|

市场调查报告书

商品编码

1643022

地理资讯系统-市场占有率分析、产业趋势与统计、成长趋势预测(2025-2030)Geographic Information System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

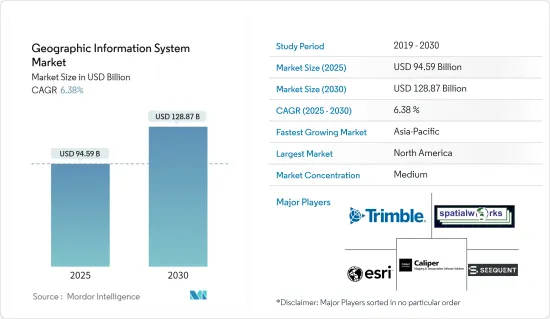

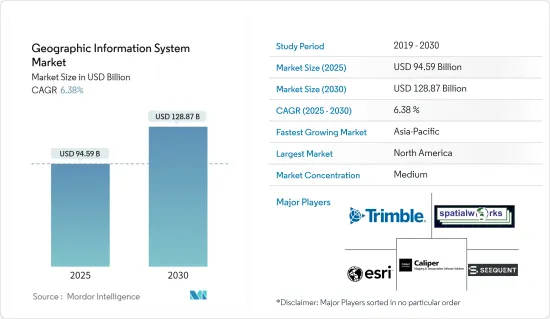

地理资讯系统市场规模预计在 2025 年为 945.9 亿美元,预计到 2030 年将达到 1,288.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.38%。

地理资讯系统 (GIS) 市场正在发展成为跨行业的关键技术,利用空间资料来增强决策流程。 GIS 使组织能够捕获、储存、分析和视觉化地理讯息,这使其对于城市规划、基础设施管理和环境监测等应用具有重要意义。智慧城市的兴起和地理空间资料的进步正在推动 GIS 在农业、公共和建筑等领域的广泛应用。

GIS 市场关键基本面

关键亮点

- 与现代商业的相关性增强:GIS 市场因融入商业环境而显着成长。政府和私人公司都在大力投资 GIS 技术,以优化业务、改善服务交付并促进永续发展。此外,硬体和软体的进步也提高了 GIS 工具的准确性和易用性。例如,云端基础的GIS 提供可扩展性和协作功能,有助于产业向资料主导解决方案的转变。

- 与新技术的整合:GIS 市场因其与人工智慧 (AI) 和物联网 (IoT) 等其他技术整合的能力而不断扩大。这种融合实现了即时资料收集和预测分析,刺激了各行业的需求。区域分析系统解决方案代表了地理空间智慧的突破,突破了资料分析和空间映射创新的界限。

- 资料品质和旧有系统整合挑战:虽然 GIS 的应用正在成长,但资料品质和与旧有系统的整合等挑战阻碍了某些地区的无缝推广。组织必须对资料准确性和基础设施现代化进行投资,以克服这些障碍,并确保其 GIS 解决方案能够满足对准确空间资料日益增长的需求。

智慧城市中 GIS 的应用

关键亮点

- 在都市规划中的关键角色:随着都市化的加速,GIS 成为智慧城市发展的核心。城市负责人使用 GIS 来管理基础设施、优化交通网络并提高公共安全。 GIS 处理大量空间资料并提取见解以改善城市管理和资源分配。

- 基础设施优化 GIS 协助城市规划者绘製资源、土地使用和基础设施开发图,以支援永续的城市设计。

- 即时监控:透过即时资料馈送,GIS 可以监控能源消耗、交通模式和紧急应变,以简化城市运作。

- 数位双胞胎:GIS 支援创建数位双胞胎(模拟城市发展的虚拟城市模型),以便在变化实际实施之前预测其影响。

整合 GIS 与商业智慧

关键亮点

- 转变商业分析:GIS 市场最重要的趋势之一是与商业智慧(BI) 工具的整合。透过这种集成,企业能够将基于位置的资料与绩效指标迭加,以更深入地了解客户行为、市场机会和供应链效率。

