|

市场调查报告书

商品编码

1644268

云端基础设施服务:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Cloud Infrastructure Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

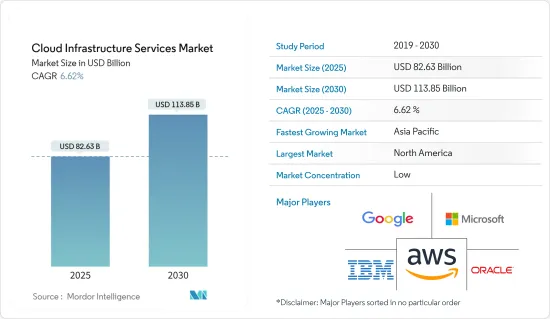

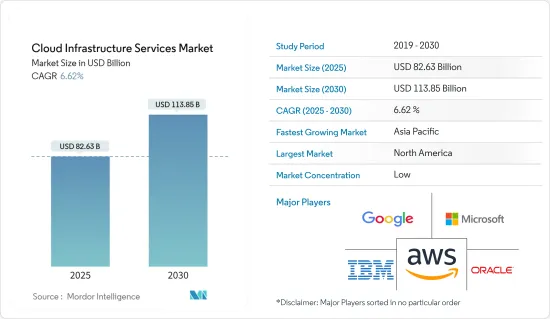

预计 2025 年云端基础设施服务市场规模为 826.3 亿美元,到 2030 年将达到 1,138.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.62%。

市场的主要成长动力是低成本、扩充性、灵活性和安全性。云端基础设施服务加速了产品上市时间(TTM)并实现了快速的应用开发和实施流程。此外,降低IT基础设施营运成本和维护成本的日益增长的需求也推动了云端基础设施服务的采用。

主要亮点

- 推动云端基础设施服务市场成长的主要因素之一是全球资料量的增加。客户越来越多地采用云端基础的技术来提高资料安全性、完整性和服务交付,加上全球互联网和智慧型手机普及率的提高,都是推动市场成长的因素。

- 根据服务类型,储存即服务预计在预测期内保持较大的市场规模。根据欧盟统计局统计,欧盟云端运算的主要用途是电子邮件服务和文件存储,分别占66%和53%。电子邮件管理保持稳定,但文件储存使用量增加了 15%。最近的另一个需求是企业资料库託管,尤其是虚拟专用伺服器 (VPS) 託管。

- IaaS 的好处也不断增加,为市场成长创造了机会。包括微软在内的主要供应商正在迅速将其解决方案转移到云端相关模型,包括 Dynamics 365、Office 365 和 Windows as a Service。 Office 365、Windows 即服务等整体而言,云端运算的成长不仅是由 IaaS 的发展所推动的,还受到三大云端运算公司的推动:Google、微软和 IBM。

- 然而,全球云端基础设施服务面临多重挑战,包括高频宽成本、频繁的监控和控制、安全问题、不愿放弃控制以及在缓慢的云端供应商网路上进行效能管理。

- COVID-19 已影响全球云端基础设施和支援服务。由于公司需要利用服务合作伙伴来支持在家工作,许多合约业务将增加,因此目前由疫情引发的危机可能会在短期内提振市场。

云端基础设施服务市场趋势

公有公共云端占据主导市场占有率

- 基于公共云端的部署模式由于其成本效益和易于取得而越来越受欢迎。公共云端基于云端运算模型,其中资源(CPU、伺服器、机架等)根据需求在多家公司之间共用。

- 基于公共云端的解决方案需要较少的实体设定和维护,并可随时随地提供全天候存取。由于公共云端具有可扩展性、可靠性、灵活性、公共事业成本和与位置无关的服务等多种优势,预计基于公共云端的采用将实现高成长率。

- 根据Visual Capitalist统计,在公共云端基础设施服务供应商中,AWS在190个国家拥有超过100万活跃用户,涵盖整个公共云端市场的41.5%。

- 市场供应商不断增强其产品和服务,以满足对公共云端基础设施日益增长的需求。例如,Oracle云端基础设施(OCI)去年6月宣布推出一项名为「OCI Dedicated Region」的新服务,为其内部客户提供公共云端服务。

北美引领云端基础设施服务市场

- 目前,由于云端基础IT服务的加速采用和IT基础设施相关企业在云端基础设施研发方面投入的巨额资金,北美占据全球云端基础设施服务市场占有率的主导地位。

- 美国在云端基础设施服务产业占据主导地位,这得益于主要供应商的进入以及旨在降低资料中心成本和提高业务永续营运的云端基础服务采用率的飙升。谷歌、亚马逊和微软等主要科技公司的存在也推动了市场的成长。

