有助于损失预防和串流内容优化。随着社交影片剪辑、客服中心记录和用户提交的图像现在都透过同一模型进行处理,融合趋势正在加速。因此,产业格局正从孤立的产品转向统一的体验引擎,从而增强内容分析市场的长期成长前景。

内容分析市场按配置类型(本地部署、公共云端、混合/多重云端)、应用领域(文字分析、视讯分析及其他)、最终用户产业(银行、金融服务和保险、医疗保健、生命科学及其他)、组织规模(大型企业、中小企业)、内容类型(文字、图像、音讯及其他)和地区进行细分。市场预测以美元计价。

区域分析

预计到2024年,北美地区的营收份额将达到38.1%,这得益于早期云端运算的普及,它催生了成熟的资料科学人才库和庞大的第三方市场生态系统。 AWS等领先供应商透过将高阶向量搜寻原语与无伺服器资料库捆绑在一起,实现了两位数的成长,提高了区域性企业的进入门槛。儘管即将生效的欧洲ESG报告要求已经影响数千家美国跨国公司,它们必须相应地调整资讯揭露流程,但技术买家正受益于稳定的监管环境。亚太地区的消费结构涵盖金融服务、医疗科技和直接面向消费者的零售等领域,确保了内容分析市场多元化的发展动能。

预计亚太地区将成为成长最快的地区,到2030年复合年增长率将达到21.7%。政府支持的基础设施计划,例如香港的3000千万亿次浮点运算超级运算中心和印度13亿美元的计算策略,将提供多模态和大规模语言模型工作负载所需的GPU密度。微信、LINE和抖音等社群媒体平台的普及确保了丰富的本地语言数据,从而加速模型微调週期。区域云端服务供应商正在竞相提供自主人工智慧区域,以满足本地化规则。

儘管隐私保护机制尚不完善,欧洲在人工智慧领域仍稳步发展。 75%的专家认为监管是人工智慧发展的最大障碍,但该地区在联邦学习等隐私保护分析方面处于领先地位。汽车、工业和能源产业正与学术实验室合作,将运行在嵌入式硬体上的轻量级多模态模型商业化,从而增强製造业的竞争力。私人投资水准仍低于北美和中国,促使人们就人工智慧战略自主性展开政策讨论。

中东和非洲的公共部门数位化和金融科技领域正迎来新的发展动能。由于GPU在这些地区的供应有限,边缘加速器因其能够最大限度地减少资料外洩而备受关注。拉丁美洲也呈现同样的趋势,零售支付领域的颠覆者以及城市安全机构都在积极采用SaaS语音分析技术。儘管这些地区的市场规模相对较小,但它们正推动全球内容分析市场对供应商多元化收入来源和降低地理集中风险的需求不断增长。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 非结构化企业资料的指数级成长

- 云端基础分析平台的采用率激增

- 即时社群媒体监听提升品牌声誉

- 向量搜寻和语义嵌入能够揭示更深层的见解

- GenAI 工作流程中的多模态(文字-图像-影片)分析

- 受监管产业面临的电子取证合规压力

- 市场限制

- 数据素养不足与变革管理差距

- 加强资料隐私/主权监管

- 大规模人工智慧管道的高能耗和高碳足迹

- 内容格式片段化和缺乏标准化

- 产业价值链分析

- 监管环境

- 技术展望

- 产业吸引力:波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 宏观经济因素如何影响市场

第五章 市场规模与成长预测(价值)

- 依部署类型

- 本地部署

- 公有云

- 混合/多重云端

- 透过使用

- 文字分析

- 影片分析

- 社群媒体分析

- 语音分析

- 网路和文件分析

- 按最终用户行业划分

- BFSI

- 医疗保健和生命科学

- 零售和消费品

- 资讯科技和电信

- 製造业

- 政府和公共机构

- 媒体与娱乐

- 其他终端用户产业

- 按公司规模

- 大公司

- 中小企业

- 按内容类型

- 文字

- 影像

- 声音的

- 影片

- 多模态/复合材料

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 智利

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 新加坡

- 马来西亚

- 澳洲

- 亚太其他地区

- 中东和非洲

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Adobe Inc.

