|

市场调查报告书

商品编码

1643020

无线测试 -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Wireless Testing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

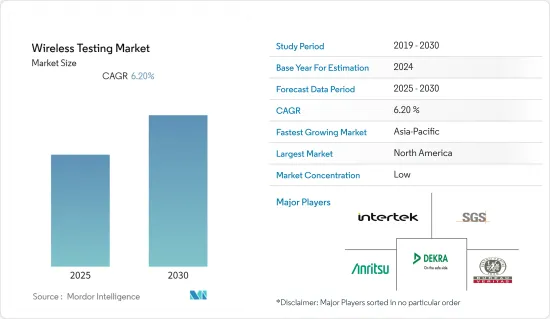

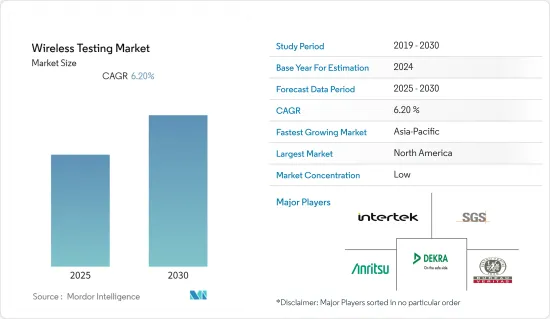

预测期内无线测试市场预计复合年增长率为 6.2%

关键亮点

- 无线测试评估由蓝牙、WiFi 和蜂窝连接等无线技术组成的产品的即时性能和功能。无线技术年復一年地发展,以实现全球范围内的语音、资料和视讯通讯。此外,机器对机器通讯和连接到互联网以实现全天候存取的物联网感测器的出现正在推动无线测试市场的需求。

- 在过去的几年里,物联网为电子设计领域带来了重大变化,处理器和无线元件加入了类比技术。由于这种转变为设计过程带来了新的复杂程度,测试设备也随之转变,客製化和整合程度上升到新的高度。

- 世界各地的不同司法管辖区都要求製造商遵守有关无线产品如何出于安全、健康和安全目的运作的规范和法规。第三方机构的合格评定也有助于製造商更好地在市场上竞争。

- 使用各种无线技术的设备市场正在不断增长,包括无线讯号和无线电力传输 (WPT)。在大多数国际市场,包括欧盟、美国、加拿大、澳洲和日本,政府标准都对电磁场的发射进行了规范。这适用于无线和WPT设备。

- 2021 年 11 月,通讯部 (DoT) 批准三家公司(Reliance Jio Infocomm、Bharti Airtel 和 Vodafone Idea)延长六个月,以进行 5G 测试。此次延期将允许通讯业者进行 5G 试验直至 2022 年 5 月。最初,通讯业者被允许测试 5G 技术直至 2021 年 11 月 26 日。今年 5 月,印度电信部在 700MHz、3.5GHz 和 26GHz 频段分配了为期六个月的 5G 试验频谱,为本地通讯业者合作开发 5G使用案例铺平了道路。

- 从技术角度来看,随着第二代5G晶片逐渐应用于产品中,且5G智慧型手机销售量不断上升,5G可望占据市场主导地位。这一成长主要受益于中国利用中频段积极建设5G网路。

- 所有拥有製造商品和服务关键资产的全球公司都因 COVID-19 疫情而经历快速下滑。这些公司的经营团队感受到了极度的危机和恐慌,一心想削减成本。随着製造活动的减少,企业将倾向于减少维护,这将导致未来价格上涨。

无线测试市场趋势

IT和通讯领域将实现大幅成长

- 在过去十年中,通讯业见证了全球行动电话网路用户数量的成长。此外,技术创新正朝着更快、更快回应的连线方向发展。这导致这些领域对测试蜂巢式网路的需求不断增加,以便从设计阶段开始测试和检验蜂窝网路、在研发期间执行预一致性测试、製造测试产品并优化已部署网路的效能。

- LTE是全球应用最广泛、部署最多的无线技术之一。随着 LTE-A 和 LTE-A Pro(LTE Advanced 和 LTE Advanced Pro)的演进提供更高的频宽和多千兆位元资料速率,供应商正在转向这些无线测试仪来优化 4.9G 的 LTE 效能。

