|

市场调查报告书

商品编码

1643099

平板天线:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Flat Antenna - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

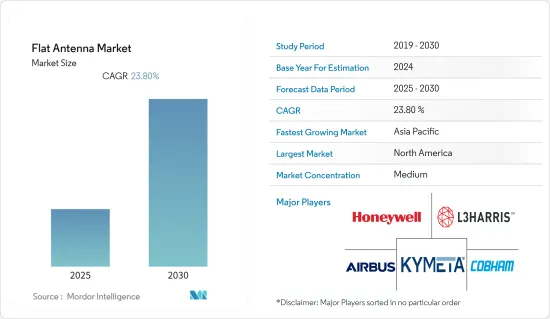

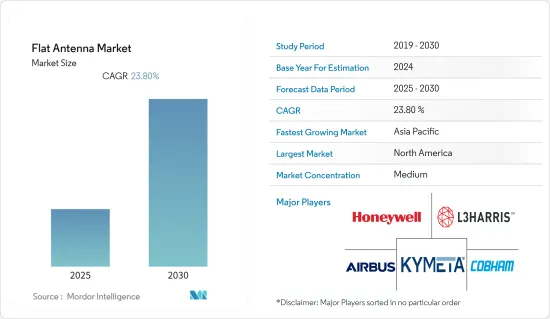

预计预测期内平板天线市场复合年增长率将达到 23.8%。

主要亮点

- 此外,民航机的连接需求持续成长,其运作环境需要开发用于卫星连接的相位阵列技术。

- 平板天线对于商用游艇和船舶尤其有用。受益于低成本指向平板天线的另一个领域是陆地移动性。此外,该行业正在开发指向平板天线、基于电磁超材料技术的超薄天线以及使用全像技术以电子方式获取、控制和锁定任何卫星的光束。预计未来几年平板天线市场对这项新技术的采用将大幅增加。

- 平板阵列由于高成本、性能不稳定而应用有限;然而,SES、SpaceX 和 Telesat 等公司推出的非地球静止卫星星系有望成为市场的主要动力。

- 此外,预计 COVID-19 疫情也将对市场产生影响。随着这些技术在 5G 部署中的应用不断增加,所考虑的市场肯定会继续扩大。 5G智慧型手机从旗舰机型向中阶的快速扩张以及5G作为独立网路的出现可能会推动市场成长。

平板天线市场趋势

国防领域采用无人系统以及对民航机的需求不断增加

- 无人系统越来越多地被应用于空中和远程地面监视、边防安全、视讯传输和战术支援。因此,与控制中心不间断的通讯对于这些系统至关重要。预计在预测期内,随着无人系统需求的不断增长以及政府倡议的推动,将产生广泛的天线需求。例如,2021 年 9 月,印度和美国根据国防技术贸易倡议签署了空射无人机 (ALUAV)计划协定 (PA)。

- 平板阵列由于成本高、性能不稳定而广泛应用,然而,Telesat、SES 和 SpaceX 等公司推出的非地球静止卫星星系有望成为市场的主要动力。

- 此外,民航机的连接需求持续成长,其运作环境需要开发用于卫星连接的相位阵列技术。

- 越来越多地采用具有更宽范围的超薄天线来以电子方式获取、控制和锁定任何卫星的光束,以及对民航连接的需求是推动市场成长的关键因素。此外,这些天线也用于地球静止卫星星系。然而平板天线高成本、辐射效率低、增益低,导致性能不稳定,往往抑制平板天线市场的成长。

北美可望主导市场

- 平板天线系统在商业和国防应用中的使用日益增多,使得该地区成为世界上成长最快的市场之一。例如,亚马逊最近宣布将在未来几个月内开始使用无人机运送包裹。该公司已获得美国航空管理局的许可,在美国境内营运无人机。

- 此类联合专案满足了国防对平板天线的需求。 Kymeta 将参与 Viasat 的政府终端改装套件计划,使 Kymeta 终端能够与 Viasat 的当前和下一代大容量卫星通讯(SATCOM) 网路互通。

- 此外,对电子控制相位阵列平板指向平板天线的需求不断增长、美国对太空探勘和卫星发射的日益关注以及对用于海事和商业应用的基于 VSAT 的平板指向平板天线的需求不断增长,正在推动指向平板天线市场的成长。

