|

市场调查报告书

商品编码

1643136

法国共乘市场:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)France Ridesharing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

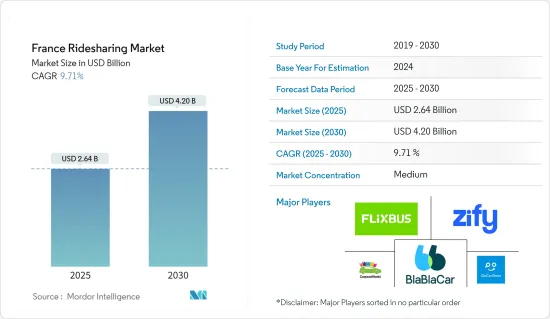

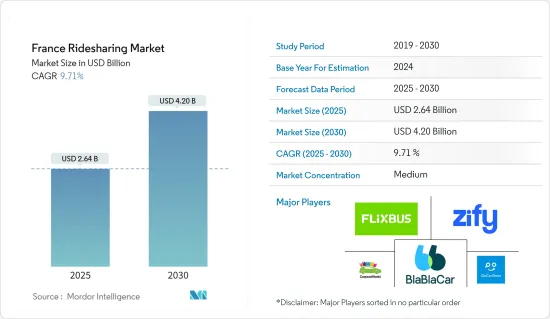

法国的共乘市场规模预计在 2025 年为 26.4 亿美元,预计到 2030 年将达到 42 亿美元,预测期内(2025-2030 年)的复合年增长率为 9.71%。

网路和智慧型手机的快速普及提高了共乘应用程式的可用性,同时也提高了其知名度。导航服务、即时交通资料和地图等对共乘服务至关重要的技术进步也推动了法国市场的发展。

关键亮点

- 全球暖化是由于人类活动造成的,报告指出,交通部门贡献了全球二氧化碳排放总量的14%。全球95%的运输能源来自石化燃料的燃烧,主要是汽油和柴油。为了减少碳排放,各国政府正在为道路车辆的二氧化碳排放设定雄心勃勃的目标,并鼓励共乘,以满足《巴黎气候变迁协定》。

- 巴黎上诉法院下令,希望与乘客共用车辆的车主所收取的费用不得超过将车辆送达目的地所需的成本,此举旨在打击该国共乘系统的盈利模式。这导致共乘在该国广泛采用。

- 要求提高监管工资的共乘业者罢工、针对非专业驾驶人(UberPoP)的刑事案件、传统运输服务的抵制和复杂的运输政策可能会限制法国共乘的发展。

- 然而,共乘既经济又环保,也为人们的约会提供了新的选择,因此预计市场将会扩大。此外,支援共乘的实体基础设施非常少(如果有的话),而且成本非常有限。

法国共乘市场趋势

共乘和摩托车共乘服务需求的增加预计将推动市场成长

- 日常上班族对共乘和两轮车共乘服务的偏好显着增加,这是共享乘车服务成长的主要原因。此外,BlaBlaCar、Uber 和 goCarShare 等主要市场参与企业提供的服务不断增加,以及可以选择方便的接送地点,都在鼓励用户选择共乘服务。

- 共乘服务依靠行动应用程式将乘客与司机联繫起来。随着网路越来越普及,越来越多的人可以使用智慧型手机,从而可以轻鬆下载和使用共乘应用程式。随着网路存取越来越普及,透过行动应用程式预订车辆的便利性将变得越来越普遍。

- 根据 StatCounter 的数据,截至 2023 年 6 月,法国超过 50% 的网路流量是透过行动电话传输的。个人电脑、桌上型电脑和笔记型电脑约占网路流量的 44%。平板电脑等其他设备约占法国网路总流量的 3%。

- 此外,共乘服务供应商还提供比传统交通服务供应商更实惠的交通、乘客资讯、经济的乘车费用和更大的便利性等优势。

- 此外,多家服务供应商还提供各种设施、折扣、共享月票等优惠,以减少日常通勤者的开支。因此,对共乘和两轮车共乘服务的需求不断增长,推动了共乘市场的成长。

动态会员类型可望占据较大市场占有率

- 动态会员模式可以为使用者提供在给定时间段内可以乘坐的次数的灵活性。这种灵活性使得乘客可以根据不断变化的交通需求调整订阅。

- 动态共乘比传统方案灵活得多。旅客可以在预计出发时间前几分钟提供或要求乘车,或预订单程行程。

- 动态共乘服务是基于行动应用程式的服务,允许驾驶人和乘客安排都市区的即时共乘。我们的智慧匹配演算法可以快速提案最佳的司机和乘客匹配,并从您的回馈中学习,随着时间的推移改进提案,以更好地满足您的期望。

