|

市场调查报告书

商品编码

1642932

条码列印机:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Barcode Printer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

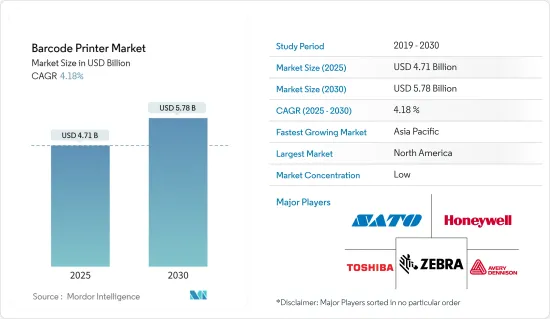

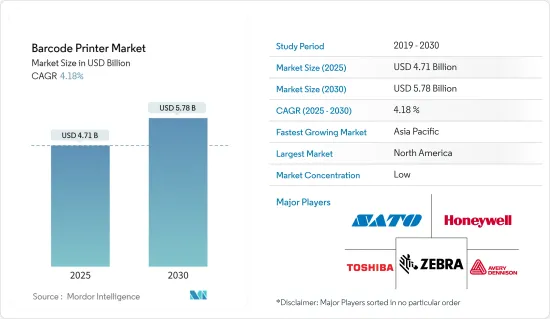

条码列印机市场规模预计在 2025 年为 47.1 亿美元,预计到 2030 年将达到 57.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.18%。

由于条码列印机使物流业务更加高效,其采用率的提高正在推动成长。当条码列印机用于监控分销链中的产品时,它们还可以帮助物联网并在产品在渠道之间移动时存储序号信息,以使这些信息可供将来使用。这是推动条码列印机普及的重要因素。

主要亮点

- 消费品和药品盗窃和诈骗事件的增加推动了条码标籤印表机市场的成长。条码标籤的使用有助于管理库存、确保货物在分销链中的顺利运输以及监控製造和组装过程,从而简化了物流和供应链管理。

- 条码可以识别订单并搜寻包裹内的物品、收件人姓名、送货地址和送货方式等详细资讯。因此,电子商务条码解决方案利用标籤来传达必要的讯息,以成功完成整个过程。

- 此外,零售业、工业和医疗保健领域也在改变。在零售业中,消费者期待个人化的互动和无缝的多通路购买历程。 2024 年 5 月,EM Microelectronic 和 SATO Corporation 透露,SATO 的工业印表机 CL4NX 和 CL6NX Plus 以及桌上型印表机 CT4-LX 现在能够列印和编码 em|echo-V RAINFC 标籤。

- 在绿色技术中使用条码是一种创新方法,透过监控和管理物品和资源的生命週期来最大限度地减少废弃物并支持永续性。条码是储存产品名称、价格、製造商和有效期限等详细资讯的常见符号。消费者和企业可以使用智慧型手机或专用设备扫描条码来获取有助于减少对环境影响的其他资讯和服务。

- 此外,条码列印机可与条码检验一起使用,有助于降低与列印品质不佳的标籤相关的成本。这些验证器确保输出在各方面都是品质良好的。条码列印机以投资回报 (ROI) 的形式提供快速的投资回报期。因此,预计预测期内供应链产业对条码列印机的需求将会增加。印刷法规确保印刷技术是环保的。

- 条码不可读或不可写,且不包含任何其他讯息,例如有效期限。仅包括製造商和产品。然而,使用条码非常耗费劳动力,因为必须单独扫描,这可能会影响市场成长。

条码列印机市场趋势

零售业将成为最大的终端用户产业

- 零售商使用条码印表机将每个产品的条码列印到自黏标籤上,然后将其贴在包装或标籤上,以便于用条码扫描器扫描。将产品收集到与各个 SKU 相关的仓库后,它们会获得一个唯一的条码,以便在零售商系统中组织产品资料、改善库存管理并更好地追踪收银机的销售交易。使用条码标籤印表机,商店可以选择仅在标籤上列印条码,或在标籤上列印其他讯息,例如价格或简要的产品说明。

- 条码使零售商能够管理库存、自动重新订购产品、分析国家品牌和自有品牌的销售情况、监控产品属性偏好、根据顾客购买习惯定制促销活动并识别个人顾客偏好。

- 直传印表机可以快速产生大量条码,是需要高效率条码列印的企业的理想选择。它的灵活性意味着它可以在各种表面上使用,包括塑胶、纸张和金属。直连条码列印机由于能够快速且准确地列印条码物品和标籤,在零售店中越来越受欢迎。

- 条码技术使零售商能够监控库存、分析类似商品的销售情况、追踪尺寸和色调等产品详细资讯、自动重新订购产品、识别顾客偏好并根据购物行为创建个人化促销活动。

- 根据美国人口普查局的资料,到2023年终,零售总额将达到约7.24兆美元,与前一年同期比较增加约15亿美元。

北美占据主要市场占有率

- 由于条码和标籤技术在各行业的广泛应用,北美被公认为市场领先的投资者和创新者之一。此外,随着该地区终端用户行业的扩张,供应商拥有巨大的机会进入该地区市场。美国市场参与企业占该区域市场主要参与企业的相当大一部分。当地市场正在发生大量创新。

