|

市场调查报告书

商品编码

1643048

马达监控:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Motor Monitoring - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

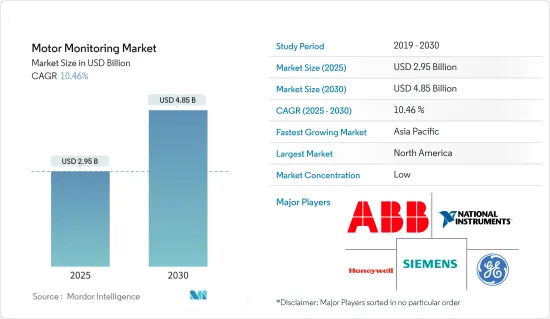

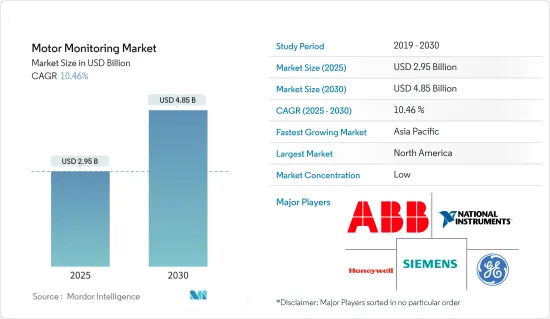

预计 2025 年马达监控市场规模为 29.5 亿美元,到 2030 年将达到 48.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 10.46%。

所有旋转机器都会经历振动。马达有多种缺陷,可以透过振动筛检来识别。透过无线物联网感测器和云端基础的软体进行状态监测,产业专业人员可以随时随地从工厂的任何地方存取电流、振动和温度资料,从而提前解决设备问题并避免停机。这符合推动市场成长的持续趋势。

主要亮点

- 人们对预测性维护和分析增强的认识不断提高,正在推动市场的发展。马达监控的重要性在于它可以防止一台马达故障造成的损害。在义式麵食生产中,每小时停工造成的生产成本损失估计约为 1,000 欧元。进一步实施预测性维护并培训内部维护负责人在最短的时间内实现自主维护是一种低成本的解决方案。

- 基于规则的预测性维护依靠感测器持续收集有关资产的资料并根据预先定义的规则发送警报(例如在达到指定的阈值时)。透过基于规则的分析,产品团队与工程和客户服务部门合作,确定导致马达故障的原因和因素。因此,这些工业IoT技术正在推动市场的发展。

- 无线电马达监控系统的日益普及将推动市场的发展。马达和驱动器消耗约 45% 的发电量。然而,如果电子机械没有适当的维护,它们会消耗约5%到10%的多余电力,影响生产力和收益。无线电子马达监控可自动侦测异常情况并在微秒内报告给伺服器,从而提供更准确的机器参数影像。无线技术的优点在于它非常可靠,即使在非常慢的网路速度下也能工作,并且可以同时处理多个设备。设计的系统不需要任何复杂的机制,并使用轻量级 MQTT通讯协定,因此易于安装且可扩展至大规模工业设置。

- 然而,高昂的初始投资和缺乏可自订性成长抑制因素。随着新技术的融合,工业系统变得越来越复杂。同时,维护和监控活动也变得越来越昂贵,及时取得可靠资料变得越来越复杂。系统中整合的感测器越多,需要处理的资料就越多。然而,使用资料库技术处理不断增长的资料量是一项挑战。这个问题和巨量资料的概念直接相关。俄罗斯和乌克兰之间的战争也对整个包装生态系统产生了影响。

- 然而,新冠疫情已经影响到汽车、采矿业和其他产业製造厂的生产。然而,数位转型正在为製造商提供重要的功能,例如部署云端解决方案、提供设备的即时可视性以及分析其马达状况的能力。製造工厂配备的其他软体解决方案也可以由中央系统监控。

- 此外,由于进行资产健康状况分析的旅行受到限制,COVID-19 迫使人们迅速采用新的马达驱动系统预测性维护服务模式。各服务供应商透过这些重要的可携式监测设备(例如 Fluke 810 振动测试仪和 Megger 的 Baker EXP4000)进行分析。智慧感测器是一种随时可用的工具,可以帮助客户远端查看他们的资产。远端监控和诊断将发挥关键作用并进一步推动市场发展。

