|

市场调查报告书

商品编码

1643095

射频前端模组:市场占有率分析、产业趋势与成长预测(2025-2030 年)RF Front End Module - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

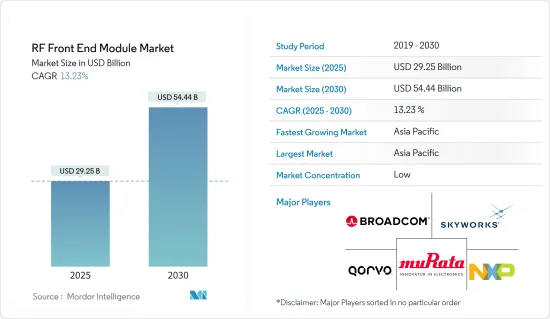

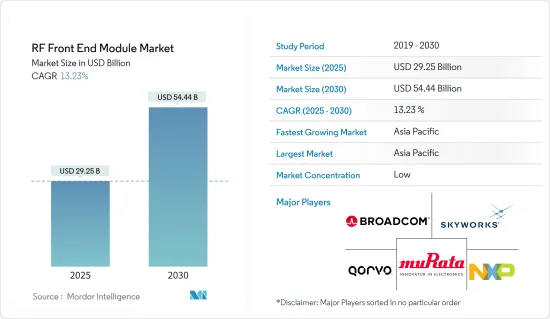

射频前端模组市场规模预计在 2025 年为 292.5 亿美元,预计到 2030 年将达到 544.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 13.23%。

最近的趋势是低成本微型卫星的发展显着增加。这是透过低成本发射载体和「商用现货」(COTS)组件来实现的。大多数 COTS 元件通常不符合太空要求,需要额外的电路重新设计和实施工作才能承受并在恶劣的太空环境中运作。 RF前端设计由完全使用COTS元件实现的S波段收发器组成,被认为是专家调查中更好、更可行的选择之一。随着微型卫星的应用不断增加,预计该领域的市场在预测期内将大幅成长。

关键亮点

- 射频前端模组是指无线电接收器电路中位于无线电接收器的天线输入和发送器的搅拌机级或功率放大器之间的电路。

- 行动通讯设备的快速成长以及资料密集型应用带来的资料流量的不断增加,推动 RF FEM 供应商引领技术创新,例如为行动装置提供高频率。此外,根据思科视觉化网路指数显示,2017 年至 2022 年间,全球行动资料流量预计将成长 7 倍,2022 年达到每月 77.5 Exabyte ,复合年增长率为 46%。

- Qorvo 宣布推出首款用于 Wi-Fi 6 的双频前端模组 (FEM),分别为 SKY85334-11 和 SKY85750-11。 SKY85334-11 和 SKY85750-11 专为客户端设备 (CPE) 设计,结合了 HD/4K 视讯传输所需的效能和物联网所需的效率。应用还包括整合开关、带旁路的低杂讯放大器 (LNA) 和功率放大器 (PA),其中模组具有线性度、功率损耗和效率,适用于网路基地台、路由器和网关,其中监管、热量和乙太网路供电 (PoE) 限制要求低电流消耗。

- 此外,新兴国家和已开发国家国防预算的不断增加以及国内外军事武器库对技术先进产品的需求预计将进一步推动全球市场的成长。随着自动驾驶汽车和无人机技术的进步,军事射频和电子战应用预计将会成长。

- 射频功率放大器 (PA) 是无线行动基础架构中每个基地台的重要组成部分。这些是任何现代基础设施设备子组件中最昂贵的部件之一。这些功率放大器中使用的 GaN RF 半导体必须随着 RF PA 设计人员和用户面临的经济和技术现实而发展。

- 政府实施的停工以及旅行和贸易限制迫使电子、汽车、航太和国防以及通讯等许多行业停止运营,从而减缓了 2020 年对射频功率半导体的需求。截至 2022 年,一些射频元件製造商正在透过与区域原料供应商合作来重组其供应链。未来预计生产者因新冠疫情所承受的负担将会减轻。

射频 (RF) 前端模组市场趋势

射频滤波器经历显着成长

- 射频(RF)滤波器广泛应用于通讯产业,用于消除各个频道上接收和传输资料时的白噪音干扰。这些滤波器通常用于电视广播、无线通讯和中高频无线电等领域。这样做是为了提供可靠、无错误且正确的端对端通讯。 RF 滤波器有四种:频宽阻滤波器、高通滤波器、带通滤波器和低通滤波器。

- 射频滤波器用于无线电接收器,以确保只广播适当的频率,并滤除不需要的频带。它是无线技术的一个基本要素。这些滤波器适用于中频至超高频,如兆赫和吉赫。由于其功能特性,它最常用于广播电台、无线通讯和电视等设备。

