|

市场调查报告书

商品编码

1644272

印度柴油发电机市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)India Diesel Generator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

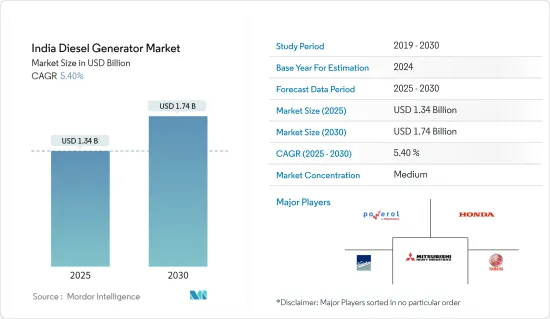

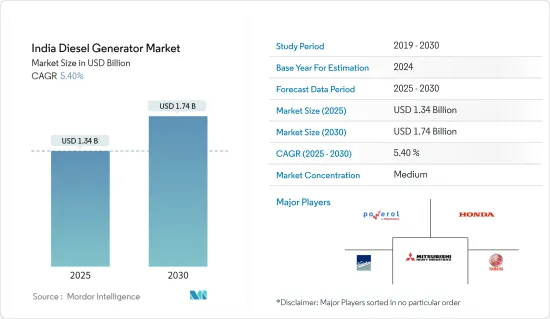

印度柴油发电机市场规模预计在 2025 年达到 13.4 亿美元,预计到 2030 年将达到 17.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.4%。

主要亮点

- 从中期来看,预计停电次数增加和都市化快速发展等因素将在预测期内推动市场成长。

- 另一方面,由于可再生能源发电的趋势日益增长,尤其是在以减少温室气体排放为目标的工业领域,印度柴油发电机市场在不久的将来可能会面临障碍。

- 然而,混合能源系统也得到了发展,配备数位工具的智慧柴油发电机也出现了。预计这些发展将为市场创造重大机会。

印度柴油发电机市场趋势

预计商业领域将主导市场

- 在停电期间(以避免生产风险)以及电网接入有限的地区,工业运作主要依赖柴油发电机产生的电力。原油和天然气、精製、采矿和采石、建筑、汽车、化学品、运输和仓储以及製药等工业部门占能源消耗的最大份额。因此,这些产业对持续可靠电力的需求不断增加,可能会增加对发电机的需求。

- 2024 年 3 月,印度政府踏上了改变国家基础设施格局的雄心勃勃的旅程,旨在加强经济成长、增强连通性并改善公民的生活品质。例如,印度在基础设施发展方面取得了重大里程碑,例如世界最长的公路隧道阿塔尔隧道的开通和世界最高的铁路桥杰纳布桥的建设。这些偏远地区的基础设施建设可能会导致对柴油发电机供电的需求激增。

- 柴油发电机市场的主要驱动力之一是国家工业基础的扩张。特别是汽车、医药、纺织等製造业近年来成长迅速。这些产业需要可靠的电力来确保高效运作并防止代价高昂的中断。柴油发电机为偏远地区或电网故障时提供电力提供了多功能且可靠的解决方案。

- 根据印度品牌股权基金会(IBEF)估计,到2025-26年,印度製造业规模预计将达到1兆美元,推动力主要集中在汽车、电子和纺织业的投资,其中古吉拉突邦、马哈拉斯特拉邦和泰米尔纳德邦的製造业将发挥主导作用。 「印度製造」和「工业投资者」计画等政府倡议将促进成长、吸引外商直接投资并加强工业基础设施。

- 根据印度统计和专案实施部 (MOSPI) 的报告,到 2024 财年,金融、房地产和专业服务将占印度附加价值毛额(GVA) 的大部分。虽然这些服务业对该国的GVA贡献巨大,但农业作为该国最大的就业部门,同年的贡献率仅为 18% 左右。

- 印度政府对基础建设发展的重视,对柴油发电机产生了巨大的需求。道路建设、铁路扩建和发电厂建设等大型计划需要依赖可靠电源的重型机械和设备。柴油发电机是此类作业的理想动力,可确保不间断的生产力并满足计划期限。

- 2024年9月,印度宣布将投资3兆印度卢比用于地铁计划,以改善城市交通并释放经济潜力。这些投资旨在减少交通拥堵和污染,刺激对施工期间柴油发电机和备用电源的需求。