- 随着电子商务和零售业(尤其是网路购物)在美国和加拿大的扩张,随着企业优先考虑流程自动化以提高业务效率,北美对条码列印机的需求预计将增长。美国人口普查局估计,2023 年美国电子商务销售额将达到约 2.75 亿美元。

- 随着美国医疗保健服务的持续发展数位化提高,准确、易于使用的解决方案对于优先考虑患者照护至关重要。医院、药房和实验室可以使用条码解决方案和麵向未来的选项来应对人口增长和老化带来的挑战。

- 此外,Digimarc 条码已获得美国农业部核准,作为包装生物工程食品(也称为基因改造生物 (GMO))的数位揭露方法。 Digimark 条码是创新的、不显眼的条码,旨在包含在产品包装、零售标籤和吊挂上。相容的消费者行动电话、零售条码扫描器和电脑视觉系统都具有扫描能力。它还符合最新的联邦法规,取消了将二维码纳入产品包装设计的要求。

条码列印机产业概况

条码列印机市场较为分散,竞争也较激烈,主要企业包括: Zebra Technologies Corporation、Avery Dennison Corporation、Honeywell International Inc.、Toshiba Tec Corporation 和 Sato Holdings Corporation。

- 2023 年 12 月,东芝推出了新款 BV400T 热转印印表机系列,扩充了其桌上型条码解决方案阵容,该系列提供了多种功能来改善标籤应用。 BV400T 具有 1/2 英吋 100 公尺和 1 英吋 300 公尺的色带相容性,可为热转印应用提供广泛的桌面列印解决方案。

- 2023 年 11 月 TEKLYNX International 透露,它已完成 Zebra Technologies 针对条码标籤设计和列印自动化等一系列软体解决方案的企业测试计画。此分类向客户和合作伙伴证明,TEKLYNX 软体经过全面测试,确保与 Zebra 工业热转印条码标籤印表机的相容性和效率。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 不断提高的技术进步

- 电子商务和物流业快速成长

- 市场限制

- 列印品质

第六章 市场细分

- 依产品类型

- 桌上型印表机

- 行动印表机

- 工业印表机

- 按印刷类型

- 热转印

- 热感

- 其他印刷类型

- 按最终用户产业

- 製造业

- 零售

- 运输和物流

- 卫生保健

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Sato Holdings Corporation

- Zebra Technologies Corporation

- Honeywell International Inc.

- Toshiba Tec Corporation

- Avery Dennison Corporation

- Seiko Epson Corporation

- TSC Auto ID Technology Co. Ltd

- Primera Technologies Inc.

- Brother Mobile Solutions Inc.

- Postek Electronics Co. Ltd

第八章投资分析

第九章:市场的未来

The Barcode Printer Market size is estimated at USD 4.71 billion in 2025, and is expected to reach USD 5.78 billion by 2030, at a CAGR of 4.18% during the forecast period (2025-2030).

Increased adoption is the driving force behind the growth of barcode printers as they make logistics operations more efficient. When barcode printers are used to monitor products in distribution chains, they also help store Internet of Things and serial number information while the product is moving between channels to keep that information available for future use. This is an essential factor that encourages the adoption of barcode printers.

Key Highlights

- Increasing incidents of theft and fraud in consumer goods and pharmaceuticals are fueling growth in the barcode label printers market. Utilizing barcode tags has simplified logistics and supply chain management by aiding in inventory control, smooth cargo movement in distribution networks, and monitoring manufacturing and assembly processes.

- A barcode is capable of recognizing the order and retrieving details like items in the package, recipient's name, shipping address, and shipping method. Therefore, e-commerce barcode solutions utilize labels to communicate this required information for the successful completion of the entire procedure.

- Moreover, changes are happening in the retail, industrial, and healthcare fields. In the retail industry, consumers seek individually tailored interactions and seamless multichannel buying processes. In May 2024, EM Microelectronic and SATO Corporation revealed that SATO's CL4NX and CL6NX Plus industrial printers, as well as CT4-LX desktop printers, can now print and encode em|echo-V RAINFC labels, catering to retail, healthcare, and smart industrial sectors.

- The use of barcodes in green technology is an innovative way to minimize waste and support sustainability by monitoring and controlling the life cycle of items and resources. Barcodes are common symbols that store details like product name, cost, maker, and expiry date. Consumers and businesses can use a smartphone or dedicated device to scan barcodes and access extra information and services to aid in decreasing their environmental footprint.

- In addition, the costs associated with poor printing of labels are reduced by barcode printers since they can use barcode verifiers. Those verifiers ensure that the output is of good quality in all respects. The barcode printer offers a quick payback period in the form of ROIs. Thus, demand for barcode printers in the supply chain industry is projected to increase during the forecast period. The printing regulations ensure that printing techniques are environmentally friendly.

- The barcode cannot be read or written, and it does not contain any additional information, such as expiration date. Only the manufacturer and the product are included in it. However, the use of barcodes can be very demanding since they must be scanned individually, which could affect the market's growth.