马达监控市场趋势

石油和天然气领域有望显着成长

- 石油和天然气工厂运作当今工业生产中最复杂的系统之一。除了这种复杂性之外,错位、鬆动、不平衡或轴承磨损等灾难性故障可能会造成极其严重的财务和环境后果。在石油和天然气工业中,感应马达因其多功能性和坚固性而成为机械的核心部件。在石油和气体纯化中,感应电动机为大大小小的系统提供旋转机械动力,因此监测其运作状况非常重要。

- 此外,石油和天然气行业长期以来一直是部署预测性维护技术以提高资产性能的领导者。 Artesis预测维修系统等参与者的目标是以极低的复杂性和成本提供传统状态监测系统的所有优势。 Artesis MCM(马达状况监测器)采用基于智慧模型的方法,为大多数马达驱动设备提供全面的监控和诊断功能。

- 此外,随着全球石油和天然气行业加大对数位技术的投资,预计预测期内石油和天然气行业对马达监控解决方案的需求将显着增长。马达监控解决方案受到上游、中游和下游营运的高度青睐,在满足最全面的产业规范的同时不断提高生产力和效率。

- 此外,在加拿大,预测期内加拿大西部和东部原油产量的增加将增加对马达监控的需求,从而使市场成长。此外,页岩蕴藏量的开发也增加了对 EPC(工程、采购和施工)服务的需求。例如,根据CAPP的资料,加拿大Cardinal石油总产量预计将达到每天667万桶。

亚太地区占主要市场成长

- 由于中国和印度等国家的工业成长不断加快,预计亚太地区的市场将显着成长。印度製造业是显着成长领域之一,与前一年同期比较去年同期成长7.9%。印度政府的「印度製造」计画旨在让印度在国内和国际市场中同样强大,并让印度经济在全球范围内获得认可。

- 中国是世界製造业中心之一,拥有世界上最大的人口,这推动了电力和基础设施领域的投资。中国政府先前已宣布投资 780 亿美元建设 110 座核能发电厂,计划于 2030 年投入营运。这些主导的发展预计将导致更广泛地采用现代技术,例如有助于马达状态监测的振动监测解决方案。

- 此外,儘管碳氢化合物能源价格下降,但我们仍强烈鼓励中国石油天然气集团公司等国家石油公司继续专注于石油和天然气探勘活动,以实现能源自给自足。预计此类活动将推动对监督和促进石油和天然气设备和基础设施维护的监控解决方案的需求。中国拥有世界上最大的页岩油蕴藏量,并确定将重点放在与石油和燃气公司的合资方式挖掘这些蕴藏量。

- 此外,日本、中国、韩国和印度等国家工业 4.0 的兴起预计将在预测期内推动亚太地区的市场成长,因为马达监控对于工业工厂的正常运作至关重要。此外,由于工业 4.0,物联网在电子机械线上状态监测中的作用预计将变得相当重要,从而对市场成长产生积极影响。

马达监控产业概况

马达监控市场比较分散,由几家领先的公司组成。透过提供创新解决方案和整合预测分析,许多市场参与者正在透过差异化的产品和服务来提高其市场价值。主要参与者包括ABB集团、西门子股份公司等。

2023年2月,OMRON宣布将于2023年3月在日本、2023年4月在全球推出其先进的马达状态监控设备K7DD-PQ系列。 K7DD-PQ以数位方式掌握伺服马达、工具机等的劣化和磨损趋势,减少检查工作并防止意外故障。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 产业影响评估

第五章 市场动态

- 市场驱动因素

- 提高对预测性维护和增强分析的认识

- 无线马达监控系统的普及

- 市场限制

- 缺乏客製化且初始投资高

第六章 市场细分

- 透过提供

- 硬体

- 软体

- 按配置

- 云

- 本地

- 按最终用户

- 车

- 石油和天然气

- 能源和电力

- 矿业

- 饮食

- 化学

- 航太和国防

- 其他最终用户

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 其他亚太地区

- 世界其他地区

- 拉丁美洲

- 中东和非洲

- 北美洲

第七章 竞争格局

- 公司简介

- ABB Group

- Siemens AG

- Honeywell International Inc.

- National Instruments Corporation

- General Electric Company

- Banner Engineering Corporation

- Iris Power LP

- Koncar-Electrical Engineering Institute, Inc.

