|

市场调查报告书

商品编码

1643144

中国固态硬碟 (SSD):市场占有率分析、产业趋势与成长预测(2025-2030 年)China Solid-State Drive - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

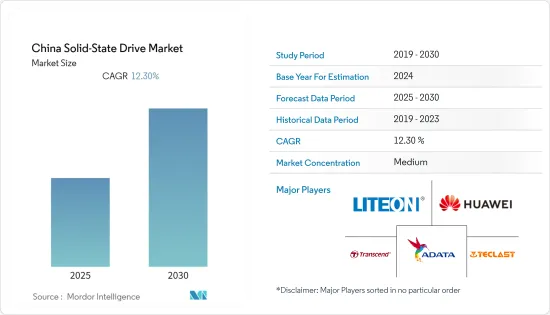

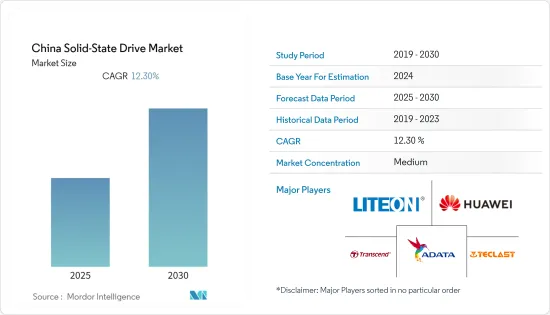

预计预测期内中国固态硬碟 (SSD) 市场复合年增长率将达到 12.3%。

主要亮点

- 在中国,近年来对资料储存的需求大幅成长。为了满足庞大的资料储存需求,固态硬碟 (SSD) 和硬碟 (HDD) 已成为两大主要的储存解决方案,每种解决方案都有其独特的优势。

- SSD 与 HDD 类似,都是非挥发性储存媒体。但是,资料不是储存在旋转的磁碟上,而是储存在一系列相互连接的微晶片上,从而使记忆体存取速度极快,这意味着 SSD 可以大大缩短启动时间。这些因素推动了 SSD 在计算过程中的广泛应用。

- 固态硬碟 (SSD) 已在桌面和笔记型电脑中普及,但它们在资料中心的引入却进展缓慢。然而,资料中心的 SSD 效能要求与消费性 PC 不同。资料中心必须能够满足这项要求,这与传统用户端 PC 不同,后者很少需要全天候不间断的效能。对于SSD的需求将会随着使用而增加。

- 中国 NAND 供应商的生产不会受到新型冠状病毒疫情的显着影响。这是因为工厂自动化程度很高,对人力的需求相对较少,而且经营者在农历新年前已经储备了原料。

- 由于该半导体製造厂拥有特殊的国家许可,因此该代工厂的产品均交货给中国境内的客户。这样我们就可以将产品运送到中国各地,甚至是隔离的城市。

- 此外,国际半导体设备与材料协会 (SEMI) 表示,由于 COVID-19 影响的不确定性迫在眉睫,硅晶圆销售量预计将下降。不过,业内专家表示,由于晶片销售復苏,中国的需求可能会回升。 SEMI也预测,2021年硅晶圆出货量将会成长,并在2022年创下历史新高。

中国SSD市场趋势

企业级 SSD 可望实现强劲成长

- 中国固态硬碟(SSD)市场持续快速成长,主要受企业、资料中心和个人电脑的需求所推动。许多企业应用程式需要持续正常运作、高效能储存设备、高可靠性和高功率效率。 SSD 满足了企业中的所有这些要求。

- 2017年NAND快闪记忆体短缺导致企业通路SSD市场成长放缓。需求主要由百度、阿里巴巴和腾讯等超大规模资料中心以及华为和浪潮等OEM製造商推动。

- 随着越来越多消费性电子产品搭载SSD(固态硬碟)及eMMC(嵌入式多媒体卡), NAND快闪记忆体必将成为未来储存与记忆产业发展的核心技术。随着国产PC在企业中的崛起,中国国内DRAM和NAND快闪记忆体消费量大幅增加。随着该地区 PC 产量的增加,市场对 SSD 的需求也增加。

- 在企业中,SSD 将资料持久性储存或暂时快取在非挥发性固态资料中,旨在用于伺服器、储存系统和直接附加储存 (DAS) 装置。中小型企业 (SME) 使用 MLC SSD,其使用寿命比 TLC SSD 更长,并且比 SLC SSD 相对便宜。 TLC SSD用户属于一般客户,因为TLC SSD容量大,价格低。

