|

市场调查报告书

商品编码

1644288

FaaS(功能即服务):市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Function As A Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

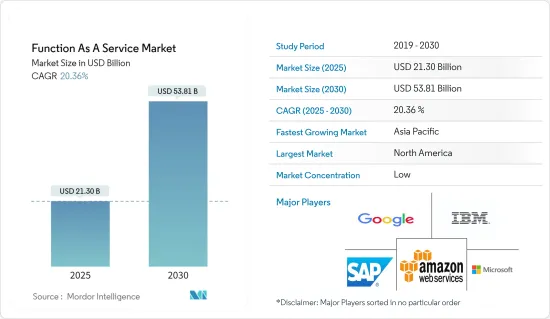

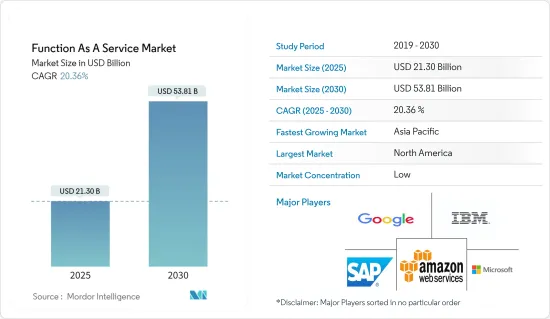

函数即服务 (FaaS) 市场规模预计在 2025 年为 213 亿美元,预计到 2030 年将达到 538.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 20.36%。

主要亮点

- FaaS(函数即服务)是一种云端运算,它使开发人员无需管理应用程式基础设施,从而实现更有效率的营运。当开发人员使用 FaaS 平台时,平台会代表开发人员建置、执行和管理应用程式套件。

- 从业务到无伺服器运算的日益转变、敏捷性、扩充性和託管服务的成熟度正在推动市场的发展。此外,企业对优化微服务和管理多平台的倾向也有望推动市场成长。

- 随着FaaS的出现,可程式云端在应用程式部署方面正在迅速发展。据Oracle称,估计在云端共用的敏感资料增加了 600 倍。许多云端供应商提供 FaaS 产品,例如 AWS Lambda 和 Azure Functions。在这些模型中,开发人员希望获得诸如简单的部署、减少的营运工作量以及计量收费好处。

- 随着各行各业的公司开始意识到云端运算的好处和价值,而不仅仅是新冠疫情造成的远距工作迫切需求,新冠疫情促使企业对 IT 和云端资源进行投资。

- FaaS 跨越每个地理区域的多个可用区,提供固有的高可用性,并允许您跨多个区域扩展而不会增加成本。此类 FaaS 很可能在预测期内推动市场成长。

FaaS(功能即服务)市场的趋势

最终用户注重安全性和隐私,混合云端推动市场成长

- 混合云端预计将推动市场成长,因为它比其他云端的使用更频繁。混合云端部署可以帮助企业减少投资以满足短期需求高峰,并且当企业需要释放本地资源以储存更敏感的资料和应用程式时。

- 随着运算和处理需求的波动,混合云端部署允许企业将其内部部署基础设施扩展到公有云中以处理溢出,而无需让第三方资料中心完全存取资料。这些发展完全缓解了最终用户的担忧,他们之前由于担心资料安全而犹豫是否要迁移到该解决方案。

- 云端和工业化服务的成长以及传统资料中心外包(DCO)的衰退标誌着混合基础设施服务的巨大转变。虽然传统的DCO市场正在萎缩,但主机託管和主机託管的支出以及基础设施公共事业服务正在成长。因此,我们预计将看到向云端基础设施即服务(IaaS)和託管的转变。由于采用混合云端的优势,它在云端市场中不断获得份额。

- 此外,由于近年来激增的需求驱动因素开始停滞,超大规模活动在去年年底趋于稳定。这一趋势可能仍会持续下去,儘管速度会比近几年更快。

- 此外,与其他云端服务相比,混合云端市场在过去几年中整体成长更为强劲。混合云端为拥有大型资料集的企业提供了一定的优势。混合云端允许企业扩展其运算资源,从而无需在需要释放本地资源以用于更敏感的资料和应用程式时投入大量资金来满足短期需求高峰。

北美占有最高市场占有率

- 北美占有最高的市场占有率。该地区在采用 5G、自动驾驶、物联网、区块链、游戏和人工智慧 (AI) 等新技术方面处于领先创新者和先驱地位。预计这一趋势将刺激该地区采用函数即服务 (FaaS)。

- 随着越来越多的通讯服务供应商(CSP) 决定与超大规模云端供应商合作提供 5G 服务,混合云端和多重云端的未来正在迅速发展。资料消费的大幅成长进一步推动了5G技术的发展,并贡献了市场成长率。

- 透过与超大规模云端供应商 (HCP) 的合作,通讯服务供应商(CSP) 正在扩展其云端基础设施并采用混合和多重云端策略。

- 过去 20 年来,IBM 和 AT&T 一直合作创新,帮助企业客户转型。两家公司宣布,他们有意展示边缘运算和 5G 无线网路在数位转型方面的潜力。去年 2 月,AT&T 和 IBM 开始提供虚拟环境,让商业客户体验 IBM混合云端和 AI 技术与 AT&T 连结结合的强大功能。

