|

市场调查报告书

商品编码

1643090

机器人视觉:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Robotic Vision - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

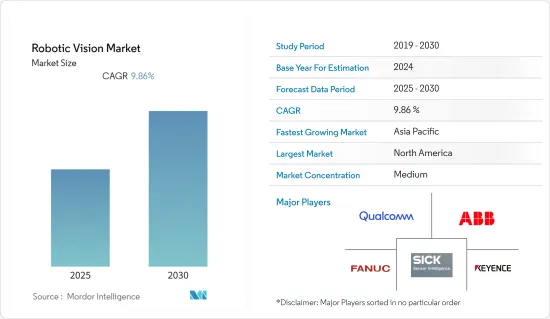

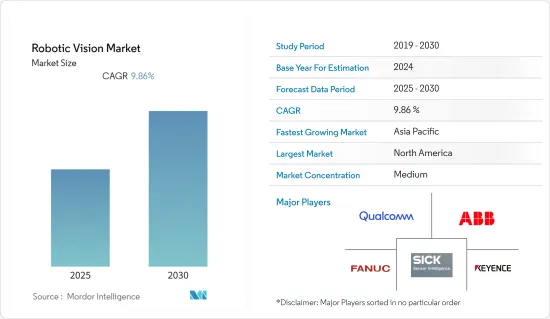

预计预测期内机器人视觉市场复合年增长率为 9.86%。

主要亮点

- 机器引导系统使用2D和3D机器视觉系统来提高组装机器人和自动化物料输送设备的准确性和速度。应用将根据生产的车辆和型号而有所不同,但常见的类别包括机器人、尺寸测量、组装检验、缺陷检测、喷漆工作检验和代码读取。

- 机器人视觉利用摄影机和影像处理为机器人提供视觉,以补充或取代人工检查任务。应用范围从存在检测到即时检查等基本任务。

- 世界各地的製造公司都意识到了这些机器人视觉系统的好处,特别是在必须精确执行检查等冗余任务的领域。它们在高速生产线和危险环境中发挥着至关重要的作用。这些系统的主要优点包括提高生产力、减少机器停机时间和加强製程控制。

- 开发机器人视觉的核心部件,例如视觉感测器和视觉软体,需要大量的开发成本。此外,引入机器人视觉的初始成本较高,这可能会阻碍市场扩张。

- 预计 COVID-19 疫情将促进视觉引导机器人的成长,这种机器人可以减少多个终端用户产业的人际接触。例如,美国公司Orrbec与中国一家机器人製造商合作,将3D相机产品引入机器人,用于各种医院应用。国内多家医院已引进采用机器视觉系统的送餐机器人、消毒机器人、方向引导机器人等。随着认知人形机器人的普及,市场将在疫情后蓬勃发展。

机器人视觉市场趋势

汽车业等终端用户的需求不断增长,推动市场成长

- 为了解决品质问题,汽车製造商加大对视觉系统的投资。汽车製造商和零件供应商越来越多地使用该技术进行各种应用,包括黏合剂分配、物料拾取、防错、线上焊接分析、物料输送、机器人引导、表面检查和可追溯性。客製化需求的不断增长、劳动力短缺的加剧以及成本压力是汽车行业使用视觉系统的主要驱动因素。

- 视觉引导机器人预计将彻底改变电子、汽车和食品加工产业。由于电弧焊接、切割和堆迭等应用对科技的需求庞大,3D视觉引导技术正成为这些产业的主流。

- 先进的机器视觉技术在全球各个汽车工厂的日常业务中发挥关键作用。例如,福特马达的范戴克变速箱工厂使用视觉引导机器人来确保齿轮和离合器等关键部件的高品质组装。该工厂已部署了 500 多个线上机器视觉应用程式来解决防错、测量和复杂性问题。

- 随着汽车 ADAS 系统的成长,摄影机主导照明、雷射雷达和 V2X 等组件的需求将很快在自动化和智慧化中发挥关键作用。此外,根据 Neuromation 的数据,道路交通事故占全球死亡人数的 2.2%。 2D 和 3D 机器视觉以及智慧交通系统 (ITS) 为驾驶员提供了安全网。这些技术可以减少汽车行业的人为错误,为驾驶员提供工具和能力,以避免代价高昂的错误和事故。

- 由于其非接触式检测、高重复性和最低成本,机器人视觉系统在各行各业的品管中越来越受欢迎。传统的产品品管方法完全依赖人工检查。另一方面,由于疲劳和重复,人工检查的表现预计会在轮班之间下降。细小的瑕疵不易察觉,但可能会导致重大错误。技术进步正在将耗时的检查任务从人工转移到机器自动化。硬体和软体的重大进步已经使世界许多地方的大多数品管检查人员转移到机器上。根据IFR统计,中国在上年度安装了约16.8万台新工业机器人,位居世界第一。

