|

市场调查报告书

商品编码

1644312

非洲包装:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Africa Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

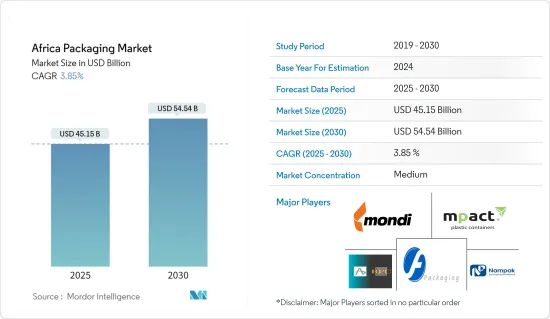

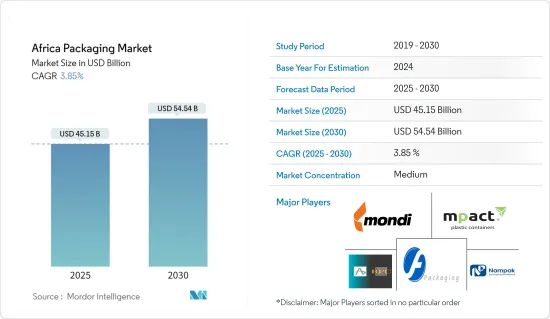

预计 2025 年非洲包装市场规模为 451.5 亿美元,到 2030 年预计将达到 545.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 3.85%。

关键亮点

- 市场发展的动力来自年轻消费者数量的成长,尤其是东非和西非地区,这些地区消费品需求不断增加,个人收入不断提高,国内经济不断扩大。

- 随着都市化和流动性的不断增强,非洲消费者正在寻找物有所值的产品,包括大宗、折扣和小包装。对于销售商来说,采用有吸引力的包装有利于促销和促进销售。此外,人们越来越关注食品、饮料、药品和其他家用产品的包装,因为它具有美感且可回收,从而推动了玻璃容器和玻璃瓶市场的发展。

- 此外,公司正在带来更先进的技术和专业知识,并耐心地寻找当地合作伙伴。例如,2022 年 10 月,总部位于奥地利的国际塑胶包装和回收专家 Alpla Group 在约翰尼斯堡附近的豪登省拉塞利亚建立了新工厂,扩大了在南非的业务。

- 阻碍包装市场成长的一大挑战是包装生产成本高。纸浆是纸包装生产的主要原料。广泛应用于瓦楞纸箱、纸板箱、纸盒、纸袋等各种包装的生产。纸浆和纸张的价格不断波动。同样,塑胶包装产业依赖原油,而原油价格波动较大。此外,俄乌战争正在影响整个包装生态系统。

- 由于新冠疫情爆发,非洲许多地区的包装製造商面临供应链中断以及现场生产减少的问题。例如,造纸和包装公司 Mondi 宣布将暂停其位于南非 Merebank 工厂的生产,该工厂的年产能为 27 万吨。

非洲包装市场趋势

玻璃瓶推动市场成长

- 玻璃容器和玻璃瓶广泛应用于製药、食品饮料、葡萄酒等终端用户产业。随着越来越多的人口转向环保解决方案并增加其贡献,该地区的玻璃包装预计将会成长。此外,玻璃包装被视为塑胶包装的可无限回收替代品。玻璃是 100% 可回收的,可以重复使用且不会降低品质。

- 南非是一个葡萄酒消费国。儘管国际趋势正转向罐装葡萄酒,但预计在该国能够效仿之前,玻璃瓶装葡萄酒市场仍将在相当长的时间内保持强劲。

- 非洲玻璃容器和瓶子市场竞争激烈,未能简化流程的参与企业将会破产。总部位于南非的多元化包装製造商 Nampak 因高昂的固定成本、间接费用和财务回报不足而被迫出售其玻璃业务。该业务以 15 亿南非兰特(1.25 亿美元)的价格出售给了 Isanti Glass(由 Kwande Capital 拥有)。

- 推动玻璃瓶使用的一大因素是当地旅游业日益提倡不再使用塑胶瓶。这预计将为该地区的玻璃製造商创造重大机会。此外,根据玻璃回收公司(TGRC)的数据,南非的玻璃回收率目前为44%,这进一步推动了市场成长。

