|

市场调查报告书

商品编码

1642999

装饰瓷砖:市场占有率分析、行业趋势和成长预测(2025-2030 年)Decorative Tiles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

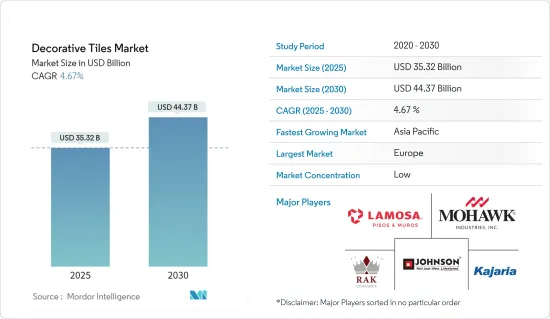

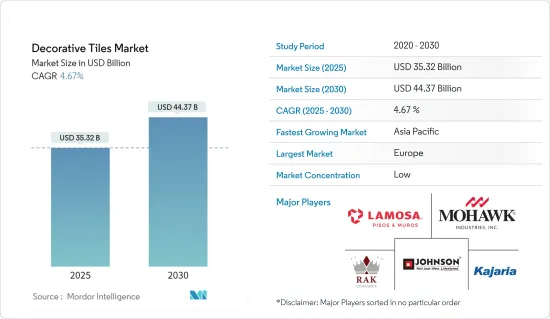

预计 2025 年装饰磁砖市场规模为 353.2 亿美元,到 2030 年预计将达到 443.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.67%。

由于全球建筑支出不断增加以及人们对浴室和厨房维修计划的兴趣日益浓厚,装饰瓷砖市场预计将出现强劲增长。都市化进程加速和商业基础建设活性化也是刺激装饰瓷砖需求的因素。从全球来看,已开发国家和新兴国家对基础建设的投资都在增加,这也是全球装饰瓷砖市场的驱动因素。

装饰瓷砖市场的主要趋势之一是 3D 列印瓷砖越来越受欢迎。通常使用黏土和沙子等材料来製作装饰瓷砖。 3D 磁砖列印作为一种污染较少的方法正迅速流行起来。瓷砖製造商可以使用 3D 列印为其产品添加精緻的刻面和设计纹理。由于装饰瓷砖具有抗污、抗刮擦等特性,且能够模仿更昂贵的天然石材和硬木瓷砖的外观,因此对装饰瓷砖的需求不断增长,预计这也是未来几年推动这些瓷砖普及的一个因素。

装饰瓷砖市场的趋势

住宅市场可能主导装饰瓷砖市场

住宅类装饰瓷砖在去年的市场占有率最高。随着可支配收入的增加以及由此引发的私人和住宅建筑的活性化,装饰瓷砖在住宅市场越来越受欢迎。全球范围内的建设活动正在蓬勃发展,预计住宅数量的增加将进一步推动装饰瓷砖的成长。由瓷器、大理石和石材製成的装饰瓷砖经过特别设计,以配合建筑类型和主题。它们增强了墙壁和地板的美感,并为建筑业增加了价值。

亚太地区装饰瓷砖市场的成长

亚太地区的装饰瓷砖市场经历了显着的成长,预计未来将继续扩大。亚太地区包括中国、印度、日本、韩国和东南亚国家,正在经历快速的都市化、有利的经济状况和不断提高的可支配收入水准。这些因素导致该地区对装饰瓷砖的需求不断增加。由于顾客偏好的变化和对室内设计的兴趣日益浓厚,装饰瓷砖在住宅和商业建筑中变得越来越普遍。消费者越来越多地寻求美观和客製化的选择,以增强生活空间和工作空间的视觉吸引力。由于亚太地区人口众多且中等收入阶层不断壮大,装饰瓷砖在该地区变得广泛可用且价格实惠。电子商务平台的扩张也使消费者更容易在网路上研究和购买各种装饰瓷砖,进一步推动了市场的成长。

装饰瓷砖行业概况

装饰瓷砖市场高度分散,多家公司相互竞争。几家大公司正在致力于开发创新产品以扩大产品系列。全球主要製造商包括 RAK Ceramics、Group Lamosa、Mohawk Industries、Johnson Tiles、Kajaria Ceramics 等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察与动态

- 市场概况

- 市场驱动因素

- 对个人化和美观的室内设计解决方案的需求日益增加

- 市场限制

- 装饰瓷砖相关成本

- 装饰瓷砖的耐用性和维护可能是一些消费者关心的问题。

- 市场机会

- 在商业领域,旅馆、餐厅和其他商业空间可能成为目标。

- 产业价值链分析

- 波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 洞察装饰瓷砖行业的主要趋势

- 洞察最新产业趋势与创新

- COVID-19 市场影响

第五章 市场区隔

- 按类型

- 陶瓷墙砖

- 乙烯基墙砖

- 石墙砖

- 其他类型

- 按最终用户

- 住宅

- 商业的

- 按应用

- 地板材料

- 墙壁材料

- 其他用途

- 按分销管道

- 家装中心

- 旗舰店

- 专卖店

- 网路商店

- 其他分销管道

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 亚太地区

- 日本

- 中国

- 其他亚太地区

- 欧洲

- 英国

- 德国

- 其他欧洲国家

- 拉丁美洲

- 巴西

- 秘鲁

- 其他拉丁美洲国家

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他中东和非洲地区

- 北美洲

第六章 竞争格局

- 市场集中度

- 公司简介

- RAK Ceramics

- Group Lamosa

- Mohawk Industries Inc.

