|

市场调查报告书

商品编码

1642951

负载监控系统:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Load Monitoring System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

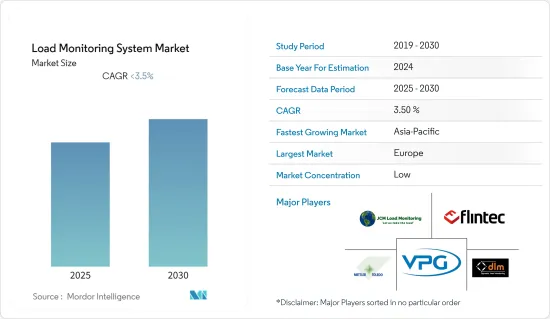

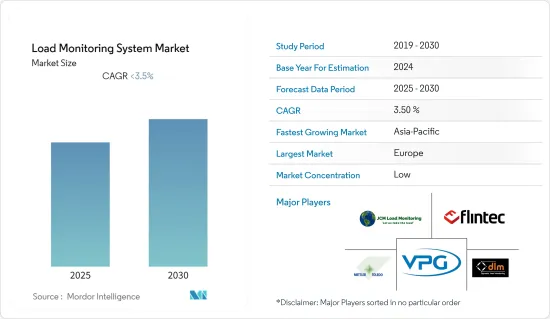

预测期内,负载监控系统市场预计复合年增长率将低于 3.5%。

主要亮点

- COVID-19 疫情对全球负载监测系统市场产生了重大影响。疫情期间,全球负载监测系统市场出现下滑。地方和全国的封锁导致许多建筑和工业场所关闭。这对全球负载监控系统市场产生了直接影响,因为必须缩减产量以防止库存过剩。然而,对医疗保健产品的需求量很大,这导致医疗保健产品製造业对负载监测系统的市场需求增加。

- 负载监控系统市场的最新趋势包括使用负载监控系统透过降低能耗来最大限度地降低生产成本并提高产品质量,预计这将在预测期内推动对这些系统的需求。此外,在预测期内,对改善负载监控系统的环境足迹的日益关注和客製化负载监控系统的日益普及预计将为负载监控系统市场提供新的成长机会。

- 此外,由于中国工业和製造业的不断扩张以及国内产量的不断增加,预计中国将为亚太地区负载监控系统市场的成长做出重大贡献。因此,亚太地区有望成为最有利可图的地区,为负载监控系统市场参与者提供巨大的成长机会。此外,「印度製造」倡议的启动也有助于促进製造业、食品饮料和汽车产业的成长。由于造船、製药和其他行业的成长,日本的负载监控系统市场也正在稳步成长。

- 然而,负载监控系统的製造工厂必须遵守ISO9001:2008品管系统、ISO14001:2004环境管理系统、OHSAS18001:2007健康与安全管理系统等标准。此外,国家型式评估计画 (NTEP) 和国际法制计量组织 (OIML) 等组织也为荷重元製造商提供认证。多项认证和标准的要求可能会成为负载监控系统市场扩张的障碍。

负载监控系统市场趋势

汽车和医疗保健产业的需求不断增长

各个新兴经济体(尤其是欧洲)的汽车产量快速成长,为全球负载监控系统市场开启了新的大门。德国、英国、法国和义大利是欧洲负载监控系统市场的主要收益贡献者。这是由于该地区汽车和货运业的不断发展。预计未来几年,包括自动驾驶汽车在内的汽车生产投资的增加将导致该地区对负载监控系统的需求增加。对负载监控系统的需求源于旨在提高车辆整体性能的创新下一代汽车技术日益增长的需求。随着数位荷重元的普及,新的机会开始出现。

对于基于荷重元的物料输送设备的需求是由以下几个关键问题所驱动的:其中最主要的是人们对汽车的兴趣日益浓厚,以及确保汽车得到适当维护的发展需求。荷重元在汽车工业的应用包括轮胎设计与开发、测功机和韧性试验台测试、零件及辅件测试、研发、踏板动力测试、安全带压力测试、悬吊测试、重心测试、车辆负载测试等。除此之外,它还有助于维护汽车在市场上取得成功所必须满足的强制性安全准则。

