|

市场调查报告书

商品编码

1643218

熔盐能源储存:市场占有率分析、产业趋势与成长预测(2025-2030 年)Molten Salt Thermal Energy Storage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

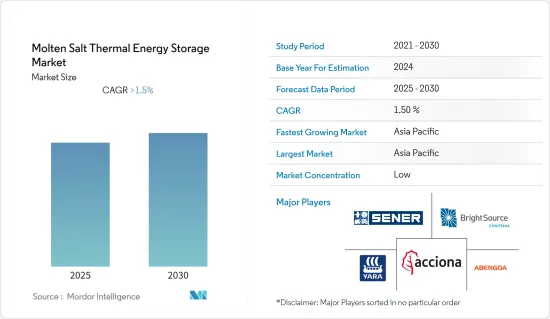

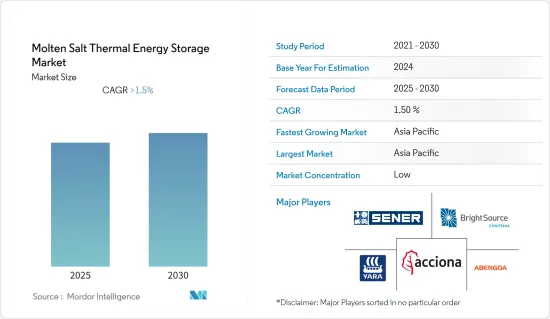

预计预测期内熔盐能源储存市场复合年增长率将超过 1.5%。

由于新冠疫情爆发,市场在计划延迟方面受到了轻微影响。然而,2021年市场復苏了。

关键亮点

- 从长远来看,电力消耗增加、每千瓦能源储存成本下降以及政府推动无污染燃料等因素预计将推动市场发展。

- 同时,与石化燃料相比,太阳能能源储存的价格较高,预计将抑制市场发展。

- 不过,新型熔盐正处于研发阶段,例如使用金属氯化物来增加熔盐的稳定性。该领域的创新可以为市场参与企业创造机会。

熔盐能源储存市场趋势

槽式太阳能发电占市场主导地位

- 槽式太阳能电站作为熔盐能源储存最常用的方法在市场上占据主导地位,因为它们能够更有效地集中太阳能。截至 2021 年,许多计划正在建设中。由于熔盐储能每千瓦成本下降,预计将在预测期内占据市场主导地位。

- 槽式太阳能发电是最有效的熔盐储存方法之一,可与塔式太阳能发电技术竞争。抛物线集热槽型能源储存系统目前已在世界各国推广应用。截至 2021 年,西班牙是聚光型太阳光电设施领先的国家,装置容量约为 2,304 兆瓦。

- 槽式抛物镜型太阳能聚光系统是由反射材料製成的抛物面集热器。集热器将入射的阳光反射到盐上,提高盐的温度并融化盐。不同类型的反射材料和熔盐正在研究中,预计这将扩大市场,因为它可以提供所需的动力来降低从熔盐中提取能源的成本。

- 中国甘肃省正在建造槽式抛物镜型熔盐太阳热能发电,预计发电量约 100 兆瓦(MW)。它采用熔盐作为储存机制,即使在没有电源的情况下也能提供七小时的电力。

- 2022 年 10 月,Abengoa 凭藉其 Noor 1计划荣获 2022 年度可再生能源太阳能项目奖,该项目在世界上最大的太阳能综合体:位于迪拜(阿联酋)南部的穆罕默德·本·拉希德·阿勒马克图姆太阳能计划(MBR)内建设三个光伏场(每个 200 兆瓦),并配备集热器。

- 因此,随着电力需求的增加以及熔盐和反射器效率的提高,预测期内采用抛物面槽的熔盐储热预计将会成长。

亚太地区是成长最快的市场

- 亚太地区是熔盐太阳能发电厂最重要的用户之一,预计在预测期内将成长最快。预计印度和中国将引领市场成长。

- 亚太地区熔盐储热市场是2021年成长最快的市场,预计未来仍将维持较高的成长率。该地区由位于南迴归线以南的大国组成,这些国家可以有效利用太阳能计划。

- 古吉拉突邦 SolarOne 是印度最大的槽式太阳能电站,熔盐容量为 9 小时。所采用的储热系统为双槽间接式。预计预测期内将扩建和建造更多的熔盐仓储设施。

- 中国是世界上最大的熔盐能源储存系统係统使用者之一。 2022年7月,新华电力宣布在亳州启动新的1GW太阳能计划。该计划涉及一个100MW塔式CSP,使用熔盐作为储热流体,储热时间为8小时,可产生900MW的太阳能电力。

- 因此,由于电力需求的增加以及政府和私人公司对该领域的投资,预计熔盐热能储存将在预测期内在亚太地区成长最快。

熔盐能源储存产业概况

熔盐能源储存市场部分细分。该市场的主要企业(不分先后顺序)是Yara International ASA、Acciona, SA、Abengoa SA、BrightSource Energy, Inc.和SENER Grupo de Ingenieria, SA。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场概况

- 介绍

- 至2027年的电力生产预测(单位:TWh)

- 截至 2027 年太阳能发电装置容量的历史和预测趋势(单位:MW)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场区隔

- 技术板块

- 槽式太阳能电站

- 菲涅耳反射器

- 电力塔

- 地区

- 北美洲

- 亚太地区

- 欧洲

- 南美洲

- 中东和非洲

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Yara International ASA

- Acciona, SA

- Abengoa SA

- BrightSource Energy, Inc.

