|

市场调查报告书

商品编码

1642975

液化石油气-市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Liquefied Petroleum Gas - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

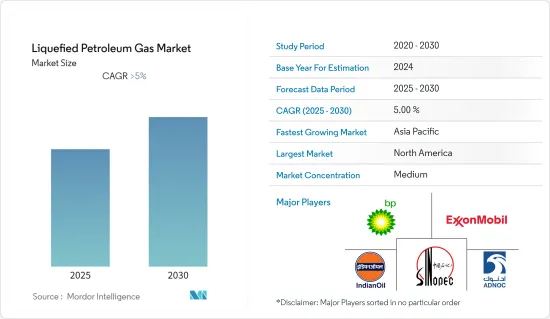

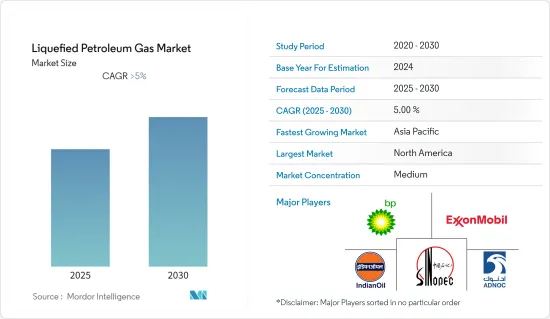

预计预测期内液化石油气市场将以超过 5% 的复合年增长率成长。

2020 年,新冠疫情对市场产生了负面影响。目前市场已恢復至疫情前的水准。

关键亮点

- 从长远来看,政府加大清洁燃料计划使用力度,预计液化石油气消费量将增加,这将推动市场发展。

- 另一方面,液化石油气储存问题和供应不连续预期会阻碍市场成长。

- 人口成长和对排放气体法规的日益关注导致液化石油气需求增加,预计将为液化石油气市场创造巨大的机会。

- 由于近年来液化石油气使用量的增加,北美占据了市场主导地位。

液化石油气 (LPG) 市场趋势

从液态天然气中提取的液化石油气占据市场主导地位

- 全球天然气液化石油气产量远超过原油产量。从地壳中提取的天然气含有气体和液体(丙烷和丁烷)的混合物,提取后可生产液化石油气。全球生产的液化石油气大部分是从天然气中提取的,其余部分是在炼油厂加工原油的过程中产生的。

- 大部分液化石油气都是从北美的天然气中提取的,据估计北美的液化石油气产量占世界最大比重。根据联合国的资料,2021年美国生产的天然气液化石油气约151,604吨,是全球最大的生产国。与 2020 年相比,成长了 4.2%。预计预测期内类似的趋势仍将持续。

- 此外,全球液态天然气产量大幅增加。根据《BP世界能源统计年鑑2022》,2021年全球液态天然气产量为12,047,000桶/日,较2020年增长2.2%,过去十年年平均成长率为3.2%。

- 由天然气生产的液化石油气不需要精製;只需要一个气体分离设施来提取形成液化石油气所需的气体。因此,从天然气提取液化石油气比炼油厂从原油生产液化石油气的成本更低。提取出的液化石油气可以透过油罐车和管线运输。

北美占据市场主导地位

- 北美是液化石油气生产最突出的市场之一。北美占全球液化石油气产量的很大份额,2021年液态天然气产量将接近每天1,980,085,000桶。美国和加拿大是该地区的主要生产国和出口国。

- 在北美的 NGL 总产量中,大部分用于生产 LPG。此外,北美是主要的液化石油气生产区之一,因为美国、加拿大和墨西哥都为原油精製的液化石油气生产做出了贡献。

- Enterprise Products Partners 于 2022 年 9 月宣布计划扩建其在二迭纪盆地的天然气液体 (NGL) 管道系统并建造两座加工厂,以适应盆地持续的产量增长。该公司计划透过接入新管道和改造现有泵站来扩大其 Shin Oak NGL 管道基础设施。此次初步扩建将使产能提高至 275,000 桶/天,预计将于 2024 年上半年完工。

- 除美国外,加拿大政府还推出倡议,提供奖励、燃料补贴和分销许可,鼓励大规模消费和使用液化石油气燃料,特别是在运输和烹饪领域,预计这将在预测期内加速液化石油气市场的成长。该地区各国政府正致力于使用液化石油气,以降低燃烧木柴、牛粪和煤炭等传统石化燃料产生的有害烟雾所造成的死亡率。这些措施可能在未来几年提振液化石油气市场的需求。

液化石油气(LPG)产业概况

液化石油气市场适度细分。 LPG市场的主要企业(不分先后顺序)包括英国石油公司、埃克森美孚公司、阿布达比国家石油公司(ADNOC)、印度石油有限公司、中国石化等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 2028 年市场规模及需求预测(十亿美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场区隔

- 生产来源

- 原油

- 天然气液

- 应用

- 住宅

- 商业/工业

- 汽车燃料

- 其他的

- 2028 年市场规模与需求预测(按地区)

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 挪威

- 荷兰

- 英国

- 德国

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 韩国

- 日本

- 其他亚太地区

- 中东和非洲

- 沙乌地阿拉伯

- 卡达

- 南非

- 其他中东和非洲地区

- 南美洲

- 巴西

- 阿根廷

- 智利

- 南美洲其他地区

- 北美洲

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- BP PLC

- Exxon Mobil Corporation

- ConocoPhillips

- Abu Dhabi National Oil Company(ADNOC)

- QatarEnergy

- Novatek PAO

- Gazprom PJSC

- China Petroleum & Chemical Corporation

- Indian Oil Corporation Ltd

- Reliance Gas

第七章 市场机会与未来趋势

简介目录

Product Code: 68820

The Liquefied Petroleum Gas Market is expected to register a CAGR of greater than 5% during the forecast period.

