|

市场调查报告书

商品编码

1643209

欧洲光伏 (PV) -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Europe Solar Photovoltaic (PV) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

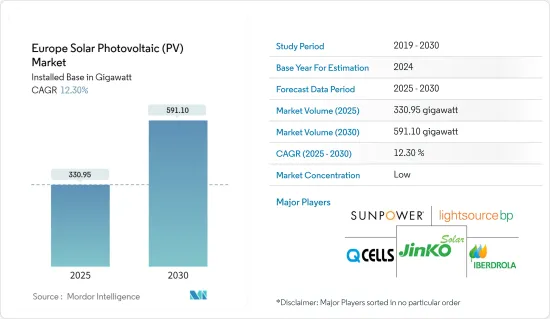

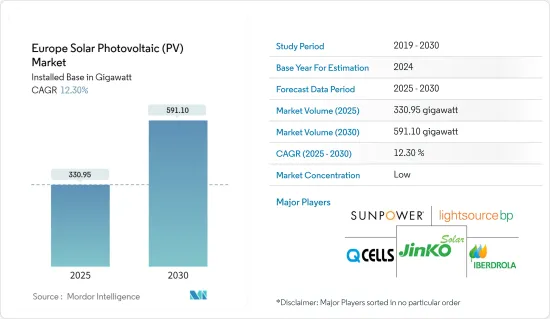

欧洲太阳能光电 (PV) 市场规模(安装基数)预计将从 2025 年的 330.95 GW 成长到 2030 年的 591.10 GW,预测期内(2025-2030 年)的复合年增长率为 12.3%。

关键亮点

- 从中期来看,全部区域对电力的需求不断增长、太阳能计划投资不断增加以及可再生能源发电正在推动市场成长。

- 另一方面,对天然气发电的日益重视以及用于发电的天然气的低可用性正在抑制欧洲市场的成长。

- 然而,为推动太阳能应用而实施的雄心勃勃的太阳能目标预计将在预测期内为市场创造有利可图的机会。

- 德国拥有最大的装置容量,预计在预测期内将主导欧洲太阳能光电 (PV) 市场。

欧洲光伏 (PV) 市场趋势

屋顶市场预计将出现显着的市场成长

- 预计预测期内欧洲屋顶市场将显着成长。欧洲的屋顶安装具有巨大的潜力,因为欧洲大多数屋顶都未被使用。欧洲多个国家正在修改其薪酬水准评估方法。

- 挪威、波罗的海地区和爱尔兰等国家拥有安装屋顶太阳能设施的有利地理条件。因此,预测期内欧洲屋顶太阳能光电安装量预计会增加。此外,在一些国家,越来越多的住宅开始安装屋顶光电模组以减少电费。根据国际可再生能源机构(IRENA)的预测,2023年欧洲太阳能发电装置与前一年同期比较将达到285.80吉瓦,年增23.45%。

- 2023年12月,欧洲议会和理事会就加强建筑物能源性能指令(EPBD)达成临时协议,旨在促进建筑物的能源性能,并强制要求新建建筑具备光伏性能。 EPBD也要求欧盟成员国确保新建筑适合安装屋顶光电发电和热能发电厂。自2027年起,现有公共建筑和非住宅建筑必须安装太阳能发电系统。

- 一些政府已经采取了支持政策,以扩大该地区屋顶太阳能板的部署。例如,2023 年 3 月,欧洲各国政府通过了修订后的《房屋能源性能指令》,要求到 2028 年所有新建建筑都必须安装屋顶太阳能发电系统,到 2032 年住宅重建都必须安装屋顶太阳能发电系统。

- 2023年,德国太阳能光电装置容量将达到创纪录的14吉瓦,达到一个里程碑。根据德国光电协会(BSW)通报,与前一年相比,发电容量增加了 85%。容量的激增主要受到住宅需求的推动,尤其是屋顶太阳能光电系统。 BSW 注意到一个显着的成长,2023 年第一季将有 159,000 个太阳能光电系统运作,是 2022 年同期的两倍多。

