|

市场调查报告书

商品编码

1643231

云端备份:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Cloud Backup - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

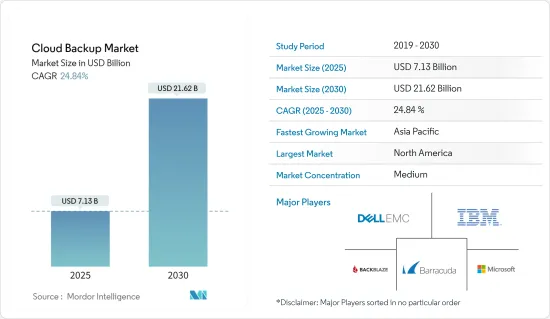

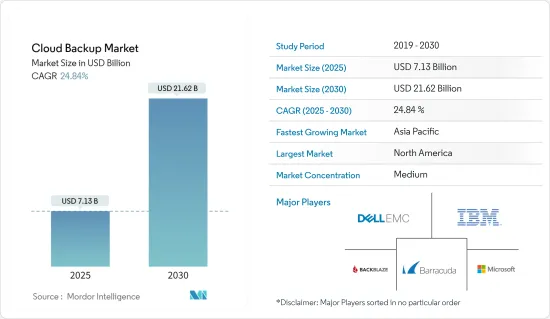

预计云端备份市场规模在 2025 年将达到 71.3 亿美元,到 2030 年将达到 216.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 24.84%。

主要亮点

- 企业采用云端备份的关键驱动因素是在加速创新和竞争中断的情况下对敏捷性和灵活性的需求。

- 市场主要企业正在加大对云端技术的投资。例如,Veeam Software 与 Microsoft Azure 合作推出 New Veeam Backup,这是一款适用于 Microsoft Azure 的企业级云端备份和復原解决方案。这款新产品可协助客户和服务供应商将更多应用程式和资料迁移到 Azure,并以经济高效、安全、轻鬆的方式保护他们的 Azure 云端应用程式和资料。

- 例如,2023 年 4 月,BETSOL 推出了 Zmanda Endpoint Backup,这是一款针对笔记型电脑和 Windows 桌上型电脑的云端基础的备份解决方案。 Zmanda Endpoint Backup 是 Zmanda 不断增长的功能係列中的最新成员。 Zmanda Endpoint Backup 为您整个组织的端点提供可扩充、云端基础的集中管理。它易于部署并提供经过验证的备份引擎的可靠性。

- 此外,资料遗失已成为所有行业的主要担忧。在最近的一项调查中,大约 33% 的人将资料遗失归因于硬体或系统故障,而 29% 的人将资料遗失归因于人为错误或勒索软体。据估计,在灾难中伺服器停机 10 天或更长时间的组织中,多达 93% 的组织将在未来 12 个月内申请破产,而 43% 的组织将永远不会重新开业。对美国和加拿大使用云端基础的资料保护服务的 IT 专业人士进行的单独行业调查发现,虽然 74% 的受访者完全依赖 Microsoft 365 原生服务进行备份,但只有 15% 的受访者能够恢復 100% 的资料。

- 随着网路攻击不断增加,Google和微软等公司正在寻求使其云端环境更加安全。过去一年,亚马逊网路服务 (AWS)、微软 Azure 和谷歌云端都进行了一系列网路安全收购。 2022年3月,Google以约54亿美元收购了网路安全公司Mandiant,为Google云端提供威胁情报服务。

- 近年来,云端运算的采用显着成长。例如,IBM 的一项分析发现,单一製造工厂每月可产生超过 2,200 Terabyte的资料。一条生产线每天可以产生超过 70 Terabyte的资料,但其中大部分资料仍未被分析和保护。因此,企业正在转向云端储存来保护和利用这些资料。

- 此外,IBM 透露,90% 的资料是在过去两年内创建的。产生的大量资料正在推动整个企业对低成本资料备份和储存的需求。自动备份、恶意软体防护、加密云端储存、檔案级復原和时间点復原是一些市场趋势。

- 然而,云端备份解决方案是防止网路攻击和资料外洩的完整工具。然而,如果不加以管理,攻击者很容易破坏备份伺服器的资料库并利用它来攻击您的使用者。因此,隐私和安全性问题是采用云端备份解决方案的主要障碍。