- 资料的地理视觉化:透过将 GIS 与 BI 工具结合,可以将业务资料进行地理视觉化,从而为效率提供新的观点。

- 产业特定优势:零售、物流和通讯等行业可以从 GIS 中受益,以优化资源配置、改善市场策略并推动客户参与。

- 预测分析:将 GIS 与预测分析结合使用,公司可以预测需求趋势、确定高潜力区域、降低风险并增强决策流程。

与现有系统整合的挑战

关键亮点

- 同步复杂性:将 GIS 与传统企业系统(例如企业资源规划 (ERP) 和客户关係管理 (CRM) 平台)整合可能很复杂,尤其是对于依赖传统技术的公司而言。

- 旧有系统:许多组织努力使其 GIS 与过时的资料管理平台保持同步,导致业务效率低落。

- 需要大量投资:成功采用 GIS 通常需要在软体升级和员工培训方面进行大量投资。

- 资料重复的风险:传统资料库与现代 GIS 解决方案之间的不匹配可能导致资料重复和错误,从而削弱空间资讯的价值。

对资料品质和准确性的担忧

关键亮点

- 高品质资料的重要性:为了使 GIS 应用程式提供准确的见解,输入的资料必须满足高品质和准确性的标准。然而,资料准确性仍然是许多用户关心的问题,特别是在农业、建筑和运输领域,空间资料中的错误可能会带来代价高昂的后果。

- 资料收集不一致:不准确的 GIS 分析通常是由于资料收集方法不一致或资料集过时所造成的。

- 开发中地区面临的挑战:在开发中地区,由于无法取得先进的资料收集工具,GIS资料的品质受到进一步损害。

- 提高准确性的挑战:对高解析度卫星影像、即时资料撷取技术和强大的资料检验流程的投资对于解决这些资料品质挑战至关重要。

地理资讯系统 (GIS) 市场趋势

新兴市场的发展和城市规划正在推动市场成长

- 智慧城市推动 GIS 市场成长智慧城市的兴起和先进的城市规划需求是 GIS 市场的主要驱动力。智慧城市依靠 GIS 技术来有效管理基础设施、资源和基本服务,这反映了对支援城市扩张和规划的技术日益增长的需求。

- 基础设施和资源管理:GIS 对于管理交通、能源和供水等城市系统至关重要,有助于 GIS 市场的成长。

- 城市设计的永续性:城市负责人使用 GIS 透过优化土地利用、监测交通、评估人口趋势等来开发永续、宜居的城市。

- 利用 GIS 技术增强决策能力:政府和城市开发商使用 GIS 分析空间资料以做出明智的决策,尤其是在基础设施开发和环境风险管理方面。对 GIS 的依赖对于应对快速都市化和永续发展的挑战至关重要。

亚太地区市场成长最高

- 快速都市化和政府倡议:由于快速都市化、政府投资和技术进步,预计亚太地区将见证 GIS 市场的最高成长。中国和印度等国家在采用 GIS 方面处于领先地位,尤其是透过其智慧城市计画和基础设施发展计划。

- 政府支持的计划:印度的「数位印度」和中国的「智慧城市」计画等措施正在加速 GIS 在城市规划和灾害管理等领域的整合。

- 关键产业应用:GIS 广泛应用于亚太地区的农业、交通和公共工程,对该地区 GIS 市场的整体成长做出了重大贡献。

- GIS 创新:人工智慧和物联网等新技术进一步推动亚太地区 GIS 的应用,提供更精确的地理空间资料和分析。随着政府和企业对 GIS 的大力投资,预计未来几年市场规模将稳定上升。

地理资讯系统 (GIS) 产业概况

地理资讯系统市场:GIS 市场适度整合,Autodesk Inc.、Bentley Systems 和 Hexagon AB 等主导参与企业引领创新与应用。儘管少数大公司占据主导地位,但区域竞争对手和利基市场参与企业正在寻找机会提供特定产业的解决方案。

技术领导:Hexagon AB、Pitney Bowes Inc.等主要企业透过广泛的全球营运和多样化的产品系列保持领先地位,并持续推动人工智慧、云端运算和巨量资料领域的研发。

客製化和伙伴关係:领先的公司专注于创新和客製化以满足特定行业的需求,并与政府和其他行业伙伴关係以扩大其市场范围。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 市场驱动因素

- GIS 在智慧城市生态系中的作用不断扩大

- 整合地理位置地图和商业智慧系统

- 市场限制

- 与遗留系统整合的问题

- 资料品质和准确性问题

- COVID-19 工业影响评估

第五章 市场区隔

- 按组件

- 硬体

- 软体

- 按功能

- 製图

- 测量

- 远端资讯处理和导航

- 定位服务

- 按最终用户

- 农业

- 公共工程

- 矿业

- 建造

- 运输

- 石油和天然气

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第六章 竞争格局

- 公司简介

- Trimble Inc.

