|

市场调查报告书

商品编码

1643171

罐头食品市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Food Cans - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

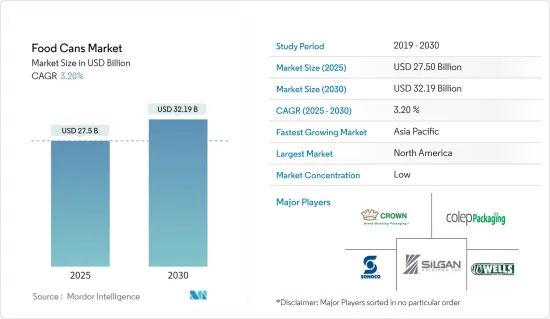

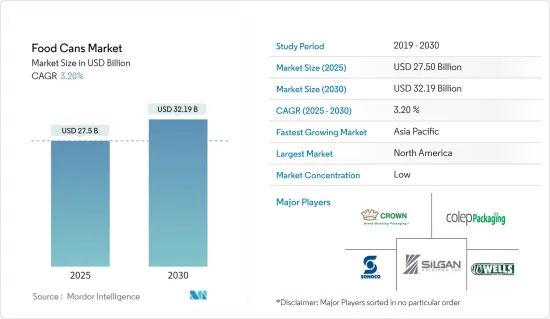

2025 年罐头食品市场规模预计为 275 亿美元,预计到 2030 年将达到 321.9 亿美元,预测期内(2025-2030 年)的复合年增长率为 3.2%。

罐头越来越受欢迎,可用于保存各种食品,包括水果、蔬菜、豆类、汤、肉类和鱼贝类,这为包装公司提供了巨大的市场机会。新兴国家对即食罐头食品的需求激增预计将扩大市场规模。

关键亮点

- 罐头食品已成为保存食品新鲜度和营养成分的热门选择。罐头製造流程的增加可望延长包装食品的保质期,从而增强罐头食品市场。钢铁作为饮料和冷冻乳製品包装罐的材料的使用越来越多,为在这个市场运营的公司创造了巨大的机会。

- 另一方面,金属罐可无限回收,预计将推动食品包装公司对金属罐的需求成长。根据美国钢铁协会统计,炼钢过程中生产的90%以上的产品被重新利用或回收。

- 快速的都市化、不断变化的饮食习惯、不断提高的收入水平和不断增加的已调理食品消费正在推动全球对罐头食品的需求。此外,人们对食品品质的日益关注和对卫生食品的需求不断增加预计将促进市场成长。新兴国家对食品包装解决方案的高需求为市场参与企业提供了有利可图的机会。

- 该行业还需要对替代包装选择的支持,例如塑胶包装。塑胶是食品工业中广泛使用的包装材料。塑胶以其柔韧性、耐用性和重量轻而闻名。由于人们对塑胶造成的环境污染的担忧日益增加,可回收塑胶材料的使用日益增加。此类替代材料的成长可能会影响罐头食品市场的成长。

- 金属罐包装面临来自塑胶、纸和玻璃等其他包装解决方案的竞争。塑胶包装仍然是金属包装的主要竞争对手。食品业是金属罐的主要用户,现在开始采用可回收塑胶包装解决方案。塑胶罐是透明的,这有助于品牌表明食品的品质。塑胶的透明度和成本效益特性可能会限制金属食品罐的市场。

罐头食品市场的趋势

铝罐市场成长最快

- 铝罐有利于长期维持食品品质。这些罐子声称可以几乎 100% 抵抗光、氧气、湿气和其他污染物。它还具有防銹、防腐蚀功能,可延长保质期。铝具有光滑、轻巧等重要特性,可协助製造商节省物流成本。

- 铝罐因其可堆迭性、重量轻、强度高、耐运输、不规则物料输送和易于回收等多种因素而变得越来越重要,使得品牌能够使用更少的材料来包装和运输更多产品。根据美国地质调查局预测,2021年铝消费量进口量为483万吨,2023年将达480万吨。

