|

市场调查报告书

商品编码

1851194

空中下载 (OTA) 测试:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Over-The-Air (OTA) Testing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

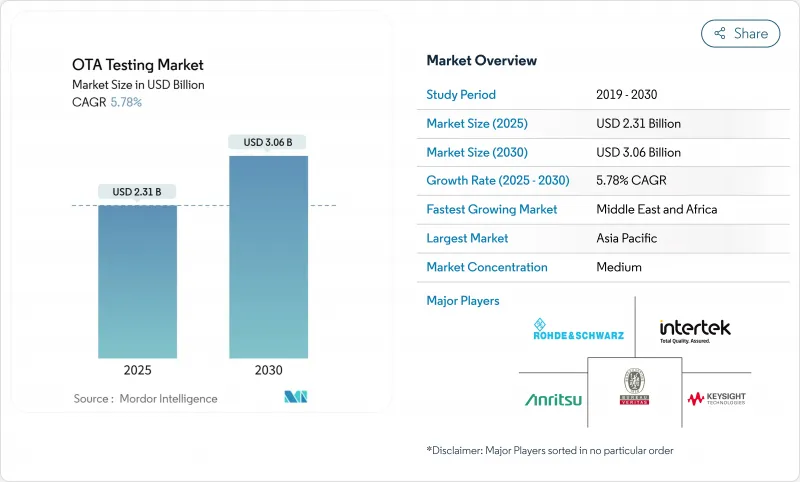

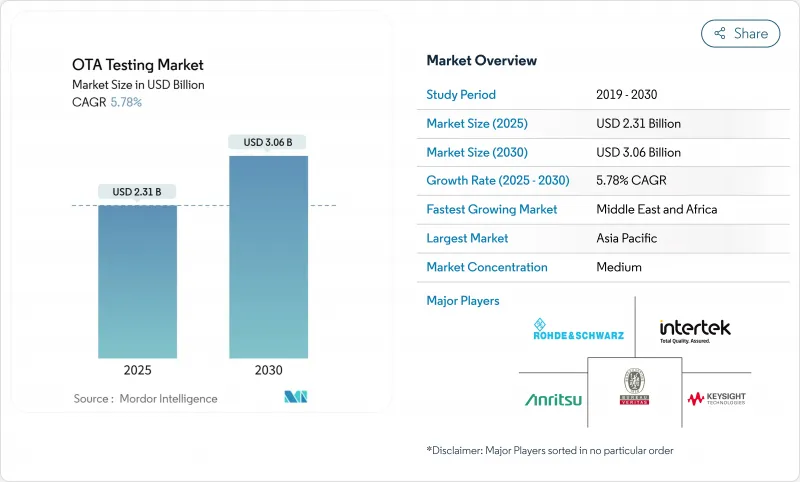

预计到 2025 年,OTA 测试市场规模将达到 23.1 亿美元,到 2030 年将达到 30.6 亿美元,在此期间的复合年增长率为 5.78%。

这一增长反映了5G独立组网的日益普及、汽车中蜂窝V2X集成度的不断提高,以及对成本敏感型物联网模组认证需求的不断增长。家用电子电器对毫米波合规性的需求不断增长、工厂中私有5G部署的增加,以及CTIA和全球认证论坛等机构日益严格的全球认证体系,也推动了这一成长。儘管硬体仍然是资本支出的主要重点,但随着企业寻求减少在消音室方面的前期投资,服务外包正在加速发展。从区域来看,亚太地区受益于全球最密集的5G部署,而中东和非洲则凭藉其积极的数位经济发展策略,实现了最快的成长速度。

全球空中(OTA)检测市场趋势与洞察

5G非独立组网和独立组网部署的激增需要新的适配通讯协定

将覆盖范围从 24 GHz 扩展到 29 GHz,要求行动电话和平板电脑製造商确保复杂天线阵列的总辐射功率和各向同性灵敏度。和硕为 Wi-Fi 6E 和 5G检验投入的 1.64 亿美元凸显了设备供应链的资本支出压力。毫米波波长显着缩短了远距离测试距离,使得近场测量至关重要。像安立 MA8172A 这样的紧凑型天线测试场 (CATR) 平台可以在不到五天的时间内重新部署,从而减少生产停机时间。因此,提供基于可携式CATR 的审核服务供应商的预约量激增。