- 国内外游客经常使用共乘服务作为逗留期间的便捷交通方式。动态固定费率模式可以为他们提供灵活性和成本可预测性,使其成为探索城市和在酒店和景点之间旅行的一种有吸引力且方便的选择。

- 根据Insee的数据,2023年7月法国的饭店住宿住宿约为1,360万晚。同时,当月入境游客住宿人数达到约950万人次。

法国共享旅游产业概况

法国的共乘市场半固化,由 BlaBlaCar、GoCarShare、Zify France、Flix Mobility 和 Carpool World 等大公司主导。这些占据了压倒性市场占有率的大公司正致力于扩大海外基本客群。这些公司正在利用策略合作措施来增加市场占有率和盈利。然而,随着技术进步和产品创新,中小企业透过赢得新契约和探索新市场来扩大其市场占有率。

- 2023 年 12 月-Uber 和家乐福合作,允许这家叫车公司的驾驶人使用这家法国超级市场的电动车充电点。 Uber 投资 30 万欧元(32.3 万美元),帮助 EV VTC(带司机旅游车)司机在法国各地的 Carrefour Energies 充电站为他们的汽车充电。

- 2023 年 1 月-Flix 宣布与戴姆勒巴士公司合作打造高性能电动远距巴士。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 产业生态系统分析

- 法国交通细分市场分析(各大汽车OEM近期推出的电动自行车和汽车共享服务)

- 市场驱动因素

- 众所周知,法国是欧洲第一个引入共乘服务的主要国家。

- 持有汽车的成本不断增加

- 社会经济和人口因素有利于共乘,众所周知,法国公民将共用交通服务作为主要交通方式之一。

- 公共为共乘乘客和使用者提供的奖励鼓励了替代交通方式的发展。

- 共乘和摩托车共乘需求增加

- 市场限制

- 与其他车型相比,最后一英里的连接性仍然是一个问题

- 行业的动态性质和对叫车行业的不断增加的投资给运营商带来了业务挑战

- 法国共乘产业的PESTLE分析

- 分析推动法国共享乘车采用的社会经济和行为模式

- COVID-19 对旅游产业的影响

- 共乘收益模式分析(佣金 | 间接收益| 白标软体)

第五章 市场区隔

- 依会员类型

- 固定式

- 动态的

- 公司

第六章 竞争格局

- 公司简介

- Bla bla Car

- goCarShare

- Zify France

- Flix Mobility

- Carpool World

- Mobicoop(Roulexmalin)

- Uber Technologies Inc.

第七章 投资情境及市场展望

The France Ridesharing Market size is estimated at USD 2.64 billion in 2025, and is expected to reach USD 4.20 billion by 2030, at a CAGR of 9.71% during the forecast period (2025-2030).

Rapid penetration of the internet and smartphones has increased the usability of ridesharing applications and created awareness at the same time. Technological advancements such as navigation service, live traffic data, and mapping, which are imperative for ridesharing services, have also propelled the market in France.

Key Highlights

- Global warming has manifolded due to human activities, and as per the report, the transportation sector contributes to 14% of total global CO2 emissions. 95% of the world's transportation energy involves burning fossil fuels, largely gasoline and diesel. To reduce CO2 emissions, the government is setting ambitious targets for the emission of CO2 for road vehicles and encouraging ride-sharing to achieve the Paris Agreement on Climate Change.

- The court of appeal in Paris has ordered vehicle owners willing to share their car with passengers not to charge any more than what it costs to drive them to their destination and has cracked down on the model of making a profit out of the country's carpooling schemes. This has increased the adoption of carpooling rides in the country.

- Rising strikes from the carpool operators for the higher and regulated pay rates, criminal cases for nonprofessional drivers (UberPoP), resistance from traditional transport services, and complex transport policies can restrain the growth of ridesharing in France.

- However, ridesharing offers cost-effective, eco-friendly, and alternative options to meet new people is expected to boost the market. Furthermore, it involves very limited physical infrastructure (if any) to boost and comes at a very limited cost.

France Ridesharing Market Trends

Rise in Demand for Carpool and Bike Pool Services is Expected to Drive the Market Growth

- A significant increase in the preference for carpool and bikepool services among regular office commuters is the major factor contributing to the growth of ridesharing services. In addition, the rise in the services offered by the leading market players, including BlaBlaCar, Uber, and goCarShare, and the option to choose convenient pick-up and drop locations are encouraging users to opt for ridesharing services.

- Ridesharing services rely on mobile applications to connect passengers with drivers. As internet penetration increases, more people have access to smartphones and can easily download and use ridesharing apps. The convenience of booking rides through mobile apps becomes more accessible with widespread internet access.