- 铝罐的一大优点是可回收。罐头中使用的铝几乎100%都可以熔化并重新利用。铝罐在其生命週期结束时可以回收利用,这使其成为整个食品行业品牌的首选包装形式。

- 纽约大学全球公共卫生学院研究人员的一项新研究表明,几十年来,几乎美国每个阶层的超加工食品消费量都有所增加。美国的平均饮食结构正在转向加工饮食。这是一个令人担忧的问题,因为吃大量超加工食品会导致饮食品质不佳并增加患多种慢性疾病的风险。超加工食品是工业生产的即食或加热食品,含添加剂,一般不含全食物。

- 产品包装的可回收性正引发消费者寻求更多永续产品的兴趣。因此,被誉为可无限回收的铝越来越受到产品製造商及其消费者的欢迎。转向使用铝的行业包括食品包装产品。向铝的转变也反映在绿色包装的预期成长。

亚太地区可望创下最快成长

- 金属罐的环境效益及其简单且快速的回收利用,以及对罐头产品日益增长的需求,预计将对该地区市场的成长产生积极影响。政府对蔬菜、麵条、肉类等塑胶包装产品的监管日益严格,为市场成长创造了机会。

- 亚太地区对自然资源利用的需求不断增长,刺激了回收活动并增加了金属的再利用。该地区各国的铝罐回收率差异很大。

- 日本等国家进口铝罐,根据日本铝罐回收协会(JACRA)的数据,2023 年进口量将达到 4.3 亿个满罐和 6,000 万个空罐,高于 2021 年的 4.1 亿个满罐和 9,000 万个空罐。

- 都市化进程加快、可支配收入增加、核心家庭增加以及对方便产品的偏好正在推动加工食品的需求。透过加工和销售食品,他们可以卖出更高的价格并获得更大的经济价值。例如,根据印度储备银行的估计,製造预製家常小菜可为产品增加 30% 的价值,而加工肉类可为产品增加 12.7% 的价值。

- 据IBEF称,印度有巨大的潜力成为世界主要加工食品出口国。这些包括丰富的农业资源基础、战略地理位置和接近性粮食进口国,以及广泛的食品加工培训、学术和研究设施网络。预计食品业对经济成长至关重要,2022 年的市场规模将达到 8,660 亿美元。 2023年,食品市场预计将创造9,630亿美元的收益。

罐头食品产业概况

罐头食品市场本质上是细分的,许多主要企业不断试图抢占最大的市场占有率。主要参与企业包括 Crown Holdings Inc.、Silgan Holdings Inc.、CANPACK SA、Wells Can Company 和 Sonoco Products Company。

- 2024年1月,供应食品罐的澳洲包装回收公司Visy Industries宣布收购塑胶回收再利用Advanced Circular Polymers (ACP)。这项策略性倡议将加强 Visy 的回收业务,并防止大量难以回收的塑胶最终进入垃圾掩埋场。

- 2023 年 11 月,Sonoco Products Company 收购了 Amcor Packaging(澳洲)的复合槽业务。 Amcor 的业务由两家工厂组成,一家位于墨尔本郊外,一家位于悉尼,主要服务于香辛料、食品和清洁剂市场。收购Amcor的罐头厂将进一步加强该公司在亚太地区的地位。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场动态

- 市场驱动因素

- 收入水准的提高和零售体系的发展导致包装食品和食品饮料的消费量增加

- 市场限制

- 食品业对软质塑胶替代品的需求不断增加

第六章 市场细分

- 依材料类型

- 铝罐

- 钢罐

- 按应用

- 调理食品

- 粉末产品

- 鱼贝类

- 水果和蔬菜

- 加工食品

- 宠物食品

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 亚洲

- 中国

- 印度

- 日本

- 澳洲和纽西兰

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 北美洲

第七章 竞争格局

- 公司简介

- Crown Holdings, Inc.

