|

市场调查报告书

商品编码

1643220

北欧可再生能源 -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)North Europe Renewable Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

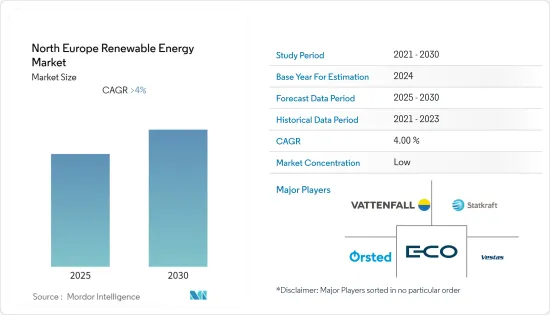

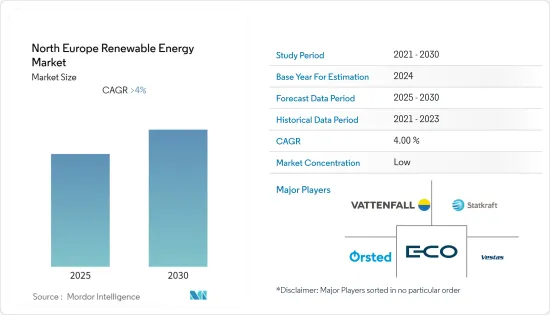

预计预测期内北欧可再生能源市场的复合年增长率将超过 4%。

2020 年,新冠疫情对市场产生了负面影响。目前市场已恢復至疫情前的水准。

关键亮点

- 从中期来看,日益增长的环境问题、政府为可再生计划开发提供的激励和税收优惠措施、以及扩大电网的高成本等因素预计将推动市场的发展。此外,降低可再生能源技术製造成本和提高发电效率的技术进步也为北欧可再生能源发电市场的成长做出了重大贡献。

- 同时,高昂的初始资本支出可能在未来几年抑制北欧可再生能源市场的成长。

- 然而,人们对清洁能源生产的日益关注以及能源生产从煤炭和天然气等传统能源来源向清洁能源的逐步转变,预计将为该地区的可再生能源营运商创造令人兴奋的机会。

- 挪威凭藉政府的支持措施在该地区可再生能源市场占据主导地位。

北欧可再生能源市场的趋势

水电占据市场主导地位

- 预计水电将主导该地区的可再生能源市场。预计这一领域将由挪威和瑞典等国家引领,这两个国家的水力发电装置容量在 2021 年将达到 38.81 吉瓦和 16.40 吉瓦。

- 截至 2021 年,北欧水电装置容量为 56.9 吉瓦,约占该地区水电总装置容量的 25%。水力发电还占该地区可再生能源容量的63%以上。

- 水力发电广泛使用的主要原因是其电力供应具有成本效益、不受动盪的批发电力市场价格飙升的影响以及供应安全。

- 水力发电产业透过提供灵活、可靠的电力供应(可在需要时调用)增强了各国和消费者的信心。

- 因此,预计上述因素将在预测期内支撑市场主导地位。

挪威主导市场成长

- 近年来,挪威一直主导该地区的可再生能源市场,预计在预测期内仍将保持这一地位。该国拥有绿能生产系统之一,97%以上的电力来自可再生能源。

- 挪威的可再生能源开发早在 19 世纪就开始了,当时该国利用河流进行水力发电。

- 可再生能源发电的大部分来自水力发电。截至 2021 年,挪威的水力发电容量为 38.81 吉瓦,可再生能源总容量为 39.77 吉瓦。挪威是该地区和欧洲第二大水力发电国,也是世界第七大水力发电国。

- 除水力发电外,该公司也活跃于风力发电领域,在陆上和海上业务规模庞大。 2022年11月,全球最大的浮体式海上风电场将在挪威海岸86英里处投入运作。该风电场将于2023年全面运作,总发电量为88兆瓦。

- 由于挪威的优惠政策和扩大可再生的意愿,预计预测期内挪威将在该地区保持领先地位。

北欧可再生能源产业概况

北欧可再生能源市场比较分散。该市场的主要企业包括(不分先后顺序)Orsted AS、Vestas Wind Systems AS、Statkraft AS、E-CO Energi Holding As 和 Vattenfall AB。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 至2027年装置容量及预测(单位:MW)

- 2021 年各国可再生能源总总设备容量(MW)

- 最新趋势和发展

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场区隔

- 市场类型

- 风

- 水力发电

- 太阳的

- 其他的

- 地区

- 瑞典

- 挪威

- 英国

- 欧洲其他地区

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Siemens Gamesa Renewable Energy SA

- General Electric Company

- Orsted AS

- Vestas Wind Systems AS

- E.ON SE

- Statkraft AS

- E-CO Energi

- Vattenfall AB

- Nordex SE

第七章 市场机会与未来趋势

简介目录

Product Code: 70286

The North Europe Renewable Energy Market is expected to register a CAGR of greater than 4% during the forecast period.