- Dynapar Corporation

- SKF Group(Baker Instrument Company)

第八章投资分析

第九章 市场机会与未来趋势

The Motor Monitoring Market size is estimated at USD 2.95 billion in 2025, and is expected to reach USD 4.85 billion by 2030, at a CAGR of 10.46% during the forecast period (2025-2030).

All rotating machines experience vibration. Motors have different faults that vibration screening can identify. The adoption of condition monitoring with wireless IoT sensors and cloud-based software empowers industry professionals to get ahead of equipment problems and avoid downtime by accessing current, vibration, and temperature data from anywhere in a plant at any given time. This follows an ongoing trend driving the growth of the market.

Key Highlights

- Growing awareness of predictive maintenance and augmenting it with analytics drive the market. The importance of electric motor monitoring is connected to the damages deriving from the failure of even a single motor. It has been estimated that for each downtime hour, the cost of the missed production is around EUR 1000 in the pasta production sector. Further implementing predictive maintenance and training the internal maintenance staff to make them autonomous in the shortest possible time is one of the low-cost solutions.

- Rule-based predictive maintenance relies on sensors to continuously collect data about assets and sends alerts according to predefined rules, including when a specified threshold has been reached. With rule-based analytics, product teams work alongside engineering and customer service departments to establish causes or contributing factors to their motor failing. Hence these industrial IoT technologies drive the market.

- The growing adoption of wireless systems for motor monitoring drives the market. Electrical motors and drives consume about 45% of the power generation. However, if the electrical machines are not maintained properly, it consumes about 5% to 10 % of excess power, which affects productivity and revenue. Wireless monitoring of the motor is capable of capturing the machine parameters more accurately with automatic detection of abnormal conditions and reporting to the server within a few microseconds. The advantage of wireless technology is that it is very reliable and operates even at very slow network speeds,and handles multiple devices at once. The designed system is easy to install and scale up to large industrial setups as it does not involve a complex mechanism and uses a lightweight MQTT protocol.

- However, lacking customization with the high initial investment restraints the growth of the market. Due to the integration of new technologies, industrial systems are becoming more complex. At the same time, it makes maintenance and monitoring activities more expensive and complicated to get reliable data on time. The more sensors are wareintegrated into the system, the more data will be generated that should be handled. But processing this growing number of data through database technologies will be challenging. This problem is directly related to the concept of Big Data. There has also been an impact of the Russia-Ukraine war on the overall packaging ecosystem.

- However, the COVID-19 pandemic affected production in manufacturing plants such as the automotive, mining sector, etc. But the digital transformation is offering significant features to manufacturers, such as real-time visibility into the equipment which have deployed the cloud solution and provides them with the ability to analyze the condition of their motor. Further software solutions equipped by the manufacturing plant can also be monitored by their central system.

- Moreover, COVID-19 forced quicker adoption of a new predictive maintenance service model on motor-driven systems as there is a restriction in traveling to perform asset health analysis. Various service providers performed an analysis through these critical portable monitoring devices, such as Fluke's 810 Vibration Tester or Megger's Baker EXP4000. Smart sensors are a readily available tool providing a remote view into client assets, which in turn eliminates the immediate need to travel to a facility. Remote monitoring and diagnosis will be a key acceptance and further help to drive the market in this situation.

Motor Monitoring Market Trends

Oil and Gas Segment is Anticipated to Witness Significant Growth

- Oil and gas plants are running some of the most complex systems in industrial production today. In addition to this complexity, if a sudden failure occurs in the form of misalignment, looseness, imbalance, and bearing wear, the financial and environmental consequences could be extremely serious. In the oil and gas industry induction motors are a core piece of machinery as they are versatile and rugged. Within an oil or gas refinery, induction motors supply rotational mechanical power to numerous systems, large and small, and are therefore important to monitor their working condition.

- Further, the oil & gas industry has long been a leader in the deployment of predictive maintenance technologies in pursuit of improved asset performance. A player such as Artesis's predictive maintenance system aims to provide all the benefits of traditional condition monitoring systems at a fraction of the complication and cost. Artesis MCM (motor condition monitor) uses an intelligent, model-based approach to provide complete monitoring and diagnostic capabilities for most electric motor-driven equipment.