北美汽车OEM厂商转向软体定义与V2X连接平台

由全球认证论坛 (GCF) 与 5G 汽车协会 (5G Automotive Association) 合作开发的 C-V2X 认证,正式确立了一种结合 5.9 GHz 侧链路和网路上行链路的双通讯模式。是德科技 (Keysight) 和罗德与施瓦茨 (Rohde & Schwarz) 正与一级供应商合作,模拟动态交通场景,以同时检验紧急煞车灯警告和空中软体更新 (OTA)。从硬体锁定的 ECU 到云端升级平台的转变,扩展了测试范围,涵盖了网路安全和功能安全方面。随着这些车辆进入量产阶段,OTA 测试市场将因工厂测试和道路测试而实现业务收益成长。

耗资巨大的消音室和混响室阻碍了二级实验室的采用。

消音室需要阻燃金字塔形吸波材料、精密起重机和多轴定位器,在添加任何其他设备之前,其建造成本可能高达数百万美元。对于拉丁美洲和东南亚的小型实验室而言,这样的预算尤其具有挑战性。即使资金到位,铁氧体瓦片和碳填充泡棉的供应瓶颈也意味着前置作业时间超过20週。因此,这些地区的公司只能将工作外包给数量有限的全球性设施,从而延长了计划週期,并限制了其在OTA测试市场的渗透率。供应商正在推出模组化、可租赁的消音室来应对这一需求,但相对于推出资金而言,价格分布仍然很高。

细分市场分析

2024年,硬体收入占总收入的60.9%,这主要得益于实验室对远场暗室、CATR反射器以及5G和Wi-Fi 7所需宽频信号产生器的投资。许多实验室扩大了测试能力,以适应更大尺寸的测试设备,例如汽车保险桿和智慧工厂机器人。然而,服务业务的成长最为迅猛,年复合成长率高达8.3%,因为企业更倾向于与认证服务商签订合同,而不是自行建设整个基础设施。这些管理合约通常包含校准、标准咨询和报告等服务,并以多年期框架进行包装。虽然软体和分析技术仍处于起步阶段,但人工智慧驱动的自动化可以将测试週期缩短多达40%,进一步提高生产效率。

到2024年,LTE/LTE-A仍将占总支出的38.5%,通讯业者将继续验证现有设备;而5G NR 9.1%的复合年增长率则凸显了产业的转型。毫米波认证要求进行动态波束控制检验,推动了侦测阵列和通道模拟器的升级。同时,Wi-Fi 6E和Wi-Fi 7引入了三频段吞吐量阈值,促使对蜂窝网路和WLAN共存进行联合测试。诸如NB-IoT之类的低功耗广域网(LPWAN)格式越来越多地整合非地面电波网络,迫使设备製造商在合规性测试期间进行卫星延迟模拟。

区域分析

亚太地区在2024年仍占全球5G收入的34.6%,这主要得益于中国80%的5G SA网路覆盖率、日本的卫星物联网试点计画以及印度旨在到2040年实现5G经济效益达5000亿美元的製造业奖励。该地区的OTA测试市场受益于委託製造和国内测试实验室之间的垂直整合,从而缩短了智慧型手机和穿戴式装置的供应链。印度和印尼政府支持的频谱竞标进一步扩大了认证设备的覆盖范围。

儘管只有2%的行动通信基地台以独立组网模式运行,欧洲在工业专用5G领域仍占据领先地位。德国、英国和西班牙的监管机构正在为26GHz工业网路提供简化的临时授权流程,鼓励机械设备製造商在本地实验室进行原型开发。 6G测量的合作研究计画正在完善文件标准,并促使测试机构升级其不确定性预算和可追溯性链。因此,OTA测试市场对咨询顾问的需求强劲,硬体销售也同样强劲。

中东和非洲地区成长最快,复合年增长率达6.8%。中东通讯业者正加速推动5G建设,并为2030年前的6G奠定基础。众包性能工具正在指南频谱政策,推动需要实验室验证的透明基准测试。南非和奈及利亚正在扩大与区域认证标誌挂钩的设备补贴,并提升区域认证中心的容量。北美正在利用联邦资金建造开放式无线接入网(RAN)和车联网(V2X)走廊,而南美则在稳步推进从4G到5G的升级,尤其是在巴西的农业地区。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 5G非独立组网和独立组网部署的激增需要新的一致性通讯协定

- 消费性设备对毫米波和大规模MIMO天线OTA合规性的需求激增

- 北美汽车OEM厂商转向软体定义与V2X连接平台

- 欧洲智慧工厂的工业专用5G部署需要强大的射频验证

- CTIA 和 GCF 要求对物料清单价格低于 10 美元的物联网模组实施快速认证流程。

- 市场限制

- 资本密集的消音室和混响室阻碍了二级实验室的采用。

- 缺乏毫米波近场到远场转换演算法的技术技能

- 缺乏全球统一的低功耗广域网路OTA标准将延缓市场融合。

- 射频吸收体供应链的波动会推高测试基础设施成本。

- 生态系分析

- 监理与技术展望

- 标准化蓝图(3GPP Rel-17/18,CTIA OTA 5.x)