COVID-19 negatively impacted the market in 2020. Presently the market has reached pre-pandemic levels.

Key Highlights

- Over the long term, the increasing consumption of LPG on account of government initiatives to increase the usage of cleaner fuel projects is expected to drive the market.

- On the other hand, the problem in LPG storage and their non-continuous supply is expected to hinder the market's growth.

- Nevertheless, the increasing demand for LPG by the growing population and increasing focus on emission control is expected to create enormous opportunities for the liquefied petroleum gas market.

- North America dominates the market due to increased usage of LPG in recent years.

Liquefied Petroleum Gas (LPG) Market Trends

LPG Extracted from Natural Gas Liquids to Dominate the Market

- Global LPG production from natural gas is much higher than from crude oil production. Natural gas extracted from the earth's crust contains a mixture of gases and liquids (propane and butane) that are extracted to produce LPG. The majority of the LPG produced globally is extracted from natural gas, while the rest is produced during crude oil processing in refineries.

- LPG extracted from natural gas is estimated to be the highest in North America, which contributes to the maximum percentage of LPG produced globally. According to the United Nations Data, in 2021, natural gas liquids from the United States accounted for around 151,604 metric tons, the world's highest. It grew by 4.2% as compared to 2020. A similar trend is expected to be followed during the forecasted period.

- Moreover, the global production of natural gas liquids increased significantly. According to BP Statistical Review of World Energy 2022, in 2021, global natural gas liquids production was at 12047 thousand barrels per day, recording a growth rate of 2.2% compared to 2020 and an annual increase of 3.2% annually over the last decade.

- LPG produced from natural gas does not require any oil refinery; it just needs a gas separation facility that can extract the necessary gases to form the LPG. Thus, LPG extraction from natural gas is less expensive than LPG production from crude oil in refineries. LPG extracted can be distributed through tankers or pipelines.

North America to Dominate the Market

- North America is one of the most prominent markets for LPG production. North America had a significant share in global LPG production, with nearly 1,980,085 thousand barrels per day of natural gas liquid production in 2021. The United States and Canada are the key producers and exporters of the region.

- Out of the total NGL production in North America, most goes to LPG production. Moreover, the contribution of the United States, Canada, and Mexico to LPG production from the crude oil refineries makes North America one of the main LPG-producing regions.

- In September 2022, Enterprise Products Partners announced plans to extend its natural gas liquid (NGL) pipeline system in the Permian Basin and build two processing plants to accommodate the basin's continuous production expansion. The company intends to expand its Shin Oak NGL pipeline infrastructure by looping new pipelines and modifying current pump stations. This initial extension would increase capacity to 275,000 bpd, with completion planned in the first part of 2024.

- Apart from the United States, government initiatives in Canada to provide incentives, fuel subsidies, and distribution licenses to promote large consumption and usage of LPG fuels, especially in the transport and cooking sectors, are anticipated to accelerate the LPG market growth during the forecast period. The governments in the region are concentrating on using LPG to reduce the percentage of the death rate due to the harmful gases produced from the combustion of conventional fossil fuels like wood, cow dung, and coal. Such initiatives will likely increase the LPG market demand in the coming years.

Liquefied Petroleum Gas (LPG) Industry Overview

The liquefied petroleum gas market is moderately fragmented. The key players in the LPG market (in no particular order) include BP PLC, Exxon Mobil Corporation, Abu Dhabi National Oil Company (ADNOC), Indian Oil Corporation Ltd, and Sinopec Corp, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast, in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Source of Production

- 5.1.1 Crude Oil

- 5.1.2 Natural Gas Liquids

- 5.2 Application

- 5.2.1 Residential

- 5.2.2 Commercial & Industrial

- 5.2.3 Autofuels

- 5.2.4 Other Applications

- 5.3 Geography [Market Size and Demand Forecast till 2028 (for regions only)]

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Norway

- 5.3.2.2 Netherlands

- 5.3.2.3 United Kingdom

- 5.3.2.4 Germany

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 South Korea

- 5.3.3.4 Japan

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 Saudi Arabia

- 5.3.4.2 Qatar

- 5.3.4.3 South Africa

- 5.3.4.4 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Chile

- 5.3.5.4 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BP PLC

- 6.3.2 Exxon Mobil Corporation

- 6.3.3 ConocoPhillips

- 6.3.4 Abu Dhabi National Oil Company (ADNOC)

- 6.3.5 QatarEnergy

- 6.3.6 Novatek PAO

- 6.3.7 Gazprom PJSC

- 6.3.8 China Petroleum & Chemical Corporation

- 6.3.9 Indian Oil Corporation Ltd

- 6.3.10 Reliance Gas

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219