- 美国资料来源数量的不断增加正在推动新商业洞察的成长,从而促进市场扩张。 FaaS 还可以显着提高运算能力并改善结果,从而直接提高业务绩效。此外,对业务敏捷性和灵活性的不断增长的需求也推动了该地区的市场需求。

功能即服务 (FaaS) 产业概览

FaaS(函数即服务)市场竞争激烈,许多参与企业市场。市场的主要企业包括Google、AWS、SAP、IBM、微软等。市场参与者透过推出新产品、扩张、协议、合资、伙伴关係、收购等方式扩大市场占有率。市场中的一些关键发展如下:

2022年6月,全球最大的IT基础设施服务供应商Kyndryl与Oracle合作,透过为全球企业提供託管云端解决方案,协助客户加速上云之旅。作为合作的一部分,Kyndryl 将成为 Oracle 云端基础架构 (OCI) 的主要交付合作伙伴,扩展其与使用Oracle产品和服务的客户合作并支援他们的丰富经验。

此外,2022年5月,全球大型公司的开放原始码解决方案供应商红帽公司与Accenture扩大了近12年的策略伙伴关係,致力于推动全球企业的开放混合云端创新。两家公司将共同投资共同开发新的解决方案,帮助企业更无缝地驾驭多重云端和混合云端世界,获得策略清晰度,加快创新步伐,更快实现价值。

此外,2022 年 8 月,边缘云端供应商 Ridge 推出了一项全新的综合云端服务:混合云端。 Ridge 表示,其分散式云端架构使公司能够统一所有位置的关键业务应用程序,无论是在本地还是在 Ridge 运营的託管位置。该公司表示,工作负载可以轻鬆地在不同环境之间移动。透过单一入口网站进行管理,您可以在所有公共和私人公司地点提供一致的云端体验。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素

- 无伺服器运算的日益普及

- 更加重视基础设施敏捷性和成本降低

- 市场限制

- 某些应用程式与云端环境不相容

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

第五章 市场区隔

- 云端部署类型

- 民众

- 私人的

- 杂交种

- 按组织规模

- 中小型企业

- 大型企业

- 按最终用户

- BFSI

- 资讯科技/通讯

- 零售

- 医疗保健和生命科学

- 其他最终用户(媒体与娱乐、政府、教育)

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第六章 竞争格局

- 公司简介

- Amazon Web Services Inc.

- IBM Corporation

- Google Inc.

- Microsoft Corporation

- SAP SE

- Infosys Limited

- Dynatrace LLC

- Tibco Software Inc.

- Oracle Corporation

- Rogue Wave Software Inc

- Fiorano Software and Affiliates

第七章投资分析

第八章 市场机会与未来趋势

The Function As A Service Market size is estimated at USD 21.30 billion in 2025, and is expected to reach USD 53.81 billion by 2030, at a CAGR of 20.36% during the forecast period (2025-2030).

Key Highlights

- Function as a Service (FaaS) is a type of cloud computing that allows developers to operate more efficiently by eliminating the need to manage application infrastructure. When developers use a FaaS platform, the platform builds, runs, and manages application packages on their behalf.

- The growing shift from development operations (DevOps) to serverless computing, agility, scalability, and the maturity of hosted services drive the market's growth. Also, companies' inclination towards optimizing microservices and managing multiple platforms is expected to boost the market's growth.

- With the emergence of FaaS, the programmable cloud has been rapidly growing for the deployment of applications. According to Oracle, it is estimated that there will be 600 times more sensitive data shared in the cloud. Many cloud providers offer FaaS, such as AWS Lambda, Azure Functions, etc. With these models, developers seek advantages in simple deployments, reduced operation efforts, and pay-as-you-go pricing.

- COVID-19 boosted the investments by companies in IT and cloud resources as companies across various industries started realizing the benefits and value of cloud computing, even beyond the immediate need for remote work generated by COVID-19.

- The FaaS offers inherent high availability because it is spread across multiple availability zones per geographic region and can be deployed across any number of areas without incremental costs. With this FaaS, the market will likely grow over the forecast period.

Function as a Service Market Trends

Hybrid Cloud to Drive the Growth of the Market for Security and Privacy Concerned End Users

- The hybrid cloud market is expected to drive market growth as they are highly used compared to other clouds. Hybrid cloud deployment helps companies reduce their investment for handling short-term spikes in demand and when the business needs to free up local resources for more sensitive data or applications.

- With the rise in fluctuating demand for computing and processing, hybrid cloud deployment allows companies to scale their on-premises infrastructure up to the public cloud to handle any overflow without giving third-party data centers access to the entirety of their data. These developments have adequately addressed the concerns of the end-users, who were concerned about their data security and were earlier hesitant to switch to this solution.