对车辆的需求不断增加以及确保及时维护车辆的需要不断增加是推动基于荷重元的物料输送机械需求的主要因素。这缩短了前置作业时间并提高了汽车行业的生产力。此外,负载监测系统在汽车产业的耐久性测试、检验、校准和鑑定过程中测量张力和压缩力方面发挥关键作用。

技术进步和准确性提高

负载监控系统在製药业的研发监控和控制以及压片机、搅拌机和滚压机等生产业务的扩大中日益受到青睐。此外,製药业对精密机械和热处理荷重元以精确测量压缩压力的需求不断增加,这也推动了对负载监测系统的需求。

负载监测系统的使用在製药製造的研究和开发过程中起着至关重要的作用,因为科学家专门测量化学和物质样品的重量。荷重元的主要应用之一是义肢和矫正器具。义肢和矫正器具中使用的荷重元具有高度灵敏度、可靠性和耐用性,用于检测负载的微小变化。此外,荷重元预计将用于多种应用,包括各种预防性医疗设备。

在预测期内,遵守严格的法规将对负载监控系统市场构成重大挑战。提供负载监控系统的供应商必须遵守国际标准化组织 (ISO)、澳洲标准 AS 1418 起重机(包括起吊装置和绞车)和职业健康与安全评估系列 (OHSAS) 等组织制定的规定。这些规定有助于确保安全性和一致性。

遵守上述规定可能会增加供应商的业务成本,进而影响他们的利润率。因此,供应商可能难以在遵守此类法规的同时管理其利润率,这可能会影响全球负载监控系统市场的成长。

高品质的IP67防护等级使荷重元能够在恶劣的工业环境中使用,消除了恶劣环境条件造成的误差。这些荷重元技术发展带来的仪器误差的减少导致了许多行业的需求增加。

预测期内,医疗保健部门预计将占据全球负载监测系统市场的最大份额。负载监控系统也用于重型机械和药品所需的细微变化。监控负载能力并调整比例以获得准确的测量。它对于测量透析设备和输液袋中的液体量非常有用。因此,考虑到这些优势,医疗保健产业将占据最大的份额。

负载监控系统产业概况

负载监控市场高度分散,存在多家参与者。医疗保健行业在多种製程中使用荷重元导致了对客製化负载监测系统和精密工程的需求,预计这将推动市场成长。此外,市场参与者正在采取积极的扩大策略,例如增加汽车产量、快速工业化和能源需求,以增加负载监控系统市场的采用。自订负载监控系统的引入允许最终用户根据他们的要求和任务来修改系统。这使得最终用户可以覆盖适合其需求的任何配置和容量。供应商还将感测元件纳入负载监控系统,以透过缩短交货时间来支援客户。

负载监控系统市场的主要企业包括 Eilersen Electric Digital Systems、Mantracourt Electronics、Mettler Toledo、Wirop Industrial、Precia Molen、Spectris、Vishay Precision Group、Flintec Inc. 和 JCM Load Monitoring。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查结果

- 调查前提

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场动态

- 驱动程式

- 限制因素

- 机会

- 波特五力分析

- 新进入者的威胁

- 购买者和消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 科技趋势

- 政府监管

- 价值链/供应链分析

- COVID-19 市场影响

第五章 市场区隔

- 按产品

- 荷重元

- 指示器和控制器

- 资料登录软体

- 依技术分类

- 模拟

- 数位的

- 按应用

- 车

- 建造

- 卫生保健

- 海洋

- 其他用途

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 法国

- 义大利

- 西班牙

- 德国

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 韩国

- 东南亚

- 澳洲

- 其他亚太地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 卡达

- 南非

- 其他中东和非洲地区

- 南美洲

- 阿根廷

- 巴西

- 智利

- 南美洲其他地区

- 北美洲

第六章 竞争格局

- 公司简介

- Flintec Inc.

- Mettler Toledo

- Precia Molen

- Spectris Plc

- Vishay Precision Group Inc.

- Dynamic Load Monitoring Ltd

- JCM Load Monitoring Ltd

- LCM Systems

- Keli Electric Manufacturing Co. Ltd

- Straightpoint

- Wirop Industrial Co. Ltd*

第七章 市场机会与未来趋势

第 8 章 附录

The Load Monitoring System Market is expected to register a CAGR of less than 3.5% during the forecast period.

