|

市场调查报告书

商品编码

1643238

中东和非洲发电机组市场占有率分析、行业趋势、统计数据、成长预测(2025-2030 年)Middle East And Africa Generator Sets - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

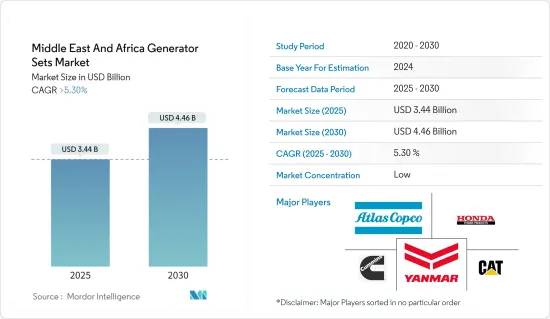

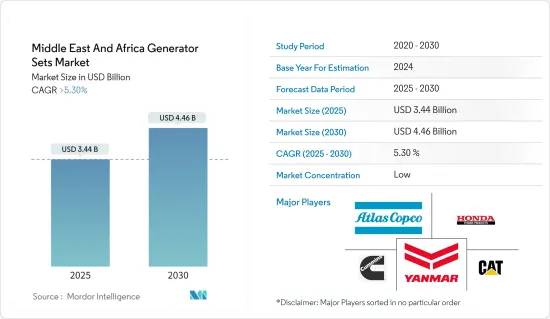

中东和非洲发电机组市场规模预计在 2025 年为 34.4 亿美元,预计到 2030 年将达到 44.6 亿美元,预测期内(2025-2030 年)的复合年增长率将超过 5.3%。

主要亮点

- 预计对不间断可靠电力供应的需求不断增加等因素将推动市场的发展。

- 相反,预计在预测期内,更清洁的替代品的出现和电池技术的进步将抑制市场的成长。

- 然而,混合发电机的日益普及和混合系统可靠性的不断提高可能为该行业带来机会,因为利用多种资源可以降低成本并减少对任何单一燃料的依赖。

- 尼日利亚由于人口众多且经济成长强劲,预计将成为最大的市场。随着人口的成长,电力需求预计也会增加。

中东和非洲发电机组市场趋势

市场主导的备用发电机

- 许多非洲国家,尤其是西非国家,严重依赖备用发电机来满足日常用电。备用发电机为面临公共事业电网供电不足的消费者提供不间断且可靠的电力供应。输电网路和公共事业电网的可靠性与备用发电机产生的电力直接相关。在北非,电网普及率较高,备用发电机的使用率低于撒哈拉以南非洲国家。

- 这个中东国家正在建造大型企划,例如 Neom 项目、住宅双子塔 Elitz、迪拜河塔、Res-Sea计划以及多个资料中心计划,这些项目需要备用发电机,以防发生任何导致停电的意外事件。例如,2022年,Al Masaud Power 为 Khazna资料中心提供了 2000/2200KW 柴油发电机作为备用电源。这显示了该地区发电机组市场的规模。

- 此外,截至 2023 年,沙乌地阿拉伯的建设产业持续引领中东和非洲地区。沙乌地阿拉伯近年来一直是最大的计划订单,该国继续按照「2030愿景」进行转型。

- 据阿拉伯石油投资公司称,2021 年至 2025 年间,中东和北非 (MENA) 地区电力行业计划的能源投资计划份额为 31%。其次是天然气产业(27%)、石油业(20%)和化工业(22%)。随着这些行业新计划的启动,对备用发电机的需求可能会长期增加,从而促进该地区发电机市场的成长。

- 因此,备用发电机组预计将继续占据市场主导地位,因为它们使用灵活,而且与其他细分市场相比,它们占的发电量比例较大。

尼日利亚占据市场主导地位

- 尼日利亚是该地区备用发电机发电量最大的消费量之一。这是由于多种因素造成的,包括石化燃料的易得性、政府政策不佳和输电能力低下,以及人口成长导致的电力需求增加。所有这些因素都在鼓励消费者使用小型备用发电机来发电,从而促进市场成长。

