|

市场调查报告书

商品编码

1644324

亚太压缩机-市场占有率分析、产业趋势与成长预测(2025-2030 年)Asia-Pacific Compressor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

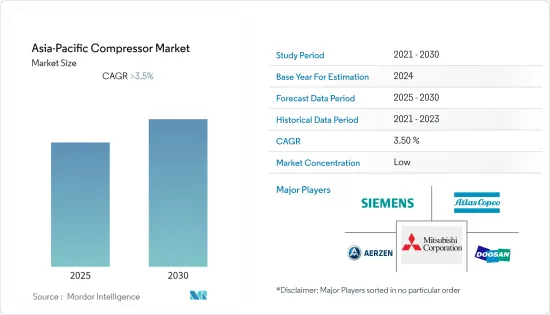

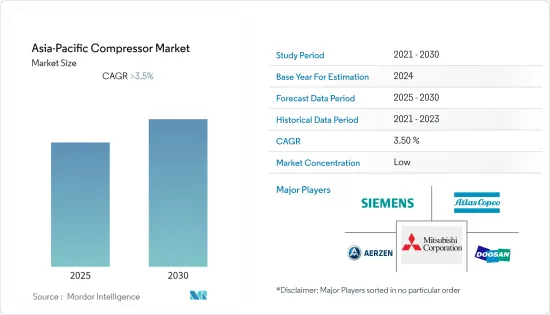

预计预测期内亚太压缩机市场的复合年增长率将超过 3.5%。

2020 年,市场受到了 COVID-19 的不利影响。不过,目前市场已经恢復到了疫情前的水准。

关键亮点

- 从长远来看,炼油厂和钢厂对用于天然气运输和能源生产的压缩机的需求不断增长,预计将推动亚太压缩机市场的发展。

- 另一方面,越来越多的再生能源来源安装用于提供无压缩机动力预计将抑制亚太地区的压缩机市场。

- 亚太国家已经意识到煤炭使用造成的环境污染。因此,各国正增加使用燃气发电厂作为更清洁的能源。预计各国的此类采用将为亚太压缩机市场创造未来机会。

- 由于中国在亚太地区的钢铁、化工、电力和其他製造业领域占据主导地位,预计中国将主导亚太压缩机市场。

亚太地区压缩机市场趋势

预计石油和天然气产业将占据市场主导地位。

- 压缩机是一种透过减少气体体积来增加气体压力的机械装置。它广泛应用于石油和天然气工业。石油和天然气上游、中游和下游作业的许多应用都需要压缩,包括输送、储存、天然气收集、气举、气体注入、闪蒸气体压缩和冷冻。

- 此外,压缩机是天然气输送基础设施的重要组成部分。因此,预计预测期内天然气管道网路的扩建将成为市场成长最重要的驱动力之一。

- 2021 年该地区的原油总精製能力为 36,478,000 桶/日 (TBPD),高于 2019 年该地区的 35,527 TBPD 产能。各国精製能力的快速成长可能需要使用压缩机进行天然气运输,这预计将对该地区的压缩机市场产生正面影响。

- 2022年8月,印度石油有限公司宣布计划实施帕尼帕特炼油厂扩建(P-25)计划,将其精製能力从1500万吨/年提高到2500万吨/年,以满足日益增长的石油产品需求。

- 此外,2022 年 12 月,国有印度盖尔公司和日本商船三井航运公司透过其全资子公司签署了一份新建液化天然气 (LNG)装运船隻的定期租船合同,以及一份现有 LNG装运船隻的联合所有权协议。该船将由韩国造船厂大宇造船海洋工程公司建造,租赁期将从2023年开始。

- 整体而言,预测期内,石油和天然气产业很可能成为亚太压缩机市场成长最快、规模最大的细分市场。

中国可望主导市场

- 在能源需求和工业化快速成长的推动下,中国有可能成为亚太地区最大的压缩机市场。此外,中国是全球製造业的驱动力。中国在钢铁、化工、电力和水泥工业领域居世界领先地位,在石化和精製工业领域也占有主要企业。

- 由于国内石油和气体纯化产品消费量增加,精製能力提高,可能会在预测期内推动压缩机市场的发展。

- 过去二十年,中国经历了全球最大规模的钢铁产能扩张。这一趋势导致大型压缩机产能过剩,并可能推动该国市场的发展。

- 2021年中国天然气消费量为3,787亿立方米,高于2020年的3,366亿立方米。日益增长的环境问题使得中国将重点转向天然气而非煤炭能源产出。上述燃煤电厂的扩张正在放缓,而天然气在发电中的使用正在激增。

- 2022年12月,沙乌地阿拉伯国家石油公司、领先的综合能源和化学公司之一中国石油化工集团公司和沙乌地基础工业公司宣布,他们将探索在中国和沙乌地阿拉伯的精製和石化计划上的合作。此外,沙乌地阿美与中石化签署了待开发区计划协议,该计画包括位于福建省桂林的一座日产32万桶/年的炼油厂和一座年产150万吨的石化裂解装置。预计于 2025年终开始营运。

- 总体而言,预计预测期内中国将主导亚太压缩机市场。

亚太地区压缩机产业概况

亚太地区压缩机市场较为分散。该市场的主要企业(不分先后顺序)包括阿特拉斯·科普柯公司、西门子股份公司、三菱重工有限公司、斗山公司和 Aerzener Maschinenfabrik GmbH。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 2027 年市场规模及需求预测(十亿美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场区隔

- 类型

- 体积

- 移动

- 最终用户

- 石油和天然气

- 电力业

- 製造业

- 化学和石化工业

- 其他的

- 地区

- 印度

- 中国

- 日本

- 其他亚太地区

第六章 竞争格局

- 合併、收购、合作及合资

- 主要企业策略

- 公司简介

- Baker Hughes Co

- Trane Technologies PLC

- Atlas Copco AB

- Ariel Corporation

- General Electric Company

- Mitsubishi Heavy Industries Ltd

- Aerzener Maschinenfabrik GmbH

- Doosan Co Ltd

- Seimens AG

第七章 市场机会与未来趋势

简介目录

Product Code: 71069

The Asia-Pacific Compressor Market is expected to register a CAGR of greater than 3.5% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. However, the market has znow reached pre-pandemic levels.