- 行动运算设备在需要不断移动和保持连网的行动用户和商务旅行者中越来越受欢迎。消费者使用这些设备可以完成多种任务,包括造访社群媒体、浏览网页、阅读新闻和查看电子邮件。网路普及率的提高和价格实惠的资料通讯速度正在推动对行动运算设备的需求。

- 行动运算设备的使用日益增多导致网路流量呈指数级增长。功能日益强大的行动运算设备(例如智慧型手机、平板电脑和笔记型电脑)的普及正在推动网路频宽的增加。智慧型手机和平板设备正在采用 LTE 和 Wi-Fi 等先进的无线技术,对新的 RF 功能的需求日益增长。

- 此外,射频滤波器在行动电话环境中发挥着至关重要的作用。例如,行动电话需要一定数量的频段才能有效运作。如果没有适当的射频滤波,各个频宽就无法同时共存。这导致某些频宽被拒绝,包括 Wi-Fi、公共和全球导航卫星系统 (GNSS)。 RF 滤波器非常重要,因为它们允许所有频宽同时共存。

- 5G智慧型手机需求的不断增长预计将进一步推动对射频滤波器的需求。根据 GSMA 预测,到 2025 年,加拿大 5G 普及率将达到行动连线的 49%,高于 2021 年的 8%。

亚太地区将经历大幅成长

- 预计亚太地区将实现强劲成长。中国、印度和韩国等主要新兴国家的显着成长,以及家用电子电器的进步和国防设备需求的不断增长,预计将进一步推动射频元件市场的需求。

- 蓬勃发展的积体电路 (IC) 产业、亚太地区不断扩大的 SOI 生态系统以及 SOI 在物联网应用中的日益广泛使用,为射频前端模组 (RFFE) 带来了成长机会。根据《富比士》报道,到2023年物联网设备数量将超过35亿,其中亚洲将占据最高市场占有率。到2023年,东北亚将成为一个超过22亿台设备的市场。

- 对于 2G、3G 和 4G/LTE(长期演进)中的资料传输,行动装置需要专用的前端模组 (FEM)。 FEM 使用 RF-SOI 晶片将开关、功率放大器、天线调谐组件、电源管理单元、滤波器等整合到单一平台上,用于物联网应用。这有助于该地区的市场成长。

- 此外,亚太地区汽车产量的成长预计将推动对在 L1 频段(1,574.42 至 1,576.42 MHz)运行的全球定位系统 (GPS) 和在 S 频段(2,320 至 2,345 MHz)运行的卫星数位音讯和无线电系统 (SDARS) 的前端紧凑型需求。这可能会促进该地区的市场发展。中国是最大的电动车製造国,预测期内也将在电动车普及率方面领先世界。到 2030 年,电动车在所有道路运输方式(两轮车、汽车、巴士和卡车)新车销量中的份额预计将达到 57%。

- 此外,由于前端模组对于基地台和5G智慧型手机等许多无线应用至关重要,中国旨在发展国内半导体产业的大型资本投资计划已开始为第二阶段资金筹措。该计划预计运行五年,预算为 2,041.5 亿元人民币(289 亿美元)。华为在射频前端模组方面的工作为该公司提供了一个机会,使其能够仔细考虑需要关注的领域,以开发必要的技术、设计和IP,甚至可能在中国开始设计完整的整合模组系统。这将进一步促进市场未来的成长。

射频(RF)前端模组产业概况

由于市场竞争激烈,射频前端模组市场高度分散。随着技术创新、合作伙伴关係和合併的不断增加,预计预测期内市场竞争将非常激烈。市场的主要企业包括 Broadcom Inc.、Skyworks Solutions, Inc. 等。

2022年6月,高通技术公司宣布推出Wi-Fi 7前端模组,该模组将增强车内和网路连线设备的无线效能。采用 RFFE 模组符合该公司的目标,即透过针对汽车和物联网的数据机到天线解决方案来扩展行动电话范围。

2022 年 2 月,村田製造公司宣布扩展其用于 5G 无线基础设施的毫米波 RF 前端产品组合。三个波束成形 IC 和两个上/下变频器允许灵活更换 IC,从而提供 n257、n258 和 n260频宽从 IF 到 RF 的全面覆盖。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- RF-SOI的普及与智慧型设备的扩展

- 蓝牙物联网应用

- 市场问题

- 疫情导致需求下滑

- 製造成本高且晶圆尺寸小

第六章 市场细分

- 按零件

- 射频滤波器

- 射频开关

- 射频功率放大器

- 其他的

- 按应用

- 家用电子电器

- 车

- 军队

- 无线通讯

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 欧洲其他地区

- 亚太地区

- 印度

- 中国

- 日本

- 其他亚太地区

- 其他 其他 (拉丁美洲、中东和非洲)

- 北美洲

第七章 竞争格局

- 公司简介

- Broadcom Inc.

