|

市场调查报告书

商品编码

1644280

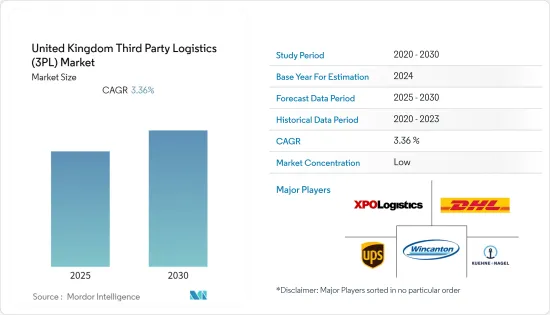

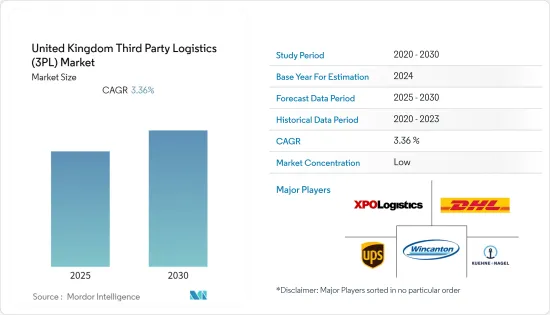

英国第三方物流(3PL) -市场占有率分析、产业趋势与成长预测(2025-2030 年)United Kingdom Third Party Logistics (3PL) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

预测期内,英国第三方物流市场预计复合年增长率为 3.36%

关键亮点

- 英国是世界主要贸易国之一,大部分製成品出口到许多欧洲国家。由于发达的基础设施、成熟的供应链网络和全球参与者的存在,该国的货运和物流市场占据强势地位。

- 大型零售和电子商务产业是该国第三方物流的主要用户。在英国这样的竞争市场中,送货时间是零售商和网路商店的关键竞争因素。这就是为什么零售商委託其物流外包给配送专家的原因,从而使大大小小的零售商能够透过按需隔日配送进行竞争。

- 托运人继续利用第三方物流产品来优化其供应链、降低成本、创造价值并协调双方成功的期望。第三方物流提供的高端技术整合、行业专业知识和成本节约是外包服务兴起的原因。此类服务的外包显示对第三方物流的需求不断增加,从而推动了市场的发展。

- 行动技术正在彻底改变第三方物流。许多第三方物流公司已经开始使用行动装置和应用程式来提高其灵活性。配备无线射频识别 (RFID) 晶片的设备不仅可以传输位置信息,还可以保存有关自身的资料,从而可以立即进行追踪和识别。客户可以随时使用安装在行动电话上的行动应用程式订购、处理和追踪他们的货物。

英国第三方物流(3PL) 市场趋势

物流园区和履约中心的成长

物流业正在经历巨大的变革,消费者现在最快只需一小时就能收到货物。快速配送服务已为多数都市区消费者所熟悉。 Deliveroo、Ofo和Uber等大型企业已经将食品和交通的极高效率变为日常现实。

为了满足疫情引发的线上购物激增的需求,英国正经历大型仓储棚建设的创纪录热潮。 2021 年计划建造近 3,700 万平方英尺(340 万平方公尺)的仓库空间,高于 2020 年的 2,300 万平方英尺。

电子商务继续推动仓库扩建的需求,但也需要新的仓库来支持创新技术和永续能源的发展。预计英国仓储业在可预见的未来仍将保持蓬勃发展。

截至 2022 年 1 月,东米德兰地区占英国在建用地面积1,860 万平方英尺的 440 多万平方英尺。这使得它成为投机市场建设活动最活跃的地区。投机性开发是指没有考虑买家或居住者的建筑计划。

电子商务推动市场成长

电子商务的快速成长正在推动英国对第三方物流服务的需求。电子商务的持续成长从根本上改变了第三方物流(3PL)的格局。随着消费者对准时、准确交付的期望不断提高,为了保持竞争力,越来越多的电子商务零售商将其物流和履约业务的关键部分外包给第三方物流合作伙伴。

许多电子商务零售商规模太小,无法承担内部物流服务,需要协助。因此,供应链管理、仓储、整合服务和订单履约等服务都外包给了第三方物流公司。然而,亚马逊和阿里巴巴等大型电子商务零售商正在开发其物流基础设施。

