|

市场调查报告书

商品编码

1643141

泰国折迭式纸盒包装:市场占有率分析、行业趋势和成长预测(2025-2030 年)Thailand Folding Carton Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

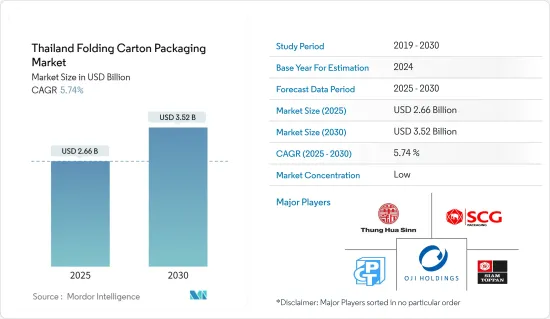

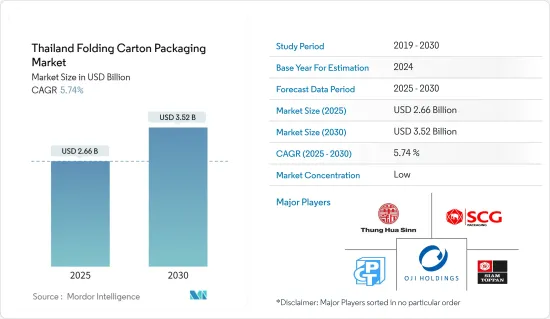

泰国折迭式纸盒包装市场规模预计在 2025 年为 26.6 亿美元,预计到 2030 年将达到 35.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.74%。

主要亮点

- 近年来,随着折迭式纸盒包装的普及,电子商务产业已成为泰国发展的主要动力。泰国人民对包装废弃物的担忧日益加剧,这可能会迫使政府实施法规,鼓励人们采用环保的方式,例如折迭式纸盒作为可行的包装选择。例如,2020年1月,泰国政府禁止大型商店使用一次性塑胶袋,并于2021年实施全面禁令,以减少废弃物。此举推动了该国纸箱等创新纸质包装的发展。

- 包装食品和饮料需求的不断增加,进一步增加了对各种类型和形状的折迭式纸盒包装的需求。作为回应,泰国酿酒等饮料公司正在增加瓦楞纸箱生产中再生纸的比例,并强调使用破损瓦楞纸箱。根据美国农业部和全球农业资讯网路的资料,2020 年泰国包装食品总销售额达到约 159.5 亿美元,而 2022 年为 151.8 亿美元。

- 折迭式纸盒包装所必需的原材料价格波动对市场成长构成了重大挑战。作为主要原料的纸板对全球纸浆和纸张趋势高度敏感,这直接影响供应商的盈利。对于议价能力有限的中小企业来说,这种影响尤其明显。例如,根据泰国工业部和商务部的数据,2023年第三季泰国纸浆、纸张和印刷媒体出口额约为6.5305亿美元。同时,2023 年第三季泰国的纸浆、纸张和印刷媒体进口额约为 7.9873 亿美元。进出口这种不平衡导致价格波动。

- 网路购物在泰国已成为主流,越来越多的消费者因其便利性而喜欢网路购物。这种转变主要因新冠疫情而加剧,严格的隔离和社交距离限制增加了网路购物和包装食品的支出,从而导致泰国对折迭式纸盒包装的需求增加。

泰国折迭式纸盒包装市场的趋势

电子商务行业的成长预计将推动市场

- 新冠疫情期间,电子商务销售量激增,增加了各种产品对折迭式纸盒包装的需求。自 2020 年初以来,社交距离法规、封锁和其他与疫情相关的措施导致网路购物业务激增,尤其是泰国的企业对消费者 (B2C) 销售和企业对企业 (B2B) 电子商务。

