|

市场调查报告书

商品编码

1643175

印度电池能源储存系统係统-市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)India Battery Energy Storage Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

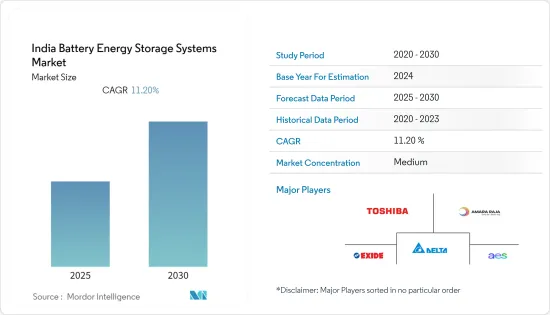

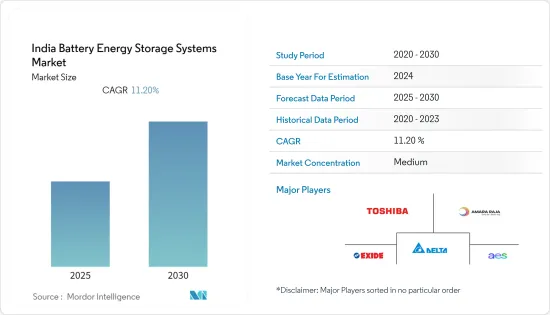

预测期内,印度电池能源储存系统(BESS) 市场预计复合年增长率为 11.2%

关键亮点

- 从中期来看,锂离子电池价格下跌以及政府推动采用能源储存的倡议等因素预计将在预测期内推动印度电池能源储存系统係统市场的发展。

- 另一方面,有关能源储存运作和所有权的法规的不确定性可能会在研究期间阻碍印度电池能源储存系统(BESS) 市场的成长。

- 用于储存能源的新型电池技术的进步以及印度到 2030 年达到约 500 吉瓦可再生能源容量的目标,可能会在预测期内为印度 BESS 市场创造丰厚的成长机会。

印度电池储存市场的趋势

预计锂离子电池领域将占市场主导地位。

- 可再生能源发电计划对锂离子电池的需求很高。许多可再生能源产业专家认为,如果没有能源储存系统,印度的可再生能源成长将是不完整的,而锂电池提供了最具成本效益的整合系统。

- 锂太阳能电池是一种可充电的能源储存解决方案,可与太阳能发电系统配对以储存多余的太阳能。截至2022年11月30日,印度太阳能发电装置容量约为6197万千瓦,政府已规划了多个计划,以实现到2022年将太阳能发电装置容量提升至1亿千瓦的雄心勃勃的目标。然而,由于太阳能供电具有间歇性,许多私人公司正在规划太阳能加能源储存计划,以确保电网的持续供电。

- 2023年6月,塔塔集团旗下的Agratas Energy Storage Solutions Private Limited与古吉拉突邦政府签署协议,在古吉拉突邦建立印度首家锂离子电池超级工厂。该公司计划最初投资 15.7 亿美元建造 20 吉瓦(GW)的发电厂。

- 塔塔电力太阳能係统有限公司(Tata Power Solar)已订单印度太阳能公司(SECI)在恰蒂斯加尔邦的一个太阳能+储能计划。该计划涉及一座 100MW 太阳能发电厂的 EPC 服务,该发电厂配备一个容量为 120MWh 的公用事业规模电池能源储存系统(BESS)。计划总成本约为1.15亿美元。预计 2023 年下半年开始试运行。

- 此外,Ramagiri太阳能-风能混合计划与电池能源储存系统係统结合,是印度能源储存发展的完美典范。该计划位于安得拉邦阿南塔普尔,由印度太阳能公司(SECI)拥有。目前正在建设中,预计2022年完工。

- 由于这些新兴市场的发展,预计锂离子电池领域将在预测期内占据最大的市场占有率。

政府措施推动市场

- 印度电池能源储存市场可能会进一步受到政府支持政策和措施的推动,以促进该技术的采用。

- 印度电力装置容量的成长并未达到印度政府的预期。因此,政府正试图透过纳入各种热能和可再生能源计划来推动这一领域的发展。可再生能源装置容量(包括大型水力发电)从2014年3月的76.37吉瓦增加到2022年12月的167.75吉瓦。

- 根据中央电力局预测,2022-23 年可再生能源发电发电量将达到 2,035,520 百万单位 (MU),上年度财年增加 19%。

- 在可再生能源总装置容量中,截至2021年印度的电池储能装置容量约为20MW,预计2030年所需容量约为38GW。印度政府和相关组织正在规划多个计划,将储能係统整合到可再生能源发电计划中。

- 2022 年 10 月,美国能源局(DOE) 和印度电力部 (MoP) 成立了能源储存工作小组,以促进两国政府官员、产业代表和其他相关人员之间进行持续、有意义的对话,帮助加速能源储存技术的扩大和部署,推动向清洁能源未来的过渡。

- 由于这些发展,预计政府政策将成为预测期内最重要的市场驱动力。

印度电池能源储存系统係统产业概况

印度电池能源储存系统係统市场适度细分。市场的主要企业(不分先后顺序)包括东芝公司、AES 公司、Exide Industries Ltd、台达电子公司和 Amara Raja 集团。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 至2028年市场规模及需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 能源储存技术成本下降

- 政府推动广泛使用能源储存的倡议

- 限制因素

- 关于能源储存运作和所有权的法规存在不确定性

- 驱动程式

- 供应链分析

- PESTLE分析

第五章 市场区隔

- 电池类型

- 锂离子

- 铅酸电池

- 流动

- 其他的

- 连接类型

- 併网

- 离网

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- AES Corporation

- Exide Industries Ltd.