- 此外,南非的葡萄酒产业横跨多个种植区。据行业组织 SAWIS(南非葡萄酒行业资讯与系统)称,2022 年酿酒葡萄产量预计为 1,378,737 吨。这比 2021 年的产量低 5.5%,但高于五年平均产量 1,346,024 吨。

- 在经历了两年的国内销售禁令和全球贸易壁垒造成的严重破坏之后,南非的葡萄酒和白兰地产业持续重组。该产业已更新其2025年策略计画(WISE),特别关注全球和国内市场进入、转型和永续性。此架构和关键绩效指标也包含在最近签署的农业和农产品加工总体规划(AAMP)中。这将确保更广泛的农业领域内葡萄酒拥有更有利的生产和贸易环境。根据 Vinpro 发布的资料显示,2021 年南非葡萄酒出口总量将成长 22%,达到 3.88 亿公升。

饮料业引领市场成长

- 饮料占据了市场的最大份额。随着消费者越来越关注他们所消费的产品及其包装的材料,他们越来越关注包装,从而进一步推动了市场的成长。

- 根据世界卫生组织 (WHO) 的数据,该地区的酒精消费者是世界上饮酒量最大的群体之一,这推动了市场的成长。此外,软性饮料供应商不断增长的需求正在帮助瓶子包装解决方案供应商和包装供应商提高该地区的产能。

- 此外,该地区的市场参与企业正在尝试各种饮料包装创新。例如,2022 年 9 月,可口可乐非洲饮料公司 (CCBA) 的子公司 Voltic Ltd 在加纳推出了 Hollandia's Choco Malt 品牌。这种以牛奶为基础的麦芽饮料采用无菌纸盒包装出售,但该公司还计划以印有现代图形和品牌的罐装形式出售。

- 能量饮料的销售成长速度远超过汽水的销售量。对低酒精和非酒精替代品、低热量和低糖饮料、更健康的饮料和更永续的包装的需求不断增加,导致了可回收玻璃瓶装果汁混合物和罐装水的推出。

- 在广大的食品饮料零售市场,众多企业争相夺冠。食品和饮料零售市场的参与企业正在研究各个方面,例如不断变化的生活方式、不断变化的饮料偏好以及特定地区人们的偏好,并据此开发他们的食品和饮料产品。这方面让参与企业赚取了不少的收益。

非洲包装产业概况

非洲包装市场竞争适中。市场参与企业继续致力于扩大其在非洲国家的基本客群,并利用策略合作措施来获得更大的市场占有率并提高盈利。市场的主要发展包括:

2022 年 7 月,Ardagh Glass Packaging Africa 宣布已开始在南非豪登省 Nigel 生产工厂进行扩建,投资 15 亿南非兰特(9,500 万美元)。该投资包括新的熔炉和生产线,使该工厂的可持续玻璃包装产能增加了一倍,以满足公司客户当前和预计的成长需求。

2022年3月,Elopak ASA 完成了对中东和北非地区领先的山形盖顶液体包装和包装系统供应商 Naturepak Beverage 的收购,收购方包括海湾工业集团的全资子公司 Naturepak Limited 和 Pactiv Evergreen Inc. 的全资子公司 Evergreen Packaging International LLC。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- COVID-19 市场影响评估

- 全球包装市场概览

第五章 市场动态

- 市场驱动因素

- 玻璃瓶推动市场成长

- 饮料业推动市场成长

- 市场限制

- 原物料价格波动可能会阻碍市场成长

第六章 市场细分

- 按材质

- 纸和纸板

- 塑胶

- 金属

- 玻璃

- 依产品类型

- 塑胶瓶

- 玻璃瓶

- 瓦楞纸箱

- 金属罐

- 其他的

- 按最终用户产业

- 饮料

- 食物

- 药品

- 家庭和个人护理

- 其他的

- 按国家

- 埃及

- 奈及利亚

- 肯亚

- 南非

- 非洲其他地区

第七章 竞争格局

- 公司简介

- Astrapak Ltd(RPC Group)

- Nampak Limited

- Mondi Group

- Mpact Pty Ltd

- Foster Packaging

- Consol Glass(Pty)Ltd.

