|

市场调查报告书

商品编码

1643217

西非可再生能源 -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)West Africa Renewable Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

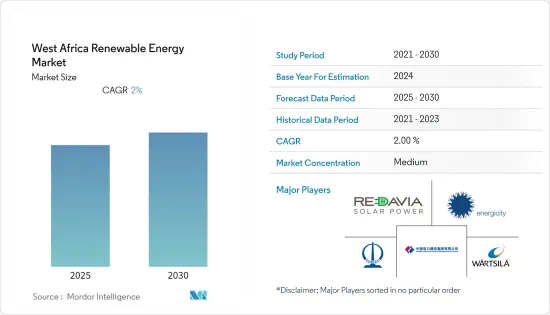

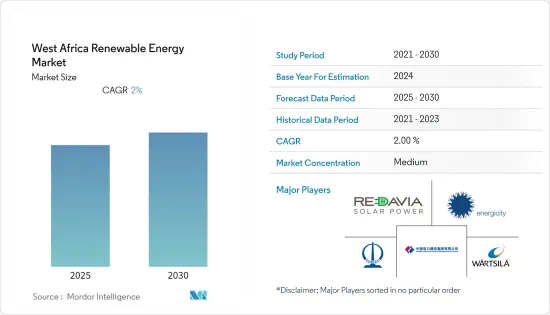

预计预测期内西非可再生能源市场复合年增长率将达到 2%。

2020 年,新冠疫情对市场产生了负面影响。目前市场已恢復至疫情前的水准。

关键亮点

- 从长远来看,环保意识、法规收紧以及每千瓦发电成本下降等因素预计将推动市场发展。

- 同时,与石化燃料相比,可再生能源的价格较高,预计将抑制市场。

- 然而,采用薄膜技术製造的新型太阳能电池(在太阳能电池上使用一层薄薄的碲化镉涂层)由于其效率高、成本低,可能为此领域带来机会。

- 由于政府致力于减少对进口石化燃料的依赖,预计尼日利亚将成为该地区可再生能源的最大份额。

西非可再生能源市场趋势

水电领域占市场主导地位

- 由于西非各地建造了水坝,水力发电产业预计将占据市场主导地位。大部分可再生水力发电能力都位于奈及利亚和加纳。

- 水力发电部分包括各种规模的水库大坝,可用于提供可再生能源。水力发电是西非应用最广泛的可再生能源。

- 2022年11月,奈及利亚政府核准斥资30亿美元兴建一座1,650兆瓦的水力发电厂。该计划将由官民合作关係资金筹措,位于中北部地区贝努埃州的 Laolu Akande。

- 2021年9月,几内亚苏阿皮蒂水力发电厂开始商业营运。该设施每年将生产 1,900 吉瓦时的清洁能源,将下游卡莱塔水力发电计画的发电量提高到每年 1,000 吉瓦时的清洁能源。

- 水力发电(包括混合电厂)占该地区可再生能源发电总量的近 94.2%,2021 年发电量约为 5,513 兆瓦。

- 因此,与其他可再生能源可再生,大型水坝水库规模较大且投资不断增加,预计它们将继续占据市场主导地位。

尼日利亚占据市场主导地位

- 由于尼日利亚电力消耗量高且政府着力减少对进口石化燃料的依赖,预计预测期内尼日利亚将成为可再生能源占比最大的国家。

- 尼日利亚是西非人口最多的国家。由于人口众多,电力需求很高,预计可再生能源将会成长。然而,可再生能源的高成本限制了其发展。

- 该国大部分可再生能源装置容量来自发电工程。 2021年水力发电装置容量为2,111兆瓦,约占全国可再生能源总量的98%。然而,由于对太阳能的投资增加,预计这种情况将在预测期内发生变化。

- 2022 年 9 月,Sterling & Wilson Renewable Energy 及其财团合作伙伴 Sun Africa 获得了尼日利亚政府一份价值 15 亿美元的订单,在五个地点安装太阳能发电厂,总装机容量为 961 兆瓦,以及电池能源储存系统,总设备容量为 455 兆瓦。

- 由于尼日利亚土地面积广阔且可再生能源装置容量不断增加,预计预测期内它将占据市场主导地位。

西非可再生能源产业概况

西非可再生能源市场适度整合。该市场的主要企业包括(不分先后顺序)中国电力建设集团有限公司、Energicity Corp、瓦锡兰公司、中国土木工程集团公司和REDAVIA GmbH。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场概况