- Alphabet Inc.(Google Cloud)

- Amazon Web Services, Inc.

- Apache Software Foundation(OpenSearch)

- Apple Inc.(Apple Analytics)

- Bazaarvoice, Inc.

- Cision Ltd.(Brandwatch)

- Clarabridge, Inc.(a Qualtrics company)

- ContentSquare SAS

- Databricks, Inc.

- Hootsuite Inc.

- IBM Corporation

- Meltwater BV

- Microsoft Corporation

- NetBase Quid, Inc.

- NICE Ltd.

- OpenText Corporation

- Oracle Corporation

- Palantir Technologies Inc.

- SAS Institute Inc.

- Sprinklr, Inc.

- Talkwalker SA

- Teradata Corporation

- TIBCO Software Inc.

- Verint Systems Inc.

第七章 市场机会与未来趋势

- 閒置频段与未满足需求评估

The Content Analytics Market size is estimated at USD 8.54 billion in 2025, and is expected to reach USD 19.89 billion by 2030, at a CAGR of 18.40% during the forecast period (2025-2030).

Accelerating cloud migration, rapid adoption of multimodal AI, and the convergence of vector search with semantic embedding technologies are reshaping how enterprises extract value from unstructured information. Public cloud deployments, real-time social listening, and large-language-model-powered "knowledge mining" pipelines are lowering entry barriers and encouraging experimentation. At the same time, demand is rising for hybrid architectures that balance data-sovereignty mandates with the scale advantages of hyperscale AI platforms. Intensifying competition among retail, media, and BFSI incumbents is pushing vendors toward verticalized solutions that promise faster time-to-value and measurable productivity gains. Together, these factors suggest that the content analytics market will keep outpacing broader enterprise-software spending through the forecast window.

Global Content Analytics Market Trends and Insights

Exponential Growth of Unstructured Enterprise Data

Unstructured information already represents the majority of corporate memory, with 80% of the 175 zettabytes expected in 2025 originating outside relational systems. Health-care providers, for example, digitized millions of images and charts to unlock real-time clinical insight while eliminating physical storage costs. These volumes are pushing enterprises toward lakehouse architectures that embed vector functions inside familiar SQL engines, allowing knowledge workers to ask semantic questions against documents, chat logs, and medical scans in the same query.

Surging Adoption of Cloud-Based Analytics Platforms

Public-cloud AI services let enterprises rent transformer-scale models on demand, avoiding capital expenditure on specialized hardware. Amazon Web Services recorded USD 33.5 billion in Q1 2025 sales, up 17% year on year, driven largely by analytics workloads. Hybrid patterns are now mainstream as firms split workloads across providers to optimize for latency, cost, and jurisdictional compliance. Google BigQuery and Microsoft Knowledge Mining pipelines are anchoring this shift by abstracting infrastructure while exposing vector search APIs.

Shortage of Data-Literate Workforce and Change Management Gaps

Only 37% of technology leaders judge generative AI as valuable today, largely because firms struggle to translate prototypes into scaled workflows. Federal Reserve research shows AI uptake ranging from 5% to 40% across companies, highlighting the skills dispersion in data engineering, model governance, and domain-specific prompt design. Without targeted reskilling programs, analytics value realisation risks stalling despite abundant vendor offerings.

Other drivers and restraints analyzed in the detailed report include:

- Real-Time Social Media Listening for Brand Reputation

- Vector Search and Semantic Embedding Unlock Deeper Insights

- Escalating Data-Privacy and Sovereignty Regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Public-cloud services captured 56.2% revenue in 2024 as enterprises sought frictionless access to transformer-class models. This share underscores the cost-efficiency and elasticity advantages that cloud hyperscalers continue to refine. The content analytics market size for public-cloud workloads is projected to climb steeply on the back of managed feature stores, model hubs, and enterprise prompts libraries. Hybrid and multi-cloud deployments are on a 21.3% CAGR trajectory because firms must reconcile latency-sensitive use cases with data-residency statutes. In regulated sectors, on-premise appliances remain indispensable for workloads requiring deterministic throughput or sovereign control.