- Wells Can Company

- Kian Joo Group

- Silgan Holdings Inc.

- CANPACK SA(CANPACK Group)

- Aaron Packaging Inc.

- Toyo Seikan Group Holdings Ltd.

- Visy Industries

- Jamestrong Packaging

- Colep Packaging

- Trivium Packaging

- Sonoco Products Company

第八章投资分析

第九章:市场的未来

The Food Cans Market size is estimated at USD 27.50 billion in 2025, and is expected to reach USD 32.19 billion by 2030, at a CAGR of 3.2% during the forecast period (2025-2030).

The increase in the popularity of canned food to preserve a wide variety of food, such as fruits, vegetables, beans, soups, meats, and seafood, offers significant market opportunities for packaging companies. The surge in demand for ready-to-eat canned food products in developing countries is expected to boost the market value.

Key Highlights

- Food cans are a widespread option for maintaining the freshness and nutritional content of food products. An increase in the canning process to enhance the shelf life of packaged food is expected to strengthen the food cans market. The rise in the utilization of steel as the material for cans for packaging beverages and frozen dairy products presents significant opportunities for companies operating in the market.

- On the other hand, metal cans are infinitely recyclable, which is anticipated to fuel the growth of these cans among food packaging companies. According to the American and Iron Steel Institute, over 90% of the co-products from the steel-making process are reused or recycled.

- Rapid urbanization, changing food habits, increased income levels, and increased consumption of ready-to-eat food are fueling the demand for canned food cans across the world. Moreover, the rise in concern over food quality and increased demand for hygienic food are expected to contribute to the market growth. Significant demand for food packaging solutions in developing countries offers lucrative opportunities for market players.

- The industry also needs help with alternative packaging options, such as plastic packaging. Plastic is a widely used packaging material in the food industry. It is known for its flexibility, durability, and lightweight. The usage of recyclable plastic materials is gaining traction due to the growing concerns about environmental pollution caused by plastic. Such growth of alternative materials can affect the market growth of food cans.

- Metal can packaging faces much competition from other packaging solutions such as plastic, paper, or glass. Plastic packaging continues to be the main competitor of metal packaging. The food industry, the primary user of metal cans, has started adopting recyclable plastic packaging solutions. Plastic cans are transparent, which helps brands to show their food's quality. Plastic's transparent and cost-effective properties might limit the metal food cans market.

Food Cans Market Trends

Aluminum Cans to Witness Highest Market Growth

- Aluminum cans deliver long-term food quality preservation advantages. These cans offer nearly 100% protection against light, oxygen, moisture, and other contaminants. They are rust and corrosion-resistant, providing extended shelf life. Aluminum has significant properties, such as being smoother and lighter, aiding manufacturers in saving logistics expenses.

- Aluminum cans are gaining significance due to various factors, such as stackability, light weight, strength, resistance to transportation, irregular handling, and easy recyclability, allowing brands to package and transport more using less material. According to the US Geological Survey, the imports of aluminum consumption in 2021 were 4,830 thousand metric tons, and they reached 4,800 thousand metric tons in 2023.

- One of the significant benefits of aluminum cans is that they are recyclable. Almost 100% of the aluminum used in the cans can be melted down and utilized too. These can be recycled at the end of their lifecycle, making them the preferred packaging type for brands across the food industry.

- According to a new study by the NYU School of Global Public Health researchers, the consumption of ultra-processed foods has risen over a couple of decades across nearly all segments of the US population. The composition of the average US diet has moved toward a more processed diet. This is concerning, as eating more ultra-processed foods is associated with inadequate diet quality and a higher risk of several chronic diseases. Ultra-processed foods are industrially manufactured, ready to eat or heat, include additives, and are mainly devoid of whole foods.

