|

市场调查报告书

商品编码

1940643

电子製造服务:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Electronics Manufacturing Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

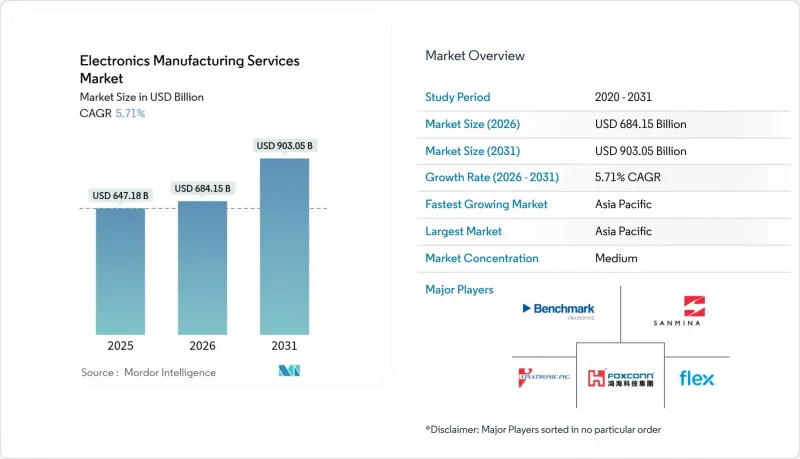

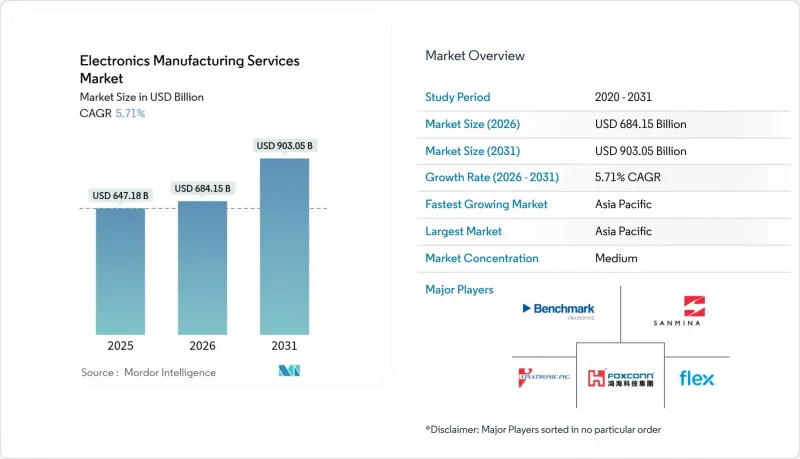

电子製造服务市场预计将从 2025 年的 6,471.8 亿美元成长到 2026 年的 6,841.5 亿美元,预计到 2031 年将达到 9,030.5 亿美元,2026 年至 2031 年的复合年增长率为 5.71%。

这一成长轨迹反映了原始设备製造商 (OEM) 持续倾向于外包,以利用尖端组装技术,同时专注于研发。对人工智慧基础设施的需求、车辆的快速电气化以及供应链从中国回流至多元化区域基地的浪潮是推动成长的最主要因素。与 IEC 60601 和 RoHS III 相关的监管成本、半导体价格波动以及日益严格的网路安全要求,正促使供应商整合资源并投资建造符合标准的工厂。同时,智慧工厂对数位製造执行系统 (MES) 平台的投资正在提高生产效率,并助力企业在多品种、小批量生产项目中实现差异化。

全球电子製造服务市场趋势与洞察

原始设备製造商选择外包,以便专注于核心竞争力。

由于高混合、小批量专案的资本密集型工装设备需求,许多北美和欧洲的原始设备製造商 (OEM) 在 2025 年前开始依赖电子製造服务 (EMS) 合作伙伴。通用汽车的 MES 4.0 实施案例研究表明,数位化整合如何提升现场可视性,同时外部合作伙伴负责处理复杂的组装流程。外包使品牌所有者能够将支出重新分配到设计、软体和产品上市时间等方面。供应商则受益于其灵活的生产线,这些生产线无需重新配置即可在工业控制器製造和小批量医疗设备生产之间切换。从 2024 年到 2025 年,家用电子电器产业对承包工程的需求激增,该产业每六个月的更新週期需要快速迭代。预计到 2027 年,随着产品复杂性的增加,内部生产线不堪重负,这一因素将维持高产量。