Barcode Printer Market Trends

Retail Segment to be the Largest End-user Industry

- Retail stores utilize barcode printers to print each product's barcode on a self-adhesive tag for ease of scanning by barcode scanners before attaching them to packages or tags. Once the products are gathered in a warehouse associated with their individual SKUs, they are labeled with unique barcodes for better organization of merchandise data in retailer systems, improved inventory management, and tracking of sales transactions at cash registers. The store then has the option to use a barcode label printer to print the barcode alone on the label or include additional details such as price or a brief product description.

- Barcodes allow retailers to manage inventory, automate product reordering, analyze sales of national brands versus private labels, monitor product attribute preferences, tailor promotions to customer buying habits, and identify individual customer preferences.

- Direct transfer printers are perfect for businesses that require efficient barcode printing, as they are able to rapidly produce a high volume of barcodes. They can be used on a variety of surfaces, such as plastic, paper, and metal, due to their flexibility. Directly connecting barcode printers are becoming increasingly popular in retail stores due to their fast and accurate printing of barcoded products and labels.

- Barcode technology allows retailers to monitor their stocks, analyze sales of comparable items, track product details like size and hue, automatically reorder products, recognize customer preferences, and create personalized promotions based on shopping behaviors.

- As per the US Census Bureau's data, total retail sales hit about USD 7.24 trillion by the conclusion of 2023, marking an increase of around USD 1.5 billion compared to the previous year.

North America Holds a Major Market Share

- Due to the widespread use of barcode and label technologies across various industries, North America is recognized as one of the leading investors and innovators in the market. Furthermore, suppliers have a significant opportunity to enter regional markets because of the expansion of end-user industries in the region. Players from the United States comprise a significant portion of the major participants in the regional market. There is a significant amount of innovation in the regional market.

- The expansion of the e-commerce and retail industries in the United States and Canada, with a focus on online shopping, is projected to increase the need for barcode printers in North America as companies prioritize automating processes to enhance operational efficiency. The US Census Bureau had estimated that e-commerce sales in the United States would hit around USD 275 million in 2023.

- With the ongoing growth of healthcare services and the adoption of digital advancements in the United States, it is crucial to have precise and easy-to-use solutions to prioritize patient care. Barcoding solutions and future-proof options are accessible for hospitals, pharmacies, and labs to handle the challenges posed by a growing or aging population.

- Furthermore, the Digimarc barcode has been approved by the US Department of Agriculture as a digital disclosure method for packaging bioengineered foods, also referred to as genetically modified organisms (GMOs). Digimarc Barcode is an innovative form of inconspicuous barcode designed to be included on product packaging, retail tags, and hangtags. Consumer phones that are compatible, as well as retail barcode scanners and computer vision systems, have the capability to scan them. It also removes the requirement of incorporating a QR method in the product package design and meets the updated federal regulations.

Barcode Printer Industry Overview

The competitive rivalry in the fragmented barcode printers market is high owing to some key players such as Zebra Technologies Corporation, Avery Dennison Corporation, Honeywell International Inc., Toshiba Tec Corporation, and Sato Holdings Corporation. Their ability to develop their products constantly has enabled them to compete more effectively with their competitors.

- December 2023: Toshiba added the new BV400T thermal transfer printer range to its lineup of desktop barcode solutions, offering a wide range of features to improve labeling applications. The BV400T allows for ribbon compatibility with 100 m on 1/2" and 300 m on 1" cores, offering a wide variety of desktop printing solutions for thermal transfer applications.

- November 2023: TEKLYNX International revealed that it had finished Zebra Technologies' Enterprise Testing Program for its range of software solutions, including barcode label design and print automation. This classification signifies to customers and partners that TEKLYNX software has been thoroughly tested, verifying its compatibility and efficiency with Zebra's industrial thermal transfer barcode label printers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitute Products

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Technological Advancements

- 5.1.2 Rapid Growth of E-commerce and the Logistics Industry

- 5.2 Market Restraints

- 5.2.1 Printing Quality

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Desktop Printer

- 6.1.2 Mobile Printer

- 6.1.3 Industrial Printer

- 6.2 By Printing Type

- 6.2.1 Thermal Transfer

- 6.2.2 Direct Thermal

- 6.2.3 Other Printing Types

- 6.3 By End-user Industry

- 6.3.1 Manufacturing

- 6.3.2 Retail

- 6.3.3 Transportation and Logistics

- 6.3.4 Healthcare

- 6.3.5 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Sato Holdings Corporation

- 7.1.2 Zebra Technologies Corporation

- 7.1.3 Honeywell International Inc.

- 7.1.4 Toshiba Tec Corporation

- 7.1.5 Avery Dennison Corporation

- 7.1.6 Seiko Epson Corporation

- 7.1.7 TSC Auto ID Technology Co. Ltd

- 7.1.8 Primera Technologies Inc.

- 7.1.9 Brother Mobile Solutions Inc.

- 7.1.10 Postek Electronics Co. Ltd