- 此外,指纹感应器很可能成为可携式固态硬碟(SSD)的关键功能,厂商将专注于在SSD中创新这种技术。 2020年4月,儘管受到疫情的不利影响,中国公司海康威视仍在中国市场推出了T100F可携式SSD。这款 SSD 配备生物识别安全功能,指纹感应器嵌入 SSD 的金属机壳中。

资料中心的采用正在增加,预计市场将成长

- 由于多种因素,资料中心对 SSD 的使用正在增长,其中包括对储存设备的需求不断增长、与传统 HDD 储存相比可用性的提高,以及企业级 SSD 可靠性和效能的大幅提升。

- 此外,SSD 之所以受到企业的青睐,是因为它们在运作时消耗的能源更少,从而减少了分散,并减少了对环境的影响。

- 根据Cloudscene统计,2020年中国每100人中约有50名网路用户,连接生态系统由85个主机託管资料中心、62个云端服务供应商和一个网路结构组成。受资料中心记忆体需求的推动,记忆体设备的需求不断增加,预计将推动 SSD 的需求。

- 预计中国资料中心市场的成长将受到政府支持和国际投资的推动。政府大力推动人工智慧在安全和智慧应用领域的发展,进一步刺激了该国对 SSD 的需求。

- 例如,苹果已经开始建造其首个中国资料中心,以扩展其在中国的服务。该计划响应了中国新的资料法,该法要求公民的资料必须託管在国内。因此,预计上述因素将推动中国对SSD的需求。

中国固态硬碟(SSD)产业概况

中国的固态硬碟 (SSD) 市场格局比较鬆散,有几家大型本土供应商。进入门槛高,使新进入者难以进入市场。现有的市场参与者将产品开发和创新视为扩大市场占有率的有利途径。创见资讯、台电电子、光宝科技、威刚科技和华为技术是主要的市场参与者。

2022年7月,ORICO重磅推出新品-ORICO USB4高速可携式SSD蒙太奇40Gbps系列。本产品采用的新设计采用耐用的套模贴标技术製造,旨在防止腐蚀。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素

- 扩大资料中心的采用

- 在高阶云端应用的采用范围扩大

- 市场限制

- 固态硬碟 (SSD)高成本且寿命短

- 生态系分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

第五章 市场区隔

- 按应用

- 企业

- 客户

- 按介面

- 串列高阶技术附件(SATA)

- 外围组件互连 (PCI) Express

第六章 竞争格局

- 公司简介

- Huawei Technologies Co. Ltd

- ADATA Technology Co. Ltd

- Transcend Information Inc.

- Teclast Electronics Co. Ltd

- LITE-ON Technology Corporation

- Lenovo Group Limited

- Memblaze Technology Co. Ltd

- Maxiotek Corporation

- PHISON ELECTRONICS

第七章投资分析

第八章 市场机会与未来趋势

The China Solid-State Drive Market is expected to register a CAGR of 12.3% during the forecast period.

Key Highlights

- In China, the data storage demand has been on a massive rise over the past few years. In order to fulfill the enormous demand for data storage, solid-state drives (SSDs) and hard disk drives (HDD) emerged as the two main storage solutions, each with its particular benefits.

- SSDs are like HDDs in terms of being non-volatile storage mediums. However, instead of spinning disks, data is stored in a series of interconnected microchips, making memory access much faster, which causes the boot time to reduce drastically in SSDs. Such factors are increasing the greater adoption of SSD in the computing process.

- Solid-state drives (SSDs) are nearly ubiquitous in desktop and laptop computers, but the introduction of SSDs in data centers has taken much longer. However, data center SSDs have distinct performance requirements compared to consumer PCs. A data center must be able to match this requirement, unlike a conventional client PC whose usage unlikely ever requires constant 24/7 performance. The demand for SSDs will increase depending on the application.

- The production by China-based NAND vendors was not severely affected by the outbreak of novel COVID-19. This was because the plants were highly automated, had relatively low demands for manpower, and the operators stocked raw materials before the Chinese Lunar New Year.

- Foundry output was delivered to customers in China because semiconductor fabrication plants hold special national licenses. These allowed them to ship products throughout domestic China, even with cities under quarantine.

- Further, according to Semiconductor Equipment and Materials International (SEMI), silicon wafer sales were anticipated to witness a dip amid the looming uncertainty surrounding the impact of COVID-19. However, in China, industry experts believed that the demand could climb on the strength of rebounding chip sales. SEMI also estimated that silicon wafer shipments would witness growth in 2021, and shipments will reach a record high in 2022.