加速供应链近岸外包/回流

为因应关税不确定性和疫情期间的物流中断,2024年PCB和机箱组装产能迅速转移至墨西哥、东欧和东协地区。富士康在越南投资3.83亿美元的基板工厂便是摆脱对单一国家依赖的典型例证。墨西哥利用美墨加协定(USMCA)获得了美国汽车和伺服器机架项目,而波兰和罗马尼亚则瞄准了欧洲电动车平台。本地化生产将运输前置作业时间缩短了高达40%,并降低了库存风险。小批量製造商也采取了类似的策略,将客製化生产环节更靠近终端用户。随着通膨驱动的运费上涨和地缘政治紧张局势持续推动多元化需求,这一趋势在2025年将更加显着。

半导体和被动元件成本波动加剧

2024年,记忆体和电源元件价格经历了两位数的波动,对与客户签订季度合约、锁定元件成本的EMS公司造成了显着影响。 SupplyFrame的数据显示,虽然75%的元件价格保持稳定或下降,但高频宽记忆体面临严重短缺,给AI伺服器的建设带来了压力。大型供应商透过向晶片製造商预付款或寄售交易来规避风险,而小型供应商则被迫承受利润压力。加速的装置过时增加了库存缓衝的风险,规模对于应对市场波动至关重要,最终导致了行业整合。儘管价格在2025年初趋于稳定,但策略采购仍拖累了利润。

细分市场分析

印刷基板组装和整机组装服务占电子製造服务市场收入的61.85%。在对闭合迴路永续性的偏好推动下,售后服务以8.05%的复合年增长率增长,超过了整个电子製造服务市场的增长速度。服务提供者在各大洲扩展了维修点,以缩短交货时间并减少电子废弃物。随着原始设备製造商 (OEM) 透过并行设计寻求降低成本,电子设计和工程活动活性化。原型製作和新产品导入生产线虽然减少了批量,但透过缩短首件上市时间,实现了高利润率。测试和认证实验室将网路安全评估与电气安全评估相结合,以满足新的监管要求。

到2025年,欧盟的循环经济指令已将零件回收再製造确立为收入来源。主要的电子製造服务(EMS)供应商将引入数位双胞胎来预测基板级故障并预先安排备用零件。随着硬体订阅模式在工业自动化和消费性电子设备领域日益普及,售后服务将成为合约续约的核心。竞争优势将取决于全球服务中心网路的密度和数据驱动的故障分析。

到2025年,契约製造仍将占据70.92%的收入份额,但随着品牌寻求一站式解决方案,原始设计製造商(ODM)预计将表现更佳。 ODM收入预计将以每年8.76%的速度成长,推动电子製造服务市场向提供设计、采购和交付服务的混合型供应商转型。承包製造在需要安全供应链的领域,例如人工智慧伺服器和医疗设备,获得了广泛关注。自有品牌製造则满足了小众家电和智慧照明应用领域的需求,在这些领域,成本优势比品牌差异化更为重要。

台湾厂商透过提供面向全球市场的预认证白盒平台,模糊了产业界线。富士康和纬创推出了可供客户自有品牌的参考设计,从而加快了产品推出速度。在日益同质化的组装环境中,未能发展出至少基本设计能力的契约製造製造商将面临利润率压缩的风险。

电子製造服务 (EMS) 市场按服务类型(电子设计和工程、原型製作和新产品导入服务、印刷基板组装等)、经营模式(契约製造、承包製造等)、製造流程(表面黏着技术、通孔技术、混合技术等)、最终用途产业(行动装置、家用电子电器等)和地区进行细分。