- 该地区也是科技新兴企业的主要中心。良好的商业环境和政府支持政策正在鼓励企业开发先进的云端平台。此外,知名科技公司对云端技术的创投不断增加也推动了市场的成长。

- 北美拥有丰富的熟练劳动力,中小企业和大型企业渴望进入并发展云端基础设施服务,这也是该地区采用云端基础设施服务的主要驱动因素。

- 此外,预计采用先进的应用开发技术和不断增加的资料量也将成为预测期内市场成长的主要驱动力。公共云端由于其成本低、按需可用性和更高的安全性,在该地区获得了显着的发展。

云端基础设施服务产业概况

云端基础设施服务市场竞争激烈,有几家大公司在竞争。市场竞争日益激烈,企业正在寻求更先进的经营模式以缩短产品上市时间,并迁移到云端基础设施以提高业务敏捷性。值得关注的公司不断创新并投入大量资金进行研发,以提供具有成本效益的产品系列。在云端基础设施服务市场中营运的主要公司包括 AT&T、阿里巴巴、Dimension 资料、AWS、IBM、Intervision、 Oracle、微软、Google等。

2022年12月,微软与伦敦证券交易所集团宣布在下一代资料分析和云端基础设施解决方案方面展开为期一年的策略合作,微软将透过股权收购的方式对伦敦证券交易所集团进行投资。该交易将使伦敦证券交易所的资料平台和其他关键技术基础设施转移到微软的 Azure 云端环境。

2022 年 10 月, Oracle宣布扩展其云端基础设施产品组合,使系统整合商和通讯业者等合作伙伴能够向其客户销售和交付云端服务。云端基础设施平台根据特定市场和产业的需求,提供全套云端基础设施和平台服务。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- 产业价值链分析

- COVID-19 对云端基础设施服务市场的影响分析

第五章 市场动态

- 市场驱动因素

- 扩大 IaaS 的优势

- 降低成本并提高投资收益(ROI)

- 扩大边缘运算的使用

- 市场挑战

- 对资料遗失的担忧日益增加

- 频宽成本高,监控频繁

第六章 市场细分

- 按服务类型

- Compute as a Service

- Storage as a Service

- Networking as a Service

- 其他服务类型(桌面即服务、主机)

- 按部署模型

- 公共云端

- 私有云端

- 混合云端

- 按组织规模

- 中小型企业

- 大型企业

- 按行业

- BFSI

- 资讯科技/通讯

- 零售

- 医疗保健与生命科学

- 政府

- 其他产业(能源与公共产业、媒体与娱乐)

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Amazon Web Services, Inc.

- Google LLC

- Microsoft Corporation

- IBM Corporation

- Oracle Corporation

- Alibaba Cloud

- Rackspace Inc.

- Fujitsu Limited

- CenturyLink, Inc.

- VMware, Inc.

- DXC Technology

- Dimension Data

- Verizon Wireless

- Tencent Holdings Ltd.

- AT&T Mobility LLC

- NEC Corporation

第八章投资分析

第九章 市场机会与未来趋势

The Cloud Infrastructure Services Market size is estimated at USD 82.63 billion in 2025, and is expected to reach USD 113.85 billion by 2030, at a CAGR of 6.62% during the forecast period (2025-2030).

The primary growth drivers for the market include low costs, scalability, flexibility, and security. The cloud infrastructure service offerings accelerate Time-to-Market (TTM) and rapid application development and running processes. Moreover, the expanding need to decrease the operational costs and maintenance of the IT infrastructure also boosts several organizations' adoption of cloud infrastructure services.

Key Highlights

- One of the primary factors fueling the growth of the cloud infrastructure services market is the increase in data quantities worldwide. The increased adoption of cloud-based technologies by customers to improve data security, integrity, and service delivery, as well as increasing internet penetration and smartphone adoption rates worldwide, all contribute to market growth.

- Based on the service type, storage as a service, service type is expected to hold a larger market size during the forecast period. According to Eurostat, email services and file storage are the predominant uses for cloud computing in the EU, with 66% and 53%, respectively. Email management remains steady, while file storage purposes have increased by a whopping 15%. Other recent needs include hosting company databases, specifically virtual private server (VPS) hosting.

- Increasing IaaS benefits are also providing ample opportunities for the growth of the market. Principal providers, including Microsoft, are quickly moving their solutions to cloud-associated models such as Dynamics 365. Office 365, and Windows as a Service, to name a few. Overall, cloud growth is propelled not only by the development of IaaS but is also being encouraged by three talented cloud players, including Google, Microsoft, and IBM.

- However, global cloud infrastructure services face a few challenges, including high bandwidth costs, frequent monitoring and control, security concerns, unwillingness to retreat controls, and performance management in case of a slow cloud provider network.

- Due to COVID-19, cloud infrastructure services and support services have been affected globally. The current crisis due to the pandemic may see work volume increase for many of the contracts in the short term as firms need to use service partners to support home working arrangements, which could boost the market.

Cloud Infrastructure Services Market Trends

Public Cloud Holds a Dominant Market Share

- The public cloud-based deployment model sees growing demand due to its cost-effectiveness and easy availability. The public cloud is based on the cloud computing model, which shares resources (such as CPU, servers, and racks) among several businesses depending on their demand.