Key Highlights

- Over the long term, factors such as increasing demand for compressors from the refineries and steel manufacturing plants used for gas transportation and energy generation plants are likely to drive the Asia-Pacific compressor market.

- On the other hand, increasing the installation of renewable energy sources to provide power that does not use compressors is expected to restrain the Asia-Pacific compressor market.

- Nevertheless, countries in the Asia-Pacific have acknowledged the environmental pollution due to the usage of coal. Hence, nations have increased the use of gas-fired plants for a cleaner form of energy. Such implementation by different countries is expected to create several future opportunities for the Asia-Pacific compressor market.

- Due to its dominance in the region's steel, chemical, power, and other manufacturing industries, China is expected to dominate the Asia-Pacific compressor market.

APAC Compressor Market Trends

Oil and Gas Industry Segment Expected to Dominate the Market

- Compressors are mechanical devices that increase the pressure of a gas by reducing its volume. They are widely used throughout the oil and gas industry. The oil and gas business's upstream, midstream, and downstream sectors require compression for numerous applications, such as transmission, storage, gas gathering, gas lift, gas injection, flash gas compression, and refrigeration.

- Moreover, compressors are also an integral part of the gas transportation infrastructure. Hence, the expanding gas pipeline networks are expected to be one of the most significant drivers for the market's growth during the forecast period.

- In 2021, the total refining capacity of crude oil in the region was 36,478 thousand barrels per day (TBPD), which was higher than the region's capacity in 2019, 35,527 TBPD. The rapid growth in the refining capacity within the nations is likely to use compressors for the transportation of gas, which is expected to create a positive impact on the compressor market in the region.

- In August 2022, Indian Oil Corporation Limited announced its plans to implement the Panipat refinery expansion (P-25) project to enhance refining capacity from 15 MMTPA to 25 MMTPA (million metric tonnes per annum) to meet the growth in demand for petroleum products.

- Moreover, in December 2022, State-owned Gail India and Japanese transport firm Mitsui OSK Lines, through its wholly-owned subsidiary, signed a time charter contract for a new-build liquefied natural gas (LNG) carrier and for joint ownership of an existing LNG carrier. The vessel will be built by South Korean shipbuilder Daewoo Shipbuilding & Marine Engineering with a charter period from 2023.

- Hence, owing to the above points, the oil and gas industry is likely going to be the fastest-growing and largest segment in the Asia-Pacific compressor market during the forecast period.

China Expected to Dominate the Market

- China, due to its rapid increase in energy demand and industrialization, is likely to be the largest market for compressor in Asia-Pacific. Moreover, China has been instrumental in driving the manufacturing sector globally. The country is the global leader in the steel, chemical, power, and cement industries and is among the top players in the petrochemical and refining industries.

- The country's increasing refinery facility capacity due to the increasing consumption of oil and gas refined products in the country is likely to drive the compressor market during the forecast period.

- The country had the largest steel manufacturing capacity additions in the world during the past two decades. This trend resulted in excessive production capacity, which uses an extensive number of compressors and is likely going to drive the market in the country.

- In 2021, gas consumption in China was 378.7 billion cubic meters (bcm), which was higher than its consumption in 2020, 336.6 bcm. Due to increasing environmental concerns, the country has targeted more gas for energy generation than coal. The above expansion in coal power plants has been slowed down, and there is a rapid increase in gas usage in energy generation.

- In December 2022, The Saudi Arabian Oil Company, one of the leading integrated energy and chemicals companies, China Petroleum and Chemical Corporation and SABIC, announced the exploring collaboration across refining and petrochemical projects in China and Saudi Arabia. Additionally, Aramco and Sinopec, have signed heads of agreement for a greenfield project in Gulei, Fujian Province, which plans to include a 320,000 barrels-per-day refinery and 1.5 million tons-per-year petrochemical cracker complex. It is expected to commence operations by the end of 2025.

- Hence, owing to the above points, China is expected to dominate the Asia-Pacific compressor market during the forecast period.

APAC Compressor Industry Overview

The Asia-Pacific compressor market is fragmented. Some of the key players in this market (in no particular order) include Atlas Copco AB, Siemens AG, Mitsubishi Heavy Industries Ltd, Doosan Co. Ltd, and Aerzener Maschinenfabrik GmbH.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Force Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Positive Diplacement

- 5.1.2 Dynamic

- 5.2 End User

- 5.2.1 Oil and Gas Industry

- 5.2.2 Power Sector

- 5.2.3 Manufacturing Sector

- 5.2.4 Chemicals and Petrochemical Industry

- 5.2.5 Other End Users

- 5.3 Geography

- 5.3.1 India

- 5.3.2 China

- 5.3.3 Japan

- 5.3.4 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Collaboration and Joint Ventures

- 6.2 Strategies Adopted by Key Players

- 6.3 Company Profiles

- 6.3.1 Baker Hughes Co

- 6.3.2 Trane Technologies PLC

- 6.3.3 Atlas Copco AB

- 6.3.4 Ariel Corporation

- 6.3.5 General Electric Company

- 6.3.6 Mitsubishi Heavy Industries Ltd

- 6.3.7 Aerzener Maschinenfabrik GmbH

- 6.3.8 Doosan Co Ltd

- 6.3.9 Seimens AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219