- Furthermore, as the global oil and gas industry increases investments in digital technologies, the demand for motor monitoring solutions is analyzed to witness significant growth in the oil & gas sector over the forecast period. Motor monitoring solutions are gaining considerable traction in upstream, midstream, and downstream operations to constantly improve productivity and efficiency while meeting the most comprehensive industry specifications.

- Morover, in Canada, with increasing crude oil production in Western and Eastern Canada during the forecasted period, the demand for motor monitoring will increase, providing growth in the market. Moreover, the exploitation of shale reserves has led to increasing demand for EPC (Engineering, Procurement, and Construction) services. For instance, according to the data from CAPP, total curde oil production in Canada is expected to reach 6.67 million barrels per day.

Asia Pacific Accounts to Hold Significant Market Growth

- Asia-Pacific is expected to account for significant market growth with the increase in industrial growth in countries such as China and India. The Indian manufacturing sector is one of the prominent growth sectors, which registers a 7.9% year-on-year growth. The government's Make in India initiates the plans to make India equally strong for domestic and foreign players and give recognition to the Indian economy at a global level.

- China is one of the global hubs for manufacturing and has the largest population worldwide, boosting investments in power as well as in the infrastructure sector. The Chinese government, in the past, announced investments worth USD 78 billion for developing 110 nuclear power plants, which are planned to start operations by 2030. Such initiative developments are expected to widen the scope of the adoption of modern technologies, including vibration monitoring solutions, to assist condition-based monitoring for the motor.

- Further, despite lowering hydrocarbon energy prices, the continued focus on oil & gas exploration activities to achieve energy self-sufficiency by NOCs, such as CNPC in China, is highly recommended. These activities are anticipated to create a robust demand for monitoring solutions to monitor and facilitate the maintenance of oil & gas equipment and infrastructures. It has been observed that China has the most significant shale oil & reserves worldwide and is focusing on tapping the same through joint ventures with oil & gas companies.

- Moreover, the emergence of Industry 4.0 in countries like Japan, China, South Korea and India is further analyzed to proliferate the market growth in Asia Pacific region over the forecast period, as monitoring of motors essential for successfully running an industrial plant. Further, with Industry 4.0, the role of IoT in online condition monitoring of electrical machines is expected to gain considerable significance, thus positively impacting the market's growth.

Motor Monitoring Industry Overview

The motor monitoring market is fragmented and consists of several major players. With innovative solution offerings and predictive analytics integration, many of the market players are increasing their market worth by product and service differentiation. Key players are ABB Group, Siemens AG, etc.

In February 2023, OMRON announced to release of the K7DD-PQ Series of advanced motor condition monitoring devices starting in March 2023 in Japan and globally in April 2023. The K7DD-PQ numerically tracks trends in the deterioration and wear of servomotors, machine tools, and other equipment to reduce inspection efforts and prevent unexpected failure.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Awareness Toward Predictive Maintenance and Augmenting it With Analytics

- 5.1.2 Growing Adoption of Wireless Systems for Motor Monitoring

- 5.2 Market Restraints

- 5.2.1 Lack of Customization and High Initial Investment

6 MARKET SEGMENTATION

- 6.1 Offering

- 6.1.1 Hardware

- 6.1.2 Software

- 6.2 Deployment

- 6.2.1 Cloud

- 6.2.2 On-Premise

- 6.3 End-User

- 6.3.1 Automotive

- 6.3.2 Oil & Gas

- 6.3.3 Energy & Power

- 6.3.4 Mining

- 6.3.5 Food & Beverage

- 6.3.6 Chemicals

- 6.3.7 Aerospace & Defense

- 6.3.8 Other End-Users

- 6.4 Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 United Kingdom

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 India

- 6.4.3.2 China

- 6.4.3.3 Japan

- 6.4.3.4 Rest of Asia-Pacific

- 6.4.4 Rest of the World

- 6.4.4.1 Latin America

- 6.4.4.2 Middle-East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Group

- 7.1.2 Siemens AG

- 7.1.3 Honeywell International Inc.

- 7.1.4 National Instruments Corporation

- 7.1.5 General Electric Company

- 7.1.6 Banner Engineering Corporation

- 7.1.7 Iris Power LP

- 7.1.8 Koncar- Electrical Engineering Institute, Inc.

- 7.1.9 Dynapar Corporation

- 7.1.10 SKF Group (Baker Instrument Company)