- mmWave 5G 产品製造商正在试验在工厂不同站点进行测试的最佳组合,并比较生产线上的产量比率和节拍时间。采用多设备并行测试技术来提高製造经济性。

- 2021 年 10 月,新兴 5G 毫米波 (mmWave) 技术领域的知名参与企业Movandi 公布了试驾结果,结果显示,5G mmWave 与 Movandi BeamXR 驱动的智慧中继器以及 Movandi BeamX 云端软体控制、机器学习和人工智慧 (AI) 相结合,可以在行驶中的汽车中发挥最佳性能。行动车辆测试展示了高频率和云端智慧如何在具有挑战性的行动环境中提供高品质的服务和每秒数Gigabit的下行速度。

- 爱立信预计,截至2021年,5G活跃用户数将达到约6.64亿。预计这一数字在五年内将成长 16 倍以上,达到近 43.9 亿活跃 5G 用户。

- 至于 5G,它能够以极低的延迟大规模增强机器对机器通讯,这使得该网路在通讯业迅速获得应用。此外,5G 设备製造商必须遵守最新的 5G NR 合规性,进一步推动业界对无线测试仪的需求。根据5G Americas预测,到2023年,5G用户数将从70万人增加到13亿。这必将促进所研究市场的成长。

北美占有最大市场占有率

- 随着汽车产业对无线技术的需求不断增长,无线测试的需求也呈现爆炸性成长。频谱分析仪大量用于满足汽车雷达的测试要求。频谱分析仪是生产车间这些高频应用的理想工具。该地区最突出的全球汽车製造住宅(13家主要汽车製造商)和无线测试供应商(例如Keysight,Viavi,EXFO等)预计将成为技术创新的源头,并估计将占据相当大的市场占有率。

- 预计汽车产业的应用将显着成长。频谱分析仪通常用于满足汽车雷达测试要求。此外,对道路安全的日益关注需要对汽车雷达系统进行准确的检验。根据美国汽车产业分析局的数据,2021 年,美国汽车产业售出了约 1,490 万辆轻型汽车。这一数字包括约 330 万辆汽车零售和略低于 1,160 万辆轻型卡车零售额。

- 2022年9月,爱达荷州的研究人员开设了美国第一个露天5G无线测试站,专门用于安全测试、培训和技术开发。该试验场位于美国能源局占地 890 平方英里的爱达荷国家实验室场地,配备了最先进的商用蜂窝设备,包括 5G 无线、天线、基地台和电脑核心网路。 频谱 Agile Range 是第一个在国家实验室推出的产品。

- 2022 年 8 月:美国超越 5G 创新 (IB5G) 计画最近启动了三个新计划,将继续推进国防部与工业界和学术界在 5G 至 NextG 无线技术方面的合作伙伴关係。美国国防部(DoD)对推进 5G-to-NextG 无线技术和概念验证很感兴趣。

无线测试产业概况

无线测试市场竞争激烈。市场的主要企业包括 SGS 集团、Bureau Veritas SA、Intertek Group PLC、Dekra SE、安立公司、是德科技、Rohde &Schwarz GmbH &Co.KG 和 Viavi Solutions。为了在预测期内获得竞争优势,公司正在建立多种伙伴关係并投资推出新服务以增加市场占有率。

- 2022 年 9 月 - SGS 与韩国检测与认证服务中心 (KTC) 合作,后者是一家世界一流的电气安全和电磁相容性 (EMC) 测试和认证机构。两个组织都将专注于无线 EMC、软体资讯安全和电子移动领域的客户满意度、产品可靠性和技术竞争。此次合作改善了品牌、製造商、零售商和政府的测试和认证流程,有助于促进新加坡和韩国之间的合作和贸易。

- 2022 年 9 月 – Dekra 与 Wi-Fi 联盟合作。未来製造商的产品将能够接受Wi-Fi CERTIFIED认证测试。新ATL(授权测试实验室)的地理重点将是汽车和工业IoT市场。 Wi-Fi 认证的互通性测试有助于确保高品质的产品部署在汽车和工业IoT等不断增长的市场中。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- COVID-19 对无线测试市场的影响

第五章 市场动态

- 市场驱动因素

- 智慧型手机和智慧型穿戴装置的普及率不断提高

- 对云端运算和物联网设备的需求不断增长

- 市场问题

- 连接通讯协定缺乏标准化

第六章 市场细分

- 按产品

- 装置

- 无线设备测试(示波器、信号产生器、频谱分析仪、网路分析仪)

- 无线网路测试(网路测试器、网路扫描器、OTA 测试器)

- 服务

- 装置

- 依技术分类

- Bluetooth

- Wi-Fi

- GPS/GNSS

- 4G/LTE

- 5G

- 其他技术(2G、3G等)

- 按应用

- 消费性电子产品

- 车

- 资讯科技/通讯

- 能源动力

- 医疗设备

- 航太和国防

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 其他的

第七章 竞争格局

- 公司简介

- SGS Group

- Bureau Veritas SA

- Intertek Group PLC

- Dekra SE

- Anritsu Corporation

- Keysight Technolgies

- Rohde & Schwarz GmbH & Co. KG

- Viavi Solutions

- TUV SUD Akademie GmbH

- EXFO Inc.

