|

市场调查报告书

商品编码

1644299

学生资讯系统:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Student Information System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

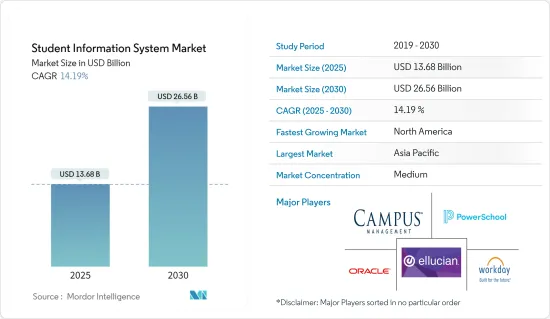

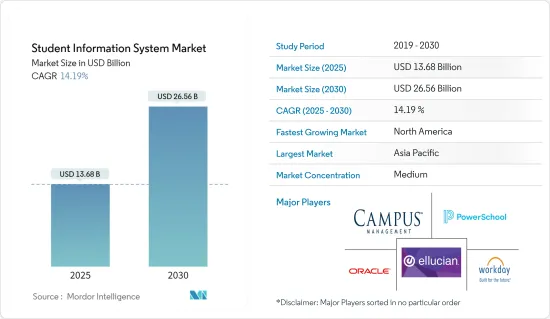

学生资讯系统市场规模预计在 2025 年为 136.8 亿美元,预计到 2030 年将达到 265.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 14.19%。

这一增长背后的主要因素是教育行业日益数位化、对数位学习的倾向日益增长以及对提高教育品质的关注。然而,缺乏训练有素的用户可能会阻碍市场成长。

主要亮点

- 学校和培训中心正在摆脱传统的黑板教学方法,将智慧科技融入学习环境。在大学层面,正在采用学生资讯系统等创新方法来优化教育机构的整体运营,将重点从手动任务和劳动转移到为学生提供获得符合行业要求的相关和有价值技能的机会。

- 这些系统有助于创造学生和教师在校园开展业务时所期望的现代化、直观的体验;透过消除资料孤岛和纸本流程以及自动化工作流程来提高业务效率;透过寻找新的收益来源和消除无利可图的专案来保留金库;为校园领导提供即时分析仪表板;并使用最新的最佳实践和技术、留住和优质的教师和员工。

- 例如,诺丁汉大学是一个庞大而复杂的组织,在英国、中国和马来西亚)。它是英国第七大大学,拥有 8,000 名教职员工和 46,000 名学生。该大学在三个校区部署了Oracle PeopleSoft 校园解决方案。现在,所有三个校区都使用单一整合的系统,预计这将提高效率、降低成本并改善教职员工和学生的使用者体验。

- 近期爆发的新冠疫情也对全球教育产业产生了不利影响。封锁导致学校和大学完全停课,并开始实施线上解决方案,以继续今年安排的课程和评估。在这种情况下,网路基础设施发达、互联网普及的国家的学生资讯系统预计会成长。然而,考虑到目前的教育需求,这些系统仅为相对较少的教育机构提供服务。这可能会导致错失在新兴国家的机会,而成本可能是阻碍市场成长的主要因素之一。

学生资讯系统 (SIS) 市场趋势

学生资讯系统中云的采用预计将推动市场发展

- 教育机构需要提供全天候资料访问,以提供更个性化和无缝的学生体验。在云端技术的支持下,教育机构可以快速实现投资回报,并在日益激烈的竞争环境中保持步伐。解决方案通常包括学生管理系统、学生资讯管理系统和学生记录系统等软体包。这些需要更多的资料储存能力,因此为云端基础的学生资讯系统带来了成长机会。

- 例如,2023 年 7 月,教育、技能发展和创业部推出了 ULLAS 行动应用程序,并与各种组织和机构签署了 106 份谅解备忘录。这些谅解备忘录包括与公共和私人实体的合作,以促进跨多个学科的创新、研究和知识交流,并开创教育合作和产学研合作的新时代。

- 此外,疫情期间教育机构全面关闭,导致对学生资讯系统等解决方案的需求激增。根据联合国教科文组织发布的数据,疫情期间,全球共有13亿名学生无法上学。世界各地许多学校、大学和学院都已关闭。

- 由于系统提供具有更高储存和处理能力的云端部署,系统内建的功能数量也随之增加,满足了这些充满挑战的时期的所有要求,从招收学生到维护校友网路的基础,否则这将是一项繁琐且耗时的任务。

