|

市场调查报告书

商品编码

1644265

固体电解质-市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Solid Electrolyte - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

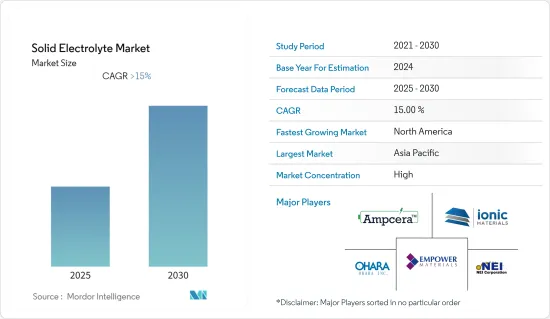

预测期内,固体电解质市场预计将以超过 15% 的复合年增长率成长。

2020 年,市场受到了 COVID-19 的负面影响。目前市场已恢復至疫情前的水准。

关键亮点

- 从长远来看,预计市场将受到对具有更高能量密度和更长循环寿命的能源储存系统的需求不断增加等因素的推动。由于电子设备和电动车的应用日益增多,预计未来几年固态电池和固体电解质的使用将会增加。

- 另一方面,固态电池的高成本可能会在预测期内阻碍固体电解质市场的发展。

- 到 2030 年,电动车 (EV) 预计将占汽车总销量的近 10-12%。有几个因素可能会促进电动车市场的发展,包括世界各国政府的法规和电池技术的进步。此外,业内专家表示,预计未来几年电动车使用的现有锂离子电池技术仍将价格昂贵。此外,锂离子电池的能量密度低、安全性有限等缺点可能会在不久的将来为固态电池和固体电解质市场创造机会。

- 预计亚太地区将占据市场主导地位,其中大部分固体电解质需求来自中国和印度等国家。

固体电解质市场趋势

薄膜电池成长强劲

- 薄膜电池是一种全固态电池(ASSB),使用陶瓷固体电解质(例如锂磷氧氮化物(LiPON))在正极和负极之间传输离子。

- 阴极材料通常由锂氧化物(例如 LiCoO2、LiMn2O4 或 LiFePO4)製成,而阳极材料通常由石墨、锂金属或其他金属材料製成。

- 薄膜电池的大部分应用旨在改善当前的消费和医疗产品。薄膜电池用于更薄的电子设备,因为它们的厚度比传统的锂离子电池小得多。

- RFID 标籤在运输和库存控制中的应用以及用于治疗患者心律不整的心臟心律调节器的应用日益增多,可能会在未来几年推动固态电池和固体电解质的使用。

- 预计全球电池需求量将从 2020 年的 185GWh 成长至 2030 年的 2,000GWh 以上。儘管2020年家用电子电器产品盛行,但由于行动电话等设备的能量容量较小,以千兆瓦计算的需求相对较低。这一显着增长将主要由交通电气化推动,到 2030 年,交通电气化将占总储存容量中电池需求的大部分。

- 2022 年 8 月,科罗拉多教育局发现了一种新的基于钠离子的固体电解质组合物,可实现电池的超快速充电和放电。新加坡国立大学研究人员取得了一项突破性发现,可用于为电动车、行动电话和许多其他应用供电的新型充电电池可能离我们更近了一步。

- 2021 年 11 月,荷兰应用科学研究组织 (TNO) 的衍生公司荷兰新兴企业LionVolt BV 宣布已获得布拉班特省研发机构的 400 万欧元资助,用于开发 3D固体薄膜电池。

- 考虑到上述观点和最近的趋势,预计薄膜电池将在预测期内主导固体电解质市场。

亚太地区可能主导市场

- 亚太市场主要由18个国家组成,占世界人口的59.76%。中国和印度占据该地区主导地位,出口和进口额最高。

- 如果不包括贸易的话,这个地区是人口最多的地区,约有 46 亿人。中国和印度是该地区人口最多的国家,也是电动车持有量最大的国家。 2021年中国和印度道路上的电动车持有数量将超过120万辆。

- 贸易量大显示RFID出货量大且用途多;人口多显示心臟病和植入心律调节器的可能性大;电动车保有量大表明充电电池的用途多。

- 此外,2022 年 8 月,中国科技公司蜂巢能源科技(SVOLT)宣布在开发固态电池取得了进展。该公司已生产出首批采用硫化物基固体电解质的 20Ah 电池。

- 此外,2022年2月,特斯拉计划在中国建造第二家电动车(EV)工厂,以满足国内和出口市场日益增长的需求。短期内,特斯拉计画将在中国的生产能力提升至至少100万辆/年,并计画在上海临港自贸区现有生产基地附近建立第二家工厂。

- 因此,电动车固态电池的发展以及该地区人口、贸易和心臟病患者的增加,很可能在不久的将来扩大固态电池和固体电解质市场。

固体电解质行业概况

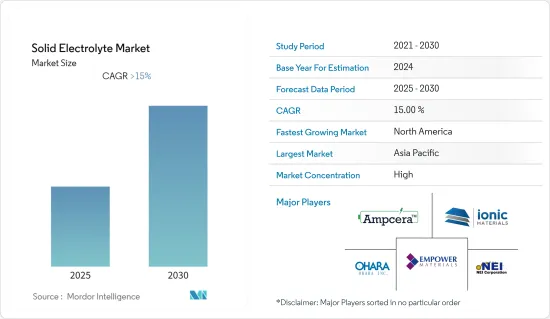

固体电解质市场正在整合。该市场的主要企业(不分先后顺序)包括 NEI Corporation、Ohara Inc.、Empower Materials、Ampcera Corp.、Iconic Material Inc. 和 Toshima Manufacturing。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 2027 年市场规模及需求预测(百万美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 类型

- 陶瓷製品

- 固体聚合物

- 应用

- 薄膜电池

- 电动汽车电池

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 南美洲

- 中东和非洲

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- NEI Corporation

- Ohara Inc.