- 根据尼日利亚国家统计局的数据,2022 年尼日利亚发电量约为 21,243 吉瓦时,低于前一年的约 35,654 吉瓦时。电力公司绩效不佳、电网崩坏、培训人员效率低下、缺乏本地製造商、电网设备被盗以及不确定的天气事件等因素导致尼日利亚的电力供应大幅下降。这将创造尼日利亚对发电机组的需求,有利于市场发展。

- 汽油发电机组只能满足基本电力需求(3-5千瓦),效率远低于柴油发电机,但它们却占奈及利亚备用发电能力的很大一部分。这主要是因为初始投资成本较低。

- 2022年9月,奈及利亚政府宣布,2020年和2021年将花费52.6亿美元进口发电机组、变压器、吸尘器、理髮器等电子机械设备。国家统计局也透露,奈及利亚 48.6% 的电力需求来自汽油、柴油和天然气发电机。

- 根据世界银行的数据,截至 2021 年,尼日利亚的电力普及率为 59.5%。儘管政府努力推出分散式发电和微电网等计划,但并联型的最后一英里可能仍会继续存在。在这种情况下,发电机组可能仍是电力供应的支柱。

- 因此,预计尼日利亚将凭藉其不断增长的人口和较低的输电能力主导市场,从而导致对发电机组的需求增加。

中东和非洲发电机组产业概况

中东和非洲的发电机组市场部分分散。该市场的主要企业(不分先后顺序)包括卡特彼勒公司、康明斯有限公司、洋马控股、阿特拉斯·科普柯公司和本田西尔动力产品有限公司。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场概况

- 介绍

- 2029 年市场规模与需求预测(美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 不间断可靠电源的需求不断增加

- 发电机组技术的技术干预

- 限制因素

- 更清洁的替代品的出现和电池技术的进步

- 驱动程式

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场区隔

- 按燃料类型

- 天然气

- 柴油引擎

- 其他燃料类型

- 按评分

- 0-75 kVA

- 75-375 kVA

- 375kVA以上

- 按应用

- 主电源

- 备用电源

- 抑低尖峰负载

- 按地区

- 奈及利亚

- 沙乌地阿拉伯

- 南非

- 阿拉伯聯合大公国

- 卡达

- 其他中东和非洲地区

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Cummins Inc.

- Kirloskar Oil Engines Limited

- Honda Siel Power Products Limited

- Yanmar Holdings Co. Ltd

- Caterpillar Inc.

- Mitsubishi Heavy Industries Ltd

- Perkins Engines Company Limited

- Atlas Copco AB

- 市场占有率

第七章 市场机会与未来趋势

简介目录

Product Code: 70388

The Middle East And Africa Generator Sets Market size is estimated at USD 3.44 billion in 2025, and is expected to reach USD 4.46 billion by 2030, at a CAGR of greater than 5.3% during the forecast period (2025-2030).

Key Highlights

- Factors such as increasing demand for uninterrupted and reliable power supply are expected to drive the market.

- Conversely, the availability of cleaner alternatives and advancement in battery technologies are expected to restrain market growth during the forecast period.

- Nevertheless, the increasing popularity of hybrid generators and the rising reliability of the hybrid system may be an opportunity for the industry due to its usage of various resources, driving down the cost and reducing dependence on a single fuel.

- Nigeria is expected to be the largest market due to its large population and increasing economic growth. The demand for electricity is expected to rise with an increase in the size of its population.

MEA Generator Sets Market Trends

Backup Power Generators to Dominate the Market

- Several African countries, especially Western Africa, heavily rely on backup power generators to meet daily electricity usage. The backup power generators provide an uninterrupted and reliable power supply to consumers facing load shedding from the utility grid supply. The transmission network and reliability of the utility grid may directly correlate with the power generated by the backup generators. North Africa, which includes higher grid access, uses backup generators less than the Sub-Saharan countries.

- The Middle-East countries are witnessing the construction of mega projects such as Project Neom, the residential twin-tower Elitz, the Dubai Creek Tower, the Res-Sea projects, and multiple Data Centre projects that would require back-power generators in unforeseen events leading to blackouts. For instance, in 2022, Al Masaood Power facilitated a 2000/2200-KW diesel generator to Khazna Data Centers for backup power. This represents a broad scope of generator sets market in the region.