北美有望成为成长最快的市场

- 北美是机器人技术应用的主要发明者和先驱,也是世界上最大的市场之一。各领域对机器人技术的应用日益广泛是市场成长的主要因素。

- 据国际机器人联合会称,今年北美工业机器人的使用量预计将达到每年 69,000 台。据Advancing Automation称,去年的机器人销售量预计与前一年同期比较增长了28%。随着越来越多的行业转向自动化来提高生产力和缓解劳动力短缺,机器人销量在去年第四季度创下历史新高(同比增长 9%),并且在近几个月已经显示出强劲势头。

- 工业机器人是工业自动化的重要组成部分,不同的机器人在各行各业中执行着重要的功能。随着该地区许多国家的经济扩张,电子、电子商务和汽车等行业也在成长。由于整个经济的需求不断增长,产品製造商正在迅速采用机器人来自动化重复程序。

- 先进製造业伙伴关係等政府措施旨在鼓励企业、大学和联邦政府投资未来的自动化技术,这可能会使机器视觉系统的生产更加频繁。

- 根据美国製造业生产力与创新联盟(MAPI)统计,美国工业产值预计较前一年成长2.8%,推动了机器人视觉技术的使用。

机器人视觉产业概览

机器人视觉市场较为分散,主要参与者包括高通技术公司、基恩士公司、发那科公司、ABB 集团和 Sick AG。市场参与者正在采用伙伴关係、创新和收购等策略来增强其产品供应并获得永续的竞争优势。

- 2022 年 10 月-ABB 宣布与美国新兴企业Scalable Robotics 建立策略伙伴关係,以扩展其用户友好型机器人焊接解决方案系列。 Scalable Robotics 的技术利用 3D 视觉和内建製程感知,让使用者无需编码即可对焊接机器人进行程式设计。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

- COVID-19 产业影响评估

- 机器人视觉整合机器人分析(按出货量)

- 工业机器人

- 移动机器人

第五章 市场动态

- 市场驱动因素

- 认知人形机器人的采用率不断提高

- 汽车业等终端用户的需求不断增加

- 市场限制

- 高投资

第六章 市场细分

- 依技术分类

- 2D 视觉

- 3D 视觉

- 按最终用户产业

- 车

- 电子产品

- 航太

- 饮食

- 药品

- 其他最终用户产业

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第七章 竞争格局

- 公司简介

- Qualcomm Technologies, Inc.

- Keyence Corporation

- FANUC Corporation

- ABB Group

- Sick AG

- Teledyne Dalsa Inc.

- Cognex Corporation

- Omron Adept Technology, Inc.

- National Instruments Corporation

- Hexagon AB

第八章投资分析

第九章:市场的未来

简介目录

Product Code: 69651

The Robotic Vision Market is expected to register a CAGR of 9.86% during the forecast period.

Key Highlights

- Machine guidance systems use 2D and 3D machine vision systems to improve the accuracy and speed of assembly robots and automated material handling equipment, which plays a crucial role in the engine chassis marriage operations. Although the applications vary depending on the vehicle or model being produced, the general categories of applications are observed in robotics, dimensional gaging functions, assembly verification, flaw detection, paint job verification, and code reading.

- Robotic vision provides the robots with a sight that helps them to complement or replace manual inspection tasks using cameras and image processing. The applications range from basic tasks, like presence detection, to real-time inspection.

- Manufacturing companies across the globe realize the benefits of these robotic vision systems, particularly in areas where redundant tasks, like inspection, should be performed with precision. They play an essential role in high-speed production lines and hazardous environments. These systems' significant benefits include increased productivity, reduced machine downtime, and tighter process control.

- Significant expenditures are required to develop the core components of robotic vision, such as vision sensors and the underlying vision software. The initial cost of implementing robotic vision is also slightly more significant, which may impede market expansion.

- The COVID-19 pandemic is expected to increase the growth of vision-guided robots that can reduce human contact in multiple end-user industries. For instance, Orrbec, a US-based company, collaborated with robot manufacturers in China to deploy its 3D camera products in robots for different hospital applications. Food delivery robots, sterilization robots, and directional guiding robots using machine vision systems have been deployed across many hospitals in China. With the increased adoption of cognitive humanoid robots, the market is proliferating after the pandemic.

Robotic Vision Market Trends

Growing Demand from End-User Segments like Automotive Industry Drives the Market Growth

- To address quality issues, Automotive manufacturers are increasingly investing in vision systems. The technology is increasingly being used by automakers and parts suppliers for various applications, including adhesive dispensing, bin picking, error-proofing, inline welding analysis, material handling, robotic guidance, surface inspection, and traceability. Growing demand for customization, increasing labor shortages, and cost pressures are some significant drivers of vision systems used in the auto industry.

