|

市场调查报告书

商品编码

1643063

媒体闸道器:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Media Gateway - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

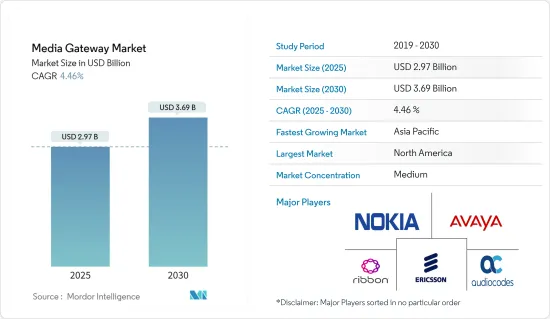

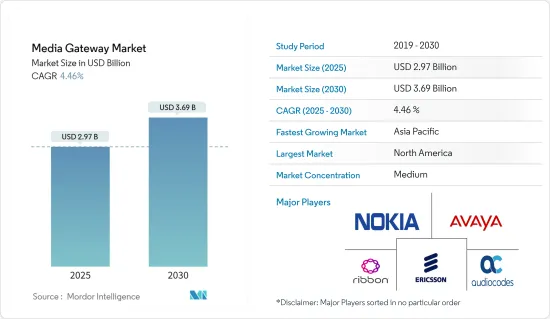

预计媒体闸道器市场规模将在 2025 年达到 29.7 亿美元,在 2030 年达到 36.9 亿美元,在市场估计和预测期(2025-2030 年)内以 4.46% 的复合年增长率增长。

媒体闸道器是一种将媒体串流转换为数位数位资料通讯的设备或服务,透过各种数位技术介面提供视讯、音讯、传真和其他服务。

关键亮点

- 通讯技术的发展和全球网路用户数量的增加正刺激对功能性、可扩展性、弹性且价格合理的通讯解决方案的需求,这些因素预计将在整个预测期内支持媒体闸道器市场的成长。

- 此外,大多数企业和服务供应商正在采用有线媒体闸道器来以更高的控制力、安全性、可靠性和速度处理资料流。有线媒体闸道器市场受到VoIP存取增加的推动。因此,预计这些网关将在预测期内占据整个媒体闸道器市场的最大份额。

- 随着 IP 电话在小型、中型和大型企业中的使用增加,对媒体闸道器的需求预计将大幅成长。媒体闸道器是此基础设施的重要组成部分。

- 然而,媒体闸道器市场的成长受到其在 VoIP 中的使用的限制。没有电力就无法提供 VoIP 服务,因此需要额外的发电机来确保不间断的服务。此外,如果发生网路中断,媒体闸道器将与控制器失去联繫,用户将会遇到服务中断。

- COVID-19 的迅速蔓延以及越来越多的国家采取旅行限制措施,对电讯业产生了重大影响,因为人们在家中度过的时间更多,并且被迫更频繁地使用资料来处理业务和娱乐。此外,COVID-19 也损害了消费者所依赖的投资,尤其是在 5G 领域的投资。我们的网路的弹性和可靠性已经下降,对媒体闸道器业务的成长产生了不利影响。

媒体闸道器市场趋势

通讯推动成长

- 媒体闸道器是通讯网路供应商核心网路中使用的硬件,用于实现利用不同网路标准、通讯协定、转码器和实体连接的媒体流之间的转换和互通性。

- 电讯网路供应商利用该技术在使用自己的网路标准(例如程式码、通讯协定和实体关联)的两个媒体流之间进行联网和转换/修改。

- 此外,通讯业在全球媒体闸道器市场中占据最大的市场占有率。这是因为全球的客户群和商业资料中心不断增加。通讯技术的进步降低了延迟并为客户提供了可携式资料,预计这将在整个预测期内引领市场。

- 媒体闸道器常用于连接各种网路(包括 2G、3G、4G 和 LTE),其主要目的是在多种编码和传输技术之间进行转换,以实现网路之间的通讯。

- 据 TRAI 称,私营通讯连接将占据印度通讯市场的主导地位,到 23 财年将超过 90%。私营部门依然保持着主导地位,且合约数量正在激增。印度拥有惊人的11.7亿通讯连接,其中绝大多数是通讯的。

- 媒体闸道器透过将网路封包传送至一个或多个装置来控製网路上的资料流。透过使用连接到网关的每个装置的网路位址,交换器可以引导流量以最大限度地提高网路的安全性和可用性。

预测期内亚太地区将实现强劲成长

- 预计预测期内亚太地区的媒体闸道器市场将会积极成长。云端基础的服务在大型和小型企业中越来越受欢迎,可以降低基础设施成本并简化业务。消费者对云端基础的服务的偏好的改变可能会影响市场扩张。

- 由于下一代网路对媒体转码的要求不断提高以及对转码设备的需求,亚太地区在全球占据了主要的市场占有率。 5G的发展以及互联网和通讯服务的相互依存等因素为整个亚太地区的媒体闸道器产业提供了丰厚的成长机会。