- Skyworks Solutions Inc.

- Murata Manufacturing Co. Ltd

- Qorvo Inc.

- NXP Semiconductors NV

- Texas Instruments Incorporated

- Infineon Technologies AG

- Qualcomm Technologies Inc.

- Teradyne, Inc.(LitePoint Corporation)

- RDA Microelectronics Inc.

第八章投资分析

第九章:市场的未来

The RF Front End Module Market size is estimated at USD 29.25 billion in 2025, and is expected to reach USD 54.44 billion by 2030, at a CAGR of 13.23% during the forecast period (2025-2030).

In recent years, the development of low-cost nanosatellites has grown considerably. It has been made viable due to the availability of low-cost launch vectors and "commercial off-the-shelf components" (COTS). Most COTS components are usually not space-qualified, and to make them work and withstand the harsh space environment, they need extra effort in in-circuit redesign and implementation. The RF front-end design is considered one of the better and more feasible choices in expert research, which consists of an S-band transceiver that is fully implemented using COTS components. If further implemented in nanosatellites, the market in this sector shall grow significantly during the forecast period.

Key Highlights

- An RF front-end module refers to the circuitry in a radio receiver circuit between a radio receiver's antenna input and the mixer stage or the transmitter's power amplifier.

- The exponential increase in mobile communication devices on a unit basis and rising data traffic due to data-intensive applications have led RF FEM providers to lead innovation, such as high-frequency bands in handsets. Additionally, per the Cisco Visual Networking Index, the global mobile data traffic is expected to increase sevenfold between 2017 and 2022, with a CAGR of 46%, reaching 77.5 exabytes per month by 2022.

- Qorvo introduced the first dual-band front-end module (FEM) for Wi-Fi 6, the SKY85334-11 and SKY85750-11. It is designed ideally for customer premise equipment (CPE), combining the performance required to deliver HD/4K video with the efficiency needed for IoT. Also, by featuring linearity, power dissipation, and efficiency for access points, routers, and gateways, where regulatory, thermals, or Power-over-Ethernet (PoE) limitations demand low current consumption, the modules overlook integration at switching, low-noise amplifier (LNA) with bypass and power amplifier (PA) as applications.

- Moreover, the constant increase in defense budgets in developing and developed nations and the demand for technologically-advanced products in the arsenal of national and international armed forces are expected to further fuel the global market's growth. Military radio frequency and electronic warfare applications are expected to grow in addition to the technological advancements in autonomous vehicles and drones.

- RF power amplifiers (PA), thus, form an integral part of all the base stations for wireless mobile infrastructure. They represent one of the most expensive components of sub-assemblies in modern infrastructure equipment. The GaN RF semiconductors used in these power amplifiers must evolve with the economic and technical realities facing the designers and users of these RF PAs.

- Due to government-imposed lockdowns and travel and trade restrictions, many industries, such as electronics, automotive, aerospace & defense, and telecommunications, were forced to shut down their operations, lowering the demand for RF power semiconductors in 2020. As of 2022, several RF component makers have reorganized their supply chains by working with regional raw material suppliers. In the future, this is projected to reduce the burden of the COVID-19 pandemic on producers.

Radio Frequency (RF) Front End Module Market Trends

RF Filters to Witness Significant Growth

- Radiofrequency (RF) filters are widely used in the communication industry to eliminate white noise interference when receiving and transferring data across various channels. These filters are often employed in operating fields, such as television broadcasting, wireless communication, and radios operating from medium to high frequencies. This is done to provide reliable, error-free, and appropriate communication from one end to the other. Band-reject, high-pass, band-pass, and low-pass filters are the four types of RF filters.

- RF filters are used with radio receivers to ensure that only the appropriate frequencies are broadcasted, filtering out undesirable bands of frequencies. They are a crucial component of wireless technology. These filters are built to function at frequencies ranging from medium to extremely high, such as megahertz and gigahertz. Due to their working feature, they are most commonly employed in equipment like broadcast radio, wireless communications, and television.

- Mobile computing devices are becoming more popular among mobile users and business travelers who need constant mobility and connection. Consumers use these gadgets for various tasks, including accessing social media applications, surfing the web, reading news, and checking emails. The growing internet penetration rate and the availability of high data rates at affordable speeds are driving the demand for mobile computing devices.

- Network traffic is increasing exponentially, owing to the growing use of mobile computing devices. The proliferation of mobile computing devices (such as smartphones, tablets, and laptops) with increased capabilities is driving internet bandwidth. The increased need for new RF functionalities in smartphones and tablets has resulted from incorporating advanced wireless technologies, such as LTE and Wi-Fi.