- SENER Grupo de Ingenieria, SA

- SolarReserve, LLC

- Engie SA

- SCHOTT AG

第七章 市场机会与未来趋势

简介目录

Product Code: 70285

The Molten Salt Thermal Energy Storage Market is expected to register a CAGR of greater than 1.5% during the forecast period.

The market was slightly affected by the outbreak of COVID-19 in terms of project delays. However, the market rebounded in 2021.

Key Highlights

- Over the long term, factors such as an increase in electricity consumption, decreasing the cost per kilowatt for energy storage, and a push by governments for cleaner fuel are expected to boost the market.

- On the other hand, the higher price of solar energy storage relative to fossil fuels is expected to restrain the market.

- However, new types of molten salt are under the research and development stage, like an increase in the stabilization of molten salts with the use of metal chloride. Innovations in the sector can spell an opportunity for market players.

Molten Salt Thermal Energy Storage Market Trends

Parabolic Trough Segment to Dominate the Market

- Parabolic troughs dominate the market as the method most used for storing energy in molten salt as they can concentrate solar energy more efficiently. Many projects are under, in 2021, under construction. With a decrease in the cost per kilowatt for molten salt stored electricity, it is expected to dominate the market in the forecast period.

- The parabolic trough is among the most efficient method for molten salt storage, competing with solar power tower technology. Many different countries around the globe have 2021 already set up a parabolic trough molten solar energy storage system. As of 2021, Spain is the leading country in concentrated solar power installation, with an installed capacity of about 2,304 MW.

- Parabolic-trough solar concentrating systems are parabolic-shaped collectors made of reflecting materials. The collectors reflect the incident solar radiation onto the salt and raise the temperature to melt the salt. Different types of reflecting material and molten salt are under research, which can provide the required push to reduce the cost of the energy extracted from molten salt, which is expected to boost the market.

- A parabolic trough molten salt solar plant is under construction in Gansu Province, China, with estimated energy generated of around 100 megawatts (MW). It has molten salt as the storage mechanism and can provide 7 hours of electricity without a source.

- In October 2022, Abengoa won the 2022 Solar Project of the Year of Renewable Energy Award for the Noor 1 project, which comprises the construction of three solar fields (200 MW each) of parabolic trough collectors in the world's largest solar complex: the Mohammed bin Rashid Al Maktoum Solar Park (MBR), south of Dubai (United Arab Emirates).

- Therefore, with the increase in demand for electricity and increasing efficiency of the molten salts and reflective material, it is expected that the molten salt thermal energy storage with the parabolic troughs expected to grow in the forecast period.

Asia-Pacific to be the Fastest Growing Market

- Asia-Pacific is among the most significant users of molten solar energy plants and is expected to grow fastest in the forecast period. India and China are expected to lead in the market's growth.

- The Asia-Pacific molten salt thermal energy storage market has grown the fastest in 2021 and is expected to continue its high growth rate in the coming yeell. The region consists of large countries below the Tropic of Capricorn, which enables the countries to use solar energy projects efficiently.

- Gujarat Solar One is India's largest Parabolic Trough with a molten salt capacity of 9 hours. The thermal storage system used is a 2-tank indirect. More molten salt storage is expected to be expanded and built in the forecast period.

- China is among the largest user of the molten salt energy storage system in the world. In July 2022, Xinhua Power Generation Company announced the commencement of the firm's 1 GW new solar energy project at Bozhou. The project includes 100 MW of tower CSP using molten salt as the thermal storage fluid, with 8 hours of storagandth 900 MW of PV.

- Hence, molten salt thermal energy storage is expected to grow the fastest in the Asia-Pacific region in the forecast period due to an increased demand for electricity and government and private players' investmeninnto in the sector.

Molten Salt Thermal Energy Storage Industry Overview

The Molten Salt Thermal Energy Storage Market is partially fragmented. Some of the key players in this market are (not in particular order) Yara International ASA, Acciona, S.A., Abengoa SA, BrightSource Energy, Inc., and SENER Grupo de Ingenieria, S.A.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Electricity Production Forecast, in TWh, till 2027

- 4.3 Solar Power Installed Capacity, Historic and Forecast, in MW, till 2027

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.2 Restraints

- 4.7 Supply Chain Analysis

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Parabolic Troughs

- 5.1.2 Fresnel Reflector

- 5.1.3 Power Tower

- 5.2 Geography

- 5.2.1 North America

- 5.2.2 Asia-Pacific

- 5.2.3 Europe

- 5.2.4 South America

- 5.2.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Yara International ASA

- 6.3.2 Acciona, S.A.

- 6.3.3 Abengoa SA

- 6.3.4 BrightSource Energy, Inc.

- 6.3.5 SENER Grupo de Ingenieria, S.A.

- 6.3.6 SolarReserve, LLC

- 6.3.7 Engie SA

- 6.3.8 SCHOTT AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219