区域分析

到2025年,亚太地区将占全球营收的47.05%,年复合成长率(CAGR)高达12.52%,成为该地区成长最快的区域。这主要得益于企业在维持中国规模化生产的同时,积极拓展越南、印度和泰国市场。印度政府的PLI计画奖励措施吸引了行动电话和穿戴式装置项目,而越南则成为美国高层印刷电路板(PCB)的首选位置。在北美,墨西哥工业走廊的投资活性化。许多电动车製造商要求在2026年前实现在地化生产。国内对国防电子产品的采购限制促使亚利桑那州和德克萨斯州新建工厂。欧洲则优先发展受监管的医疗和工业项目,儘管人事费用高昂,但接近性原始设备製造商(OEM)设计中心的优势使其得以充分发挥。

儘管南美洲的市场份额仍然不大,但巴西和墨西哥大力发展与汽车最终组装相关的电子产业丛集,推动了其成长。台湾的印刷电路板(PCB)产业链预计到2025年将以每年5.8%的速度成长,为全球人工智慧伺服器製造商提供先进的基板。在中东和非洲,对智慧电錶和可再生能源控制设备的初始投资越来越多地与培训倡议结合。随着脱碳计划需要在地采购的电子元件,新兴地区的电子製造服务市场规模将会扩大。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 在北美和欧洲的高混合度、低产量产业,OEM 製造商正在推广外包,以便专注于核心竞争力并减少资本投资。

- 中国加征关税后,供应链向墨西哥、东欧和东协地区的近岸外包/回流加速。

- 电动车电力电子技术的快速发展需要先进的PCB组装能力。

- 工业物联网边缘设备的普及正在推动亚洲对高密度互连(HDI)和先进封装电子製造服务(EMS)的需求。

- 严格的IEC 60601和FDA 21 CFR 820品质标准推动了医疗设备认证EMS外包的发展。

- 消费性电子设备产品上市週期日益缩短,将推动对灵活的新产品导入 (NPI) 和麵向製造的设计 (DfM) 服务的需求。

- 市场限制

- 半导体和被动元件成本波动加剧,对电子製造服务(EMS)利润率带来压力。

- 智慧财产权问题限制了欧盟航太和国防领域的外包。

- 在智慧型手机领域,与ODM和OEM厂商自有生产线的竞争

- 遵守 RoHS III 和 REACH 法规将增加现有设施的资本投资。

- 价值链分析

- 监理展望

- 技术展望-SMT、HDI、先进封装、数位化MES

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 投资分析(资本投资和併购趋势)

- 对影响市场的宏观经济因素进行评估

第五章 市场规模与成长预测

- 按服务类型

- 电子设计与工程

- 原型製作和新产品导入服务

- 印刷基板组装(表面黏着技术/通孔)

- 整机组装/系统集成

- 测试和认证

- 售后服务(维修、逆向物流)

- 按经营模式

- 契约製造(CM)

- 承包製造

- 原始设计製造(ODM)

- 自有品牌製造

- 透过製造工艺

- 表面黏着技术(SMT)

- 通孔和混合技术

- 先进封装/系统级封装(SiP)

- 按最终用途行业划分

- 行动装置(智慧型手机和平板电脑)

- 家用电子电器

- 汽车和电动车

- 工业与自动化

- 医疗/医疗设备

- 航太/国防

- 资讯科技与电信(5G、资料中心)

- 照明

- 能源和公共产业(智慧电錶、太阳能发电)

- 按地区

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 北欧国家(瑞典、挪威、芬兰、丹麦)

- 其他欧洲地区

- 亚太地区

- 中国

- 台湾

- 日本

- 韩国

- 印度

- ASEAN

- 亚太其他地区

- 南美洲

- 墨西哥

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 其他非洲地区

- 中东

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略性倡议(合作、产能扩充、近岸外包)

- 市占率分析

- 公司简介

- Hon Hai Precision Industry Co., Ltd.(Foxconn)

- Pegatron Corp.

- Flex Ltd.

- Jabil Inc.

- Wistron Corp.

- Sanmina Corp.

- Celestica Inc.

- Benchmark Electronics Inc.

- Plexus Corp.