- 介绍

- 至2027年可再生能源产能预测(单位:MW)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场区隔

- 类型

- 水力发电

- 太阳热

- 风

- 其他的

- 地区

- 奈及利亚

- 迦纳

- 其他的

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Power Construction Corporation of China

- Energicity Corp

- Wartsila Oyj Abp

- China Civil Engineering Construction Corporation

- REDAVIA GmbH

第七章 市场机会与未来趋势

简介目录

Product Code: 70282

The West Africa Renewable Energy Market is expected to register a CAGR of 2% during the forecast period.

COVID-19 negatively impacted the market in 2020. Currently, the market has reached pre-pandemic levels.

Key Highlights

- Over the long term, factors such as increased environmental awareness and regulations and decreased cost per kilowatt of electricity generated are expected to boost the market.

- On the other hand, the high price of renewable energy relative to fossil fuels is expected to restrain the market.

- However, new models of solar cells made of a thin film technology that uses narrow coatings of cadmium telluride in solar cells, which have higher efficiency and lower cost, may prove to be an opportunity in the sector.

- Nigeria is expected to have the largest share of renewable energy in the region due to the government's focus on decreasing dependence on imported fossil fuels.

West Africa Renewable Energy Market Trends

Hydropower Segment to Dominate the Market

- The hydropower segment is expected to dominate the market as dams have been built across West Africa. Most of the renewable hydro capacity has been constructed in Nigeria and Ghana.

- The hydropower segment includes different-sized reservoir dams that can be used to provide renewable energy. Hydropower is the most used renewable energy in West Africa.

- In November 2022, the Nigerian government approved the construction of a 1,650 MW hydropower plant at USD 3 billion. The project would be funded under a public-private partnership arrangement and located in the north-central state of Benue, Laolu Akande.

- In September 2021, the Souapiti hydropower plant in Guinea began commercial operation. The facility will produce 1,900 GWh of clean energy per year and increase production of the downstream Kaleta hydro scheme to 1,000 GWh/per year.

- Hydropower (including mixed plants) constitute almost 94.2%of the total renewable energy generated in the region, with nearly 5,513 MW of power being produced, in 2021.

- Therefore, vast reservoirs of dams providing renewable energy are expected to continue to dominate the market due to their large size relative to other renewable energy and an increase in investments.

Nigeria to Dominate the Market

- Nigeria is expected to have the largest share of renewable energy among the nations in the forecast period due to its significant consumption of electricity and government focus on decreasing dependence on imported fossil fuel.

- Nigeria is the most populous nation in West Africa. The country's high demand for electricity due to the high population is expected to promote growth in renewable energy. However, the high cost of renewable energy causes constraints to its growth.

- Most of the installed renewable capacity in the country comes from Hydropower projects. In 2021, Hydropower constituted 2111 MW of installed capacity, which is approximately 98% of all the renewable energy in the country. However, this scenario is expected to change during the forecast period owing to increasing investment in solar energy.

- In September 2022, Sterling & Wilson Renewable Energy bagged a USD 1.5-billion order from the government of Nigeria, along with its consortium partner Sun Africa, for setting up solar PV power plants aggregating 961 MW at five locations along with battery energy storage systems with a total installed capacity of 455 MW.

- Hence, Nigeria is expected to dominate the market due to its large size and increased renewable energy installed capacity in the forecast period.

West Africa Renewable Energy Industry Overview

West Africa Renewable Energy Market is moderately consolidated. Some of the key players in this market are (not in particular order) Power Construction Corporation of China Ltd, Energicity Corp, Wartsila Oyj Abp, China Civil Engineering Construction Corporation, and REDAVIA GmbH.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Renewable Energy Installed Capacity Forecast in MW, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Hydro

- 5.1.2 Solar

- 5.1.3 Wind

- 5.1.4 Others

- 5.2 Geography

- 5.2.1 Nigeria

- 5.2.2 Ghana

- 5.2.3 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Power Construction Corporation of China

- 6.3.2 Energicity Corp

- 6.3.3 Wartsila Oyj Abp

- 6.3.4 China Civil Engineering Construction Corporation

- 6.3.5 REDAVIA GmbH

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219