Enterprises increasingly position vector indexes at the edge while offloading heavy embedding generation to cloud GPUs, achieving policy compliance without sacrificing insight depth. Vendors now bundle observability dashboards that score pipeline health across private and public endpoints, a trend that strengthens the content analytics market's resilience to single-provider outages.

Social media monitoring retained a 33.6% share in 2024, reflecting mature adoption of brand-listening suites and influencer tracking modules. Yet contact-center automation, real-time transcription, and voice biometrics are pushing speech and audio analytics toward a 20.5% CAGR, the fastest among tracked segments. The content analytics market size for speech-centric tools is scaling as voice assistants proliferate across banking, travel, and healthcare kiosks. High-quality automatic speech recognition feeds multi-modal dashboards where tone, sentiment, and intent scores guide agent coaching or trigger escalation workflows.

Text analytics remains essential for contractual review and compliance flagging, while video-centric pipelines serve loss-prevention and streaming-content optimisation. Convergence is gaining speed as social-video clips, call-center transcriptions, and user-posted images are routed into the same model garden. The industry narrative, therefore, shifts away from siloed products toward cohesive experience engines, reinforcing long-term growth prospects for the content analytics market.

Content Analytics Market is Segmented by Deployment Type (On-Premise, Public Cloud, and Hybrid/Multi-Cloud), Application (Text Analytics, Video Analytics, and More), End-User Industry (BFSI, Healthcare and Life Sciences, and More), Organisation Size (Large Enterprises and Small and Medium-Sized Enterprises), Content Type (Text, Image, Audio, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 38.1% revenue share in 2024 because early cloud adoption produced mature data-science talent pools and extensive third-party marketplace ecosystems. Major providers like AWS drove double-digit percentage growth by bundling advanced vector search primitives into serverless databases, raising the entry barrier for regional challengers. Technology buyers benefit from a stable regulatory backdrop, although impending European ESG-reporting mandates already affect thousands of US multinationals that must align disclosure pipelines accordingly. The region's spend mix spans financial services, health-tech, and direct-to-consumer retail, ensuring diversified momentum for the content analytics market.

Asia-Pacific is the fastest-growing territory, expected to clock a 21.7% CAGR through 2030. Government-backed infrastructure projects, including Hong Kong's 3,000-petaflops supercomputing centre and India's USD 1.3 billion compute strategy, provision the GPU density required for multimodal and large-language model workloads. Social-media penetration across WeChat, LINE, and Douyin ensures abundant vernacular data that accelerates fine-tuning cycles. Regional cloud providers are racing to deliver sovereign AI zones to meet localisation rules, a move likely to preserve high services revenue inside domestic value chains.

Europe advances steadily despite fragmented privacy regimes. Seventy-five percent of professionals cite regulation as their biggest AI hurdle, yet the region leads in privacy-preserving analytics such as federated learning. Automotive, industrial, and energy sectors align with academic labs to commercialise lightweight multimodal models that run on embedded hardware, reinforcing manufacturing competitiveness. Private investment still trails North American and Chinese levels, motivating policy debate on strategic AI autonomy.

Middle East and Africa show emerging momentum in public-sector digitalisation and fintech. Limited local GPU availability has spurred interest in edge accelerators that minimise data egress. Latin America mirrors this trend, with retail payment disruptors and urban-safety agencies embracing SaaS voice analytics. Although smaller in absolute terms, these regions contribute incremental demand that diversifies vendor revenue streams and mitigates geographic concentration risk in the global content analytics market.

- Adobe Inc.

- Alphabet Inc. (Google Cloud)

- Amazon Web Services, Inc.