- Compal Electronics Inc.

- Inventec Corp.

- Universal Scientific Industrial Co., Ltd.(USI)

- Shenzhen Kaifa Technology Co., Ltd.

- Asteelflash Group

- Kimball Electronics Inc.

- Sumitronics Corp.

- Nortech Systems Inc.

- Creation Technologies Ltd.

- Integrated Micro-Electronics Inc.

- Zollner Elektronik AG

- New Kinpo Group(Cal-Comp)

- SIIX Corp.

第七章 市场机会与未来展望

The electronic manufacturing services market is expected to grow from USD 647.18 billion in 2025 to USD 684.15 billion in 2026 and is forecast to reach USD 903.05 billion by 2031 at 5.71% CAGR over 2026-2031.

The growth trajectory reflects OEMs' ongoing preference for outsourcing to focus on R&D while accessing cutting-edge assembly capabilities. Demand for AI infrastructure equipment, the rapid electrification of vehicles, and a wave of supply-chain reshoring from China to diversified regional hubs are the most visible accelerants. Regulatory costs tied to IEC 60601 and RoHS III, volatile semiconductor pricing, and mounting cybersecurity requirements have pushed providers to consolidate and invest in compliance-ready plants. Meanwhile, smart-factory investments in digital MES platforms sharpen productivity and offer differentiation in high-mix, low-volume programs.

Global Electronics Manufacturing Services Market Trends and Insights

OEMs Outsourcing to Focus on Core Competencies

Capital-intensive tooling for high-mix, low-volume programs pushed many North American and European OEMs to rely on EMS partners prior to 2025. General Motors' MES 4.0 roll-out illustrated how digital integration improved shop-floor visibility while external partners handled complex assemblies. Outsourcing lets brand owners redirect spending toward design, software, and go-to-market work. Providers benefited by offering flexible lines that could switch from an industrial controller build to a short-run medical device without retooling. Over 2024-2025, demand for turnkey programs rose sharply in consumer electronics, where six-month refresh cycles require rapid iteration. This driver is poised to keep transaction volumes high through 2027 as product complexity grows and in-house lines struggle to keep pace.

Accelerated Near-/Re-shoring of Supply Chains

Tariff uncertainty and pandemic-era logistics disruptions triggered a fast relocation of PCB and box-build capacity toward Mexico, Eastern Europe, and ASEAN in 2024. Foxconn's USD 383 million board plant in Vietnam typified the movement away from single-country dependence. Mexico leveraged USMCA to secure automotive and server rack programs for the United States, while Poland and Romania targeted European EV platforms. Localization reduced freight lead times by up to 40% and lowered inventory risk. Small-batch manufacturers adopted the same strategy to keep custom builds closer to end customers. The trend remains strongest in 2025 as inflationary freight rates and geopolitical tensions sustain the need for diversified footprints.

Rising Semiconductor and Passive Component Cost Volatility

Memory and power devices swung in price by double-digit percentages during 2024, leaving EMS firms exposed when customer contracts locked BOM prices for quarters in advance. Supplyframe data showed that 75% of components either stabilized or declined, yet high-bandwidth memory faced acute shortages, straining AI server builds. Large providers prepaid chipmakers or hedged with consignment deals, but small firms absorbed margin pressure. Higher obsolescence made inventory buffers riskier, prompting consolidation as scale became critical to weather volatility. Although prices moderated in early-2025, strategic sourcing complexity remains a drag on earnings.

Other drivers and restraints analyzed in the detailed report include:

- Surge in EV Power-Electronics Requirements

- Proliferation of IIoT Edge Devices

- IP Protection Concerns in Aerospace and Defense

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

PCB assembly and box-build services contributed 61.85% of the electronic manufacturing services market revenue. Growing preference for closed-loop sustainability drove after-market services toward an 8.05% CAGR, outpacing the broader electronic manufacturing services market. Providers expanded repair hubs on every major continent to cut turnaround times and lower e-waste. Electronics design and engineering engagements intensified as OEMs sought concurrent-engineering savings. Prototype and NPI lines handled shorter lots but yielded high margins by helping brands cut weeks from first-article schedules. Testing and certification labs are integrating cybersecurity assessments alongside electrical safety to meet new regulatory checklists.