亚太地区正在快速成长

- 透过内建的特定机制,学生资讯系统将满足学校管理系统的目标,同时满足中国、印度、印尼和马来西亚等新兴国家对学生相关资讯管理的需求,特别是在K-12教育领域。但其成长在很大程度上依赖优质电脑、充足的网路连线和安全的网路等设备的广泛普及。

- 中亚地区国家类型多样,收入和发展程度各异。学生资讯系统的普及、使用和可用性对于市场成长至关重要,线上学习材料的可用性以及家庭设备和网路连接水平也同样重要。

- 例如,印度拥有全世界最大的正规教育体系,有150多万所学校、870多万名中小学教师,在校学生超过2.6亿。它拥有世界上最大、最复杂的教育系统,每年为超过2.6亿年轻人提供服务,为学生资讯系统供应商扩大基本客群提供了绝佳机会。

- 此外,该地区各政府正在采取倡议提供优质教育并提高识字率,预计这将在长期内推动市场成长。例如,中国政府正在资助一项旨在缩小都市区教育品质差距的技术计画。他们正在推出一个直播网络,连结中国广大农村地区的数百名学生。

学生资讯系统 (SIS) 产业概览

学生资讯系统市场半分散,主要是因为国内和国际市场上有许多参与者。市场参与者正在采取合作和扩张等策略来增强产品功能并扩大地理覆盖范围。

- 2023 年 2 月-学校管理软体供应商 Skyward 宣布与 K-12 学生教育科技领域的领导者 Otus 建立合作伙伴关係。此次合作将实现 Skyward 和 Otus 的整合,相关人员一套先进的工具,以更有效地收集、视觉化和使用学生资料,从而最大限度地提高学生的成功率。

- 2023 年 5 月 - Jenzabar, Inc. 和 Spark451 开始提供策略性招生和学生保留套件。该解决方案旨在改变教育机构实现招生目标的方式,并支持学生在整个教育过程中取得成功。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 市场驱动因素

- 提高对改善教育机构行政程序的认识

- 教育机构越来越注重提高教育品质和客户满意度

- 学生资讯系统中的云端采用

- 市场限制

- 缺乏最终用户专业知识和基础设施

- 评估新冠肺炎对市场的影响

第五章 市场区隔

- 按类型

- 解决方案

- 按服务

- 按最终用户

- K-12 教育

- 高等教育

- 依部署方式

- 本地

- 云

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第六章 竞争格局

- 公司简介

- Ellucian Company LP

- Eduware ntc

- Jenzabar Inc.

- PowerSchool Group LLC

- Skyward Inc.

- Workday Inc.

- Tribal Group Plc

- Foradian Technologies

- Unit4

- Oracle Corporation

- Campus Management Corp.

第七章投资分析

第八章 市场机会与未来趋势

The Student Information System Market size is estimated at USD 13.68 billion in 2025, and is expected to reach USD 26.56 billion by 2030, at a CAGR of 14.19% during the forecast period (2025-2030).

The growth is majorly driven by increased digitization in the education industry, growing inclination towards e-learning, and emphasis on improving the quality of education. However, the lack of trained users might hamper the growth of the market.

Key Highlights

- Schools and training centers are moving from the traditional blackboard approach to integrating smart technology into learning environments. At the university level, institutions are adopting innovative methods, such as student information systems, to optimize the overall institution operations by shifting focus from the manual workload and labor to providing opportunities for students to develop relevant and valuable skills in line with industry requirements the system offers remote access, security, data backup, and cost-effectiveness.

- These systems help in creating the modern, intuitive experience that students, faculty, and staff expect when transacting business on campus, increasing operational efficiency by eliminating data silos and paper-based processes and automating workflows, sustaining financial resources by identifying new sources of revenue and removing unprofitable programs, Providing campus leaders with real-time analytics dashboards and leveraging modern best practices and technology to recruit, retain, and develop top faculty and staff.

- For instance, The University of Nottingham is a large, complex organization with three campuses across the world (in the UK, China, and Malaysia). It is the seventh-largest University in the UK, with 8,000 staff and 46,000 students. The University rolled out Oracle's PeopleSoft Campus Solutions across all three campuses. All three campuses are now using a single, integrated system, which is expected to increase efficiencies, reduce costs, and improve the user experience for both employees and students.

- The recent COVID-19 outbreak also negatively impacted the education industry worldwide. With the lockdown, schools and colleges came to a complete halt and started implementing online solutions to continue the scheduled curriculum and assessments for the year. In this scenario, student information systems are expected to grow in countries having good network infrastructure and internet penetration. However, these systems cater to a comparatively less number of institutes with respect to the current demand for education. Thus cost might become one of the major factors hindering the growth of the market, as this may result in a loss of opportunity in emerging countries.