- 随着云端备份市场越来越受欢迎,关键任务数位产业中未管理的风险数量正在激增。云端安全态势管理 (CSPM) 可自动执行跨不同云端基础架构的云端安全管理。这导致该领域的收购活动增加。

- 例如,Google于 2022 年 3 月宣布以 54 亿美元收购网路安全公司 Mandiant,这反映了主要云端供应商为企业提供更好的保护以应对日益增长的威胁而做出的更广泛努力。这项协议是在俄罗斯入侵乌克兰之际达成的,这进一步增加了企业对网路安全保护的投资需求。这也反映了这家云端运算巨头的成长领域。 Mandiant的持续经营收益预计将在2021年成长21%至8.43亿美元,其独立收益预计将在2022年超过5.5亿美元。

云端备份市场趋势

预计 BFSI 将获得最大程度的采用

- 银行业越来越多地采用数位银行和投资解决方案,推动了 BFSI 领域对云端储存/备份的需求。此外,一些金融业正在转向云端技术来获得竞争优势,实现创新、竞争和安全。

- 此外,政府机构和私人公司正在与许多公司合作,以寻找未来五年市场的新成长机会。例如,瑞银和微软公司正在扩大合作,以在未来五年内加强瑞银的公有云业务。跨国投资银行和金融服务公司瑞银 (UBS) 打算在 运作运行其一半以上的应用程序,包括瑞银旗舰云端平台上的关键工作负载。此次伙伴关係加速了瑞银的云端优先策略及其全球技术资产的现代化。

- 例如,IBM 正在使用混合云帮助两家欧洲银行集团数位化。西班牙银行 IT 服务供应商 Rural Services Informaticos (RSI) 将利用 IBM 和 Red Hat 的混合云技术和行业专业知识,透过其 Cloud Office 平台增强其数位产品和服务。这就是为什么许多供应商投资混合云端解决方案,以消除管理、维护、更新和扩展大量服务的需求。这些发展预计将增加 BFSI 领域对云端备份解决方案的采用。

- 此外,银行业资料外洩事件的增加,促使银行转向云端备份解决方案,以帮助他们从任何灾难中恢復。公有云解决方案提供增强的备份资源,以确保在灾难发生时业务永续营运。

- 云端基础的即时付款解决方案的成长趋势得益于它们为零售商提供即时付款洞察的灵活性。在全球范围内,BFSI 对数位付款的采用正在成长,预计未来五年市场将成长。根据IBM针对企业云端使用情况的调查,微软Azure去年的云端使用率最高,达56%。

北美可望主导市场

- 北美一直是领先的区域市场,预计在整个预测期内将继续保持主导地位,这得益于各个终端用户垂直领域早期采用该技术,以及该地区存在市场领先的公司。此外,早期采用新技术、对云端基础的解决方案研发的大量投资以及加强IT基础设施预计将进一步推动市场成长。

- 预计未来五年美国将占据云端基础的储存和备份解决方案需求的很大一部分。支持该市场投资的关键因素是新技术的不断发展和应用,从而释放了以前被认为是商业性的潜力。随着医疗保健、零售、通讯和製造业领域的投资持续增加,预计未来五年中国云端基础解决方案市场将显着成长。

- 该国已采取各种措施来实现其基础设施的现代化。为实现这一目标,美国计划在私有云端运算服务和资料中心上投入高达 2.49 亿美元。通用动力公司、惠普和诺斯罗普·格鲁曼公司是陆军私有云端合约中选定的服务供应商之一,提供云端处理服务,利用安全的私有云端来整合资料中心。

- 云端为基础的运算在美国的普及正在迅速推进,导致该国资料中心的数量也相应增加。据瑞信称,美国目前拥有世界上最多的超大规模资料中心,占全国所有超大规模资料中心的三分之一以上。

- 此外,该地区不断增加的政府措施也将在整个预测期内推动市场的显着成长。据美国管理和预算办公室称,2023财年,美国联邦政府已拨款约244亿美元用于联邦重大IT投资。预计到 2023 年,IT 总支出将达到约 874 亿美元。此外,据新加坡政府科技局称,新加坡政府计划在 2022 财年投入 38 亿新元用于资讯和通讯技术。政府机构在IT方面的巨额支出将为云端解决方案提供者创造机会,以开发新的解决方案来满足政府机构的各种需求。