- Vision-guided robots are projected to revolutionize the electronics, automotive, and food processing industries. Due to the tremendous technology demand for applications such as arc welding, cutting, and palletizing, these industries are dominated by 3D vision-guided technology.

- Advanced machine vision technology plays a significant role in the daily operation of various global automotive plants. Ford Motor Co.'s Van Dyke transmission plant, for instance, uses vision-guided robots to ensure the high-quality assembly of critical components like gears and clutches. The plant has deployed over 500 inline machine vision applications for error-proofing, gauging, and complexity issues.

- With the growth of the ADAS system in Automotives, the requirement of components like camera-led lighting, Lidar, and V2X, among others, would play a crucial role shortly for automation and intelligence. Further, according to Neuromation, traffic accidents account for 2.2% of global deaths. With 2D and 3D machine vision and intelligent transportation systems (ITS), drivers are provided with a safety net. These technologies make it possible to mitigate human error in the auto industry, assisting drivers at the wheel with tools and features that keep them from committing severe mistakes and accidents.

- Because of their noncontact inspection, high repeatability, and minimal cost, robotic vision systems are becoming more popular for quality control in various sectors. Traditional methods of product quality control rely entirely on human inspection. On the other hand, human inspection performance is projected to decline over a shift of work owing to weariness and repetition. Minor faults may go unnoticed, resulting in non-trivial errors. Technological breakthroughs are transferring the time-consuming inspection labor from humans to machine automation. Significant advances in hardware and software have already shifted most of the quality control inspection labor to machines in various regions of the globe. According to IFR, With approximately 168 thousand new industrial robot installations in China, it had set up the most robotics-worldwide in the previous year.

North America is Expected to become the Fastest Growing Market

- In robotics adoption, North America is one of the significant inventors and pioneers and one of the world's largest markets. The rising deployment of robotics across various sectors is the key driver of the market's growth.

- According to the International Federation of Robotics, North American industrial robot deployments are predicted to reach 69,000 annually by the current year. According to Advancing Automation, the number of robots sold last year was estimated to rise by 28% over before previous year. As more sectors resorted to automation to enhance productivity and reduce persistent labor shortages, record robot sales were recorded in the fourth quarter of the last year (up by 9% from the fourth quarter of before earlier year), demonstrating strong momentum already gained in the previous few months.

- Industrial robots are critical in industrial automation, with various robots managing many vital functions in multiple industries. Electronics, e-commerce, and automotive industries, among others, are growing in tandem with economic expansion in many countries in this region. Product manufacturers are rapidly employing robots to automate repetitive procedures in response to rising demand across economies.

- Machine vision systems would be produced more frequently due to government efforts such as the Advanced Manufacturing Partnership, which aims to encourage businesses, universities, and the federal government to invest in future automation technology.

- According to the MAPI (Manufacturers Alliance for Productivity and Innovation), industrial production in the United States was estimated to rise by 2.8% by the earlier year, boosting the country's use of robotic vision technologies.

Robotic Vision Industry Overview

The robotic vision market is moderately fragmented due to major players like Qualcomm Technologies, Inc., Keyence Corporation, FANUC Corporation, ABB Group, and Sick AG. Players in the market are adopting strategies such as partnerships, innovations, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- October 2022 - ABB announced a strategic partnership with the US-based startup Scalable Robotics to expand its user-friendly robotic welding solutions line. Scalable Robotics technology, which uses 3D vision and embedded process awareness, enables users to program welding robots without coding.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of Covid-19 on the Industry

- 4.5 Analysis of Robots Integrated with Robotic Vision (in terms of Volumes Shipped)

- 4.5.1 Industrial Robots

- 4.5.2 Mobile Robots

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Adoption of Cognitive Humanoid Robots

- 5.1.2 Growing Demand from End - User Segments like Automotive Industry

- 5.2 Market Restraints

- 5.2.1 High Investments

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 2D Vision

- 6.1.2 3D Vision

- 6.2 By End User Industry

- 6.2.1 Automotive

- 6.2.2 Electronics

- 6.2.3 Aerospace

- 6.2.4 Food and Beverage

- 6.2.5 Pharmaceutical

- 6.2.6 Other End User Industries

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Qualcomm Technologies, Inc.

- 7.1.2 Keyence Corporation

- 7.1.3 FANUC Corporation

- 7.1.4 ABB Group

- 7.1.5 Sick AG

- 7.1.6 Teledyne Dalsa Inc.

- 7.1.7 Cognex Corporation

- 7.1.8 Omron Adept Technology, Inc.

- 7.1.9 National Instruments Corporation

- 7.1.10 Hexagon AB

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219