|

市场调查报告书

商品编码

1644321

中东太阳能光电:市场占有率分析、产业趋势与成长预测(2025-2030 年)Middle-East Solar Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

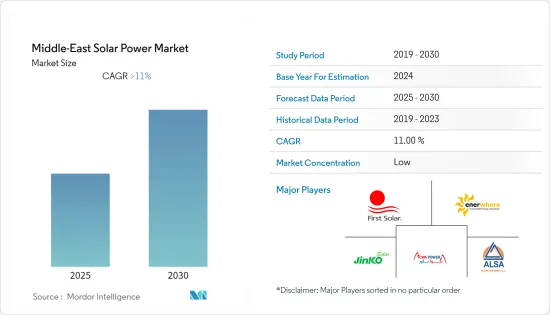

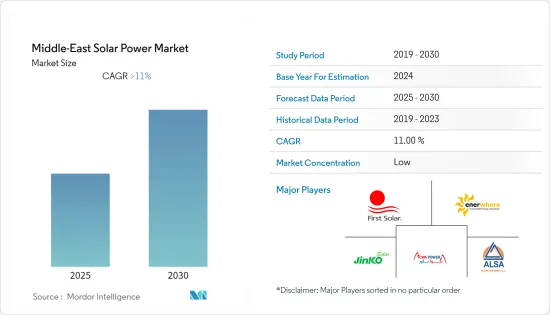

预测期内,中东太阳能市场预计将以超过 11% 的复合年增长率成长。

2020年第一季的新冠疫情对中东太阳能光电市场造成了一定影响。由于太阳能板出货延迟,沙乌地阿拉伯、科威特和卡达等一些国家的 2020 年新增安装量大幅下降。 2021年,市场復苏。

关键亮点

- 政府的支持性政策、加强利用再生能源来源满足电力需求的力度以及减少对石化燃料的依赖等因素预计将成为推动市场发展的主要因素。此外,许多雄心勃勃的太阳能发电工程计画在预测期内实施,预计将在未来几年推动太阳能发电市场的发展。

- 然而,大型太阳能发电工程推迟以及对替代能源的日益关注等因素预计将阻碍市场成长。

- 即将在该地区实施的太阳能发电工程以及混合电力解决方案的利用很可能在不久的将来为太阳能市场创造巨大的机会。

- 由于预测期内大量正在进行和即将开展的计划,预计沙乌地阿拉伯的需求将大幅增加。

中东太阳能发电市场趋势

光伏(PV)计划推动市场

- 光伏 (PV) 电池是包含光伏材料的电池阵列,可将来自太阳的辐射或能量转换为直流电。 2022 年,光伏 (PV) 太阳能板占中东地区太阳能组装机量的 96.57% 以上。

- 中东地区太阳能发电装置容量预计将从 2021 年的 923.9 万千瓦增加到 2022 年的 1,244 万千瓦。预计即将实施的计划将在预测期内进一步增加产能。

- 2022 年 10 月,水务采购公司(OPWP)和阿曼电力公司在阿曼西北部伊布里启动第二个大型太阳能光伏(PV)计划的竞标。新的伊布里三期太阳能独立发电工程(IPP)的太阳能发电能力将达到 500MW。新工厂预计将于 2026 年第四季开始商业运作。

- 2023年2月,穆巴拉克钢铁公司预计将为伊斯法罕省库赫帕耶县的一座600兆瓦太阳能发电厂提供资金。该计划预计投资5亿美元。第一阶段预计将在2023年7月为国家电网增加近100兆瓦的发电量。

- 随着沙乌地阿拉伯和阿拉伯联合大公国等国家有多个计划在建或处于竞标阶段,预计预测期内太阳能发电量将大幅成长,推动中东地区太阳能市场的发展。

沙乌地阿拉伯主导市场

- 在沙乌地阿拉伯,装置容量的成长是由国家可再生能源计画推动的,该计画的目标是到 2030 年实现 35 个可再生计划和 58.7 吉瓦的装置容量。

- 沙乌地阿拉伯2022年的太阳能光电装置容量为440兆瓦,预计未来几年还会成长。此外,沙乌地阿拉伯的太阳能光电装置容量预计将从 2020 年的 59 兆瓦增加到 2022 年的 390 兆瓦。

- 2022年11月,ACWA Power与水力发电控股公司(Badeel)签署协议,在麦加省的Al Shuaibah 开发世界上最大的单站点太阳能发电厂。该太阳能发电厂的发电容量为 2,060 兆瓦,计划于 2025年终投入营运。

- 此外,据工业和矿产资源部称,沙乌地阿拉伯于 2022 年 3 月启动了一项新计划,以支持绿色能源努力并减少对原油的依赖。该部还计划为可再生能源企业提供税收减免和其他激励措施。

- 因此,基于上述事实,预计预测期内沙乌地阿拉伯将在中东地区太阳能市场出现巨大需求。

中东太阳能产业概况

中东太阳能光电市场中等程度细分。该市场的主要企业包括晶科能源控股、First Solar Inc.、Enerwhere Sustainable Energy DMCC、ACWA POWER BARKA SAOG 和 Alsa Solar Systems LLC(不分先后顺序)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场概况

- 介绍

- 2028 年装置容量及预测(单位:吉瓦)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 技术板块

- 光伏 (PV)

- 聚光型太阳光电(CSP)

- 地区

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 阿曼

- 其他中东地区

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- JinkoSolar Holding Co. Ltd.