Key Highlights

- The COVID-19 pandemic impacted the global load monitoring system market significantly. The global load monitoring system market saw a decline during the pandemic. Due to lockdowns at the regional and national levels, many construction and industrial sites were closed. This affected the global load monitoring system market directly as manufacturing had to be curtailed to prevent excess stock. But because there was a substantial demand for healthcare products, the market demand for load monitoring systems increased in the healthcare products manufacturing industry.

- The recent trends in the load monitoring system market include the use of load monitoring systems for minimizing production costs by limiting energy consumption and improving product quality is expected to fuel the demand for these systems during the forecast period. Also, the growing focus on improving the environmental footprint of load monitoring systems and the increasing popularity of customized load monitoring systems is anticipated to offer new and more growth opportunities for the load monitoring systems market during the forecast period,

- Furthermore, China is expected to be the key contributor to the growth of the load monitoring system market in APAC, owing to its expanding industrial and manufacturing sectors as well as increasing domestic production. Therefore, Asia Pacific is anticipated to be the most lucrative region offering substantial growth opportunities for the players in the load monitoring system market. Additionally, the launch of the Make in India initiative has assisted in promoting the growth of manufacturing, food & beverages as well as automotive sectors in India. Japan is also witnessing steady growth in the load monitoring system market owing to the increase in shipbuilding, pharmaceuticals markets, etc.

- However, standards such as ISO9001:2008 Quality Management System, ISO14001:2004 Environmental Management System, and OHSAS 18001:2007 Health and Safety Management System need to be adhered to in the manufacturing facilities of the load monitoring system. In addition, certifications are offered to load cell producers by organizations such as the National Type Evaluation Program (NTEP) and the International Organization of Legal Metrology (OIML). The demand for several certifications and standards may serve as a barrier that inhibits the expansion of the market for load monitoring systems.

Load Monitoring System Market Trends

Increasing Demand in Automotive and Healthcare Industry

The production of automobiles has advanced quickly in a variety of rising economies, particularly in Europe, which has resulted in the opening of new doors in the market for load monitoring systems worldwide. Germany, the UK, France, and Italy are the key revenue contributors to the load monitoring systems market in Europe. This is attributed to the growing automotive and cargo industry in the region. The increase in investments in vehicle production, including autonomous vehicles, would lead to a rise in the demand for load monitoring systems in the region in the coming years. The need for load monitoring systems is being driven upward by the rising demand for innovative and next-generation automotive technology, which is intended to improve the overall performance of vehicles. As digital load cells continue to gain in popularity, new opportunities have begun to present themselves.

The need for load cell-based material handling equipment is being driven by a number of major issues, the most important of which are the growing interest in cars and the developing requirement to guarantee the appropriate maintenance of vehicles. In the automotive industry, some of the applications for load cells include tyre design development, dynamometer and toughness test stage testing, testing of parts and auxiliary components, research and development, testing of pedal power, testing of safety belt pressure, testing of suspension, testing of the center of gravity, and testing of vehicle loads. In addition to this, it contributes to the maintenance of the mandatory safety guidelines that must be met in order for the vehicle to be successful on the market.

Growing demand for vehicles and the increasing need to ensure timely maintenance of vehicles are the key factors that are driving the demand for load cell-based material handling machinery. This reduces lead time and increases productivity in the automotive industry. Additionally, the load monitoring system plays an important role in measuring tension and compression, during endurance testing, validation, verification, and qualification in the automotive industry.

Increasing Technological Advancement and the Precision Rate

The load monitoring system is gaining momentum in the pharmaceutical business for monitoring and controlling R&D as well as scaling up production operations in tablet presses, mixers, and roller compactors. Furthermore, the pharmaceutical industry's desire for a load monitoring system has been driven by rising demand for precision machinery, as well as heat-treated load cells for accurately measuring compression pressures.

The use of the load monitoring system plays a vital role in the R&D process of pharmaceutical manufacturing, as scientists specifically weigh chemicals and substance samples. One of the major applications of the load cell is prosthetics. The load cells used in prosthetics are sensitive, reliable, and durable, and are used for detecting minute changes in the load. Furthermore, load cells are expected to be used in several applications, including a wide range of preventive medical equipment.