- Johnson tiles

- Kajaria Ceramics Limited

- The Siam Cement Public Company Limited

- Roca Sanitario SA

- Panariagroup Industrie Ceramiche SpA

- Gruppo Concorde SpA

- Pamesa Ceramica SL

- Guangdong Dongpeng Ceramic Co. Ltd

- Emser Tile LLC

- Seneca Tiles

- Porcelanosa Grupo

- British Ceramic Tile

- China Ceramics Co. Ltd*

第七章 市场趋势

第 8 章:关于发布者

The Decorative Tiles Market size is estimated at USD 35.32 billion in 2025, and is expected to reach USD 44.37 billion by 2030, at a CAGR of 4.67% during the forecast period (2025-2030).

The decorative tiles market is expected to grow strongly, owing to increasing building construction spending and rising interest in bathroom and kitchen renovation projects worldwide. The rise in urbanization and increased commercial infrastructure development are other factors fuelling the demand for decorative tiles. Globally, there is an increase in investments in infrastructure development in developed and developing countries, which is another factor driving the global decorative tiles market.

One of the main trends in the decorative tile market is the rising popularity of 3D-printed tiles. Since clay, sand, and other materials are typically used to make decorative tiles. A method that produces less pollution is 3D tile printing, which is rapidly gaining traction. Tile manufacturers may add exquisite facets and design textures to their products using 3D printing. The rising demand for decorative tiles, owing to their stain and scratch resistance and ability to mimic the appearance of more expensive natural stone and hardwood tiles, is another factor that is anticipated to boost the adoption of these tiles in the next few years.

Decorative Tiles Market Trends

The Residential Segment is Likely to Dominate the Decorative Tiles Market

The market share of decorative tiles held by the residential category was the highest the year before. Decorative tiles are growing in popularity in the residential market, partly because of increased private and residential construction activity brought on by customers' increasing disposable income. Construction activity is growing rapidly at a worldwide level, and there is an increase in the growth of housing units, which is likely to propel the growth of decorative tiles further in the anticipated period. Decorative tiles made from porcelain, marble, and stones are designed specifically for construction type and theme. They enhance the aesthetic appeal of walls and floors and increase the value of the construction sector.

Rise in Decorative Tiles Market in Asia-Pacific

The decorative tiles market in the Asia-Pacific region is experiencing substantial growth and is expected to continue expanding in the coming years. Rapid urbanization, advantageous economic conditions, and rising disposable income levels have been observed throughout the Asia-Pacific region, including nations like China, India, Japan, South Korea, and Southeast Asian states. These factors have contributed to the rise in demand for decorative tiles in the region. Decorative tiles are becoming more common in residential and commercial settings due to shifting customer preferences and an increased focus on interior design. Consumers are increasingly looking for aesthetically appealing and customized options to enhance the visual appeal of their living and working spaces. Decorative tiles are now more widely available and affordable in the Asia-Pacific region due to the region's vast population base and growing middle class. The expansion of e-commerce platforms has also assisted in the growth of the market by making it simpler for customers to explore and buy a wide selection of decorative tiles online.

Decorative Tiles Industry Overview

The decorative tiles market is highly fragmented, with several companies competing against one another. Several key players engage in the development of innovative products to expand their product portfolios. Leading worldwide producers include RAK Ceramics, Group Lamosa, Mohawk Industries, Johnson Tiles, and Kajaria Ceramics.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand for Personalized and Aesthetically Pleasing Interior Design Solutions

- 4.3 Market Restraints

- 4.3.1 Cost Associated with Decorative Tiles

- 4.3.2 Durability and Maintenance of Decorative Tiles can be a Concern for Some Consumers

- 4.4 Market Opportunities

- 4.4.1 In the Commercial Sector, Businesses can Target Hotels, Restaurants, and Other Commercial Spaces

- 4.5 Industry Value Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights into the Key Trends in the Decorative Tiles Industry

- 4.8 Insights into the Recent Developments and Technological Innovations in the Industry

- 4.9 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Ceramic Wall Tiles

- 5.1.2 Vinyl Wall Tiles

- 5.1.3 Stone Wall Tiles

- 5.1.4 Other Types

- 5.2 By End User

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.3 By Application

- 5.3.1 Flooring

- 5.3.2 Wall Coverings

- 5.3.3 Other Applications

- 5.4 Distribution Channel

- 5.4.1 Home Centers

- 5.4.2 Flagship Stores

- 5.4.3 Specialty Stores

- 5.4.4 Online Stores

- 5.4.5 Other Distribution Channels

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Asia-Pacific

- 5.5.2.1 Japan

- 5.5.2.2 China

- 5.5.2.3 Rest of Asia-Pacific

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 Rest of Europe

- 5.5.4 Latin America

- 5.5.4.1 Brazil

- 5.5.4.2 Peru

- 5.5.4.3 Rest of Latin America

- 5.5.5 Middle East & Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Rest of Middle East & Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Company Profiles

- 6.2.1 RAK Ceramics

- 6.2.2 Group Lamosa

- 6.2.3 Mohawk Industries Inc.

- 6.2.4 Johnson tiles

- 6.2.5 Kajaria Ceramics Limited

- 6.2.6 The Siam Cement Public Company Limited

- 6.2.7 Roca Sanitario SA

- 6.2.8 Panariagroup Industrie Ceramiche SpA

- 6.2.9 Gruppo Concorde SpA

- 6.2.10 Pamesa Ceramica SL

- 6.2.11 Guangdong Dongpeng Ceramic Co. Ltd

- 6.2.12 Emser Tile LLC

- 6.2.13 Seneca Tiles

- 6.2.14 Porcelanosa Grupo

- 6.2.15 British Ceramic Tile

- 6.2.16 China Ceramics Co. Ltd*