- The growth of cloud and industrialized services and the decline of traditional data center outsourcing (DCO) indicate a massive shift towards hybrid infrastructure services. While the conventional DCO market is shrinking, spending on colocation and hosting is increasing along with infrastructure utility services. This is expected to drive the shift toward cloud infrastructure-as-a-service (IaaS) and hosting. Owing to its benefits, hybrid cloud deployment occupies a continuously increasing share of the cloud market.

- Moreover, hyper-scale activity leveled out at the end of the previous year as demand drivers that spiked in recent years began to plateau, including enterprise clients utilizing hybrid IT solutions to accommodate remote working mandates. This trend will likely continue, albeit faster than in the last few years.

- Furthermore, the hybrid cloud market has experienced significant overall growth in the past few years compared to other cloud services. It offers certain benefits to organizations with a vast data set. Using a hybrid cloud allows companies to scale computing resources and helps eliminate the need to invest massive capital in handling short-term spikes in demand when the business needs to free up local resources for more sensitive data or applications.

North America to Hold Highest Market Share

- North America holds the highest market share. The region is among the lead innovators and pioneers in adopting new technologies such as 5G, autonomous driving, IoT, blockchain, gaming, and artificial intelligence (AI), among others. This trend will likely fuel the region's adoption of function as a service.

- As more communication service providers (CSPs) decide to deliver their 5G services in collaboration with hyper-scale cloud providers, a hybrid and multi-cloud future is quickly developing. The significant growth in data consumption is further boosting the 5G technology, thereby contributing to the market growth rate.

- Through collaborations with hyper-scale cloud providers (HCPs), communication service providers (CSPs) are growing their cloud infrastructures and are increasingly implementing a hybrid and multi-cloud strategy.

- Over the last two decades, IBM and AT&T have collaborated on innovations and supported enterprise clients' transformation. The two organizations announced intentions to demonstrate the possibilities of edge computing and 5G wireless networking for digital transformation. In February last year, AT&T and IBM launched virtual environments that allow business clients to physically experience the power of combining IBM hybrid cloud and AI technologies with AT&T connection.

- The growth of new business insights contributes to expanding the market in the United States as many data sources increase. FaaS can also dramatically boost computing performance and improve results that directly strengthen business performance. Furthermore, the rise in demand for business agility and flexibility is also increasing the market demand in the region.

Function as a Service Industry Overview

The function as a service Market is highly competitive due to the many players in the market. Key players in the market include Google, AWS, SAP, IBM, and Microsoft, among others. Players in the market use new product launches, expansions, agreements, joint ventures, partnerships, acquisitions, etc., to increase their market share. Some of the key developments in the market are mentioned below.

In June 2022, Kyndryl, the world's largest IT infrastructure services provider, partnered with Oracle to help customers accelerate their journey to the cloud by delivering managed cloud solutions to enterprises worldwide. As part of the alliance, Kyndryl will become a key delivery partner for Oracle Cloud Infrastructure (OCI), expanding upon its deep experience of working with and supporting customers using Oracle products and services.

Moreover, in May 2022, Red Hat Inc., the world's leading provider of open source solutions, and Accenture expanded their nearly 12-year strategic partnership further to power open hybrid cloud innovation for enterprises worldwide. The companies are jointly investing in the co-development of new solutions to help organizations more seamlessly navigate a multi- and hybrid cloud world, define their strategy, and accelerate their pace of innovation to get to value faster.

Further, in August 2022, Ridge, a provider of edge clouds, launched a hybrid cloud, a brand-new all-inclusive cloud service. According to Ridge, its distributed cloud architecture allows businesses to unify business-critical apps across all their locations, whether on-premises or managed locations run by Ridge. According to the company, workloads can be transferred easily between different environments. Businesses can also manage them through a single portal, providing companies with a cohesive cloud experience across all public and private locations..

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing shift towards serverless computing

- 4.2.2 Increasing focus towards agility of infrastructure and cost reduction

- 4.3 Market Restraints

- 4.3.1 Incompatibility of some applications with cloud environment

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porters Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment on the Impact of COVID-19 on the market

5 MARKET SEGMENTATION

- 5.1 By Type of Cloud Deployment

- 5.1.1 Public

- 5.1.2 Private

- 5.1.3 Hybrid

- 5.2 By Organization Size

- 5.2.1 Small and Medium Enterprises

- 5.2.2 Large Enterprises

- 5.3 By End-User

- 5.3.1 BFSI

- 5.3.2 IT and Telecommunication

- 5.3.3 Retail

- 5.3.4 Healthcare and Life Sciences

- 5.3.5 Other End-Users (Media and Entertainment, Government, Educational Institutions))

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Amazon Web Services Inc.

- 6.1.2 IBM Corporation

- 6.1.3 Google Inc.

- 6.1.4 Microsoft Corporation

- 6.1.5 SAP SE

- 6.1.6 Infosys Limited

- 6.1.7 Dynatrace LLC

- 6.1.8 Tibco Software Inc.

- 6.1.9 Oracle Corporation

- 6.1.10 Rogue Wave Software Inc

- 6.1.11 Fiorano Software and Affiliates