- Public cloud-based solutions need fewer physical setups and low maintenance and provide 24/7 accessibility from any time, anywhere. Due to various benefits of public clouds, such as scalability, reliability, flexibility, utility-style costing, and location independence services, public cloud-based deployments are expected to record a high growth rate.

- Among the public cloud infrastructure service providers, Visual Capitalist states that AWS has over a million active users spread across 190 countries, supporting that AWS covers 41.5% of the entire public cloud market.

- Market vendors are constantly enhancing their products and services to meet the rising demand for public cloud infrastructure. For instance, in June last year, Oracle Cloud Infrastructure (OCI) announced the launch of a new offering - OCI Dedicated Region - that would enable it to offer public cloud services to customers on its premises.

North America to Drive the Cloud Infrastructure Services Market

- At present, North America is commanding the global cloud infrastructure services market share due to an escalation in the adoption of cloud-based IT services and huge investments by organizations in IT infrastructure in the research and development of cloud infrastructure.

- The U.S. dominates the cloud infrastructure services industry due to the attendance of principal vendors and the soaring adoption rate of cloud-based services to decrease costs for data centers and improve business continuity. The market growth is also connected to the presence of major technology players such as Google, Amazon, and Microsoft.

- This area is also a principal center for technology start-ups. Favorable business conditions and supportive government policies have encouraged businesses to develop advanced cloud platforms. Moreover, prominent tech players' increasing venture capital in cloud technology has also driven market growth.

- The availability of skilled labor and the keen focus of SMEs and large enterprises to enter and grow in North America are also primary driving factors for adopting cloud infrastructure services in the region.

- The increasing adoption of advanced application development technologies and data volumes will also drive significant market growth during the forecast period. The public cloud is gaining massive approval in this region due to its low costs, on-demand availability, and improved security.

Cloud Infrastructure Services Industry Overview

The Cloud Infrastructure Services Market is highly competitive and consists of several major players. As the competition among market players increases, organizations are looking for more advanced business models to reduce their time to market and switching to cloud infrastructure to improve business agility. The notable members keep innovating and spending on research and development to present a cost-effective product portfolio. The major companies operating in the cloud infrastructure services market are AT&T, Alibaba, Dimension Data, AWS, IBM, InterVision, Oracle, Microsoft, and Google, among others.

In December 2022, Microsoft and LSEG announced a 1-year strategic collaboration for next-generation data and analytics and cloud infrastructure solutions by making equity investments in LSEG through the acquisition of shares. Under the arrangements, LSEG's data platform and other key technology infrastructure will migrate into Microsoft's Azure cloud environment.

In October 2022, Oracle announced the expansion of its cloud infrastructure portfolio that will allow partners such as system integrators and telcos to sell and deliver cloud services to their customers. The cloud infrastructure platform will offer the full set of cloud infrastructure and platform services tailored to the needs of specific markets and industries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Analysis on the impact of COVID-19 on the Cloud Infrastructure Services Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing IaaS Benefits

- 5.1.2 Increased Cost-Savings and Return on Investments (ROI)

- 5.1.3 Growing Use of Edge Computing

- 5.2 Market Challenges

- 5.2.1 Rising Concerns of Data Losses

- 5.2.2 High Bandwidth Costs & Frequent Monitoring and Control

6 MARKET SEGMENTATION

- 6.1 By Service Type

- 6.1.1 Compute as a Service

- 6.1.2 Storage as a Service

- 6.1.3 Networking as a Service

- 6.1.4 Other Service Types (Desktop as a Service, Managed Hosting)

- 6.2 By Deployment Model

- 6.2.1 Public Cloud

- 6.2.2 Private Cloud

- 6.2.3 Hybrid Cloud

- 6.3 By Organization Size

- 6.3.1 Small and Medium-Sized Enterprises (SMEs)

- 6.3.2 Large Enterprises

- 6.4 By End-user Vertical

- 6.4.1 BFSI

- 6.4.2 IT & Telecommunications

- 6.4.3 Retail

- 6.4.4 Healthcare & Life Sciences

- 6.4.5 Government

- 6.4.6 Other End-user Verticals (Energy & Utilities, Media & Entertainment)

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia Pacific

- 6.5.4 Latin America

- 6.5.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amazon Web Services, Inc.

- 7.1.2 Google LLC

- 7.1.3 Microsoft Corporation

- 7.1.4 IBM Corporation

- 7.1.5 Oracle Corporation

- 7.1.6 Alibaba Cloud

- 7.1.7 Rackspace Inc.

- 7.1.8 Fujitsu Limited

- 7.1.9 CenturyLink, Inc.

- 7.1.10 VMware, Inc.

- 7.1.11 DXC Technology

- 7.1.12 Dimension Data

- 7.1.13 Verizon Wireless

- 7.1.14 Tencent Holdings Ltd.

- 7.1.15 AT&T Mobility LLC

- 7.1.16 NEC Corporation