- 从行业来看,企业包装的需求正在快速增长,而且随着各行业销售额的增加,预计大批量折迭式纸盒包装的需求将比中小型企业更大。例如,根据(ETDA)统计,2022年泰国企业电商交易额从2021年的2.83兆泰铢增加至3.15兆泰铢,中小企业电商交易金额为1.71兆泰铢。

- 电子产品销售的不断增长进一步推动了市场成长,大大增加了对折迭式纸盒包装的需求。电子产品的包装有家庭常用的收纳盒,以及折迭纸盒包装。各种电子产品都采用折迭式的纸箱包装,以方便运输并维持环境的永续性。此外,电子产品出口大幅增加,进一步加速了折迭式纸盒的需求。根据泰国工业部和工业经济部调查显示,2023年第四季泰国电子产品出口额达约120亿美元,2022年为123.6亿美元。

- 电子商务领域新零售参与者的进入预计将进一步推动折迭式纸盒包装的需求。例如,2023 年 9 月,家装产品零售商 Mr.DIY Thailand 在入驻零售平台 Shopee 一个月后,透过推出其官方网路商店,进入泰国电子商务领域。该公司此举是为了响应电子商务在家装零售市场的扩张。

食品和饮料行业占最大市场占有率

- 可支配收入不断上升的中产阶级在食品和饮料上的支出不断增加,导致食品和饮料行业对折迭式纸盒包装的需求增加。随着越来越多的人迁往都市区,对方便包装食品的需求不断增加,从而推动了市场的发展。快速的都市化也推动了对加工食品和已调理食品的需求,这些食品是二次包装纸箱的主要用户,对市场成长做出了重大贡献。

- 泰国千禧世代的消费者更喜欢环保且易于携带的食品包装,推动了对食品和饮料包装纸容器的需求。由于这些产品便于携带、耐用且重量轻,折迭式纸盒已成为包装此类产品的合适选择。此外,网路食品配送的激增也进一步加强了泰国折迭纸盒市场。

- 2023年10月,亚航超级App与泰国领先的食品和杂货配送平台Foodpanda延长了合作伙伴关係。由于亚洲航空仍专注于打造一站式旅游平台的愿景,提供从航班、饭店、叫车服务、免税购物到餐饮体验等各种服务,此次合作预计将持续加强两个平台。亚航超级应用程式用户现在可以存取 Foodpanda 的食品配送服务,展示来自全国各地餐厅合作伙伴的多元美味菜单。预计食品服务业的此类发展将进一步推动对折迭式纸盒包装解决方案的需求不断增长。

- 此外,食品业的不断发展成为该国折迭式纸盒包装需求成长的主要驱动力。这种需求源自于对产品保护、品牌和功能的渴望,并从食品产业的製造商延伸到最终消费者。例如,2023 年泰国的包装食品总销售额达到 159.5 亿美元。该国包装食品的销售额不断增加,与2022年相比增加了约5.07%。

泰国折迭式纸盒包装产业概况

市场分散,参与者多,包括: Sarnti Packaging、Toppan Printing、Thai Packaging and Printing Public Company Limited、Bobst 和 SCG Packaging PCL。

- 2023年2月,泰国暹罗凸版包装有限公司安装了胶印,主要生产出口到欧洲、北美和世界其他地区的产品的折迭式纸盒包装。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 评估微观经济因素对产业的影响

第五章 市场动态

- 市场驱动因素

- 电子商务领域永续性目标推动强劲需求

- 折迭式纸盒包装在各行各业的应用日益广泛

- 市场挑战/限制

- 原物料价格波动

- 产业价值链分析

- 贸易情境分析 – 对应 HS 编码的进出口分析

第六章 市场细分

- 按最终用户

- 饮食

- 卫生保健

- 家庭和个人护理

- 产业

- 其他最终用户

第七章 竞争格局

- 公司简介

- Siam Toppan Packaging Co. Ltd

- Thai Containers Group(SCG Packaging)

- Thung Hua Sinn Group

- Continental Packaging(Thailand)Co. Ltd

- Oji Holdings Corporation

- ASA Group Company Limited

- Sarnti Packaging Co. Ltd

- Thai Cardboard Co. Ltd

- S&D Industries Co. Ltd

- JKCARTONS GROUP CO. LTD

第八章投资分析

第九章:未来市场展望

The Thailand Folding Carton Packaging Market size is estimated at USD 2.66 billion in 2025, and is expected to reach USD 3.52 billion by 2030, at a CAGR of 5.74% during the forecast period (2025-2030).