In 2025, circular-economy directives in the EU made component harvest and refurbishment viable revenue streams. Leading EMS operators embedded digital twins to predict board-level failures and pre-stage spares. As hardware subscription models spread in industrial automation and consumer devices, post-sale services will become central to contract renewals. Competitive differentiation will hinge on global depot density and data-driven failure analytics.

Contract manufacturing remained the bedrock, representing 70.92% of 2025 revenue, yet original design manufacturing grew faster as brands chased one-stop solutions. ODM revenue is set to climb 8.76% annually, pulling the electronic manufacturing services market toward hybrid engagements where design, sourcing, and fulfillment reside in one vendor. Turnkey manufacturing gained traction for AI servers and medical devices that demand secure supply chains. Private-label builds filled niche appliance and smart-lighting slots requiring cost leadership over brand differentiation.

Taiwan-based providers blurred lines by offering white-box platforms pre-certified for global markets. Foxconn and Wistron introduced reference designs that customers could brand, accelerating launch timelines. Contract manufacturers that fail to develop at least light design capabilities risk margin compression in a commoditizing assembly landscape.

Electronic Manufacturing Services (EMS) Market is Segmented by Service Type (Electronics Design and Engineering, Prototype and NPI Services, PCB Assembly, and More), Business Model (Contract Manufacturing, Turnkey Manufacturing, and More), Manufacturing Process (Surface-Mount Technology, Through-Hole and Mixed Technology, and More), and End-Use Industry (Mobile Devices, Consumer Electronics, and More), and Geography.

Geography Analysis

Asia-Pacific held 47.05% of 2025 revenue and posted a 12.52% CAGR, the highest among regions, as companies diversified into Vietnam, India, and Thailand while retaining China for scale production. Government incentives in India's PLI scheme drew handset and wearables programs, and Vietnam became a preferred site for high-layer PCBs targeting US buyers. North America enjoyed strong inflows into Mexican industrial corridors, with many EV OEMs demanding localized printed-circuit capacity by 2026. Domestic content rules in defense electronics secured new plant builds in Arizona and Texas. Europe prioritized compliance-heavy medical and industrial programs, leveraging proximity to OEM design centers despite higher labor costs.

South America's share remained modest yet grew as Brazil and Mexico advanced electronics clusters linked to automotive final assembly. Taiwan's PCB ecosystem, projected to grow 5.8% yearly through 2025, supplied advanced substrates to global AI server builders. Middle East and Africa saw initial investments in smart metering and renewable energy controllers, often bundled with training initiatives. The electronic manufacturing services market size in emerging regions will broaden as decarbonization projects demand localized electronics content.

- Hon Hai Precision Industry Co., Ltd. (Foxconn)

- Pegatron Corp.

- Flex Ltd.

- Jabil Inc.

- Wistron Corp.

- Sanmina Corp.

- Celestica Inc.

- Benchmark Electronics Inc.

- Plexus Corp.

- Compal Electronics Inc.

- Inventec Corp.

- Universal Scientific Industrial Co., Ltd. (USI)

- Shenzhen Kaifa Technology Co., Ltd.

- Asteelflash Group

- Kimball Electronics Inc.

- Sumitronics Corp.

- Nortech Systems Inc.

- Creation Technologies Ltd.

- Integrated Micro-Electronics Inc.