- 此外,由于电控指向平板天线体积小、成本低,且在企业、航海、陆地移动和航空业中被广泛采用,预计它将获得发展动力。 AlCAN Systems(加拿大)、C-COM Satellite Systems(加拿大)和 ThinKom Solutions(美国)是主要企业。

- 此外,美国波音幻影工厂推出了一种新型平板卫星通讯(SATCOM)宽频天线,可使军用飞机接收高速资料。扁平保形天线将于明年投入生产,并将安装在海军未来的MQ-25无人空中加油机上。

平板天线产业概况

平板天线市场相当分散,有许多大大小小的参与者,在全球和区域范围内运作。市场的一些主要企业包括 Cobham plc、Kymeta Corporation、Airbus SE、Honeywell International Inc 和 L3Harria Technologies。市场正在经历新产品发布和技术创新的快速成长。

- 2022 年 3 月-Intellian 推出三项天线发明:可携式、坚固耐用的背负式终端、低调的行动通讯(COTM) 解决方案和高资料速率固定业务解决方案。未来我们也计划提供空中和海上航站楼。此天线系列将于 2023 年上市。

- 到 2022 年至 2023 年 3 月,休斯计划提供能够存取 OneWeb 服务的天线技术。在 2022 卫星展上,休斯在展示了混合消费者服务后推出了一种新型电动可调平板天线。此天线是为OneWeb LEO通讯服务设计的。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素

- 国防领域采用无人系统以及民航机需求的增加正在推动市场

- 科技创新扩大了平板天线的用途

- 市场限制

- 高成本阻碍更广泛应用

- 波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

- COVID-19 产业影响评估

第五章 市场区隔

- 按应用

- 航太

- 防御

- 商业的

- 按地区

- 北美洲

- 亚太地区

- 欧洲

- 世界其他地区

第六章 竞争格局

- 公司简介

- Cobham PLC

- Kymeta Corporation

- Airbus SE

- Honeywell International Inc.

- L3Harris Technologies

- L-Com Global Connectivity(Infinite Electronics International, Inc.)

- General Dynamics SATCOM Technologies Inc.

- General Dynamics Corporation

- Phasor Inc.

- MacDonald, Dettwiler and Associates Ltd

- Mars Antenna & RF Systems Ltd

第七章投资分析

第八章 市场机会与未来趋势

简介目录

Product Code: 69684

The Flat Antenna Market is expected to register a CAGR of 23.8% during the forecast period.

Key Highlights

- Further, the demand for connectivity in commercial aviation has been continually growing, and the operating environment has necessitated the development of phased array technology for satellite connectivity.

- For commercial yachts and ships, flat antennas are particularly beneficial. Another sector that benefits from low-cost flat-panel antennas is land mobility. In addition, the industry is developing flat-panel antennas with ultra-thin antennas that use a holographic technique to electronically acquire, steer, and lock a beam to any satellite based on electromagnetic meta-materials technology. In the coming years, such widespread use of new technology in the flat antenna market will develop tremendously.

- Though Flat Panel Arrays have been used limitedly due to high costs and variable performance, the introduction of Non-Geostationary Orbit satellite constellations from players like SES, SpaceX, Telesat, and others, is expected to act as a significant driver of the market.

- Furthermore, the COVID-19 pandemic is projected to influence the market. The growing utilization of these technologies for 5G deployment will ensure that the market under consideration continues to expand. The quick extension of 5G smartphones from flagship-only models to the mid-range segment and 5 G's emergence as an independent network is likely to drive market growth.

Flat Antenna Market Trends

Adoption of Unmanned Systems in Defense and Increasing Demand for Commercial Aircraft

- Unmanned Systems are being increasingly deployed for airborne and remote ground surveillance, border patrol, video transmission, and tactical support. Hence, uninterrupted communication with the control center is critical for these systems. The growing need for Unmanned Systems, along with government initiatives, is expected to create demand for a wide range of antennas over the forecast period. For instance, in September 2021, India and the United States inked a Project Agreement (PA) for an Air-Launched Unmanned Aerial Vehicle (ALUAV) under the Defense Technology and Trade Initiative.

