|

市场调查报告书

商品编码

1642958

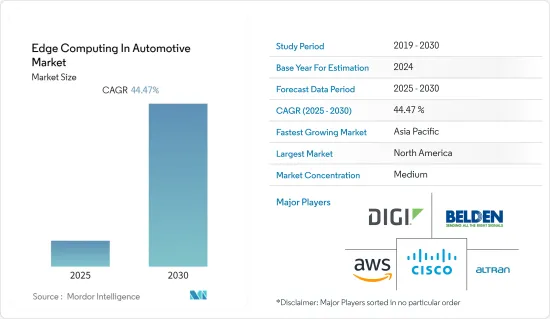

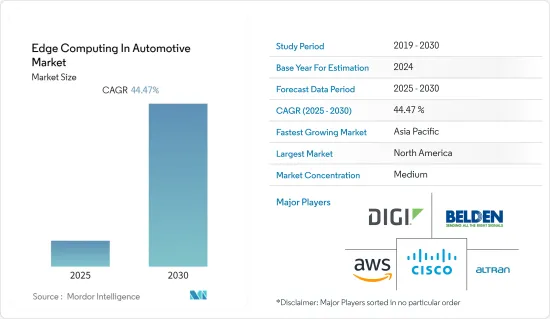

汽车边缘运算:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Edge Computing In Automotive - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

预计预测期内汽车边缘运算市场将以 44.47% 的复合年增长率成长。

自动驾驶汽车和联网汽车基础设施的发展,以及对提高边缘运算解决方案效率的轻量级框架和系统的需求,预计将为边缘运算供应商创造丰富的商机。

主要亮点

- 汽车公司开始透过采用各种技术创新来追求新的性能和生产力水平,包括感测器和其他资料生成和收集设备以及分析工具。传统上,资料管理和分析是在云端或资料中心进行的。然而,随着智慧製造、智慧城市等网路化技术和措施的不断渗透,这种情况似乎正在改变。

- 为了使连网汽车实现预期的价值,它们需要能够即时融合这些资料的设备。边缘运算是处理物联网 (IoT) 设备产生的资料的一种方式。在边缘,收集的资料在源头受到严格审查。

- 此外,以更快的速度处理配备各种感测器的工业机器人和连网汽车产生的越来越多的资料是一个问题,而5G应用将以其低延迟和高可靠性解决此类问题,从而轻鬆地将部分处理需求卸载到边缘或云端基础的伺服器,从而最大限度地降低复杂性。

- 此外,由于缺乏「全球」边界,以及由大量必须透过网路合作的个人控制的单一所有者生态系统,它变得更加脆弱。您的基础设施的某些部分可能会遭受高度局部的攻击,并产生局部的影响。

汽车边缘运算的市场趋势

物联网的普及将推动汽车边缘运算市场的成长

- 物联网技术正在解决製造业的劳动力短缺问题。对越来越多的公司来说,机器人等工业4.0技术的使用已成为日常业务的一部分。

- 使用边缘网路上的物联网设备收集和传输资料的机器人可以比使用云端基础的设计的机器人更快地检测异常并消除低效率。由于采用分散式设计,此类系统具有更强的容错能力,并且还能确保更高水准的执行时间生产力。

- 物联网在汽车行业的日益广泛应用将主要受到 5G 营运的推动,得益于低延迟和网路切片功能。目前,相当一部分工业IoT服务供应商和聚合商都提供支援 5G 的网路选项,并且预计未来几年将融入边缘运算来处理大量资料。

- 边缘运算的潜力正在改变工业製造。未来几十年,边缘运算应用将从根本上改变製造业,提高效率和产量,同时降低成本。这将与新一代智慧物联网边缘设备结合实现。预计这将对预测期内的市场成长产生积极影响。

- 此外,企业采用云端运算主要是因为它的灵活性、扩充性和成本效益,这有助于提高所研究市场中车辆功能的复杂性。

北美占有最大市场占有率

- 北美占据了最大的市场占有率,由于该地区消费者和商业部门对物联网设备的依赖,预计在整个预测期内仍将保持主导地位。随着云端运算的采用,该地区正经历技术转型的加速。此外,该地区自动驾驶汽车等创新概念的发展也有望在未来几年推动该地区的市场成长。