同时,电子商务的成长和消费者期望的变化也对第三方物流公司提出了挑战,要求他们缩短小包裹运送时间、提高效率并采用新的先进技术。最后一哩配送即将发生重大转变,一些公司正在探索宅配储物柜、收集点、众包配送、无人机配送和自动驾驶汽车等替代方案。技术进步正在重塑整个供应链并彻底改变小包裹产业。科技正在成为提高效率和满足消费者期望的关键推动因素。

英国第三方物流(3PL) 产业概况

英国第三方物流(3PL) 市场本质上是分散的,少数大公司与中小企业建立策略合作伙伴关係,以利用其在市场上的本地能力。我们看到大型区域性公司正在向新的地区扩张并扩大其地理覆盖范围。英国第三方物流(3PL) 市场正在迎来提供客製化产业特定服务的新竞争对手。市场的主要企业包括 DHL International GmbH、Kuehne+Nagel、UPS、Wincanton PLC 和 XPO Logistics Inc.

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提

- 市场定义

- 研究范围

第 2 章执行摘要

第三章调查方法

第四章 市场动态与洞察

- 市场概况

- 市场动态

- 驱动程式

- 政府倡议

- 贸易增加

- 限制因素

- 劳动力短缺

- 机会

- 物流领域的技术进步

- 逆向物流

- 驱动程式

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 消费者议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 价值链/供应链分析

- 行业法规及政策

- 仓储市场的整体趋势

- CEP、最后一哩配送和低温运输物流等其他领域的需求

- 物流领域的技术发展

- 电子商务业务洞察

- COVID-19 对市场的影响

第五章 市场区隔

- 按服务

- 国内运输管理

- 国际运输管理

- 加值仓储和配送

- 按最终用户

- 製造/汽车

- 石油、天然气和化工

- 分销业(批发和零售,包括电子商务)

- 製药和医疗

- 建设业

- 其他的

第六章 竞争格局

- 市场集中度概览

- 公司简介

- Kuehne Nagel

- DHL Supply Chain

- United Parcel Service of America

- Wincanton

- Eddie Stobart

- FedEx

- XPO Logistics

- CEVA Logistics

- Tarlu Ltd

- Schenker Limited

- Yusen Logistics

- Bibby Distribution

- Xpediator

- Rhenus Logistics

- Torque

- Lloyd Fraser

- Pointbid Logistics Systems Ltd

- Parcel Hub*

第七章:市场的未来

第 8 章 附录

- 宏观经济指标(GDP分布、按活动划分、运输和仓储业对经济的贡献)

- 对外贸易统计 - 出口和进口(按产品划分)

- 了解主要出口和进口国家目的地

The United Kingdom Third Party Logistics Market is expected to register a CAGR of 3.36% during the forecast period.

Key Highlights

- The United Kingdom is one of the major trading countries globally, which exports most of its products to many European countries. The country's freight and logistics market has gained a strong base due to its developed infrastructure, sophisticated supply chain network, and presence of global players.

- The large retail and e-commerce sectors are among the country's key third-party logistics users. In highly-competitive markets, such as the United Kingdom, delivery time is a key competitive factor for retailers and online stores. So, retailers outsource their logistics to delivery specialists, and large and small retailers can compete on on-demand, next-day delivery.

- Shippers are continuing to leverage what 3PLs offer, allowing them to optimize the supply chain, minimize costs, create value, and align expectations to achieve success for both parties. The high-end technology integration by 3PLs, industry expertise, and cost reduction are reasons for an increase in outsourcing services. This outsourcing of services indicates that the demand for 3PLs is rising and driving the market.

- Mobile technology is revolutionizing 3PL. Many 3PL companies have already begun using mobile devices and apps to improve agility. Devices fitted with radio frequency identification (RFID) chips are not only capable of transmitting their location, but they also have the potential to hold data about themselves so that they can be instantly tracked and identified. Customers can order, process, and track freight shipments anytime using mobile apps installed on their mobile phones.

UK Third Party Logistics (3PL) Market Trends

Growth in Logistics Parks and Fulfilment Centers

The logistics sector is experiencing massive disruption where consumers will now be able to receive their items in time as little as one hour. The rapidly-delivered services are already familiar to most urban consumers. Leaders like Deliveroo, Ofo, and Uber have already made extreme efficiency a day-to-day reality for food and rides.

The United Kingdom is experiencing a record-breaking boom in constructing massive sheds to serve the soaring increase of internet shopping during the pandemic. Nearly 37 million square feet (3.4 million square meter) of warehouse space was slated for construction in 2021, up from 23 million square feet in 2020.