- 此外,加拿大政府还采用了「云端优先」策略,这意味着在启动任何资讯技术投资、倡议、策略或计划时,云端服务将被确定和评估为主要交付选项。云端运算也允许政府利用私人供应商的创新,使资讯技术更加灵活。这项措施预计将为云端备份市场提供许多机会,因为这种模式兼具私有云端的安全性和公共云端的灵活性。

云端备份产业概览

由于多家全球市场参与者的存在,云端备份市场的竞争格局更加紧密。预计云端运算在资料储存方面的应用将不断增多,资料产生的大幅增加将推动市场的发展。因此,市场参与者有以下几类: Dell EMC、IBM Corporation、Backblaze Inc. 和 Barracuda Networks, Inc. 正在进行多项创新,以在市场上提供比同行更强大的解决方案并获得最大的市场吸引力。

- 2023年11月,三星电子宣布在全球推出临时云端备份,让用户可以安全、轻鬆地储存和传输重要资料。该功能旨在为三星 Galaxy 用户提供舒适和安心,帮助他们避免遗失照片、影片、私人檔案等资料。此功能彰显了三星持续致力于提供强大的互联体验,使用户的生活更加轻鬆。

- 2023 年 11 月全球网路保护公司 Acronis 和 Sourcepath 宣布与费城 76 人队建立正式伙伴关係。此次伙伴关係将利用 Acronis 先进的技术解决方案加强 NBA 球队的资料备份策略,以保护关键资料和系统。 Sourcepath、费城 76 人队和 Acronis 之间的合作标誌着 Acronis TeamUp 使命取得了重要成就,为专业运动队提供世界一流的资料混合云端备份。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 购买者/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 产业影响评估

第五章 市场动态

- 市场驱动因素

- 资料产生的大量增加推动了对低成本、高容量储存的需求

- SaaS 和其他类似解决方案的采用率不断提高

- 企业越来越多采用云端运算

- 市场挑战

- 政府法规与合规性

- 关于云端储存的隐私和安全问题

第六章 市场细分

- 按组件

- 解决方案

- 按服务

- 依部署方式

- 公共云端

- 私有云端

- 混合云

- 按最终用户产业

- BFSI

- 资讯科技/通讯

- 媒体与娱乐

- 零售

- 卫生保健

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 世界其他地区

第七章 竞争格局

- 公司简介

- IBM Corporation

- Dell EMC

- Backblaze Inc.

- Acronis International GmbH

- Arcserve LLC

- Rubrik

- Veritas Technologies

- Barracuda Networks Inc.

- Carbonite Inc.

- Commvault Systems Inc.

- Cohesity Inc.

第八章投资分析

第九章:市场的未来

The Cloud Backup Market size is estimated at USD 7.13 billion in 2025, and is expected to reach USD 21.62 billion by 2030, at a CAGR of 24.84% during the forecast period (2025-2030).

Key Highlights

- The primary driver for adopting cloud backup across businesses is the need for agility and flexibility in the face of accelerating innovation and disruptions from competitors due to the increase in cloud adoption across both big and small.

- Key players in the market are increasing investments in cloud technologies. For Instance, Veeam Software has partnered with Microsoft Azure to provide New Veeam Backup, an enterprise-ready cloud backup and recovery solution for Microsoft Azure. The new product will help customers and service providers to migrate more apps and data to Azure and to cost-effectively, securely, and easily protect cloud applications and data in Azure.

- For instance, in April 2023, BETSOL launched Zmanda Endpoint Backup, a cloud-based backup solution for laptop computers and Windows desktops. It is the most recent addition to Zmanda's expanding feature lineup. Zmanda Endpoint Backup provides scalable, cloud-based, centralized management of the entire organization's endpoints. It's simple to deploy and brings the reliability of our proven backup engine.

- Furthermore, data loss is becoming a significant concern across all industries. In one recent survey, around 33% blamed hardware or system failure for data loss, while 29% reported that their companies lost data due to human error or ransomware. It is estimated that up to 93% of organizations that lose servers for 10 days or more during a disaster filed for bankruptcy within the next 12 months, with 43% never reopening. Another industrial survey of the US and Canadian IT professionals using cloud-based data protection services found that while 74% of respondents rely only on the native Microsoft 365 services for backup, only 15% could recover 100% of their data.