第八章投资分析

第九章:市场的未来

The Wireless Testing Market is expected to register a CAGR of 6.2% during the forecast period.

Key Highlights

- Wireless testing assesses products' real-time performance and functionality consisting of wireless technologies such as Bluetooth, WiFi, and cellular connectivity. Wireless technology has evolved to communicate voice, data, and video globally over the years. Additionally, the emergence of machine-to-machine communication and IoT sensors connected to the internet for full-time access has driven the demand for the wireless testing market.

- Over the past few years, IoT has caused a tremendous shift in the field of electronic design, with processors and wireless components now finding their way into analog technology. As this shift introduces a new level of complexity into the design process, test equipment has followed the trend, rising to new heights of customization and integration.

- Different jurisdictions around the globe require manufacturers to comply with codes and regulations regarding how their wireless products function for security, health, and safety purposes. Third-party conformity assessments also help to strengthen the manufacturer's competitive position in the market.

- There is an increasing market of devices that use different types of wireless technologies, such as radio signals and wireless power transfer (WPT). Government standards regulate the radiation of electromagnetic fields in most international markets, including the European Union, the United States, Canada, Australia, and Japan. This applies to both radio and WPT devices.

- In November 2021, the Department of Telecommunications (DoT) granted Reliance Jio Infocomm, Bharti Airtel, and Vodafone Idea a six-month extension to perform 5G trials. Due to this extension, the carriers would conduct 5G experiments until May 2022. Initially, telcos were given until November 26, 2021, to test 5G technology. In May, the DoT awarded a 5G trial spectrum for six months in the 700 MHz, 3.5 GHz, and 26 GHz bands, paving the way for local carriers to partner and develop 5G use cases.

- By technology, 5G is expected to dominate the market since second-generation versions of 5G chips are making their way into products, increasing the sale of 5G-enabled smartphones. This growth is primarily driven by an aggressive 5G build-out in China using the mid-band spectrum.

- All businesses globally with crucial assets for manufacturing goods and services have been experiencing a rapid decline due to the COVID-19 pandemic. The management of such companies has been feeling extreme urgency and panic, putting more emphasis on cutting costs. Since manufacturing activity is low, companies are tempted to eliminate maintenance, resulting in high prices in the future.

Wireless Testing Market Trends

IT and Telecommunication Segment to Witness Significant Growth

- In the recent past ten years, the telecommunication industry witnessed a growth in the number of cellular network subscriptions globally. Additionally, innovation is moving toward faster and more actively responsive connections. Therefore, testing equipment is increasingly needed in these domains, starting at the design stage to testing and validating the design and at the R&D stage for performing pre-conformance testing, manufacturing built-to-test, and optimizing the performance of the deployed network with the cellular network.

- LTE is one of the most popular wireless technologies globally, with the highest number of deployments. Due to the evolution of LTE-A and LTE-A Pro (LTE Advanced and LTE Advanced Pro) for offering higher bandwidth range and multi-gigabyte data rates, the vendors are increasingly using these wireless testers for optimizing LTE performance to 4.9G.

- Manufacturers of mmWave 5G products are experimenting with an optimal mix of tests performed in different stations in the factory vs. yield and takt time on the line. They are applying multi-device parallel test techniques to improve manufacturing economics.

- In October 2021, Movandi, a prominent player in new 5G millimeter-wave (mmWave) technology, announced the test drive results showing how 5G mmWave can deliver optimum performance in a moving automobile when Movandi BeamXR powered smart repeater with Movandi BeamX cloud software control, machine learning, and artificial intelligence (AI) are combined. This test in a moving vehicle demonstrated the ability of the high frequencies and cloud intelligence to provide a high quality of service and multi-gigabit per second downlink speeds in challenging mobile environments.

- According to Ericsson, as of 2021, there were approximately 664 million active 5G subscriptions. This figure is expected to increase more than sixteen-fold in five years when forecasts show there will be close to 4.39 billion active 5G subscriptions.

- In terms of 5G, the network is rapidly gaining traction in the telecommunication industry due to its capability to enhance massive machine-to-machine communication with extremely low latency. Additionally, the 5G device manufacturers must comply with the latest 5G NR compliance, further driving the industry's demand for a wireless tester. According to 5G Americas, the number of 5G subscribers is estimated to increase from 0.7 million to 1.3 billion by 2023. This is determined to drive the studied market's growth.