- Spatialworks

- Geosoft

- ESRI Inc.

- Caliper Corporation

- Topcon Positioning Systems

- Pitney Bowes Inc.

- Hexagon AB

- Bentley Systems

- Autodesk Inc.

第七章投资分析

第八章 市场机会与未来趋势

The Geographic Information System Market size is estimated at USD 94.59 billion in 2025, and is expected to reach USD 128.87 billion by 2030, at a CAGR of 6.38% during the forecast period (2025-2030).

The Geographic Information System (GIS) market has evolved into a critical technology across industries, leveraging spatial data to enhance decision-making processes. GIS allows organizations to capture, store, analyze, and visualize geographic information, making it invaluable for applications in urban planning, infrastructure management, and environmental monitoring. The rise of smart cities and advancements in geospatial data have significantly expanded the adoption of GIS in sectors such as agriculture, utilities, and construction.

Key Fundamentals of the GIS Market

Key Highlights

- Increased Relevance in Modern Business: The GIS market has grown significantly due to its integration into business environments. Both governments and private enterprises are investing heavily in GIS technologies to optimize operations, improve service delivery, and drive sustainable development. Additionally, advances in hardware and software have enhanced the precision and usability of GIS tools. For instance, cloud-based GIS offers scalability and collaborative features, contributing to the industry's shift toward data-driven solutions.

- Integration with Emerging Technologies: The GIS market is expanding due to its ability to integrate with other technologies like Artificial Intelligence (AI) and the Internet of Things (IoT). This convergence allows for real-time data collection and predictive analytics, spurring demand across industries. Geographic information system solutions have seen significant advancements in geospatial intelligence, pushing the boundaries of innovation in data analysis and spatial mapping.

- Challenges in Data Quality and Legacy System Integration: While GIS adoption is growing, challenges like data quality and the integration of GIS with legacy systems hinder seamless deployment in some regions. Organizations need to invest in data accuracy and infrastructure modernization to overcome these barriers, ensuring that GIS solutions meet the growing demand for precise spatial data.

Adoption of GIS in Smart Cities

Key Highlights

- Essential Role in Urban Planning: As urbanization accelerates, GIS has become central to smart city development. Urban planners use GIS to manage infrastructure, optimize transportation networks, and enhance public safety. GIS processes vast amounts of spatial data, providing insights that improve city management and resource allocation.

- Infrastructure Optimization: GIS aids urban planners in mapping resources, land use, and infrastructure development, supporting sustainable city designs.

- Real-Time Monitoring: Through real-time data feeds, GIS monitors energy consumption, traffic patterns, and emergency responses, streamlining city operations.

- Digital Twins: GIS supports the creation of digital twins, virtual city models that simulate urban developments, predicting the impact of changes before physical implementation.

Integration of GIS with Business Intelligence

Key Highlights

- Transforming Business Analytics: One of the most significant trends in the GIS market is its integration with Business Intelligence (BI) tools. This convergence enables businesses to layer location-based data with performance metrics, generating deeper insights into customer behavior, market opportunities, and supply chain efficiencies.

- Geographical Visualization of Data: Integrating GIS with BI tools allows businesses to visualize operational data geographically, offering new perspectives on efficiency.

- Industry-Specific Benefits: Sectors like retail, logistics, and telecommunications benefit from GIS, optimizing resource allocation, improving market strategies, and driving customer engagement.

- Predictive Analytics: Businesses can use GIS with predictive analytics to anticipate demand trends, identify high-potential regions, and mitigate risks, enhancing decision-making processes.

Integration Challenges with Traditional Systems

Key Highlights

- Complexity in Synchronization: Integrating GIS with traditional enterprise systems, such as enterprise resource planning (ERP) or customer relationship management (CRM) platforms, can be complex, especially for organizations relying on outdated technology.

- Legacy Systems: Many organizations struggle to synchronize GIS with older data management platforms, leading to operational inefficiencies.

- Significant Investments Needed: Integration often requires substantial investments in software upgrades and personnel training to ensure smooth GIS adoption.

- Data Duplication Risks: Misalignment between traditional databases and modern GIS solutions can result in data duplication or errors, compromising the value of spatial information.