Key Highlights

- The e-commerce industry has emerged as a key driver in Thailand in recent years with the increasing adoption of folding carton packaging. The increasing concerns of Thai people associated with packaging waste are likely to compel the government to implement regulations that prompt the citizens to adopt eco-friendly options, such as folding cartons, as a viable choice for packaging. For instance, in January 2020, the Thai government banned the usage of single-use plastic bags at major stores and implemented a complete ban in 2021 to reduce waste. This move resulted in increased adoption of innovative paper-based packaging developments such as folding cartons in the country.

- The continuously increasing demand for packaged food and beverages is further proliferating the demand for folding carton packaging in various types and shapes. In response, beverage companies such as ThaiBev have emphasized increasing the proportion of recycled paper and the use of damaged cartons in the production of corrugated cartons. As per data from the US Department of Agriculture and Global Agriculture Information Network, the total sales value of packaged food in Thailand reached approximately USD 15.95 billion compared to USD 15.18 billion in 2022.

- Fluctuating prices of raw materials, crucial for folding carton packaging, pose a significant challenge to market growth. Given that paperboard, the primary material is highly sensitive to global pulp and paper dynamics, it directly impacts the profitability of vendors. This effect is particularly pronounced for smaller companies with limited negotiating power. For instance, according to the Ministry of Industry and Ministry of Commerce Thailand, during the third quarter of 2023, the export value of pulp, paper, and print media in Thailand amounted to approximately USD 653.05 million. In comparison, during the third quarter of 2023, the import value of pulp, paper, and print media in Thailand amounted to around USD 798.73 million. This imbalance between imports and exports leads to price volatility.

- Online shopping has become mainstream in Thailand, with more consumers preferring it due to its convenience. This shift was mainly augmented by the COVID-19 pandemic, with the strict lockdown and social distancing restrictions resulting in increased spending on online shopping and packaged foods, leading to increased demand for folding carton packaging in Thailand.

Thailand Folding Carton Packaging Market Trends

Rise in E-commerce Sector is Expected to Drive the Market

- The surge in e-commerce sales during the COVID-19 pandemic increased the demand for folding carton packaging for various products. From the start of 2020, the enforcement of social distancing, lockdowns, and other pandemic-related measures resulted in spikes in online shopping businesses, especially in business-to-consumer (B2C) sales and business-to-business (B2B) e-commerce in Thailand.

- Among the types of businesses, the rapid growth of the enterprise segment is likely to boost demand for folding carton packaging in larger quantities than SMEs owing to their sales growth across industries. For instance, according to (ETDA), in 2022, the value of e-commerce for enterprises in Thailand increased to THB 3.15 trillion from THB 2.83 trillion in 2021, whereas the value of e-commerce for SMEs stood at THB 1.71 trillion in 2022.

- The growth in the sales of electronic products is further driving market growth, increasing the demand for folding carton packaging significantly. Electronic goods packaging includes storage boxes that are used frequently in households and are packaged in foldable cartons. Various electronic gadgets are packaged in folding cartons for easier transportation and for maintaining environmental sustainability. Moreover, the export of electronic goods has seen a significant rise, further accelerating the demand for folding cartons. According to a survey conducted by the Ministry of Industry and Office of Industrial Economics Thailand, in the fourth quarter of 2023, the export value of electronic products from Thailand amounted to around USD 12 billion compared to USD 12.36 billion in 2022.