- First Solar Inc

- Enerwhere Sustainable Energy DMCC

- ACWA POWER BARKA SAOG

- Alsa Solar Systems LLC

- Enviromena Power Systems

- Trina Solar Ltd.

- JA SOLAR Co. Ltd.

- Sungrow Power Supply Co. Ltd.

- Hitachi Energy Ltd.

- Canadian Solar Inc.

第七章 市场机会与未来趋势

The Middle-East Solar Power Market is expected to register a CAGR of greater than 11% during the forecast period.

With the COVID-19 outbreak in Q1 2020, the Middle Eastern solar power market was moderately impacted. Few countries like Saudi Arabia, Kuwait, and Qatar had significantly less number of new installations in 2020 due to delays in the shipping of solar modules. The market rebounded in 2021.

Key Highlights

- Factors such as supportive government policies and increasing efforts to meet power demand using renewable energy sources, and decreased dependency on fossils are expected to be significant contributors to driving the market. Besides, many ambitious photovoltaic projects are lined up in the forecast period and are expected to drive the solar market in the coming years.

- However, factors such as delays in large-scale solar projects and increasing focus on alternative energy sources are expected to hinder the market's growth.

- The upcoming solar power projects, along with the use of hybrid power solutions in this region, can create immense opportunities for the solar power market in the near future.

- Saudi Arabia is expected to witness significant demand due to the number of ongoing and upcoming projects over the forecast period.

Middle East Solar Power Market Trends

Solar Photovoltaic (PV) Projects to Drive the Market

- Photovoltaic (PV) cells are arrays of cells containing a solar photovoltaic material that converts solar radiation or energy from the sun into direct current electricity. Photovoltaic (PV) solar panels held a share of more than 96.57% of the total Middle Eastern solar energy installed in 2022.

- The solar PV installed capacity of the Middle East grew to 12.440 GW in 2022, which is higher compared to the 9.239 GW installed in 2021. Upcoming projects are expected to increase capacity during the forecast period even further.

- In October 2022, the Water Procurement Company (OPWP) and Oman Power initiated bidding for the second large-scale solar photovoltaic (PV) project at Ibri in northwest Oman. The new Ibri III Solar Independent Power Project (IPP) has a solar PV capacity of 500 MW. The new facility is anticipated to begin commercial operations in the fourth quarter of 2026.

- In February 2023, Mobarakeh Steel Company was anticipated to finance the solar photovoltaic power plant in Kouhpayeh County, Isfahan Province, with a capacity of 600 MW. The project is expected to receive an investment of USD 500 million. The first phase will likely add nearly 100 MW to the nation's power grid by July 2023.

- With several projects under construction or in the tender phase in countries like Saudi Arabia and the United Arab Emirates, considerable growth in solar PV is expected to drive the solar power market in the Middle Eastern region over the forecast period.

Saudi Arabia to Dominate the Market

- In Saudi Arabia, the solar energy installed capacity growth can be attributed to the National Renewable Energy Program, which had a target of installing 35 renewable projects with 58.7 GW of installed capacity by 2030.

- The installed solar power capacity for Saudi Arabia in 2022 was 440 MW, which is expected to increase in the coming years. Also, the solar PV installed capacity for Saudi Arabia increased to 390 MW in 2022, which was higher compared to 59 MW in 2020.

- In November 2022, ACWA Power signed an agreement with Water and Electricity Holding Company (Badeel) to develop the world's largest single-site solar-power plant in Al Shuaibah, Mecca province. With a 2,060 MW generation capability, the solar power plant is anticipated to begin operations by the end of 2025.

- Moreover, in March 2022, according to the Ministry of Industry and Mineral Resources, Saudi Arabia launched a new plan to support green energy initiatives and reduce its reliance on crude oil. Additionally, the ministry would provide tax breaks and other benefits to businesses that generate renewable energy.

- Therefore, based on the aforementioned facts, Saudi Arabia is expected to witness significant demand for the solar power market in the Middle Eastern region over the forecast period.

Middle East Solar Power Industry Overview

The Middle Eastern solar power market is moderately fragmented. Some of the key players in this market include (not in particular order) JinkoSolar Holding Co. Ltd, First Solar Inc., Enerwhere Sustainable Energy DMCC, ACWA POWER BARKA SAOG, and Alsa Solar Systems LLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Installed Capacity and Forecast in GW, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Solar Photovoltaic (PV)

- 5.1.2 Concentrated Solar Power (CSP)

- 5.2 Geography

- 5.2.1 Saudi Arabia

- 5.2.2 United Arab Emirates

- 5.2.3 Oman

- 5.2.4 Rest of the Middle East

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 JinkoSolar Holding Co. Ltd.

- 6.3.2 First Solar Inc

- 6.3.3 Enerwhere Sustainable Energy DMCC

- 6.3.4 ACWA POWER BARKA SAOG

- 6.3.5 Alsa Solar Systems LLC

- 6.3.6 Enviromena Power Systems

- 6.3.7 Trina Solar Ltd.

- 6.3.8 JA SOLAR Co. Ltd.

- 6.3.9 Sungrow Power Supply Co. Ltd.

- 6.3.10 Hitachi Energy Ltd.

- 6.3.11 Canadian Solar Inc.