Data Quality and Accuracy Concerns

Key Highlights

- The Importance of High-Quality Data: For GIS applications to deliver accurate insights, the data inputted must meet high standards of quality and precision. However, data accuracy remains a concern for many users, especially in agriculture, construction, and transportation, where errors in spatial data can lead to costly consequences.

- Inconsistent Data Collection: Inaccurate GIS analysis often stems from inconsistent data collection methods or outdated datasets.

- Challenges in Developing Regions: In developing regions, access to advanced data-gathering tools is limited, further compromising the quality of GIS data.

- Solutions for Improved Accuracy: Investments in high-resolution satellite imagery, real-time data acquisition technologies, and robust data validation processes are crucial for addressing these data quality challenges.

Geographic Information System (GIS) Market Trends

The Rising Smart Cities Development and Urban Planning to Drive the Market Growth

- Smart Cities Drive GIS Market Growth: The rise of smart cities and advanced urban planning needs are key drivers of the GIS market. Smart cities depend on GIS technology to efficiently manage infrastructure, resources, and essential services, reflecting the increasing demand for technology that supports urban expansion and planning.

- Infrastructure and Resource Management: GIS is essential for managing urban systems like transportation, energy, and water supply, contributing to the growth of the GIS market.

- Sustainability in Urban Design: Urban planners use GIS to develop sustainable, livable cities by optimizing land use, monitoring traffic, and assessing demographic trends.

- Enhanced Decision-Making with GIS Technology: Governments and urban developers use GIS to analyze spatial data for informed decision-making, particularly in infrastructure development and environmental risk management. This reliance on GIS is essential in addressing the challenges of rapid urbanization and sustainable development.

Asia-Pacific to Register Highest Market Growth

- Rapid Urbanization and Government Initiatives: The Asia-Pacific region is expected to experience the highest growth in the GIS market due to rapid urbanization, government investments, and technological advancements. Countries like China and India lead GIS adoption, particularly through smart city initiatives and infrastructure development projects.

- Government-Backed Projects: Initiatives like India's Digital India and China's smart city programs are accelerating GIS integration in sectors such as urban planning and disaster management.

- Key Industry Applications: GIS is widely used in agriculture, transportation, and utilities in the Asia-Pacific, contributing significantly to the region's overall GIS market growth.

- Technological Innovation in GIS: Emerging technologies like AI and IoT are further driving GIS adoption in Asia-Pacific, delivering more accurate geospatial data and analytics. With governments and enterprises investing heavily in GIS, the market value is set to climb steadily in the coming years.

Geographic Information System (GIS) Industry Overview

Semi-Consolidated Market: The GIS market is moderately consolidated, with dominant players like Autodesk Inc., Bentley Systems, and Hexagon AB leading innovation and adoption. While a few large companies dominate, regional competitors and niche players still find opportunities to offer industry-specific solutions.

Technological Leadership: Companies like Hexagon AB and Pitney Bowes Inc. lead through extensive global operations and diverse product portfolios, continuously driving R&D efforts in AI, cloud computing, and big data.

Customization and Partnerships: Industry leaders focus on innovation and customization to meet specific sector needs, forming partnerships with governments and other industries to expand market reach.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Market Drivers

- 4.3.1 Growing role of GIS in Smart Cities Ecosystem

- 4.3.2 Integration of Location-based Mapping Systems with Business Intelligence Systems

- 4.4 Market Restraints

- 4.4.1 Integration Issues with Traditional Systems

- 4.4.2 Data Quality and Accuracy Issues

- 4.5 Assessment of Impact of COVID-19 on the Industry

5 MARKET SEGMENTATION

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software

- 5.2 By Function

- 5.2.1 Mapping

- 5.2.2 Surveying

- 5.2.3 Telematics and Navigation

- 5.2.4 Location-based Services

- 5.3 By End User

- 5.3.1 Agriculture

- 5.3.2 Utilities

- 5.3.3 Mining

- 5.3.4 Construction

- 5.3.5 Transportation

- 5.3.6 Oil and Gas

- 5.4 By Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia

- 5.4.4 Australia and New Zealand

- 5.4.5 Latin America

- 5.4.6 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Trimble Inc.

- 6.1.2 Spatialworks

- 6.1.3 Geosoft

- 6.1.4 ESRI Inc.

- 6.1.5 Caliper Corporation

- 6.1.6 Topcon Positioning Systems

- 6.1.7 Pitney Bowes Inc.

- 6.1.8 Hexagon AB

- 6.1.9 Bentley Systems

- 6.1.10 Autodesk Inc.