North America to Witness the Largest Market Share

- The growing demand for wireless technology in the automotive industry has also surged the need for wireless testing. Spectrum analyzers are highly being used to meet automotive radar test requirements. The spectrum analyzer is ideal equipment on the production floor for these high-frequency applications. Housing, the region's most prominent global automotive players (13 major automotive manufacturers), and wireless testing vendors (Keysight, Viavi, and EXFO, among others) are expected to emerge as a source of innovation and are estimated to hold a significant market share.

- The automotive industry is expected to witness significant growth in terms of application. Generally, spectrum analyzers are used to meet automotive radar test requirements. Additionally, heightened road safety requires precise verification of the automotive radar systems. In 2021, according to BEA, the automotive industry in the United States sold approximately 14.9 million light vehicle units. This figure includes retail sales of about 3.3 million autos and just under 11.6 million light truck units.

- In September 2022, researchers in Idaho opened the nation's first open-air, 5G wireless test range focused exclusively on security testing, training, and technology development. Located across the US Department of Energy's 890-square mile Idaho National Laboratory Site, the range is outfitted with state-of-the-art commercial cellular equipment, including 5G radios, antennas, base stations, and a computerized core network. The spectrum-agile range is the first to be opened at a national laboratory.

- In August 2022, the United States Department of Defense Innovation Beyond 5G (IB5G) Program recently started three new projects that continue to advance DoD collaborative partnerships with industry and academia for 5G-to-NextG wireless technologies. The DoD(Department of Defense) is interested in promoting 5G-to-NextG wireless technologies and concept demonstrations.

Wireless Testing Industry Overview

The wireless testing market is very competitive in nature. Some of the significant players in the market are SGS Group, Bureau Veritas SA, Intertek Group PLC, Dekra SE, Anritsu Corporation, Keysight Technologies, Rohde & Schwarz GmbH & Co. KG, Viavi Solutions, and many more. The companies are increasing the market share by forming multiple partnerships and investing in introducing new services to earn a competitive edge during the forecast period.

- September 2022 - SGS partnered with Korea Testing Certification Institute (KTC), a global-class testing and certification agency in electrical safety and electromagnetic compatibility (EMC). Both organizations focused on customer satisfaction, product reliability, and technological competitiveness in the wireless and EMC, software and information security, and e-mobility sectors. The collaboration improved the testing and certification process for brands, manufacturers, retailers, and governments and helped facilitate cooperation and trade between Singapore and South Korea.

- September 2022 - Dekra partnered with Wi-Fi Alliance. In the future, manufacturers can have authorized Wi-Fi CERTIFIED testing for the products. The regional focus of the new ATL (Authorized Test Laboratory) is on the automotive and industrial IoT markets. Wi-Fi-certified interoperability testing helps ensure high-quality products are deployed in growing markets like automotive and industrial IoT.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Wireless Testing Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Smartphones and Smart Wearables

- 5.1.2 Growing Demand for Cloud Computing and IoT Devices

- 5.2 Market Challenges

- 5.2.1 Lack of Standardization in Connectivity Protocols

6 MARKET SEGMENTATION

- 6.1 By Offering

- 6.1.1 Equipment

- 6.1.1.1 Wireless Device Testing (Ocilloscope, Signal Generators, Spectrum Analyzers, and Network Analyzers)

- 6.1.1.2 Wireless Network Testing (Network Testers, Network Scanners, and Ota Testers)

- 6.1.2 Services

- 6.1.1 Equipment

- 6.2 By Technology

- 6.2.1 Bluetooth

- 6.2.2 Wi-Fi

- 6.2.3 GPS / GNSS

- 6.2.4 4G / LTE

- 6.2.5 5G

- 6.2.6 Other Technologies (2G, 3G, etc)

- 6.3 By Application

- 6.3.1 Consumer Electronics

- 6.3.2 Automotive

- 6.3.3 IT and Telecommunication

- 6.3.4 Energy and Power

- 6.3.5 Medical Devices

- 6.3.6 Aerospace and Defense

- 6.3.7 Other Applications

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 SGS Group

- 7.1.2 Bureau Veritas SA

- 7.1.3 Intertek Group PLC

- 7.1.4 Dekra SE

- 7.1.5 Anritsu Corporation

- 7.1.6 Keysight Technolgies

- 7.1.7 Rohde & Schwarz GmbH & Co. KG

- 7.1.8 Viavi Solutions

- 7.1.9 TUV SUD Akademie GmbH

- 7.1.10 EXFO Inc.