Compliance with strict regulations will be a major challenge for the load monitoring system market during the forecast period. Vendors that offer load monitoring systems need to comply with regulations framed by organizations such as the International Organization for Standardization (ISO), Australian Standard AS 1418 Cranes (Including Hoists and Winches), and Occupational Health and Safety Assessment Series (OHSAS). Such regulations help in ensuring safety and consistency.

Compliance with the above-mentioned regulations can increase the operational cost incurred by vendors, which, in turn, affects their profit margins. Hence, vendors find it difficult to manage their profit margins while complying with such regulations, which can impact the growth of the global load monitoring systems market.

The adoption of high-quality IP67 protection, which permits the use of load cells in tough industrial environments, has eliminated the errors caused by challenging environmental conditions. The reduction of instrumental errors brought on by these technological developments in load cells has increased demand in a number of industries.

The healthcare segment is expected to witness the largest share in the global load monitoring system market during the forecast period. The load monitoring system is used for heavy equipment and even delicate changes needed in medicines. They monitor the load capacity and adjust the proportion for precise measurements. It is extremely useful in dialysis machines, measuring fluid in IV bags, etc. Hence, considering these advantages healthcare segment will have the largest share.

Load Monitoring System Industry Overview

The load monitoring market is highly fragmented, due to several players present in the market. The market is expected to grow, due to the demand for customized load monitoring systems and precision-engineered technologies in the healthcare industry, as the load cells are used for several processes in this industry. Moreover, market players are taking up aggressive expansion strategies, such as increased automotive production, rapid industrialization, and energy demand, in order to increase the adoption of the load monitoring systems market. The introduction of custom load monitoring systems has allowed the end users to modify these systems as per their requirements and tasks. It helps them cover all configurations and capacities that match their applications. Vendors are also incorporating sensing elements with load monitoring systems, to support their customers by improving their delivery times.

Some of the major players in the load monitoring systems market include Eilersen Electric Digital Systems, Mantracourt Electronics, Mettler Toledo, Wirop Industrial, Precia Molen, Spectris, Vishay Precision Group, Flintec Inc., JCM Load Monitoring, and Others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.2 Restraints

- 4.2.3 Opportunities

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Technological Trends

- 4.5 Government Regulations

- 4.6 Value Chain/Supply Chain Analysis

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Product

- 5.1.1 Load Cell

- 5.1.2 Indicator and Controller

- 5.1.3 Data Logging Software

- 5.2 By Technology

- 5.2.1 Analog

- 5.2.2 Digital

- 5.3 By Application

- 5.3.1 Automotive

- 5.3.2 Construction

- 5.3.3 Healthcare

- 5.3.4 Marine

- 5.3.5 Other Applications

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 France

- 5.4.2.3 Italy

- 5.4.2.4 Spain

- 5.4.2.5 Germany

- 5.4.2.6 Russia

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Southeast Asia

- 5.4.3.6 Australia

- 5.4.3.7 Rest of Asia-Pacific

- 5.4.4 Middle-East and Africa

- 5.4.4.1 Saudi Arabia

- 5.4.4.2 United Arab Emirates

- 5.4.4.3 Qatar

- 5.4.4.4 South Africa

- 5.4.4.5 Rest of Middle-East and Africa

- 5.4.5 South America

- 5.4.5.1 Argentina

- 5.4.5.2 Brazil

- 5.4.5.3 Chile

- 5.4.5.4 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Overview (Market Concentration, Major Players)

- 6.2 Company Profiles

- 6.2.1 Flintec Inc.

- 6.2.2 Mettler Toledo

- 6.2.3 Precia Molen

- 6.2.4 Spectris Plc

- 6.2.5 Vishay Precision Group Inc.

- 6.2.6 Dynamic Load Monitoring Ltd

- 6.2.7 JCM Load Monitoring Ltd

- 6.2.8 LCM Systems

- 6.2.9 Keli Electric Manufacturing Co. Ltd

- 6.2.10 Straightpoint

- 6.2.11 Wirop Industrial Co. Ltd*