- 此外,由于边缘运算供应商数量众多,且北美企业对该技术的接受度不断提高,以利用 5G 等新技术,预计该地区将在预测期内占据最大的市场。

- 2022 年 3 月,联邦汽车安全监管机构批准开发和使用无人驾驶汽车,这种汽车没有方向盘或踏板等手动控制装置。

- 5G技术仍处于测试阶段。但希望将来能结出硕果。例如在美国,AT&T和Verizon正在进行现场测试。其中一些公司得到了企业合作伙伴的支持,例如美国最大的行动电话站点营运商 Crown Castle 和边缘运算专家 VaporIO 的投资者。

汽车产业边缘运算概述

汽车边缘运算市场竞争激烈,已有多家主要参与者进入市场。目前,少数大公司占了大部分市场占有率,以北美和欧洲为主的新兴市场占了很大份额。在日本和中国等新兴市场,市场高度混乱,区域和本地卖家占据主导地位。国际参与者逐渐意识到潜在商机的巨大潜力,并逐步建立供应网络,并透过併购进入这些非结构化市场。

2023 年 1 月,Belden 推出了单对乙太网路 (SPE) 连接产品组合,旨在优化恶劣环境下的乙太网路连接,包括工业和运输业务。 SPE 产品组合包括用于洁净区域连接的 IP20 级 PCB 插孔、插线和电线组,以及用于可靠现场设备工业乙太网连接的 IP65/IP67 级圆形 M8/M12插线、电线组和插座。

2022年11月,Belden Inc.宣布推出网路安全、强化和部署简化解决方案,包括Hirschmann GDME重型阀门连接器和Belden HorizonTM边缘编配平台。该平台管理着能够安全存取远端装置的软体,同时确保 OT 装置和应用程式的安全且易于部署、连接和管理。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 价值链/供应链分析

- 产业吸引力-波特五力分析

- 购买者/消费者的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场动态

- 市场驱动因素

- 提高物联网采用率

- 资料量和网路流量呈指数级增长

- 市场限制

- 基础建设的初始资本投资

- 隐私和安全问题

第六章 市场细分

- 按应用

- 联网汽车

- 交通管理

- 智慧城市

- 运输和物流

- 其他用途

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Altran Inc

- Belden Inc.

- Digi International Inc.

- Cisco Systems, Inc.

- Amazon Web Services(AWS), Inc.

- General Electric Company

- Hewlett Packard Enterprise Development LP

- Huawei Technologies Co., Ltd.

- Litmus Automation

- Azion Technologies Ltd.

第八章投资分析

第九章 市场机会与未来趋势

The Edge Computing In Automotive Market is expected to register a CAGR of 44.47% during the forecast period.

The evolution of autonomous vehicles and connected car infrastructure and the requirement for lightweight frameworks and systems to heighten the efficiency of edge computing solutions are anticipated to generate abundant opportunities for edge computing vendors.

Key Highlights

- Enterprises across automotive are beginning to drive new levels of performance and productivity by deploying different technological innovations, like sensors and other data-producing and collecting devices, along with analysis tools. Traditionally, data management and analysis are performed in the cloud or data centers. However, the scenario seems to be changing with the increasing penetration of network-related technologies and initiatives, such as smart manufacturing and smart cities.

- For connected cars to give the value they are expected to, there is a device that can concoct this data in real time. Edge computing is the method of processing data from IoT (Internet of Things) devices where it is generated. With the edge, the data being gathered gets examined right at the source.

- Moreover, processing increasing amounts of data at a faster pace, generated by industrial robots and connected cars equipped with various sensors, is problematic, and 5G applications are solving such issues with their low latency and high reliability, making it easier to offload part of this processing need to edge or cloud-based servers, thus, minimizing the complexity.

- Additionally, the absence of a "global" border and an ecosystem with a single owner that is governed by numerous individuals who must cooperate through networks makes it even more vulnerable. A piece of the infrastructure may be under the control of highly localized attacks with localized impact.

Edge Computing In Automotive Market Trends

Rising Adoption of IOT to Witness the Growth Edge Computing in Automotive Market

- IoT technologies are overcoming the labor shortage in the manufacturing sector. For more organizations, using Industry 4.0 technologies, like robotization, is part of day-to-day operations.