Student Information System (SIS) Market Trends

Adoption of Cloud in Student Information System is Projected to Drive the Market

- The need for institutions to provide access to data 24/7 and deliver a more personalized and seamless student experience is vital. Supported by cloud technologies, institutions can see a rapid return on investment and keep moving at pace in this increasingly competitive environment. Solutions usually include software packages such as student management systems, student information management systems, student records systems, and others. These require more data storage capabilities and thus provide growth opportunities for cloud-based student information systems.

- For instance, in July 2023, The Ministry of Education, Skills Development, and Entrepreneurship launched the ULLAS mobile app and signed 106 Memorandums of Understanding (MoUs) with various organizations and institutions. The Memorandums of Understanding include collaborations with both public and private entities to foster innovation, research, and knowledge exchange across multiple domains, ushering in a new era of education collaboration and industry-academia linkages.

- Moreover, during the pandemic, education institutes came to a total shutdown, and the demand for solutions such as student information systems has spiked rapidly. According to the figures released by UNESCO, 1.3 billion learners around the world were not able to attend schools during the pandemic. Many schools, colleges, and universities were closed across the globe.

- As the systems offer cloud deployment, which has higher storage and processing capabilities, the number of features embedded in the system can also increase, facilitating all the requirements demanded in the challenging times, right from enrolling the student to maintaining an alumni network base which otherwise would be a tedious and time-consuming task.

Asia Pacific to Witness Significant Growth

- A student information system with specific built-in mechanisms caters to the purpose of the school management system at the same time meeting the demands of student-related information management in developing countries such as China, India, Indonesia, and Malaysia, among others, majorly in K-12 Education. However, the growth highly depends upon the penetration of devices such as good computers and networking with decent internet connectivity and robust security.

- There are diverse sets of countries at different levels of income and development in Central Asia. The spread, use, and availability of student information systems are essential for the growth of the market, as is the availability of online learning materials, as well as devices and the level of internet connectivity at home.

- For instance, the school education system in India is the largest in the world, with over 1.5 million schools, over 8.7 million primary and secondary teachers, and more than 260 million enrolments. It is home to the largest and most complex education system in the world, catering to over 260 million young population each year, making it a region with immense opportunities for student information system vendors to penetrate and increase its customer base.

- Moreover, Governments of various countries in the region are taking initiatives to provide quality education and increase the literacy rate, which is expected to help the market grow in the longer run. For instance, the Chinese government is funding technology initiatives that are aimed at narrowing the gap between the quality of education in rural and urban areas. They have deployed a live-streaming network that connects hundreds of students spread across a vast expanse of China's countryside.

Student Information System (SIS) Industry Overview

The student information system market is semi fragmented, primarily owing to the presence of multiple players in the market operating in the domestic and international markets. The players in the market are adopting strategies like partnerships and expansions to increase their product functionality and expand their geographic reach.

- February 2023 - Skyward, a provider of school administration software announced a collaboration with Otus, a leader in K-12 student-growth edtech. With this collaboration the company will enable integration between Skyward and Otus, giving educators access to a advance suite of tools for more efficiently gathering, visualizing, and acting on student data to maximize student success.

- May 2023 - Jenzabar, Inc. and Spark451 have launched their Strategic Enrollment and Student Retention Suites. The solutions seek to alter how institutions meet enrollment targets and support students' success throughout their educational journeys.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Market Drivers

- 4.3.1 Increasing Awareness to Improve the Administrative Process among Education Institutes

- 4.3.2 Rising Focus of Educational Institutions to Improve Education Quality and Customer Satisfaction

- 4.3.3 Adoption of Cloud in Student Information System

- 4.4 Market Restraints

- 4.4.1 Lack of Expertise and Infrastructure Among End Users

- 4.5 Assessment of Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Solution

- 5.1.2 Services

- 5.2 By End-User

- 5.2.1 K-12 Education

- 5.2.2 Higher Education

- 5.3 By Deployment Mode

- 5.3.1 On Premise

- 5.3.2 Cloud

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 Latin America

- 5.4.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Ellucian Company LP

- 6.1.2 Eduware ntc

- 6.1.3 Jenzabar Inc.

- 6.1.4 PowerSchool Group LLC

- 6.1.5 Skyward Inc.

- 6.1.6 Workday Inc.

- 6.1.7 Tribal Group Plc

- 6.1.8 Foradian Technologies

- 6.1.9 Unit4

- 6.1.10 Oracle Corporation

- 6.1.11 Campus Management Corp.