- East African Packaging Industries Ltd(EAPI)

- Constantia Afripack(Pty)Ltd

- Tetra Pak SA

- Bonpak(Pty)Ltd.

- Frigoglass South Africa(Pty)Ltd.

第八章投资分析

第九章:市场的未来

The Africa Packaging Market size is estimated at USD 45.15 billion in 2025, and is expected to reach USD 54.54 billion by 2030, at a CAGR of 3.85% during the forecast period (2025-2030).

Key Highlights

- An increasing number of young consumers is driving the market, increasing demand for consumer goods, rising individual incomes, and expanding domestic economies, particularly in East and West Africa.

- With increasing urbanization and mobility, African consumers are looking for products that offer the best value for money, such as bulk, discounted, and smaller packs. It can be an advantage for vendors to go for attractive packaging to encourage and boost sales. Moreover, the growing concern regarding the packaging of food, beverages, pharmaceuticals, and other household products is driving the market for glass containers and bottles as they offer an aesthetic charm to people and are recyclable.

- Furthermore, companies are willing to bring better technology, technical expertise, and patience to find local partners. For instance, in October 2022, Austria-based Alpla Group, an international plastic packaging, and recycling specialist, expanded its footprint in South Africa by building a new facility in Lanseria, Gauteng Province, near Johannesburg.

- One of the significant challenges impeding packaging market growth is high packaging manufacturing costs. Paper pulp is a primary raw material used in paper packaging manufacturing. It is widely used in manufacturing corrugated boxes, cardboard boxes, folding cartons, and paper bags, among other types of packaging. The price of paper pulp has constantly been fluctuating. Similarly, the plastic packaging industry is also dependent on crude oil, and crude oil prices are also volatile. Furthermore, the Russia-Ukraine war has an impact on the overall packaging ecosystem.

- With the outbreak of COVID-19, packaging manufacturers faced supply chain disruption along with decreasing manufacturing at the site in many parts of Africa. For instance, paper and packaging company Mondi announced the temporary suspension of production at its Merebank mill in South Africa, which has a production capacity of 270,000 tonnes annually.

Africa Packaging Market Trends

Glass Bottles to Drive the Market Growth

- Glass containers and bottles are widely used by end-user industries like pharmaceuticals, food and beverage, and wine. As more and more population of the region is turning toward eco-friendly solutions to increase their contribution, glass packaging is expected to grow in the region. Moreover, glass packaging is seen as an endless recyclable alternative to plastic packaging. Glass can be 100% recycled and reusable without losing quality.

- South Africa is a wine-consuming country. Although the international trend is shifting toward wine in cans, the country is expected to continue to be a strong glass market for a significant amount of time before it can follow.

- The African glass bottles and container market is highly competitive, and the players who fail to streamline their operations are exiting the business. Nampak, a South Africa-based diversified packaging manufacturer, has been forced to sell its glass business due to high fixed costs and expenditures, leading to inadequate financial returns. It was sold to Isanti Glass (Kwande Capital-owned) for ZAR 1.5 billion (USD 125 million).

- One of the significant drivers of glass bottles is the growing drive by the local tourism industry to stop using plastic bottles. This is expected to create a massive opportunity for companies to produce Glass in the region. Moreover, according to Glass Recycling Company (TGRC), the current glass recycling rate in South Africa is 44%, which further adds to the market's growth.

- Furthermore, the wine industry in South Africa is spread across several cultivation areas. According to the industry body, South African Wine Industry Information & Systems (SAWIS), the wine grape crop is estimated to be 1,378,737 tonnes 2022. It is 5.5% lower than the crop for 2021, but it is higher than the fi)ve-year average of 1,346,024 tonnes.

- The South African wine and brandy industry is continuing to rebuild after two years of severe disruptions due to domestic sales bans and global trade barriers; the industry has revised its strategic plan (WISE) towards 2025, which includes a specific focus on global and local market access, transformation, and sustainability. The framework and key performance indicators are also included in the recently signed Agriculture and Agro-processing Master Plan (AAMP). This can ensure a far more favorable production and trading environment for wine within the broader agricultural sector. According to data published by Vinpro, South Africa's total wine export volume grew by 22% to 388 million liters in 2021.