- Robots collecting and transferring data using IoT devices on an edge network can detect anomalies and eliminate inefficiencies far faster than they could use a cloud-based design. Such a system is substantially more resilient due to its distributed design, which also ensures higher levels of uptime productivity.

- The growing use of IoT in the automotive industry is accelerated by 5G operations, principally fueled by lower latency and network slicing capabilities. A sizable portion of industrial IoT service providers and aggregators currently offer 5 G-enabled network options, which are anticipated to incorporate edge computing over the next few years to handle the massive volume of data.

- Due to the potential of edge computing, industrial manufacturing is transforming. In the upcoming decades, edge computing applications will radically alter manufacturing to increase efficiency and production while lowering costs. This would be accomplished by combining them with a new generation of intelligent IoT edge devices. Over the projected period, this is expected to have a favorable effect on the market's growth.

- Furthermore, the adoption of the cloud in enterprises is primarily due to flexibility, scalability, and cost-effectiveness, which can help the advancement of vehicle capabilities in the studied market.

North America Occupies the Largest Market Share

- North America has accounted for the largest market share and is projected to maintain dominance throughout the forecast years as the consumer and business sectors in the region rely on IoT devices. Higher cloud adoption in the region contributes to the continued transition toward technology. The development of innovative concepts, such as autonomous cars, within the area is also expected to propel regional market growth in the years to come.

- Additionally, the region is anticipated to represent the largest market during the forecast period due to a significant number of edge computing suppliers and the growing acceptance of technology among North American businesses for utilizing new technologies, such as 5G.

- In March 2022, Federal vehicle safety regulators gave the go-ahead for developing and using driverless cars without manual controls like steering wheels or pedals.

- 5G technology is still in the testing stage. However, it is hoped that it will be fruitful in the future. For example, AT&T and Verizon conduct field tests in the United States. Some are backed by corporate partners, such as Crown Castle, the largest US mobile phone website operator and an investor in his Vapor IO, an edge computing specialist.

Edge Computing In Automotive Industry Overview

Edge computing in the automotive market is moderately competitive and consists of several major players. Few major companies today hold a disproportionate amount of the market share, which continues to be significant in all developed nations, particularly in North America and Europe. The market is highly disorganized in developing nations like Japan and China, where regional or local sellers predominate. International players are gradually creating supply networks and entering these unstructured marketplaces through mergers and acquisitions as they become aware of the significant potential opportunities.

In January 2023, Belden introduced its Single Pair Ethernet (SPE) portfolio of connectivity products designed to optimize Ethernet connection possibilities in harsh environments, including industrial and transportation operations. The SPE portfolio includes IP20-rated PCB jack, patch cords, and cord sets for clean-area connections and IP65/IP67-rated circular M8/M12 patch cords, cord sets, and receptacles for reliable field device industrial ethernet connections.

In November 2022 - Belden Inc. announced the launch of solutions for network security, ruggedization, and simplified deployment, including the Hirschmann GDME Heavy-Duty Valve Connectors and the Belden HorizonTM edge orchestration platform. The platform manages software that allows secure access to remote equipment while sustaining secure and easy deployment, connection, and management of OT devices and applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain / Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Buyers/Consumers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Adoption of IOT

- 5.1.2 Exponentially Growing Data Volumes And Network Traffic

- 5.2 Market Restraints

- 5.2.1 Initial Capital Expenditure For Infrastructure

- 5.2.2 Privacy and Security Concerns

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Connected Cars

- 6.1.2 Traffic Management

- 6.1.3 Smart Cities

- 6.1.4 Transportation & Logistics

- 6.1.5 Other Applications

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Altran Inc

- 7.1.2 Belden Inc.

- 7.1.3 Digi International Inc.

- 7.1.4 Cisco Systems, Inc.

- 7.1.5 Amazon Web Services (AWS), Inc.

- 7.1.6 General Electric Company

- 7.1.7 Hewlett Packard Enterprise Development LP

- 7.1.8 Huawei Technologies Co., Ltd.

- 7.1.9 Litmus Automation

- 7.1.10 Azion Technologies Ltd.