- 新的调查方法(用于可重构智慧表面的OTA、6G太赫兹)

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 报价

- 硬体

- 房间(消音室、残响室、紧凑型测距室)

- 测量设备(信号产生器、频谱分析仪、控制器)

- 软体与分析

- 服务

- 测试和认证服务

- 咨询与整合

- 硬体

- 透过技术

- 5G NR(6GHz 以下和毫米波)

- LTE/LTE-A/LTE-M

- UMTS/WCDMA

- GSM/CDMA

- Wi-Fi 6/7 和 Wi-Fi HaLow

- 蓝牙和超宽频

- LPWAN(NB-IoT、LoRaWAN、Sigfox)

- 按测试类型

- 天线效能(TRP、TIS、EIRP、EIS)

- 符合性与认证

- 相容性/互通性

- 生产/生产线末端

- 透过使用

- 电信、消费性电子

- 汽车和运输设备

- 工业和製造业物联网

- 航太/国防

- 医疗设备和穿戴式设备

- 智慧家庭/建筑自动化

- 透过测试环境

- 远距离消音室

- 紧凑型天线测试范围

- 近场系统

- 残响室

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 北欧国家

- 其他欧洲地区

- 南美洲

- 巴西

- 其他南美洲

- 亚太地区

- 中国

- 日本

- 印度

- 东南亚

- 亚太其他地区

- 中东和非洲

- 中东

- GCC

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Keysight Technologies Inc.

- Rohde and Schwarz GmbH and Co. KG

- Anritsu Corporation

- SGS SA

- Intertek Group plc

- Bureau Veritas SA

- UL Solutions Inc.

- Eurofins Scientific SE

- Microwave Vision Group(MVG)

- CETECOM GmbH

- BluFlux LLC

- Element Materials Technology

- National Technical Systems Inc.(NTS)

- TUV Rheinland AG

- TUV SUD AG

- Spirent Communications plc

- VIAVI Solutions Inc.

- ETS-Lindgren Inc.

- Chotest Technology Inc.

- Shenzhen Sunwave Communications Co., Ltd.

第七章 市场机会与未来展望

The OTA testing market stood at USD 2.31 billion in 2025 and is forecast to reach USD 3.06 billion by 2030, translating into a 5.78% CAGR over the period.

This expansion reflects wider adoption of 5G standalone networks, increasing integration of cellular V2X in vehicles, and escalating certification needs for cost-sensitive IoT modules. Heightened demand for mmWave compliance in consumer electronics, rising private-5G deployments inside factories, and stricter global conformance schemes from bodies such as CTIA and the Global Certification Forum also underpin growth. Hardware continues to anchor capital spending, but service outsourcing is accelerating as enterprises look to curb up-front investments in anechoic chambers. Regionally, Asia Pacific benefits from the world's densest 5G roll-outs, while the Middle East and Africa register the fastest trajectory thanks to aggressive digital-economy agendas.

Global Over-The-Air (OTA) Testing Market Trends and Insights

Proliferation of 5G Non-Standalone and Stand-Alone Deployments Requiring New Conformance Protocols

Expansion of 24-29 GHz coverage obliges phone and tablet makers to assure total radiated power and isotropic sensitivity across intricate antenna arrays. Pegatron invested USD 164 million in new lines for Wi-Fi 6E and 5G validation, underlining cap-ex pressures in device supply chains. Near-field measurement has become essential, because mmWave wavelengths shorten far-field test distances dramatically. Compact Antenna Test Range (CATR) platforms such as Anritsu MA8172A can be redeployed in under five days, reducing production downtime. Consequently, service providers offering portable CATR-based audits are experiencing higher booking rates.

Automotive OEM Shift to Software-Defined and V2X Connectivity Platforms in North America

C-V2X certification, developed by the Global Certification Forum with the 5G Automotive Association, formalizes dual communication modes that combine 5.9 GHz sidelink and network uplinks. Keysight and Rohde & Schwarz have partnered with tier-one suppliers to emulate dynamic traffic scenarios, validating emergency brake-light alerts and over-the-air software updates concurrently. The change from hardware-locked ECUs to cloud-upgradable platforms widens test matrices to include cybersecurity and functional-safety vectors. As these vehicles move toward production, the OTA testing market records deeper service revenues from in-plant and roadside evaluations.