- 预计未来印度柴油发电机市场将持续保持成长轨迹。该国强劲的经济成长,加上对可靠电力的需求不断增长,为柴油发电机製造商和供应商创造了巨大的机会。随着工业部门的扩大和基础设施建设的进步,柴油发电机将继续成为印度电力格局中不可或缺的一部分。

替代能源的日益普及预计将阻碍市场

- 人们对环境和能源安全的日益担忧正推动印度转向更清洁的能源。现在,市场正在向更清洁的燃料开放——包括天然气、生质柴油、乙醇和太阳能等再生能源来源。此外,技术进步正在推动柴油发电机更清洁替代品的创新。

- 柴油发电机引起环保人士的担忧,因为排放大量空气和噪音污染物。燃气发电机是柴油发电机的可靠替代品,而柴油发电机的市场占有率正在被燃气和其他替代燃料发电机所蚕食。

- 近年来,印度多个邦已出台指令,限制使用柴油发电机。例如,鑑于德里-NCR地区的污染水平不断上升,2023 年 9 月,空气品质管理委员会 (CAQM) 禁止在医疗保健等基本服务中使用大型柴油发电机。同样,果阿邦污染控制委员会(GSPCB)也禁止安装柴油发电机以抑制污染。

- 儘管委员会和州级机构已建议印度的柴油发电机组使用排放气体控制设备(ECD) 和双燃料套件,但这会为最终消费者带来额外的成本。这将迫使最终消费者寻找替代能源解决方案作为临时电源或备用电源。这种情况抑制了印度柴油发电机市场的成长。

- 例如,三星印度公司于2024年3月宣布,将在其印度诺伊达工厂从柴油发电机过渡到天然气发电机,凸显其对永续性的承诺。这种转变不仅可以抑制排放,还可以大幅节省成本。该公司还指出,已经用 8 台天然气发电机取代了 10 台柴油发电机。该计划包括安装一台 20 兆瓦的 PNG 天然气发电机,以满足诺伊达工厂的需求并在危机情况下提供紧急支援。预计工业消费者的此类环保措施将在预测期内抑製印度柴油发电机市场。

- 印度柴油发电机组市场的参与者,包括 Jakson Group、Kirloskar Oil Engines、Cummins、Greaves Cotton Limited 和 Mahindra Powerol,正在将重点转向製造使用生物柴油和乙醇等更清洁燃料的发电机组。

- 例如,2024 年 7 月,Greaves Engineering 在印度推出了新一代符合 CPCB IV+ 标准的发电机。新型发电机也相容于乙醇和生物柴油,可供商业和工业消费者使用。发电机容量范围从5kVA至500kVA。

- 其他可再生能源发电技术,如太阳能与电池集成,也正在成为柴油发电机的可行替代品。例如,2026 年 5 月,EcoFlow 在印度市场推出太阳能发电机,以满足备用电源的需求。该公司声称,整合电池的太阳能发电机 DELTA 2 MAX 是可携式发电机市场的开创性创新。容量约为 2048 瓦时,可为您的家庭提供长达两天的紧急电力。它很可能成为印度市场柴油发电机的有力替代品。

- 截至 2024 年 2 月,印度私部门的可再生能源装置容量最大,总合约 223,000 兆瓦。南亚各国政府坚定致力于扩大计划能源来源的使用,并带头进行大大小小的计划。除了生产可再生能源外,这些措施还注重创造就业机会,特别是在农村地区。

- 鑑于这些新兴市场趋势,采用替代能源的趋势日益增长预计将抑製印度柴油发电机市场的成长。

印度柴油发电机产业概况

印度柴油发电机市场比较分散。市场的主要企业(不分先后顺序)包括本田印度动力产品有限公司、Yamaha Motor Co, Ltd.、三菱重工、马恆达 Powerol 有限公司和 Kirloskar 石油发动机有限公司。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 2029 年市场规模与需求预测(美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 停电次数增加

- 柴油发电机技术的改进

- 限制因素

- 越来越多采用替代能源

- 驱动程式

- 供应链分析

- PESTLE分析

第五章 市场区隔

- 按额定功率

- 小于75kVA

- 75-350 kVA

- 350kVA以上

- 按最终用户

- 住宅

- 商业的

- 产业

- 按应用

- 备用电源

- 常用/连续功率

- 抑低尖峰负载电力

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Honda India Power Products Ltd.

- Yamaha Motor Co. Ltd.

- Mitsubishi Heavy Industries Ltd.