- According to StatCounter, as of June 2023, more than 50 percent of internet traffic in France came through mobile phones. Computers, Desktop and laptops' share of internet traffic was approximatly 44 percent. Other devices, such as tablets, accounted for about three percent of overall web traffic in France.

- Furthermore, ridesharing service providers offer advantages such as affordable pick-up and drop-off, co-passenger information, economical ride fares, and higher convenience than traditional transport service providers.

- In addition, several service providers offer various facilities, discounts, and offers, such as monthly passes on shared rides, to decrease the expenses of daily commuters. Thus, the rise in demand for carpooling and bikepool services collectively drives the ridesharing market's growth.

Dynamic Membership Type Segment is Expected to Hold Significant Market Share

- Dynamic subscription models may offer users flexibility regarding the number of rides they can take within a specific period. This flexibility allows users to adapt subscriptions to their changing transportation needs.

- Dynamic ridesharing offers carpoolers considerably more flexibility than conventional programs. Travelers can provide or request rides just minutes before their desired departure times or make scheduled appointments for one-time, one-way trips.

- The dynamic ridesharing service is based on a mobile application that allows people to make real-time arrangements for sharing car rides in an urban area, both as drivers and passengers. A smart matching algorithm would offer, in a short period, the best matching between the driver and the passenger, learning from users' feedback and improving its suggestions over time to better fulfill users' expectations.

- Domestic and international tourists often rely on ridesharing services for convenient transportation during their stays. Dynamic subscription models can provide them with flexibility and cost predictability, making it an attractive and convenient option for exploring the city or communicating between their hotel and tourist attractions.

- According to Insee, the number of overnight hotel stays in France, in July 2023, hotel establishments in France recorded approximately 13.6 million overnight stays by domestic guests. Meanwhile, overnight stays by inbound travelers reached about 9.5 million that month.

France Ridesharing Industry Overview

The French ridesharing market is semi-consolidated and dominated by major players like BlaBlaCar, GoCarShare, Zify France, Flix Mobility, and Carpool World. These major players, with a prominent market share, focus on expanding their customer base across foreign countries. These companies leverage strategic collaborative initiatives to increase their market share and profitability. However, with technological advancements and product innovations, mid-size to smaller companies are increasing their market presence by securing new contracts and tapping new markets.

- December 2023 - Uber and Carrefour teamed up to allow drivers of the ride-hailing company to access the French supermarket chain's charging points for electric vehicles; Uber invested EUR 0.3 million (USD 0.323 million) to allow its VTC (tourist vehicle with driver) drivers using EVs to charge their cars at Carrefour Energies' stations in France.

- January 2023 - Flix announced its partnership with Daimler Buses to manufacture high-performance electric long-distance buses and also announced the testing of 2 prototype coaches running on electricity.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Ecosystem Analysis

- 4.3 Analysis of the Mobility sector in France (Recent launch of e-bike and motor vehicle sharing by major automotive OEMs)

- 4.4 Market Drivers

- 4.4.1 France is Widely Considered to be the First Adopters of Ridesharing among major Countries in Europe

- 4.4.2 Growing Cost of Vehicle Ownership

- 4.4.3 Socio-economic and Demographic Factors are Highly Favorable to Ridesharing as the French Public is known to Rely on Shared Transport Services as one of the Key Modes of Travel

- 4.4.4 Incentives Provided by Local Agencies to Passengers and Riders of Ridesharing to Promote Development of Alternative Modes of Transport mainly Driven by Frequent Strikes by Local Train Employee Bodies

- 4.4.5 Rise in Demand for Carpool and Bike Pool Services

- 4.5 Market Restraints

- 4.5.1 Last mile connectivity remains a concern as compared to other models

- 4.5.2 Operational challenges for operators due to the dynamic nature of the industry and increasing investments in the ride hailing industry

- 4.6 PESTLE Analysis French Ridesharing Industry

- 4.7 Analysis of the socio economic and behavioral patterns promoting adoption of ridesharing in France

- 4.8 Impact of COVID-19 on the mobility industry

- 4.9 Analysis of Ridesharing Revenue Models (Commissions| Indirect Revenue| White-Label Software)

5 MARKET SEGMENTATION

- 5.1 By Membership Type

- 5.1.1 Fixed

- 5.1.2 Dynamic

- 5.1.3 Corporate

6 COMPETITIVE LANDSCAPE FRANCE RIDESHARING MARKET

- 6.1 Company Profiles

- 6.1.1 Bla bla Car

- 6.1.2 goCarShare

- 6.1.3 Zify France

- 6.1.4 Flix Mobility

- 6.1.5 Carpool World

- 6.1.6 Mobicoop (Roulexmalin)

- 6.1.7 Uber Technologies Inc.