- Delta Electronics Inc.

- Toshiba Corporation

- Amara Raja Group

- Panasonic Corporation

第七章 市场机会与未来趋势

- 印度的目标是到 2030 年实现约 500 吉瓦可再生能源装置容量

简介目录

Product Code: 70157

The India Battery Energy Storage Systems Market is expected to register a CAGR of 11.2% during the forecast period.

Key Highlights

- Over the medium term, factors such as declining prices of lithium-ion batteries and government initiatives to promote energy storage deployment are likely to drive the India battery energy storage systems market in the forecast period.

- On the other hand, the uncertainty in the rules governing energy storage operations and ownership will likely hinder the growth of the India battery energy storage systems (BESS) market in the studied period.

- Nevertheless, technological advancements in new battery technologies to store energy and India's target to reach around 500 GW of renewable capacity by 2030 will likely create lucrative growth opportunities for the India BESS market during the forecast period.

India Battery Energy Storage Systems Market Trends

Lithium-ion Battery Segment Expected to Dominate the Market

- Lithium-ion batteries witness high demand in renewable power projects. Many renewable industry experts believe that the growth of renewables in India is incomplete without energy storage systems, and lithium batteries offer the most cost-effective integration.

- Lithium solar batteries are a rechargeable energy storage solution that can be paired with a solar power system to store excess solar power. India's installed solar energy capacity stood at around 61.97 GW as of 30th November 2022, and the government planned many projects to reach its ambitious target of increasing its share to 100 GW by 2022. But due to the intermittency of solar power supply, many private players have planned solar plus energy storage projects to ensure a continuous power supply to the grid.

- In June 2023, Tata Group subsidiary Agratas Energy Storage Solutions Private Limited signed an agreement with the Gujarat government to set up India's first gigafactory for Lithium-Ion batteries in the state. The company is expected to invest USD 1.57 billion initially to set up a 20-gigawatt (GW) unit.

- Tata Power Solar Systems Limited (Tata Power Solar) bagged a solar plus storage project from Solar Energy Corporation of India Ltd (SECI) in Chattisgarh. The project includes EPC services for a 100 MW solar power plant with a utility-scale Battery Energy Storage System (BESS) of 120 MWh capacity. The total outlay of the project was approximately USD 115 million. It is likely to get commissioned in the second half of 2023.

- Moreover, The Ramagiri Solar-Wind-Hybrid project, integrated with battery energy storage systems, is a perfect example of energy storage development in India. Located in Anantapur, Andhra Pradesh, the project is owned by the Solar Energy Corporation of India (SECI). It is currently under construction and is expected to be completed by 2022.

- Due to such developments, the lithium-ion battery segment is expected to hold the largest market share during the forecast period.

Government Initiatives Expected to Drive the Market

- The Indian battery energy storage market will likely be further driven by supportive government policies and initiatives to ease technological implementation.

- The power capacity additions in India were not as per the expectations of the Indian government. Thus, the government is trying to boost the sector by including various thermal and renewable projects. The installed Renewable energy capacity (including large hydro) has increased from 76.37 GW in March 2014 to 167.75 GW in December 2022, i.e., an increase of around 2.20 times.

- According to Central Electricity Authority, in FY 2022-23, the country's total renewable energy generation accounted for 203,552 million units (MU), with an annual growth rate of 19% compared to the previous year.

- Out of the total renewable installed capacity, India's installed battery energy storage capacity was around 20MW as of 2021, and the required capacity is estimated to be about 38 GW by 2030. Several projects have been planned to integrate energy storage systems in renewable power projects by the Indian government and affiliated entities.

- In October 2022, The United States Department of Energy (DOE) and India's Ministry of Power (MoP) established the Energy Storage Task Force to facilitate an ongoing and meaningful dialogue between government officials, industry representatives, and other stakeholders from both countries to help scale up and accelerate deployment of energy storage technologies to facilitate the transition to a clean energy future.

- Owing to these developments, government policies are expected to be the most significant market drivers during the forecast period.

India Battery Energy Storage Systems Industry Overview

India's battery energy storage systems market is moderately fragmented. Some of the major players in the market (in no particular order) include Toshiba Corporation, AES Corporation, Exide Industries Ltd, Delta Electronics Inc., and Amara Raja Group.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecasts in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Declining Cost of Energy Storage Technologies

- 4.5.1.2 Government Initiatives to Promote Energy Storage Deployment

- 4.5.2 Restraints

- 4.5.2.1 Uncertainty in the Rules Governing Energy Storage Operations and Ownership

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion

- 5.1.2 Lead-acid

- 5.1.3 Flow

- 5.1.4 Other Battery Types

- 5.2 Connection Type

- 5.2.1 On-grid

- 5.2.2 Off-grid

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 AES Corporation

- 6.3.2 Exide Industries Ltd.

- 6.3.3 Delta Electronics Inc.

- 6.3.4 Toshiba Corporation

- 6.3.5 Amara Raja Group

- 6.3.6 Panasonic Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 India's Target to Reach Around 500 GW of Renewable Capacity by 2030

02-2729-4219

+886-2-2729-4219