- Zollner Elektronik AG

- New Kinpo Group (Cal-Comp)

- SIIX Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 OEMs Outsourcing to Focus on Core Competencies and Reduce Capex in High-Mix Low-Volume Segments in North America and Europe

- 4.2.2 Accelerated Near-/Re-shoring of Supply Chains to Mexico, Eastern Europe and ASEAN Post-China Tariffs

- 4.2.3 Surge in EV Power-Electronics Requiring Advanced PCB Assembly Capabilities

- 4.2.4 Proliferation of IIoT Edge Devices Driving HDI and Advanced Packaging EMS Demand in Asia

- 4.2.5 Stringent IEC 60601 and FDA 21 CFR 820 Quality Norms Lifting Certified Healthcare EMS Outsourcing

- 4.2.6 Rapid-Cycle Consumer Device Launches Boosting Flexible NPI and DfM Service Needs

- 4.3 Market Restraints

- 4.3.1 Rising Semiconductor and Passive Component Cost Volatility Compressing EMS Margins

- 4.3.2 IP Protection Concerns Limiting Outsourcing in EU Aerospace and Defense

- 4.3.3 Competition From ODMs and OEM In-house Lines in Smartphones

- 4.3.4 RoHS III and REACH Compliance Raising Capex for Legacy Facilities

- 4.4 Value Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook - SMT, HDI, Advanced Packaging, Digital MES

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis (Capital Expenditure and M&A Trends)

- 4.9 Assessment of macroeconomic factors on the market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Service Type

- 5.1.1 Electronics Design and Engineering

- 5.1.2 Prototype and NPI Services

- 5.1.3 PCB Assembly (SMT, Through-Hole)

- 5.1.4 Box-Build / System Integration

- 5.1.5 Testing and Certification

- 5.1.6 After-Market Services (Repair, Reverse Logistics)

- 5.2 By Business Model

- 5.2.1 Contract Manufacturing (CM)

- 5.2.2 Turnkey Manufacturing

- 5.2.3 Original Design Manufacturing (ODM)

- 5.2.4 Private Label Manufacturing

- 5.3 By Manufacturing Process

- 5.3.1 Surface-Mount Technology (SMT)

- 5.3.2 Through-Hole and Mixed Technology

- 5.3.3 Advanced Packaging / System-in-Package (SiP)

- 5.4 By End-use Industry

- 5.4.1 Mobile Devices (Smartphones and Tablets)

- 5.4.2 Consumer Electronics

- 5.4.3 Automotive and EV

- 5.4.4 Industrial and Automation

- 5.4.5 Healthcare / Medical Devices

- 5.4.6 Aerospace and Defense

- 5.4.7 IT and Telecom (5G, Data Centers)

- 5.4.8 Lighting

- 5.4.9 Energy and Utilities (Smart Metering, PV)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Nordics (Sweden, Norway, Finland, Denmark)

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Taiwan

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 India

- 5.5.3.6 ASEAN

- 5.5.3.7 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Mexico

- 5.5.4.2 Brazil

- 5.5.4.3 Argentina

- 5.5.4.4 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves (Partnerships, Capacity Expansions, Near-Shoring)

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Hon Hai Precision Industry Co., Ltd. (Foxconn)

- 6.4.2 Pegatron Corp.

- 6.4.3 Flex Ltd.

- 6.4.4 Jabil Inc.

- 6.4.5 Wistron Corp.

- 6.4.6 Sanmina Corp.

- 6.4.7 Celestica Inc.

- 6.4.8 Benchmark Electronics Inc.

- 6.4.9 Plexus Corp.

- 6.4.10 Compal Electronics Inc.

- 6.4.11 Inventec Corp.

- 6.4.12 Universal Scientific Industrial Co., Ltd. (USI)

- 6.4.13 Shenzhen Kaifa Technology Co., Ltd.

- 6.4.14 Asteelflash Group

- 6.4.15 Kimball Electronics Inc.

- 6.4.16 Sumitronics Corp.

- 6.4.17 Nortech Systems Inc.

- 6.4.18 Creation Technologies Ltd.

- 6.4.19 Integrated Micro-Electronics Inc.

- 6.4.20 Zollner Elektronik AG

- 6.4.21 New Kinpo Group (Cal-Comp)

- 6.4.22 SIIX Corp.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 Emerging Near-shoring Hubs (Mexico, Poland, Vietnam)

- 7.2 Smart Factory and Digital MES Adoption Roadmap

- 7.3 Circular Economy and E-waste Reverse Logistics Potential

- 7.4 White-space and Unmet-Need Assessment