- 4G 和 5G、云端运算等新技术以及不断增长的智慧型手机用户正在推动该地区的市场成长。该地区的市场扩张受到云端部署和便携性和可访问性数位平台的日益采用的刺激。

- 由于 IP 电话如今已成为该地区多个新兴国家的可行连接选项,因此该地区的新兴市场有望成为长期内媒体闸道器成长的最大贡献者。

- 印度、澳洲、日本、新加坡和中国等国家高度依赖网路和通讯服务。核准和采用这些服务使公司能够专注于其核心业务目标。

媒体闸道器产业概览

媒体闸道器市场竞争激烈,由几位知名成员组成。从市场占有率来看,目前少数几家大公司占据着市场主导地位。凭藉着巨大的市场占有率,这些市场领导专注于在国际上扩大消费群。这些公司正在采取多项倡议,如产品发布和开发、伙伴关係、收购和合作,以扩大和发展媒体闸道器市场。

- AXP 是一个由人工智慧驱动的联络中心即服务 (CCaaS) 协作平台,也是 Avaya Experience Platform 的关键元件,提供全面的工作流程协作和整合通讯技术。

- 2023年3月-诺基亚公司宣布将加强NTT Docomo。 Docomo 将在其 7750 SR-14s 核心路由器中使用诺基亚创新的 FP 路由硅片。 Docomo 将在其 7750 SR-14s 核心路由器中采用诺基亚创新的 FP 路由硅片,其中 FP5 线卡的功耗比上一代降低 75%,可实现 800GE 功能,容量提高三倍以上,并且透过在同一系统中同时运行线速 FP5 和 FP4 线卡来简化网路。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 购买者/消费者的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 工业影响评估

第五章 市场动态

- 采用市场驱动因素与限制因素

- 市场驱动因素

- 对不同网路间高品质通讯的需求

- 媒体闸道器为传统网路提供弹性

- 市场限制

- 缺乏熟练的人才来为现有网路添加新的解决方案

第六章 市场细分

- 按类型

- 模拟

- 数位的

- 依技术分类

- 有线

- 无线的

- 杂交种

- 按最终用户

- BFSI

- 製造业

- 政府

- 医疗

- 通讯

- 运输

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Nokia Corporation

- AudioCodes Ltd.

- Ribbon Communications Operating Company Inc.

- Avaya Inc.

- Telefonaktiebolaget LM Ericsson

- Huawei Technologies Co. Ltd.

- Cisco Systems Inc.

- ZTE Corporation

- Synway Information Engineering Co. Ltd.

- Dialogic Corp.

- Mitel Networks Corporation

- Grandstream Networks

- Squire Technologies Ltd.

- Shenzhen Dinstar Co. Ltd.

第八章投资分析

第九章 市场机会与未来趋势

The Media Gateway Market size is estimated at USD 2.97 billion in 2025, and is expected to reach USD 3.69 billion by 2030, at a CAGR of 4.46% during the forecast period (2025-2030).

A media gateway is a device or service that converts media streams into digital data communications to provide video, audio, fax, and other services across various digital technology interfaces.

Key Highlights

- The demand for functional, scalable, resilient, and affordable communication solutions is rising due to the development of communication technology and increasing internet subscriber penetration globally, and these factors are anticipated to support the growth of the media gateway market throughout the anticipated period.

- Additionally, most businesses and service providers employ wired media gateways to handle data flow with improved control, security, dependability, and speed. The market for media gateways based on wireline technology is driven by the uptake of VoIP access. Therefore, these gateways are projected to hold the most significant share of the entire media gateway market during the forecast period.

- The need for media gateways is anticipated to increase significantly as IP telephony usage increases among SMEs and large businesses. Media gateways are one of the essential parts of this infrastructure.

- However, the expansion of the media gateway market is constrained by its use in VoIP. Since VoIP service cannot be given without power, additional power generator installations are needed to ensure uninterrupted service. Additionally, in the event of a network outage, the media gateway loses contact with the controller, which causes subscribers to experience service interruptions.

- The swift adoption of COVID-19 and the rise in nations adopting travel restrictions greatly influenced the telecom industry by forcing people to spend more time at home and use data more frequently for business and enjoyment. Additionally, COVID-19 harmed consumers' anticipated investments, particularly in 5G. It decreased network resilience and reliability for them, which has had an adverse effect on the growth of the media gateway business.

Media Gateways Market Trends

Telecommunication to Witness the Growth

- A media gateway is a piece of hardware used in a telecom network provider's core network to enable transformation and interoperability between media streams that utilize diverse network standards, communication protocols, codecs, and physical connections.

- Telecom network providers use this technology for networking and transformation or alteration between two media streams that use unique network standards like codes, communication protocols, and physical associations.