- The recyclability of product packaging is of increasing interest to consumers seeking more sustainable products. As a result, aluminum, which is touted as infinitely recyclable, is gaining traction among product manufacturers and the consumers they serve. Industries transitioning to aluminum include food packaging products. The move to aluminum is reflected in the expected growth of green packaging.

Asia-Pacific Expected to Register Fastest Growth

- The environmental advantages of metal cans and their easy and quick recycling, along with the growing demand for canned products, are anticipated to positively affect the market growth in the region. Increasing government restrictions on plastic packaging products for packing vegetables, noodles, meat, etc., are creating opportunities for market growth.

- Growing demand for the utilization of natural resources in the region has revved recycling activities and increased the reuse of metals in the Asia-Pacific. There are substantial variations in the recycling rate of aluminum cans across the countries in the region.

- Countries such as Japan import aluminum cans to the country, and according to the Japan Aluminum Cans Recycling Association (JACRA), in 2023, the actual cans imported were 430 million units, and empty cans were 60 million units, and imports increased from 410 actual cans and 90 empty cans in 2021.

- Increased urbanization, higher disposable incomes, the growth of nuclear families, and a preference for convenience goods are driving the demand for processed food products. Selling food in processed form allows one to charge a more significant price and capture a more considerable economic value. For instance, according to an estimation by the RBI, manufacturing prepared meals adds 30% value to the product, whereas processing meat adds 12.7%.

- According to the IBEF, India has significant potential to become a global processed food export powerhouse. It includes an affluent agricultural resource base, strategic geographic location and proximity to food-importing countries, and an expansive network of food processing training, academic, and research facilities. With a market size of USD 866 billion in 2022, the food industry was projected to be critical to the economy's growth. In 2023, the food market was expected to generate USD 963 billion in revenue.

Food Cans Industry Overview

The food cans market is fragmented in nature, as many key players continually try to gain maximum market share. Some of the major players include Crown Holdings Inc., Silgan Holdings Inc., CANPACK SA, Wells Can Company, and Sonoco Products Company.

- In January 2024, Australian packaging and recycling company Visy Industries, a provider of food cans, announced the acquisition of Advanced Circular Polymers (ACP), a plastic recycling company. This strategic move will bolster Visy's recycling operations and prevent a significant volume of hard-to-recycle plastics from ending in landfills.

- In November 2023, Sonoco Products Company purchased the composite can operations of Amcor Packaging (Australia). The Amcor operations consist of two plants, one in suburban Melbourne and the other in Sydney, and they mainly serve the spice, food, and cleanser sectors. Acquiring the Amcor can plants will further strengthen its position in the Asia-Pacific.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Improving Income Levels and Development of Retail Systems are Increasing the Consumption of Packaged Food and Beverages.

- 5.2 Market Restraints

- 5.2.1 Increasing Demand for Alternatives, such as Flexible Plastics, in the Food Industry.

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Aluminium Cans

- 6.1.2 Steel Cans

- 6.2 By Application

- 6.2.1 Ready Meals

- 6.2.2 Powder Products

- 6.2.3 Fish and Seafood

- 6.2.4 Fruits and Vegetables

- 6.2.5 Processed Food

- 6.2.6 Pet Food

- 6.2.7 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Spain

- 6.3.2.5 Italy

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 Australia and New Zealand

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.4.3 Argentina

- 6.3.5 Middle East and Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 South Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Crown Holdings, Inc.

- 7.1.2 Wells Can Company

- 7.1.3 Kian Joo Group

- 7.1.4 Silgan Holdings Inc.

- 7.1.5 CANPACK S.A. (CANPACK Group)

- 7.1.6 Aaron Packaging Inc.

- 7.1.7 Toyo Seikan Group Holdings Ltd.

- 7.1.8 Visy Industries

- 7.1.9 Jamestrong Packaging

- 7.1.10 Colep Packaging

- 7.1.11 Trivium Packaging

- 7.1.12 Sonoco Products Company