- The entrance of new retail companies in the e-commerce sector is further anticipated to drive the demand for folding carton packaging. For instance, in September 2023, Mr. DIY Thailand, a retailer of home improvement products retailer, entered the Thai e-commerce sector when it launched its official online store a month after it started taking up space on the retailing platform Shopee. The company has undergone this initiative as a result of the expansion of e-commerce in the home improvement retail market.

Food and Beverages Vertical to Hold the Maximum Market Share

- The country's growing middle class, with more disposable income, is spending more on food and beverages, which is leading to an increasing demand for folding carton packaging in the food and beverage industry. As more people move to urban areas, the demand for convenient packaged foods is rising, boosting the market. Rapid urbanization is also driving the demand for processed and ready-to-eat foods, and these products are major users of cartons for secondary packaging, significantly contributing to market growth.

- Millennial consumers in Thailand are driving the demand for folding cartons in food and beverage packaging by preferring eco-friendly and convenient on-the-go food packaging. Given that these products are portable, durable, and lightweight, folding cartons have emerged as a well-suited option to pack such products. Moreover, the surge in online food deliveries further bolsters the folding carton market in Thailand.

- In October 2023, airasia Superapp extended its partnership with Foodpanda, the key food and grocery delivery platform in Thailand. As airasia is focusing on its vision of a one-stop travel platform providing all things from flights, hotels, ride-hailing, duty-free shopping, and dining experiences, this partnership is expected to continue to strengthen both platforms. airasia Superapp users are then able to access Foodpanda's food delivery services, which showcase a diverse array of delightful menus from restaurant partners nationwide. Such developments in food service businesses are further projected to drive increased demand for folding carton packaging solutions.

- Moreover, the growing food sector is acting as a significant driver for the increasing demand for folding carton packaging in the country. This demand comes from the requirements for product protection, branding, and functionality, extending from manufacturers to end consumers in the food sector. For instance, in 2023, the total sales value of packaged food in Thailand reached USD 15.95 billion. The sales value of packaged food in the country has been increasing continuously, with a rise of approximately 5.07% compared to 2022.

Thailand Folding Carton Packaging Industry Overview

The market is fragmented with the presence of a large number of players such as Sarnti Packaging Co. Ltd, Toppan Printing Co. Ltd, Thai Packaging and Printing Public Company Limited, Bobst, and SCG Packaging PCL. With technological advancement and product innovation, mid-size to smaller companies are increasing their market presence by securing new contracts and tapping new markets.

- In February 2023, Thailand-based Siam Toppan Packaging Co. Ltd primarily implemented offset printing to manufacture folding carton packaging for products exported to Europe, North America, and other regions throughout the world.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of Impact of Microeconomic Factors on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Strong Demand Arising from the Sustainability Goals of the E-commerce Sector

- 5.1.2 Increase in Adoption of Folding Carton Packaging by Different Industries

- 5.2 Market Challenges/Restraints

- 5.2.1 Fluctuations in the Price of Raw Materials

- 5.3 Industry Value Chain Analysis

- 5.4 Trade Scenario Analysis - Import and Export Analysis of Corresponding HS Codes

6 MARKET SEGMENTATION

- 6.1 End-User

- 6.1.1 Food and Beverage

- 6.1.2 Healthcare

- 6.1.3 Household and Personal Care

- 6.1.4 Industrial

- 6.1.5 Other End Users

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Siam Toppan Packaging Co. Ltd

- 7.1.2 Thai Containers Group (SCG Packaging)

- 7.1.3 Thung Hua Sinn Group

- 7.1.4 Continental Packaging (Thailand) Co. Ltd

- 7.1.5 Oji Holdings Corporation

- 7.1.6 ASA Group Company Limited

- 7.1.7 Sarnti Packaging Co. Ltd

- 7.1.8 Thai Cardboard Co. Ltd

- 7.1.9 S&D Industries Co. Ltd

- 7.1.10 J.K.CARTONS GROUP CO. LTD