- Moreover, the telecommunications sector held the most significant market share in the worldwide media gateway market. This is because there are more and more client bases and business data centers worldwide. Due to decreased latency and the availability of portable data for clients due to advancements in telecom technology, it is anticipated to lead the market throughout the forecast period.

- The major purpose of media gateways, frequently used to connect various networks (including 2G, 3G, 4G, and LTE), is to convert multiple coding and transmission techniques to permit communication between the networks.

- According to TRAI, In the financial year 2023, private telecom connections held a commanding share, surpassing 90% of India's telecom market. The private sector has maintained its stronghold, witnessing a surge in subscriptions. India boasted a staggering 1.17 billion telecom connections, predominantly wireless, underscoring the nation's tech-savvy adoption.

- A media gateway controls data flow over a network by sending a network packet to one or more devices it was designed for. By using the network address of each connected device to the gateway, the switch may direct traffic to maximize network security and effectiveness.

Market in Asia-Pacific to witness Significant Growth During Forecast Period

- The Asia-Pacific region anticipates the market for media gateways to grow positively during the anticipated time. Cloud-based services are becoming more popular among large, small, and medium-sized businesses to cut infrastructure expenses and streamline operations. The current shift in consumer preference for cloud-based services will impact the market expansion.

- Due to the growing requirement for media transcoding for next-generation networks and the demand for transcoding devices, APAC is a significant market share leader globally. The development of 5G and factors like the interdependence of the Internet and telecommunications services provide lucrative growth opportunities for the media gateway industry throughout the Asia-Pacific region.

- Emerging 4G and 5G technologies, such as cloud computing, and an increase in smartphone users are blamed for the market's growth in the area. Market expansion in the area has been spurred by cloud deployment and increased adoption of digital platforms for portability and accessibility.

- Even though IP telephony is currently one of the feasible options for connectivity in several developing countries throughout this region, it is projected that the growing markets in this region will contribute the most significantly to the extensive long-term growth of media gateways.

- Countries such as India, Australia, Japan, Singapore, and China intensely depend on the Internet and telecommunication services. The approval and adoption of these services enable businesses to focus on their core business goals.

Media Gateways Industry Overview

The media gateway market is competitive and consists of some prominent members. Regarding market share, some of those big players currently dominate the market. These market leaders with significant market shares are concentrating on growing their consumer base internationally. These firms have supported several initiatives to expand and develop in the media gateway market, including product launches and developments, partnerships, acquisitions, and collaborations.

- March 2023 - Avaya announced to launch of the Avaya Experience Platform (AXP) in Australia and New Zealand (A/NZ) to deliver flexible and productive hybrid work for employees and create seamless experiences for customers, where AXP is an AI-powered, contact center-as-a-service (CCaaS) collaboration platform and a vital component of the Avaya Experience Platform, which offers comprehensive workstream collaboration and unified communications technologies.

- March 2023 - Nokia Corporation announced it would enhance NTT DOCOMO, INC.'s. As it introduces new 5G mobile services, it will also enable a nationwide IP core backbone and transport network slicing.DOCOMO used Nokia's revolutionary FP routing silicon in its 7750 SR-14s core routers. With a 75 percent reduction in power consumption over earlier generations, FP5 line cards enable 800GE capability, boost capacity by more than three times, and streamline network evolution with simultaneous line rate FP5 and FP4 line card operation in the same system.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Buyers/Consumers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Introduction to Market Drivers and Restraints

- 5.2 Market Drivers

- 5.2.1 Requirement for High-quality Communication Over Disparate Networks

- 5.2.2 Media Gateways Providing Augmented Flexibility to Legacy Networks

- 5.3 Market Restraints

- 5.3.1 Dearth of Skillful Workforce to Add New Solutions in Existing Network

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Analog

- 6.1.2 Digital

- 6.2 By Technology

- 6.2.1 Wireline

- 6.2.2 Wireless

- 6.2.3 Hybrid

- 6.3 By End-User

- 6.3.1 BFSI

- 6.3.2 Manufacturing

- 6.3.3 Government

- 6.3.4 Healthcare

- 6.3.5 Telecommunication

- 6.3.6 Transportation

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Nokia Corporation

- 7.1.2 AudioCodes Ltd.

- 7.1.3 Ribbon Communications Operating Company Inc.

- 7.1.4 Avaya Inc.

- 7.1.5 Telefonaktiebolaget LM Ericsson

- 7.1.6 Huawei Technologies Co. Ltd.

- 7.1.7 Cisco Systems Inc.

- 7.1.8 ZTE Corporation

- 7.1.9 Synway Information Engineering Co. Ltd.

- 7.1.10 Dialogic Corp.

- 7.1.11 Mitel Networks Corporation

- 7.1.12 Grandstream Networks

- 7.1.13 Squire Technologies Ltd.

- 7.1.14 Shenzhen Dinstar Co. Ltd.