Capital-Intensive Anechoic and Reverberation Chambers Discouraging Adoption by Tier-2 Labs

Anechoic facilities require fire-retardant pyramidal absorbers, precision cranes and multi-axis positioners that can cost several million dollars before instrumentation is added. Such budgets deter smaller labs, particularly in Latin America and Southeast Asia. Even when financing is secured, supply bottlenecks for ferrite tiles and carbon-loaded foam extend lead times beyond 20 weeks. Consequently, enterprises in those regions outsource to a limited pool of global facilities, lengthening project cycles and curbing the OTA testing market's service penetration. Vendors are responding with modular, lease-ready chambers, yet price points remain high relative to start-up cash flows.

Other drivers and restraints analyzed in the detailed report include:

- Surging OTA Compliance Demand for mmWave and Massive-MIMO Antennas in Consumer Devices

- Industrial Private-5G Roll-outs in Europe for Smart Factories Requiring Robust RF Validation

- Technical Skill Scarcity for mmWave Near-Field-to-Far-Field Transform Algorithms

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hardware contributed 60.9 % of revenue in 2024 as laboratories invested in far-field chambers, CATR reflectors and wide-bandwidth signal generators required for 5G and Wi-Fi 7. Many facilities expanded capacity to accommodate larger device-under-test form factors such as automotive bumpers and smart-factory robots. Services nonetheless record the steepest curve at an 8.3 % CAGR, because enterprises prefer contracting accredited providers rather than owning full infrastructures. Those managed contracts frequently include calibration, standards consulting and report generation packaged under multi-year frameworks. Software and analytics, still nascent, benefit from AI-driven automation that cuts test cycles by as much as 40 %, unlocking further productivity.

LTE/LTE-A maintained 38.5 % of 2024 spending as operators kept validating legacy devices; however, 5G NR's 9.1 % CAGR underscores an industry pivot. mmWave certification demands dynamic beam-steering checks, driving upgrades in probe arrays and channel emulators. Meanwhile, Wi-Fi 6E and Wi-Fi 7 introduce tri-band throughput thresholds, prompting joint testing of cellular and WLAN coexistence. LPWAN formats such as NB-IoT increasingly incorporate non-terrestrial networks, compelling device makers to run satellite delay emulation during compliance sessions.

The Over-The-Air (OTA) Testing Market Report is Segmented by Offering (Hardware, Software and Analytics, and Services), Technology (Bluetooth and UWB, and More), Test Type (Antenna Performance (TRP, TIS, EIRP, EIS), and More), Application (Telecom and Consumer Electronics, Aerospace and Defense, and More), Test Environment (Far-Field Anechoic Chambers, and More), Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific retained 34.6 % of global revenue in 2024 on the back of China's 80 % 5G SA coverage, Japan's satellite-IoT pilots and India's manufacturing incentives targeting USD 500 billion in economic impact from 5G by 2040. The OTA testing market in the region benefits from vertical integration between contract manufacturers and domestic test labs, shortening supply chains for smartphones and wearables. Government-backed spectrum auctions in India and Indonesia have further enlarged addressable volumes for certified devices.

Europe remains a powerhouse for industrial private-5G, even though only 2 % of cell sites operate in standalone mode. German, UK and Spanish regulators offer streamlined temporary licenses for 26 GHz industrial grids, encouraging machinery OEMs to prototype inside local labs. Joint research programs on 6G metrology sharpen documentation standards, forcing test houses to upgrade uncertainty budgets and traceability chains. Consequently, the OTA testing market records robust consultancy demand alongside hardware sales.

The Middle East and Africa is the quickest climber at a 6.8 % CAGR as operators in the Gulf expedite 5G and lay foundations for 6G before 2030. Crowdsourced performance tools increasingly guide spectrum policy, driving transparent benchmarks that require laboratory correlation. South Africa and Nigeria expand device subsidies tied to local conformance marks, enlarging throughput for regional certification centers. North America leverages federal funds for open-RAN and V2X corridors, whereas South America continues steady upgrades from 4G to 5G, particularly in Brazil's agritech zones.

- Keysight Technologies Inc.

- Rohde and Schwarz GmbH and Co. KG

- Anritsu Corporation

- SGS SA

- Intertek Group plc

- Bureau Veritas SA

- UL Solutions Inc.

- Eurofins Scientific SE

- Microwave Vision Group (MVG)

- CETECOM GmbH

- BluFlux LLC

- Element Materials Technology

- National Technical Systems Inc. (NTS)

- TUV Rheinland AG

- TUV SUD AG

- Spirent Communications plc

- VIAVI Solutions Inc.

- ETS-Lindgren Inc.

- Chotest Technology Inc.