- 鑑于上述情况,预计预测期内屋顶太阳能光电将在欧洲太阳能光电市场中见证显着成长。

德国可望主导市场

- 德国是欧洲可再生能源生产(包括太阳能)最有利可图的市场之一。由于国家製定了减少二氧化碳排放的目标,太阳能发电的安装量大幅增长,预计未来这一趋势仍将持续。

- 近年来,该国太阳能发电能力显着成长。 2023年太阳能发电装置容量约为81.73GW,而2022年为67.47GW,复合年增长率超过21%,显示太阳能发电系统的渗透率正在提高。

- 该国已实施多项法规和激励措施,鼓励在都市区安装太阳能板。 2023年6月,德国经济部宣布政府将提供新的资金来重组该国的太阳能产业。经济部将很快推出新的资金筹措工具,并将根据新的欧盟补贴框架准备未来的竞标。

- 德国一些城市已强制要求新建建筑配备太阳能发电系统,有助于扩大德国国内市场。 2022年12月,欧盟核准了德国280亿欧元的可再生能源计画。该倡议的目的是迅速扩大包括太阳能发电在内的自然能源的使用。这是德国到2030年实现80%电力来自可再生能源的目标的一部分。

- 因此,鑑于上述情况,预计德国太阳能将在预测期内主导欧洲太阳能市场。

欧洲光电产业概况

欧洲太阳能光电市场是分散的。市场的主要企业(不分先后顺序)包括 Hanwha Q CELLS Technology、Iberdrola SA、SunPower Corporation、JinkoSolar Holding 和 Lightsource BP Renewable Energy Investments Limited。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场概况

- 介绍

- 至2029年装置容量及预测(单位:GW)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 全部区域的电力需求增加

- 增加对太阳能计划的投资

- 限制因素

- 更加重视天然气发电

- 驱动程式

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场区隔

- 类型

- 薄膜

- 硅晶型

- 最终用户

- 住宅

- 商业和工业(包括中小企业)

- 扩张

- 地面安装

- 屋顶安装类型

- 2029 年市场规模与需求预测(按地区)

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 比利时

- 北欧的

- 土耳其

- 欧洲其他地区

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- First Solar Inc.

- Electricite de France SA(EDF)

- Hanwha Q CELLS Technology Co. Ltd

- Iberdrola SA

- JinkoSolar Holding Co. Ltd

- SunPower Corporation

- Lightsource bp Renewable Energy Investments Limited

- Enel SpA

- Centrotherm International AG

- 市场排名/份额(%)分析

第七章 市场机会与未来趋势

- 雄心勃勃的太阳能目标

The Europe Solar Photovoltaic Market size in terms of installed base is expected to grow from 330.95 gigawatt in 2025 to 591.10 gigawatt by 2030, at a CAGR of 12.3% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as rising demand for electricity across the region, increasing investments in solar energy projects, and producing most of the electricity from renewable sources have driven the growth of the market.

- On the other hand, the rising emphasis on natural gas power generation and the availability of natural gas at lower prices for power generation restrain the market growth in the European region.

- However, the ambitious solar energy targets implemented to boost solar PV installation are expected to create lucrative opportunities for the market during the forecast period.

- Germany, with the largest installed capacity of solar photovoltaics, is expected to dominate the European solar photovoltaics (PV) market during the forecast period.

Europe Solar Photovoltaic (PV) Market Trends

The Rooftop Segment Anticipated to Witness Significant Market Growth

- The rooftop segment is estimated to witness significant growth during the forecast period in Europe. The European region's rooftop installation has lots of potential as most of Europe's roof surfaces are unused. Several countries in Europe are working on modifying their policies to assess remuneration levels.

- Norway, the Baltic region, Ireland, and others have geographical conditions favorable to rooftop PV installation. This is expected to increase rooftop solar PV installation in Europe during the forecast period. Also, in several countries, homeowners are willing to install rooftop PV modules to reduce their electricity bills. According to the International Renewable Energy Agency (IRENA), in 2023, Europe's solar PV installed reached 285.80 GW, with a growth rate of 23.45% over the previous year.

- In December 2023, the European Parliament and the European Council reached an interim agreement on the strengthened Energy Performance of Buildings Directive (EPBD), aspiring to stimulate the energy performance of buildings and requiring new buildings to be solar-ready. The EPBD also mandates that EU member states ensure new buildings are fit to host rooftop solar PV or thermal installations. Existing public and non-residential building solar will require to be installed commencing from 2027.