E-commerce continues to drive demand for warehouse expansion, but new warehouses are also needed to support the development of innovative technologies and sustainable energy. The UK warehousing sector is anticipated to continue strong for the foreseeable future.

As of January 2022, the East Midlands region had over 4.4 million square feet of the total 18.6 million square feet of speculative warehouse space under construction in the United Kingdom. This made the region with the most construction activity in the speculative market. Speculative development refers to construction projects that are undertaken without a commitment to a buyer or occupier.

E-Commerce Driving the Growth of the Market

The rapid growth of e-commerce is driving the demand for 3PL services in the United Kingdom. The unrelenting growth of e-commerce is fundamentally changing the third-party logistics (3PL) landscape. With the increasing consumer expectations for on-time and accurate deliveries and to stay competitive, more e-commerce retailers are outsourcing mission-critical components of their distribution and fulfillment operations to 3PL partners.

Many e-commerce retailers are small in size and need help to afford to have in-house logistic services. Therefore, services such as supply chain management, warehousing, consolidation service, and order fulfillment are outsourced to 3PL companies. However, major e-commerce retailers like Amazon and Alibaba are developing their logistics infrastructure.

Meanwhile, the growth of e-commerce and change in consumer expectations are also presenting challenges to the 3PL companies in terms of reducing parcel delivery times, increasing efficiency, adopting the latest and advanced technologies, etc. A huge transformation is taking place in last-mile delivery, with companies looking at alternatives, such as delivery lockers, pickup points, crowdsourced deliveries, drone deliveries, and autonomous vehicles. The evolution of technology is reshaping the entire supply chain and reinventing the parcel industry. Technology is becoming a crucial enabler in increasing efficiency and reaching consumer expectations.

UK Third Party Logistics (3PL) Industry Overview

The United Kingdom third-party logistics (3PL) market is fragmented in nature, with several large companies strategically forming alliances with mid-sized or small-sized companies to leverage their regional capabilities in the market. Major regional players have been observed to venture into new regions, allowing the companies to improve their geographic reach. New competitors are entering the United Kingdom third-party logistics (3PL) market with customized and industry-specific services. Some of the major players in the market include DHL International GmbH, Kuehne + Nagel, UPS, Wincanton PLC, and XPO Logistics Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Market Definition

- 1.3 Scope of the Study

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.1.1 Government Initiatives

- 4.2.1.2 Increase of Trade

- 4.2.2 Restraints

- 4.2.2.1 Shortage of Labor

- 4.2.3 Opportunities

- 4.2.3.1 Technological Advancements in the Logistic Sector

- 4.2.3.2 Reverse Logistics

- 4.2.1 Drivers

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitutes Products and Services

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Industry Policies and Regulations

- 4.6 General Trends in Warehousing Market

- 4.7 Demand From Other Segments, Such as CEP, Last Mile Delivery, Cold Chain Logistics Etc.

- 4.8 Technological Developments in the Logistics Sector

- 4.9 Insights on Ecommerce Business

- 4.10 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Services

- 5.1.1 Domestic Transportation Management

- 5.1.2 International Transportation Management

- 5.1.3 Value-added Warehousing and Distribution

- 5.2 By End User

- 5.2.1 Manufacturing and Automotive

- 5.2.2 Oil & Gas and Chemicals

- 5.2.3 Distributive Trade (Wholesale and Retail Trade Including E-commerce)

- 5.2.4 Pharmaceuticals and Healthcare

- 5.2.5 Construction

- 5.2.6 Other End Users

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Kuehne Nagel

- 6.2.2 DHL Supply Chain

- 6.2.3 United Parcel Service of America

- 6.2.4 Wincanton

- 6.2.5 Eddie Stobart

- 6.2.6 FedEx

- 6.2.7 XPO Logistics

- 6.2.8 CEVA Logistics

- 6.2.9 Tarlu Ltd

- 6.2.10 Schenker Limited

- 6.2.11 Yusen Logistics

- 6.2.12 Bibby Distribution

- 6.2.13 Xpediator

- 6.2.14 Rhenus Logistics

- 6.2.15 Torque

- 6.2.16 Lloyd Fraser

- 6.2.17 Pointbid Logistics Systems Ltd

- 6.2.18 Parcel Hub*

7 FUTURE OF THE MARKET

8 APPENDIX

- 8.1 Macroeconomic Indicators (GDP Distribution, by Activity, Contribution of Transport and Storage Sector to economy)

- 8.2 External Trade Statistics - Exports and Imports, by Product

- 8.3 Insights into Key Export Destinations and Import Origin Countries