- Also, as of 2023, Saudi Arabia's construction industry continued to lead the Middle-East and African region. The Kingdom witnessed the highest value of project awards in recent years, transforming the country in line with its Vision 2030.

- According to Arab Petroleum Investments Corporation, during 2021-2025, the share of planned energy investment projects in the power sector in the Middle-East and North Africa (MENA) region was 31%. The gas sector followed it with a share of 27%, the oil sector with 20%, and the chemical sector with 22%. With the onset of new projects in these sectors, the demand for backup power generators would likely increase in the longer term, benefitting the growth of the generator market in the region.

- Therefore, backup power generator sets are expected to continue to dominate the market due to their flexible use and significant share in electricity generation relative to other market segments.

Nigeria to Dominate the Market

- Nigeria is among the highest consumers of energy generated by backup generators in the region. It is due to several factors, including easy fossil fuel availability, poor governmental policies leading to low transmission capabilities, and an increasing population, leading to increased electricity demand. All these factors push consumers to produce their electricity using small backup generators, aiding the market's growth.

- According to the National Bureau of Statistics of Nigeria, nearly 21,243 GWh of electricity was generated in Nigeria in 2022, a decline from around 35,654 GWh in the previous year. Factors such as poor utility performance, grid collapse, inefficient trained personnel, shortage of local manufacturing, theft of grid equipment, and uncertain weather events have significantly decreased the electricity supply in Nigeria. This would necessitate demand for generator sets in the country and benefit its market development.

- Although gasoline generator sets can provide only basic electricity needs (3 - 5 KW) and contain much lower efficiency than diesel generators, they make up a large share of backup generation capacity in the country. This is primarily due to their lower initial investment costs.

- In September 2022, the government of Nigeria announced that it had spent USD 5.26 billion importing electric generator sets, transformers, vacuum cleaners, hair clippers, and other electrical machinery and equipment in 2020 and 2021. Also, the National Bureau of Statistics disclosed that Nigeria gets 48.6% of its electricity needs from generators powered by petrol, diesel, and gas.

- As per the World Bank, electricity access in Nigeria stood at 59.5% as of 2021. The last-mile grid connectivity will persist in the future despite government efforts to roll out projects such as distributed electricity generation and microgrids. In such a scenario, the generator sets will remain the mainstay to deliver electricity.

- Hence, Nigeria is expected to dominate the market due to its growing population and low transmission capabilities, leading to increased demand for generator sets.

MEA Generator Sets Industry Overview

The Middle-East and African generator sets market is partially fragmented. Some key players in this market (in no particular order) include Caterpillar Inc., Cummins Ltd, Yanmar Holdings Co. Ltd, Atlas Copco AB, and Honda Siel Power Products Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing demand for uninterrupted and reliable power supply

- 4.5.1.2 Technological Interventions in generator set technologies

- 4.5.2 Restraints

- 4.5.2.1 Availability of Cleaner Alternatives and Advancement in Battery Technologies

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Fuel Type

- 5.1.1 Natural Gas

- 5.1.2 Diesel

- 5.1.3 Other Fuel Types

- 5.2 Ratings

- 5.2.1 0 - 75 kVA

- 5.2.2 75 - 375 kVA

- 5.2.3 Above 375 kVA

- 5.3 Application

- 5.3.1 Prime Power

- 5.3.2 Backup Power

- 5.3.3 Peak Shaving

- 5.4 Geography

- 5.4.1 Nigeria

- 5.4.2 Saudi Arabia

- 5.4.3 South Africa

- 5.4.4 United Arab Emirates

- 5.4.5 Qatar

- 5.4.6 Rest of Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Cummins Inc.

- 6.3.2 Kirloskar Oil Engines Limited

- 6.3.3 Honda Siel Power Products Limited

- 6.3.4 Yanmar Holdings Co. Ltd

- 6.3.5 Caterpillar Inc.

- 6.3.6 Mitsubishi Heavy Industries Ltd

- 6.3.7 Perkins Engines Company Limited

- 6.3.8 Atlas Copco AB

- 6.4 Market Share

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219