- Governments in several countries have adopted supportive policies to increase the deployment of rooftop PV arrays within the region. For instance, in March 2023, the European government adopted the revised Energy Performance of Business Directive mandating rooftop solar systems for all new buildings by 2028 and renovating residential buildings by 2032.

- In 2023, Germany achieved a milestone by installing a record 14GW of solar energy capacity, facilitated by adding over a million new solar power systems, a significant portion of which were residential rooftop installations. This surge reflects an impressive 85% increase in capacity compared to the previous year, as the German Solar Association (BSW) reported. The surge in capacity was primarily fueled by residential demand, particularly for rooftop solar power systems. The BSW noted a substantial increase, with 159,000 PV systems operational in the first quarter of 2023, more than double the number recorded during the same period in 2022.

- Therefore, from the above points, the rooftop solar photovoltaic segment is anticipated to witness significant growth in the European solar photovoltaic market during the forecast period.

Germany Expected to Dominate the Market

- Germany is one of the most lucrative markets in the European region for renewable energy production, including solar. The country has experienced significant developments in solar PV installation due to its target of reducing carbon emissions, and it is likely to continue witnessing growth in solar installation.

- The country's solar PV installed capacity has witnessed massive growth in recent years. In 2023, the installed solar PV was around 81.73 GW compared to 67.47 GW in 2022, registering a CAGR of over 21%, signifying the country's growing penetration of solar PV systems.

- The country has implemented several regulations and incentive schemes to promote the installation of solar modules in cities. In June 2023, Germany's economy ministry announced new government funding to rebuild the country's solar industry. The economy ministry is expected to present the new funding instrument soon and is preparing a tender in line with a new EU subsidy framework in the future.

- The mandates for solar photovoltaic installation on new buildings in a few German cities have helped expand the market in Germany. In December 2022, the European Union approved a EUR 28 billion German renewable energy scheme. The policy aims to increase the use of renewables, including solar power rapidly. It is designed to deliver Germany's target of producing 80% of its electricity from renewable sources by 2030.

- Therefore, based on the above points, solar photovoltaic in Germany will dominate the European solar photovoltaic market during the forecast period.

Europe Solar Photovoltaic (PV) Industry Overview

The European solar photovoltaic (PV) market is fragmented. Some of the major companies in the market (in no particular order) include Hanwha Q CELLS Technology Co. Ltd, Iberdrola SA, SunPower Corporation, JinkoSolar Holding Co. Ltd, and Lightsource BP Renewable Energy Investments Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definiton

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Installed Capacity and Forecast, in GW, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Rising Demand for Electricity across the Region

- 4.5.1.2 Increasing Investments on Solar Energy Projects

- 4.5.2 Restraints

- 4.5.2.1 Rising Emphasis on Natural Gas Power Generation

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Thin Film

- 5.1.2 Crystalline Silicon

- 5.2 End User

- 5.2.1 Residential

- 5.2.2 Commercial and Industrial (including SMEs)

- 5.3 Deployment

- 5.3.1 Ground-Mounted

- 5.3.2 Rooftop Solar

- 5.4 Geography Regional Market Analysis {Market Size and Demand Forecast till 2029 (for regions only)}

- 5.4.1 Germany

- 5.4.2 United Kingdom

- 5.4.3 France

- 5.4.4 Italy

- 5.4.5 Spain

- 5.4.6 Netherlands

- 5.4.7 Belgium

- 5.4.8 Nordic

- 5.4.9 Turkey

- 5.4.10 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 First Solar Inc.

- 6.3.2 Electricite de France S.A. (EDF)

- 6.3.3 Hanwha Q CELLS Technology Co. Ltd

- 6.3.4 Iberdrola SA

- 6.3.5 JinkoSolar Holding Co. Ltd

- 6.3.6 SunPower Corporation

- 6.3.7 Lightsource bp Renewable Energy Investments Limited

- 6.3.8 Enel SpA

- 6.3.9 Centrotherm International AG

- 6.4 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Ambitious Solar Energy Targets