- Mahindra Powerol Ltd.

- Kirloskar Oil Engines Ltd.

- Cummins India Ltd.

- Greaves Cotton Limited

- Ashok Leyland Ltd.

- Caterpillar Inc.

- Cooper Corporation Pvt. Ltd.

- Atlas Copco AB

第七章 市场机会与未来趋势

- 混合能源系统的发展

简介目录

Product Code: 70459

The India Diesel Generator Market size is estimated at USD 1.34 billion in 2025, and is expected to reach USD 1.74 billion by 2030, at a CAGR of 5.4% during the forecast period (2025-2030).

Key Highlights

- Over the medium period, factors such as growing power outages and rapid urbanization are anticipated to drive the market's growth during the forecast period.

- On the other hand, the Indian diesel generator market may face hurdles in the near future due to the growing trend of renewable power generation, particularly in industries that have targeted reducing greenhouse gas emissions.

- Nevertheless, the development of hybrid energy systems and emergence of smart diesel generator sets equipped with digital tools. Such developments are anticipated to create significant opportunities for the market.

India Diesel Generator Market Trends

The Commercial Segment is Expected to Dominate the Market

- Industrial operations mainly depend on electricity generated from diesel generators during power outages (to avoid production risks) and in regions with limited grid access. The industrial sector, which includes crude oil, natural gas, refining, mining and quarrying, construction, automotive, chemicals, transportation and storage, and pharmaceuticals, accounts for the largest share of energy consumption. Therefore, the increasing demand for continuous and reliable power from these industries will escalate the demand for generators.

- In March 2024, the Government of India embarked on an ambitious journey to revolutionize the country's infrastructure landscape, aiming to bolster economic growth, enhance connectivity, and improve the quality of life for its citizens. For instance, India has achieved significant milestones in infrastructure development, including the inauguration of the world's longest highway tunnel, the Atal Tunnel, and the construction of the world's highest railway bridge, the Chenab Bridge. This remote infrastructure construction is likely to surge the demand for diesel generators for power supply.

- One of the primary drivers of the diesel generator market is the country's expanding industrial base. Manufacturing, particularly automotive, pharmaceuticals, and textiles, has grown significantly in recent years. These industries require reliable power to ensure efficient operations and prevent costly disruptions. Diesel generators provide a versatile, dependable solution that delivers power in remote locations or during grid failures.

- According to the India Brand Equity Foundation (IBEF), India's manufacturing sector is poised to reach USD 1 trillion by 2025-2026, led by Gujarat, Maharashtra, and Tamil Nadu, fueled by investments in automobile, electronics, and textile industries. Government initiatives like Make in India and PLI schemes drive growth, attract FDI, and enhance industrial infrastructure.

- As reported by the Ministry of Statistics and Programme Implementation (MOSPI), in fiscal year 2024, finance, real estate, and professional services dominated India's gross value added (GVA) landscape. While these service sectors significantly contributed to the nation's GVA, agriculture, being the country's largest employer, accounted for approximately 18% that year.

- The Indian government's focus on infrastructural development has created a substantial demand for diesel generators. Large-scale projects, such as road construction, railway expansion, and power plant construction, necessitate heavy machinery and equipment that rely on reliable power sources. Diesel generators are ideal for powering these operations, ensuring uninterrupted productivity, and meeting project deadlines.

- In September 2024, India announced an investment value of INR 3 trillion in metro rail projects to improve urban mobility and unlock economic potential. These investments aim to reduce congestion and pollution while fueling the demand for diesel generators during construction work, as well as to have a backup power source.

- Indian diesel generator market will continue its growth trajectory in the coming years. The country's robust economic growth, coupled with the increasing demand for reliable power, presents significant opportunities for manufacturers and suppliers of diesel generators. As the industrial sector expands and infrastructure development continues, diesel generators will remain vital to the Indian power landscape.

Increasing Adoption of Alternative Energy Sources is Expected to Hinder the Market

- Increasing environmental and energy security concerns led to a shift toward cleaner resources in India. At present, the market for cleaner fuels (such as natural gas and renewable energy sources, like biodiesel, ethanol, solar, etc.) is developing. Additionally, technological advancement has led to the innovation of cleaner alternatives to diesel generators.

- Diesel generators emit high levels of air and noise-polluting elements, which has been one of the concerns of environmentalists. As gas generators serve as reliable alternatives for diesel generators, the diesel generator has been losing its market share to gas generators and other alternative fuel generators.