- Apache Software Foundation (OpenSearch)

- Apple Inc. (Apple Analytics)

- Bazaarvoice, Inc.

- Cision Ltd. (Brandwatch)

- Clarabridge, Inc. (a Qualtrics company)

- ContentSquare S.A.S.

- Databricks, Inc.

- Hootsuite Inc.

- IBM Corporation

- Meltwater B.V.

- Microsoft Corporation

- NetBase Quid, Inc.

- NICE Ltd.

- OpenText Corporation

- Oracle Corporation

- Palantir Technologies Inc.

- SAS Institute Inc.

- Sprinklr, Inc.

- Talkwalker S.A.

- Teradata Corporation

- TIBCO Software Inc.

- Verint Systems Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Exponential growth of unstructured enterprise data

- 4.2.2 Surging adoption of cloud-based analytics platforms

- 4.2.3 Real-time social media listening for brand reputation

- 4.2.4 Vector search and semantic embedding unlock deeper insights

- 4.2.5 Multimodal (text-image-video) analytics in GenAI workflows

- 4.2.6 e-Discovery compliance pressures in regulated industries

- 4.3 Market Restraints

- 4.3.1 Shortage of data-literate workforce and change management gaps

- 4.3.2 Escalating data-privacy/sovereignty regulations

- 4.3.3 High energy and carbon footprint of large-scale AI pipelines

- 4.3.4 Fragmentation of content formats and lack of standardisation

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Deployment Type

- 5.1.1 On-Premise

- 5.1.2 Public Cloud

- 5.1.3 Hybrid/Multi-Cloud

- 5.2 By Application

- 5.2.1 Text Analytics

- 5.2.2 Video Analytics

- 5.2.3 Social Media Analytics

- 5.2.4 Speech/Audio Analytics

- 5.2.5 Web and Document Analytics

- 5.3 By End-user Industry

- 5.3.1 BFSI

- 5.3.2 Healthcare and Life Sciences

- 5.3.3 Retail and Consumer Goods

- 5.3.4 IT and Telecom

- 5.3.5 Manufacturing

- 5.3.6 Government and Public Sector

- 5.3.7 Media and Entertainment

- 5.3.8 Other End-user Industries

- 5.4 By Organisation Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Medium-sized Enterprises (SMEs)

- 5.5 By Content Type

- 5.5.1 Text

- 5.5.2 Image

- 5.5.3 Audio

- 5.5.4 Video

- 5.5.5 Multimodal/Composite

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Chile

- 5.6.2.4 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 Singapore

- 5.6.4.6 Malaysia

- 5.6.4.7 Australia

- 5.6.4.8 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 United Arab Emirates

- 5.6.5.1.2 Saudi Arabia

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Adobe Inc.

- 6.4.2 Alphabet Inc. (Google Cloud)

- 6.4.3 Amazon Web Services, Inc.

- 6.4.4 Apache Software Foundation (OpenSearch)

- 6.4.5 Apple Inc. (Apple Analytics)

- 6.4.6 Bazaarvoice, Inc.

- 6.4.7 Cision Ltd. (Brandwatch)

- 6.4.8 Clarabridge, Inc. (a Qualtrics company)

- 6.4.9 ContentSquare S.A.S.

- 6.4.10 Databricks, Inc.

- 6.4.11 Hootsuite Inc.

- 6.4.12 IBM Corporation

- 6.4.13 Meltwater B.V.

- 6.4.14 Microsoft Corporation

- 6.4.15 NetBase Quid, Inc.

- 6.4.16 NICE Ltd.

- 6.4.17 OpenText Corporation

- 6.4.18 Oracle Corporation

- 6.4.19 Palantir Technologies Inc.

- 6.4.20 SAS Institute Inc.

- 6.4.21 Sprinklr, Inc.

- 6.4.22 Talkwalker S.A.

- 6.4.23 Teradata Corporation

- 6.4.24 TIBCO Software Inc.

- 6.4.25 Verint Systems Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-Space and Unmet-Need Assessment