- Shenzhen Sunwave Communications Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Proliferation of 5G Non-Standalone and Stand-Alone Deployments Requiring New Conformance Protocols

- 4.2.2 Surging OTA Compliance Demand for mmWave and Massive-MIMO Antennas in Consumer Devices

- 4.2.3 Automotive OEM Shift to Software-Defined and V2X Connectivity Platforms in North America

- 4.2.4 Industrial Private-5G Roll-outs in Europe for Smart Factories Requiring Robust RF Validation

- 4.2.5 Rapid Certification Cycles Mandated by CTIA and GCF for IoT Modules Below USD-10 BOM

- 4.3 Market Restraints

- 4.3.1 Capital-Intensive Anechoic and Reverberation Chambers Discouraging Adoption by Tier-2 Labs

- 4.3.2 Technical Skill Scarcity for mmWave Near-Field-to-Far-Field Transform Algorithms

- 4.3.3 Lack of Harmonised Global Standards for LPWAN OTAs Delaying Market Convergence

- 4.3.4 Supply-Chain Volatility of RF Absorber Materials Inflating Test Infrastructure Costs

- 4.4 Industry Ecosystem Analysis

- 4.5 Regulatory and Technological Outlook

- 4.5.1 Standardisation Roadmap (3GPP Rel-17/18, CTIA OTA 5.x)

- 4.5.2 Emerging Test Methodologies (OTA for Reconfigurable Intelligent Surfaces, 6G Terahertz)

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Offering

- 5.1.1 Hardware

- 5.1.1.1 Chambers (Anechoic, Reverberation, Compact Range)

- 5.1.1.2 Instrumentation (Signal Generators, Spectrum Analysers, Controllers)

- 5.1.2 Software and Analytics

- 5.1.3 Services

- 5.1.3.1 Testing and Certification Services

- 5.1.3.2 Consulting and Integration

- 5.1.1 Hardware

- 5.2 By Technology

- 5.2.1 5G NR (Sub-6 GHz and mmWave)

- 5.2.2 LTE/LTE-A/LTE-M

- 5.2.3 UMTS/WCDMA

- 5.2.4 GSM/CDMA

- 5.2.5 Wi-Fi 6/7 and Wi-Fi HaLow

- 5.2.6 Bluetooth and UWB

- 5.2.7 LPWAN (NB-IoT, LoRaWAN, Sigfox)

- 5.3 By Test Type

- 5.3.1 Antenna Performance (TRP, TIS, EIRP, EIS)

- 5.3.2 Conformance and Certification

- 5.3.3 Compatibility/Inter-operability

- 5.3.4 Production/End-of-Line

- 5.4 By Application

- 5.4.1 Telecom and Consumer Electronics

- 5.4.2 Automotive and Transportation

- 5.4.3 Industrial and Manufacturing IoT

- 5.4.4 Aerospace and Defense

- 5.4.5 Healthcare Devices and Wearables

- 5.4.6 Smart Home and Building Automation

- 5.5 By Test Environment

- 5.5.1 Far-Field Anechoic Chambers

- 5.5.2 Compact Antenna Test Range

- 5.5.3 Near-Field Systems

- 5.5.4 Reverberation Chambers

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Nordics

- 5.6.2.5 Rest of Europe

- 5.6.3 South America

- 5.6.3.1 Brazil

- 5.6.3.2 Rest of South America

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South-East Asia

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Gulf Cooperation Council Countries

- 5.6.5.1.2 Turkey

- 5.6.5.1.3 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Keysight Technologies Inc.

- 6.4.2 Rohde and Schwarz GmbH and Co. KG

- 6.4.3 Anritsu Corporation

- 6.4.4 SGS SA

- 6.4.5 Intertek Group plc

- 6.4.6 Bureau Veritas SA

- 6.4.7 UL Solutions Inc.

- 6.4.8 Eurofins Scientific SE

- 6.4.9 Microwave Vision Group (MVG)

- 6.4.10 CETECOM GmbH

- 6.4.11 BluFlux LLC

- 6.4.12 Element Materials Technology

- 6.4.13 National Technical Systems Inc. (NTS)

- 6.4.14 TUV Rheinland AG

- 6.4.15 TUV SUD AG

- 6.4.16 Spirent Communications plc

- 6.4.17 VIAVI Solutions Inc.

- 6.4.18 ETS-Lindgren Inc.

- 6.4.19 Chotest Technology Inc.

- 6.4.20 Shenzhen Sunwave Communications Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment

- 7.2 Emerging 6G Terahertz OTA Opportunities

- 7.3 Sustainability-Driven Low-Power OTA Protocols