- Furthermore, RF filters play an essential function in the cell phone environment. Mobile phones, for example, require a particular number of bands to function effectively. Without the right RF filter, the various bands cannot coexist simultaneously. This will result in the rejection of certain bands, such as the Wi-Fi, public safety, and global navigation satellite system (GNSS). RF filters are crucial because they allow all bands to coexist simultaneously.

- The increasing demand for 5G smartphones will further boost the demand for RF filters. According to GSMA, the 5G adoption rate as a share of mobile connections in Canada will reach 49% by 2025 from 8% in 2021.

Asia-Pacific to Witness Major Growth

- The Asia-Pacific is expected to witness significant growth. The advancement in consumer electronics and growing defense equipment requirements with the considerable growth of major emerging economies, such as China, India, and South Korea, will further boost the demand for the RF component market.

- The flourishing Integrated Circuit (IC) industry, expanding the SOI ecosystem in the Asia-Pacific, and increasing the use of SOI in IoT applications act as growth opportunities for the RF Front End Module (RFFE). According to Forbes, the number of IoT devices will surpass 3.5 billion by 2023, with Asia leading the highest market share. By 2023, Northeast Asia will be a market for more than 2.2 billion devices.

- For data transmission over 2G, 3G, and 4G/ Long-term Evolution (LTE), mobile devices require dedicated front-end modules (FEMs). FEMs use RF-SOI chips, which integrate switches, power amplifiers, antenna tuning components, power management units, and filters on a single platform for IoT applications. Hence, this caters to the market growth in the region.

- Further, increasing the production of vehicles in the Asia-Pacific is expected to drive the demand for compact dual-band RF front-end modules for global positioning system (GPS) operating in the L1-band (1574.42-1576.42 MHz) and satellite digital audio radio system (SDARS) operating in the S-band (2320-2345 MHz. This, in turn, may boost the market in the region. China is the largest maker of electric vehicles and leads with the highest level of EV uptake over the projection period. By 2030, the share of EVs in new vehicle sales is estimated to reach 57% across all road transport modes (i.e., two-wheelers, cars, buses, and trucks).

- Furthermore, as front-end modules are essential to many wireless applications, such as base stations and 5G smartphones, China's massive capital investment project designed to nurture the domestic semiconductor industry has rolled out its second funding phase. The project is scheduled for the next five years with a budget of YUAN 204.15 billion (USD 28.9 billion). By addressing RF front-end modules, Huawei creates an opportunity to ponder areas that need attention for developing the necessary technologies, designs, and IPs, possibly expected to begin designing a whole integrated module system in China. This further penetrates future growth for the market.

Radio Frequency (RF) Front End Module Industry Overview

The RF front-end module market is fragmented due to high market rivalry. With increasing innovation, partnerships, and mergers, the market is expected to have high competition in the forecasted period. Key players in the market are Broadcom Inc., Skyworks Solutions, Inc., etc.

In June 2022, Qualcomm Technologies Inc. announced the launch of Wi-Fi 7 front-end modules that offered enhanced wireless performance in automotive and internet-connected devices. The introduction of the RFFE modules aligned with the company's objective to extend its handset range with modem-to-antenna solutions for automotive and IoT.

In February 2022, Murata Manufacturing announced the expansion of its millimeter-wave RF front-end portfolio for 5G wireless infrastructure applications. The three beam-forming ICs and two up-down converters offered flexibility to interchange ICs for full IF-to-RF coverage across the n257, n258, and n260 bands.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Popularity of RF-SOI and the Increasing Adoption of Smart Devices

- 5.1.2 Adoption of Bluetooth IoT Applications

- 5.2 Market Challenges

- 5.2.1 Low Demand due to the Impact of COVID-19

- 5.2.2 Expensive to Fabricate and Smaller Wafer Sizes

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 RF Filters

- 6.1.2 RF Switches

- 6.1.3 RF Power Amplifiers

- 6.1.4 Other Components

- 6.2 By Application

- 6.2.1 Consumer Electronics

- 6.2.2 Automotive

- 6.2.3 Military

- 6.2.4 Wireless Communication

- 6.2.5 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 India

- 6.3.3.2 China

- 6.3.3.3 Japan

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Rest of the World (Latin America, Middle East and Africa)

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Broadcom Inc.

- 7.1.2 Skyworks Solutions Inc.

- 7.1.3 Murata Manufacturing Co. Ltd

- 7.1.4 Qorvo Inc.

- 7.1.5 NXP Semiconductors NV

- 7.1.6 Texas Instruments Incorporated

- 7.1.7 Infineon Technologies AG

- 7.1.8 Qualcomm Technologies Inc.

- 7.1.9 Teradyne, Inc. (LitePoint Corporation)

- 7.1.10 RDA Microelectronics Inc.