- Empower Materials

- Ampcera Corp

- Ionic Materials Inc.

- Toshima Manufacturing Co. Ltd

第七章 市场机会与未来趋势

简介目录

Product Code: 70429

The Solid Electrolyte Market is expected to register a CAGR of greater than 15% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the long term, factors such as the increasing demand for an energy storage system with high energy density and longer cycle life are likely to drive the market. Increasing uses of electronic devices and electric vehicles are expected to increase the use of solid-state batteries and solid electrolytes in the coming years.

- On another note, the high cost of a solid-state battery is likely to hinder the solid electrolyte market during the forecast period.

- Electric vehicles (EVs) are expected to account for nearly 10-12% of total vehicle sales by 2030. Multiple factors, such as government regulations in various regions of the world and technological developments in batteries, are likely to boost the EV market. Moreover, as per industry experts, existing lithium-ion battery technology used in electric vehicles is expected to maintain a high price in the upcoming years. Additionally, drawbacks such as lower energy density and limited safety features of a lithium-ion battery are likely to create an opportunity for the markets like solid-state batteries and solid electrolytes in the near future.

- Asia-Pacific is expected to dominate the market, with most of the solid electrolyte demand coming from countries like China and India.

Solid Electrolyte Market Trends

Thin-Film Battery to Witness a Significant Growth

- Thin-film batteries are one of the All-Solid-State Batteries (ASSB) that utilize ceramic solid electrolytes such as Lithium phosphorous oxy-nitride (LiPON) to transfer the ions between the cathode and anode.

- Cathode materials are often made of lithium-oxide, such as LiCoO2, LiMn2O4, and LiFePO4, while anode materials are typically made of graphite, Li metal, or other metallic materials.

- The majority of thin-film battery applications are directed toward improving current consumer and medical products. Thin-film batteries are used in thinner electronic devices, as the thickness of the battery is much less than that of conventional Li-ion batteries.

- With the increasing use of RFID tags in shipping and inventory control and a cardiac pacemaker to treat irregular heart rhythms of patients, they are likely to have a high use of solid-state batteries and solid electrolytes in the coming years.

- The global demand for batteries is expected to increase from 185 GWh in 2020 to over 2,000 GWh by 2030. Despite the prevalence of consumer electronics in 2020, the small energy capacities of gadgets such as phones mean that, in terms of gigawatts, the demand was relatively low. This large increase was mainly due to the electrification of transport, which will account for the vast majority of battery demand in 2030 in terms of total energy storage capacity.

- In August 2022, the Colorado Department of Education identified a new sodium-ion-based solid electrolyte composition that may enable ultrafast battery charge and discharge. The new rechargeable battery utilized for powering electric vehicles, mobile phones, and many other applications could be a step closer following a breakthrough discovery by NUS researchers.

- In November 2021, Dutch start-up LionVolt BV, a spin-off from the Netherlands Organization for Applied Scientific Research (TNO), announced it had secured EUR 4 million from the development agency of the region of Brabant to develop a 3D solid-state thin film battery, which it expects to apply initially in wearables and electric cars.

- Owing to the above-mentioned points and the recent developments, thin film battery is expected to dominate the solid electrolyte market during the forecast period.

Asia-Pacific is Likely to Dominate the Market

- The Asia-Pacific market majorly consists of 18 countries, with 59.76% of the world's population. China and India dominate the region, with the highest valuation of export and import bills.

- Apart from trade, the region has the highest population of nearly 4.6 billion. China and India have the highest populations in the region, with a higher number of electric vehicle populations. Cumulatively, China and India had more than 1.2 million electric vehicles in 2021.

- High trade value indicates high shipments and high uses of RFID, a high population indicates higher chances of heart diseases and implantation of cardiac pacemakers, and a high population of EVs indicates high uses of rechargeable batteries.

- Moreover, in August 2022, SVOLT Energy Technology Co. Ltd (SVOLT), a high-tech company headquartered in China, announced that it was progressing in the development of solid-state batteries. The company produced an initial batch of 20Ah cells with sulfide-based solid-state electrolyte.

- Furthermore, in February 2022, Tesla planned to build a second electric vehicle (EV) facility in China to help it keep up with the increasing demand both locally and in export markets. In the short-term, Tesla plans to increase capacity in China to at least 1 million cars per year, with a second plant planned near its present production site in Shanghai's Lingang free trade zone.

- Thus, developments of solid-state battery for electric vehicles and the increasing population, along with growing trade and cardiac patients in the region, is likely is expand the solid-state battery and solid electrolyte market in the near future.

Solid Electrolyte Industry Overview

The solid electrolyte market is consolidated. Some of the key players in the market (in no particular order) include NEI Corporation, Ohara Inc., Empower Materials, Ampcera Corp., Iconic Material Inc., and Toshima Manufacturing Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD million, untill 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Ceramic

- 5.1.2 Solid Polymer

- 5.2 Application

- 5.2.1 Thin-Film Battery

- 5.2.2 Electric Vehicle Battery

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 South America

- 5.3.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 NEI Corporation

- 6.3.2 Ohara Inc.

- 6.3.3 Empower Materials

- 6.3.4 Ampcera Corp

- 6.3.5 Ionic Materials Inc.

- 6.3.6 Toshima Manufacturing Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219