- In recent years, few Indian states have notified directives to limit the utilization of diesel generators. For instance, in September 2023, the Commission for Air Quality Management (CAQM) banned large diesel generator sets considering the increased pollution levels in the Delhi NCR region, exempting the same only for essential services like healthcare, etc. Likewise, the Goa State Pollution Control Board (GSPCB) has also banned the integration of diesel generator sets to limit pollution.

- While the commission and state-level agencies have recommended emission control devices (ECDs) and Dual Fuel Kits for diesel generator sets in India, it comes with an additional cost to the end-consumers. This prompts them to look for alternate energy solutions for temporary or backup power. Such a scenario has restrained the growth of the diesel generator market in India.

- For instance, in March 2024, Samsung India noted the transition from diesel to natural gas generators at its Noida Plant in India, underscoring its commitment to sustainability. This shift not only curtails emissions but also results in significant cost savings. Further, the company noted replacing ten diesel generators with eight natural gas-based alternatives. The initiative involved setting up a 20 MW PNG gas-based genset to cater to the Noida plant's requirements and offer emergency support in critical situations. Such commitment to environmental stewardship by industrial consumers is expected to restrain India's diesel generator market during the forecast period.

- The diesel Generator market players in India, such as Jakson Group, Kirloskar Oil Engines, Cummins, Greaves Cotton Limited, and Mahindra Powerol, have shifted their focus on manufacturing generator sets that utilize cleaner fuels such as biodiesel and ethanol.

- For instance, in July 2024, the firm Greaves Engineering launched new generation products that are CPCB IV + Compliant Gensets in India. The new gensets are compatible with ethanol and biodiesel, which is feasible for commercial and industrial consumers. Further, the gensets are launched with capacities ranging from 5 kVA to 500 kVA.

- Other renewable energy technologies, such as solar energy integrated with batteries, have also emerged as viable alternatives to diesel generators. For instance, in May 2026, EcoFlow rolled out solar generators in the Indian market to cater to backup power requirements. The company claims that DELTA 2 MAX, a solar generator integrated with a battery, is a pioneer innovation in the portable generator market. With a capacity of approx. 2048 watt-hour, the product intends to deliver emergency power to a household for up to two days. This is likely to emerge as a robust alternative for diesel generators in the Indian market.

- As of February 2024, India's private sector boasted the largest installed renewable energy capacity, totaling around 223 thousand megawatts. The South Asian nation's government has been steadfast in its commitment to amplifying the use of clean energy sources, spearheading both small and large-scale projects. Beyond just generating renewable energy, these initiatives also focus on creating job opportunities, particularly in rural regions.

- Owing to these developments, the growing trend of adoption of alternative energy sources is expected to restrain the growth of the diesel generator market in India.

India Diesel Generator Industry Overview

The Indian diesel generator market is semi-fragmented. Some of the key players in the market (in no particular order) include Honda India Power Products Ltd, Yamaha Motor Co. Ltd., Mitsubishi Heavy Industries Ltd, Mahindra Powerol Ltd., Kirloskar Oil Engines Ltd., and others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Power Outages

- 4.5.1.2 Improvement in Technology of Diesel Generator

- 4.5.2 Restraints

- 4.5.2.1 Increasing Adoption Of Alternative Energy Sources

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Power Rating

- 5.1.1 Below 75 kVA

- 5.1.2 75-350 kVA

- 5.1.3 Above 350 kVA

- 5.2 End-User

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.3 Industrial

- 5.3 Application

- 5.3.1 Standby Backup Power

- 5.3.2 Prime/Continuous Power

- 5.3.3 Peak Shaving Power

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Honda India Power Products Ltd.

- 6.3.2 Yamaha Motor Co. Ltd.

- 6.3.3 Mitsubishi Heavy Industries Ltd.

- 6.3.4 Mahindra Powerol Ltd.

- 6.3.5 Kirloskar Oil Engines Ltd.

- 6.3.6 Cummins India Ltd.

- 6.3.7 Greaves Cotton Limited

- 6.3.8 Ashok Leyland Ltd.

- 6.3.9 Caterpillar Inc.

- 6.3.10 Cooper Corporation Pvt. Ltd.

- 6.3.11 Atlas Copco AB

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Hybrid Energy Systems

02-2729-4219

+886-2-2729-4219