Beverage Industry to Lead the Market Growth

- Beverages hold the maximum market share in the market studied. With consumers getting increasingly careful about what they consume and what material is packaged, the focus on packaging is increased, further driving the market growth.

- According to the World Health Organization (WHO), the consumers of alcohol in the region are some of the heaviest drinkers globally, which boosts the market growth. Also, the increase in demand from soft-drink vendors is helping bottle packaging solution providers and packaging vendors increase their capacities in the region.

- Moreover, market players in the region are trying out various innovations for beverage packaging. For instance, in September 2022, Voltic Ltd, Coca-Cola Beverages Africa's (CCBA) subsidiary, launched Hollandia's Choco Malt brand in Ghana. Malted drinks containing milk are sold in aseptic cartons, and the company is also planning to sell them in cans with modern graphics and branding.

- Sales of energy drinks are growing significantly faster than carbonated drinks. There is increasing demand for low or no-alcohol drink substitutes, low-calorie and low-sugar options, health drinks, and sustainable packaging resulting in the launch of fruit juice blends in returnable glass bottles and canned water.

- Numerous players compete for the top spot in the vast food and beverage retail market. Food and beverage retail market players research various aspects such as lifestyle changes, evolving drink preferences, and the preferences of people in a specific area and develop food and beverage items accordingly. This aspect allows the players to earn a lot of money.

Africa Packaging Industry Overview

The Africa Packaging Market is moderately competitive. The players in the market are continuously focusing on expanding their customer base across the countries of Africa and leveraging strategic collaborative initiatives to increase their market share and increase their profitability. Some of the key developments in the market are:

In July 2022, Ardagh Glass Packaging Africa announced the commissioning of a ZAR 1.5 billion (USD 95 million) extension of its Nigel production facility in Gauteng, South Africa. The investment doubled the facility's capacity to provide sustainable glass packaging to support the company's customers' current and projected demand growth and incorporates a new furnace and production lines.

In March 2022, Elopak ASA completed the acquisition of Naturepak Beverage, a leading gable top fresh liquid carton and packaging systems supplier in the MENA region, from Naturepak Limited, a wholly owned subsidiary of Gulf Industrial Group, and Evergreen Packaging International LLC, a wholly owned subsidiary of Pactiv Evergreen Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitutes

- 4.4 Assessment of the Impact of COVID-19 on the Market

- 4.5 Overview of the Global Packaging Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Glass Bottles to Drive the Market Growth

- 5.1.2 Beverage Industry to Lead the Market Growth

- 5.2 Market Restraints

- 5.2.1 Fluctuation in Raw Material Price can Hinder the Growth of the Market.

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Paper and Paperboard

- 6.1.2 Plastic

- 6.1.3 Metal

- 6.1.4 Glass

- 6.2 By Product Type

- 6.2.1 Plastic Bottles

- 6.2.2 Glass Bottles

- 6.2.3 Corrugated Boxes

- 6.2.4 Metal Cans

- 6.2.5 Other Applications

- 6.3 By End-user Industry

- 6.3.1 Beverage

- 6.3.2 Food

- 6.3.3 Pharmaceuticals

- 6.3.4 Household and Personal Care

- 6.3.5 Other

- 6.4 By Country

- 6.4.1 Egypt

- 6.4.2 Nigeria

- 6.4.3 Kenya

- 6.4.4 South Africa

- 6.4.5 Rest of Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Astrapak Ltd (RPC Group)

- 7.1.2 Nampak Limited

- 7.1.3 Mondi Group

- 7.1.4 Mpact Pty Ltd

- 7.1.5 Foster Packaging

- 7.1.6 Consol Glass (Pty) Ltd.

- 7.1.7 East African Packaging Industries Ltd (EAPI)

- 7.1.8 Constantia Afripack (Pty) Ltd

- 7.1.9 Tetra Pak SA

- 7.1.10 Bonpak (Pty) Ltd.

- 7.1.11 Frigoglass South Africa (Pty) Ltd.