- As cyberattacks keep increasing, companies such as Google and Microsoft, among others, are aiming to make their cloud environments more secure. Amazon Web Services (AWS), Microsoft Azure, and Google Cloud have made various acquisitions in the cybersecurity space over the past year. In March 2022, Google acquired Mandiant, a cybersecurity company, for about USD 5.4 billion to provide threat intelligence services to Google Cloud.

- In recent years, cloud adoption has significantly grown. For instance, according to an IBM analysis, a single manufacturing site may generate more than 2,200 terabytes of data in a month. A single production line can generate more than 70 terabytes per day-yet the vast majority of data remains unanalyzed and unprotected. Therefore, companies are moving to cloud storage to secure and utilize this data.

- Furthermore, IBM revealed that 90% of the data was created in the previous two years. Because of the large amount of data generated, there is a rising demand for low-cost data backup/storage across companies. Automated backup, Malware protection, Encrypted cloud storage, File-level Recovery, and Point-in-time Restore, among others, are some trending services in the market.

- However, Cloud backup solutions, on the other hand, are one of the complete tools for defending against cyber-attacks and data breaches. However, if unmanaged, attackers may smoothly infiltrate the backup server's database and utilize it against the user. Hence, privacy and security issues are major hindrances to adopting cloud backup solutions.

- As the cloud backup market sees an increase in use, there has been an explosion in the number of unmanaged risks in the mission-critical digital industry. Cloud Security Posture Management (CSPM) automates cloud security management across the diverse cloud infrastructure. Due to this, there has been an increased acquisition activity in the segment.

- For instance, Google's agreement to buy cybersecurity firm Mandiant for USD 5.4 Billion, announced in March 2022, reflects broad efforts by leading cloud providers to provide enterprises with better protection against a growing set of threats. The deal comes as the Russian invasion of Ukraine further illustrates the need for companies to invest in cybersecurity protections. It also reflects the growth areas of cloud giants. Mandiant's revenue from continuing operations in 2021 was projected to increase by 21% to USD 843 Million, and in 2022, the revenue as an independent company was projected to exceed USD 550 Million.

Cloud Backup Market Trends

BFSI Expected to Exhibit Maximum Adoption

- The banking industry is increasingly embracing digital banking and investing solutions, which is increasing demand for Cloud storage/backup in the BFSI sector. Further, some financial sector businesses are transitioning to cloud technologies to obtain a competitive advantage, enabling innovation, customization, and security.

- Further, Government and private organizations are collaborating with many companies to anticipate new growth opportunities in the market over the next five years. For Instance, UBS and Microsoft Corp have expanded their collaboration to boost UBS's public cloud footprint over the next five years. UBS (multinational investment bank and financial services company) intends to operate more than half of its applications, running on Microsoft Azure, including critical workloads on UBS's primary cloud platform. The partnership furthers UBS's cloud-first strategy and the modernization of its global technology estate.

- For instance, IBM is using a Hybrid Cloud to Help Two European Banking Groups Go Digital. Rural Services Informaticos (RSI), a Spanish banking IT services provider, will increase its digital product and service offerings using hybrid cloud technology and industry expertise from IBM and Red Hat to boost its digital products and service offerings through a Cloud Office platform. Hence, many vendors are investing money in hybrid cloud solutions to eliminate the need to manage hosts, maintain, update, and scale service operations. These developments are projected to increase the usage of cloud backup solutions in the BFSI sector.

- Furthermore, the growing number of data breaches in the banking sector is driving banks to use cloud backup solutions that will allow them to recover from any disaster. Public cloud solutions provide an enhanced backup resource to ensure business continuity despite a disaster.

- The growing trends for cloud-based real-time payment solutions can be attributed to their flexibility in providing real-time payment insights to retailers. The growing adoption of digital payment methods in BFSI globally is anticipated to drive market growth over the next five years. According to an IBM survey on Cloud usage by organizations, Microsoft Azure has the highest percentage of 56% of cloud usage in the last year.

North America Expected to Dominate the Market

- With the early adoption of technologies across various end-user verticals and the presence of market leaders in the region, North America stood as the leading regional market and is expected to continue its dominance throughout the forecast period. Also, early adoption of new technologies, considerable investments in R&D for cloud-based solutions, and enhanced IT infrastructure are expected to drive market growth further.