- Though flat panel arrays have been used limitedly due to high costs and variable performance, the introduction of the non-geostationary orbit satellite constellations from players like Telesat, SES, SpaceX, and others, are expected to act as significant drivers in the market.

- Further, the demand for connectivity in commercial aviation has been continually growing, and the operating environment has necessitated the development of phased array technology for satellite connectivity.

- The rise in the adoption of ultra-thin antennas with a broader range to electronically acquire, steer, and lock a beam to any satellite, as well as the demand for connectivity in commercial aviation, are the significant factors that propel the market growth. In addition, these antennas are used in geostationary orbit satellite constellations. However, the high cost, low radiation efficiency, and low gain of flat antennas resulting in variable performance tend to restrain the flat antenna market growth.

North America is Expected to Dominate the Market

- The growing use of flat antenna systems in commercials and defense applications makes this region one of the world's fastest-growing markets. Amazon, for instance, recently stated that it would deliver packages using drones within months. The company has acquired permission from the US Federal Aviation Administration to operate its drones in the US.

- Such collaborative programs have met the need for flat antennas in defense. Kymeta will participate in Viasat's government-focused terminal modification kit program, which will ensure Kymeta's terminals interoperate with Viasat's current and next-generation high-capacity satellite communications (SATCOM) networks.

- Additionally, the rising demand for electronically steered phased array flat panel antennas, increasing focus on space explorations and satellite launches in the US, and growing demand for VSAT-Based flat panel antennas for maritime and commercial applications are driving the growth of the flat panel antenna market.

- Also, an Electrically steered flat panel antenna is expected to gain traction due to its compact size, low cost, and significant adoption in enterprise, maritime, land mobile, and aviation industries. AlCAN Systems (Canada), C-COM Satellite Systems Inc (Canada), and ThinKom Solutions (US) are some of the prominent players in North America that are providing electronically steered FPA systems.

- Furthermore, Boeing Phantom Works in the United States has launched a novel flat satellite communications (SATCOM) broadband antenna that will allow military aircraft to receive high-speed data. The flat conformal antenna will be in production next year and will be used in the Navy's future unmanned mid-air refueling tanker, the MQ-25.

Flat Antenna Industry Overview

The flat antenna market is moderately fragmented, with the presence of numerous large and small players operating globally and regionally. Some of the key players operating in the market include Cobham plc, Kymeta Corporation, Airbus SE, Honeywell International Inc, and L3Harria Technologies, among others. The market has been experiencing significant new product launches and innovations.

- March 2022 - Intellian revealed the invention of three antennas: a portable, rugged manpack terminal, a low-profile communication on the move (COTM) solution, and a high data rate fixed business solution. The corporation will also offer future terminals for aviation and maritime. The antenna lineup will be available in 2023.

- March 2022 - By 2023, Hughes intends to make its antenna technology accessible for OneWeb services. Hughes unveiled a new electrically steerable flat panel antenna at Satellite 2022 as a follow-up to its hybrid consumer service demonstration. This antenna was designed for OneWeb LEO communication services.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Adoption of Unmanned Systems in Defense and Increasing demand for Commercial Aircraft are the Major Driver of the Market

- 4.2.2 Innovation Leading To Wider Application of Flat Antenna

- 4.3 Market Restraints

- 4.3.1 High Price acts as a Restraint for Wider Application

- 4.4 Porters Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Industry Value Chain Analysis

- 4.6 Assessment of Impact of COVID-19 on the Industry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Aerospace

- 5.1.2 Defense

- 5.1.3 Commercial

- 5.2 Geography

- 5.2.1 North America

- 5.2.2 Asia-Pacific

- 5.2.3 Europe

- 5.2.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Cobham PLC

- 6.1.2 Kymeta Corporation

- 6.1.3 Airbus SE

- 6.1.4 Honeywell International Inc.

- 6.1.5 L3Harris Technologies

- 6.1.6 L-Com Global Connectivity (Infinite Electronics International, Inc.)

- 6.1.7 General Dynamics SATCOM Technologies Inc.

- 6.1.8 General Dynamics Corporation

- 6.1.9 Phasor Inc.

- 6.1.10 MacDonald, Dettwiler and Associates Ltd

- 6.1.11 Mars Antenna & RF Systems Ltd

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219