COVID-19 negatively impacted the market in 2020. Currently, the market has reached pre-pandemic levels.

Key Highlights

- Over the medium term, factors such as rising environmental concerns, government policies for incentives and tax benefits for renewable project development, and the high cost of grid expansion are expected to drive the market. Also, advancement in technology, leading to renewable energy technology manufacturing cost reduction and an increase in power generation efficiency, is a significant factor in the growth of the North Europe renewable energy market.

- On the other hand, high initial CAPEX is likely to restrain the growth of the North Europe renewable energy market in the coming years.

- However, the increasing focus on producing clean energy and the gradual shift from energy generation from conventional sources such as coal and natural gas to clean energy is expected to create an excellent opportunity for the renewable energy players in the region.

- Norway has dominated the renewable energy market in the region due to supportive government policies.

North Europe Renewable Energy Market Trends

Hydro Power to Dominate the Market

- Hydropower is expected to dominate the renewable energy market in the region. The sector is expected to be led by countries like Norway and Sweden having a capacity of 38.81 GW and 16.4 GW of hydropower capacity in 2021, respectively.

- North Europe holds around 25% share of the region's hydropower capacity at 56.9 GW as of 2021. Hydropower also makes up over 63% share of the region's renewable energy capacity.

- The main reasons behind such extensive usage of hydropower are the cost-efficient supply of electricity, independence from price spikes in volatile wholesale electricity markets, and security of supply.

- The hydropower sector provides a sense of reliability to countries and consumers by providing a flexible and reliable capacity that can be called upon when needed.

- Therefore, the factors above are expected to help the market dominate in the forecast period.

Norway to Dominate the Market Growth

- Norway has dominated the renewable energy market in the region in recent years and is expected to continue to do so in the forecast period too. The country has one of the cleanest electricity production systems in place, with over 97% of its electricity generated from renewable energy.

- Renewable energy development in Norway started as early as the 1800s, with the harvest of hydropower from the rivers cascading through the country.

- The majority of the electricity generation from renewable resources comes from hydropower. As of 2021, the hydropower capacity of Norway stood at 38.81 GW, and the total renewable energy capacity stood at 39.77 GW. Norway is the second-largest hydropower producer in the region and Europe and the seventh-largest producer in the world.

- Apart from hydropower, the country has been very active in the wind power sector, with a number of utility sizes in both its onshore and offshore regions. In November 2022, the world's largest floating offshore wind farm went online 86 miles off the coast of Norway. The wind farm will be fully operational in 2023 with a total capacity of 88 MW.

- The country is likely to maintain its dominance in the region during the forecast period, supported by its favorable policies and awareness for more and more usage of renewable energy.

North Europe Renewable Energy Industry Overview

The North Europe Renewable Energy Market is fragmented. Some of the key players in this market include (not in particular order) Orsted AS, Vestas Wind Systems AS, Statkraft AS, E-CO Energi Holding As, and Vattenfall AB.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Installed Capacity and Forecast in MW, till 2027

- 4.3 Installed Total Renewable Energy Capacity, in MW, by Country, 2021

- 4.4 Recent Trends and Developments

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Wind

- 5.1.2 Hydro

- 5.1.3 Solar

- 5.1.4 Others

- 5.2 Geography

- 5.2.1 Sweden

- 5.2.2 Norway

- 5.2.3 United Kingdom

- 5.2.4 Rest of North Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Siemens Gamesa Renewable Energy SA

- 6.3.2 General Electric Company

- 6.3.3 Orsted AS

- 6.3.4 Vestas Wind Systems AS

- 6.3.5 E.ON SE

- 6.3.6 Statkraft AS

- 6.3.7 E-CO Energi

- 6.3.8 Vattenfall AB

- 6.3.9 Nordex SE

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219