- The United States is anticipated to occupy a crucial portion of the demand for cloud-based storage/backup solutions over the next five years. A significant driver behind the investments in the market is the continuous evolution and application of new technologies to unlock volumes that were previously considered non-commercial. With a series of investments across healthcare, retail, communications, and manufacturing applications in the country, the market for cloud-based solutions is expected to witness significant growth over the next five years.

- The country has made multiple efforts to modernize its infrastructure. To achieve this, the US Army planned to spend up to USD 249 million to deploy private cloud computing services and data centers. General Dynamics, HP, and Northrop Grumman were among the service providers selected for the Army Private Cloud contract, providing cloud computing services to consolidate data centers using a secure private cloud.

- In the United States, the adoption of cloud-based computing is increasing rapidly, owing to which the data centers in the country are also witnessing an increase. According to Credit Suisse, the United States currently accounts for the highest number of hyperscale data centers worldwide, holding more than one-third of the total hyperscale data centers in the country.

- Furthermore, the rise in government initiatives within the region is also helping the market to grow considerably throughout the forecast period. According to the US Office of Management and Budget, For the 2023 fiscal year, the U.S. federal government allocated around 24.4 billion U.S. dollars for major federal IT investments. The total amount of spending on IT is expected to amount to some 87.4 billion U.S. dollars in 2023. Further, According to Government Technology Agency (Singapore), The Singapore government intended to spend SGD 3.8 billion on information and communications technologies in the fiscal year 2022. Such huge IT spending by the government agencies would create an opportunity for the cloud solution providers to develop new solutions to cater various needs of the government bodies.

- Moreover, the government of Canada has adopted a "cloud-first" strategy, whereby cloud services are identified and estimated as the principal delivery option when initiating information technology investments, initiatives, strategies, and projects. The cloud will also let the government harness the innovation of private-sector providers and thus make its information technology more agile. Such initiatives are expected to offer plenty of opportunities to the cloud backup market, as this model enables private cloud security and public cloud flexibility.

Cloud Backup Industry Overview

The Cloud Backup Market's competitive landscape could be more cohesive due to the presence of several global market players. The increasing adoption of cloud computing for data storage and a massive increase in data generation is expected to boost the market. Hence, market players such as Dell EMC, IBM Corporation, Backblaze Inc., and Barracuda Networks, Inc. are making several innovations to provide enhanced solutions in the market compared to their peers and gain maximum market traction.

- November 2023: Samsung Electronics Co., Ltd. announced the global rollout of Temporary Cloud Backup, a secure and easy way to save and transfer important data. In situations where Samsung Galaxy users may experience anxiety about losing their data, including photos, videos, and private files, this feature is designed to provide comfort and reassurance. It highlights Samsung's continued commitment to delivering powerful, connected experiences that help make users' lives easier.

- November 2023: Acronis, a global player in cyber protection, and Sourcepass, Inc. have announced their official partnership with the Philadelphia 76ers. The partnership will enhance the NBA team'steam's data backup strategy using Acronis'Acronis' advanced technology solutions to protect critical data and systems.The collaboration involving Sourcepass, the Philadelphia 76ers, and Acronis, represents a momentous achievement in Acronis' TeamUp mission to equip professional sports teams with world-class data hybrid cloud backup

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Massive Growth in Data Generation Stimulating the Demand for Larger Storage Space at Low Cost

- 5.1.2 Increasing Adoption of SaaS and Other Similar Solutions

- 5.1.3 Increasing Adoption of Cloud Computing Amongst Enterprises

- 5.2 Market Challenges

- 5.2.1 Government Regulations and Compliance

- 5.2.2 Privacy and Security Concerns regarding Cloud Storage

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Solution

- 6.1.2 Services

- 6.2 By Deployment Mode

- 6.2.1 Public Cloud

- 6.2.2 Private Cloud

- 6.2.3 Hybrid Cloud

- 6.3 By End-user Industry

- 6.3.1 BFSI

- 6.3.2 IT and Telecom

- 6.3.3 Media and Entertainment

- 6.3.4 Retail

- 6.3.5 Healthcare

- 6.3.6 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Dell EMC

- 7.1.3 Backblaze Inc.

- 7.1.4 Acronis International GmbH

- 7.1.5 Arcserve LLC

- 7.1.6 Rubrik

- 7.1.7 Veritas Technologies

- 7.1.8 Barracuda Networks Inc.

- 7.1.9 Carbonite Inc.

- 7.1.10 Commvault Systems Inc.

- 7.1.11 Cohesity Inc.