China Solidstate Drive (SSD) Market Trends

Enterprise SSDs Expected To Grow Significantly

- The Chinese solid-state drive market continued its rapid pace of growth, driven primarily by enterprise and data center demand, as well as PC demand. Many enterprise applications need constant uptime, high-performance storage devices, high reliability, and power efficiency. SSDs fulfill all these requirements in the enterprise.

- Due to the NAND flash shortage in 2017, the enterprise channel SSD market grew at a more modest rate. The demand was fueled by hyper-scale data centers, such as Baidu, Alibaba, Tencent, and OEMs, including Huawei and Inspur.

- NAND flash is certain to become the core technology in the development of storage and memory industries in the future as the number of consumer electronic products that include solid-state drives (SSDs) and embedded MultiMediaCards (eMMCs) increases. Chinese domestic DRAM and NAND flash consumption is dramatically increasing with the rise in popularity of Chinese PCs in enterprises. With the increase in the production of PCs in the region, the demand for SSDs has been increasing in the market.

- SSDs in enterprises store data persistently or cache data in the non-volatile semiconductor memory temporarily and are intended for use in servers, storage systems, and direct-attached storage (DAS) devices. Small and Medium Enterprises (SME) uses MLC SSD, which contains a longer life span than TLC SSD and a relatively friendlier price than SLC SSD. Due to its higher capacity and lower cost, users of TLC SSD are general customers.

- Further, the fingerprint sensor may be given as a prime feature in portable solid-state drives (SSDs), and players are focused on innovating such technology with SSD. In April 2020 despite the negative impact of pandemic, Chinese firm Hikvision launched its T100F portable SSD in the Chinese market. This SDD comes with biometric security and an embedded fingerprint sensor into the metal casing of the SSD.

Increased Adoption in Data Centers Expected to Boost the Market Growth

- The applications of SSD in data centers have been increasing owing to a wide range of factors, such as the rising need for storage facilities, improved efficacy in contrast to conventional HDD storage, and breakthroughs in enterprise-level SSD reliability and performance.

- Moreover, SSDs are preferred by businesses as they require less energy, which enables less dispersion, thereby resulting in a reduced environmental imprint.

- According to Cloudscene, China had approximately 50 internet users per 100 in 2020, and the connectivity ecosystem comprised 85 colocation data centers, 62 cloud service providers, and one network fabric. The increasing demand for memory devices, buoyed by the requirement of data centers for memory, is expected to drive the demand for SSDs.

- The growth in the Chinese data center market is expected to be bolstered by supportive government initiatives and international investments. The government's push for AI in security and intelligence use further strengthens the demand for SSDs in the country.

- For instance, Apple started constructing its first Chinese data center to expand its services in China. The project would respond to new Chinese data laws that demand the citizens' data to be hosted on Chinese soil. Thus, the abovementioned factors are expected to bolster the demand for SSDs in the country.

China Solidstate Drive (SSD) Industry Overview

The Chinese Solid State Drive Market is moderately consolidated due to a few major vendors based in the country. As the entry barriers in the market are high, the entry of new players is difficult. The existing market players view product developments and innovations as a lucrative path toward the expansion of market share. Transcend Information Inc., Teclast Electronics Co. Ltd, LITE-ON Technology Corporation, ADATA Technology Co. Ltd, and Huawei Technologies Co. Ltd are the major market players.

In July 2022, ORICO launched its new product, the ORICO USB4 High-Speed Portable SSD Montage 40 Gbps series. The new design used in this product would be manufactured using a durable in-mold labeling technique with an aim to prevent corrosion.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Adoption in Data Centers

- 4.2.2 Increasing Deployment in High-end Cloud Applications

- 4.3 Market Restraints

- 4.3.1 High Cost and Smaller Life-time of Solid State Drives

- 4.4 Industry Ecosystem Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of the Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Application

- 5.1.1 Enterprise

- 5.1.2 Clients

- 5.2 By Interface

- 5.2.1 Serial Advanced Technology Attachment (SATA)

- 5.2.2 Peripheral Component Interconnect (PCI) Express

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Huawei Technologies Co. Ltd

- 6.1.2 ADATA Technology Co. Ltd

- 6.1.3 Transcend Information Inc.

- 6.1.4 Teclast Electronics Co. Ltd

- 6.1.5 LITE-ON Technology Corporation

- 6.1.6 Lenovo Group Limited

- 6.1.7 Memblaze Technology Co. Ltd

- 6.1.8 Maxiotek Corporation

- 6.1.9 PHISON ELECTRONICS