|

市场调查报告书

商品编码

1644325

欧洲压缩机:市场占有率分析、行业趋势和成长预测(2025-2030 年)Europe Compressor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

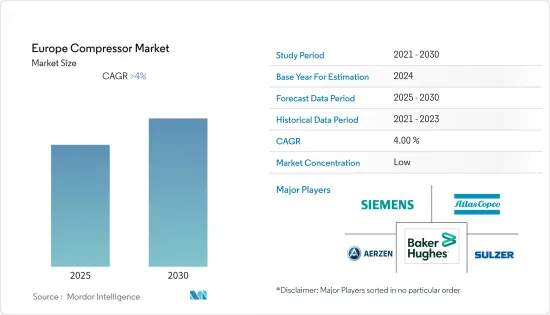

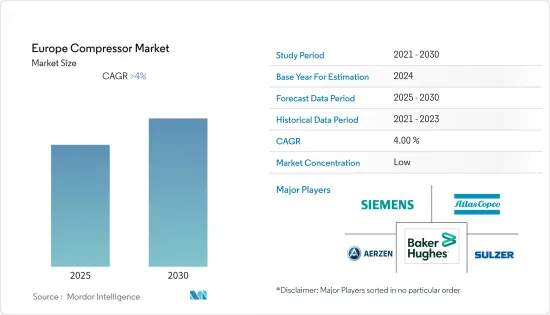

预计预测期内欧洲压缩机市场的复合年增长率将超过 4%。

2020 年,市场受到了 COVID-19 的不利影响。不过,目前市场已经恢復到了疫情前的水准。

关键亮点

- 从长远来看,化学工业对冷冻等应用的压缩机的需求不断增长,预计将推动欧洲压缩机市场的发展。

- 然而,预计再生能源来源的安装不断增加以提供无压缩机电力将抑制欧洲压缩机市场的发展。

- 新的压缩机技术比现在更有效率,可节省20-50%的能源,预计将为未来的欧洲压缩机市场创造许多机会。

- 俄罗斯拥有该地区最高的石油和气体纯化能力,预计将主导欧洲压缩机市场。截至 2021 年,欧洲 30% 以上的精製总产能位于俄罗斯,而压缩机则用于多种用途,包括天然气运输和液化天然气转换。

欧洲压缩机市场趋势

预计石油和天然气产业将占据市场主导地位。

- 压缩机是一种透过减少气体体积来增加气体压力的机械装置。它广泛应用于石油和天然气工业。石油和天然气上游、中游和下游作业的许多应用都需要压缩,包括输送、储存、天然气收集、气举、气体注入、闪蒸气体压缩和冷冻。

- 由于日益增长的环境问题,一些欧洲国家正计划逐步淘汰煤炭能源。这项决定可能会引发天然气发电的增加,因为能源来源比煤炭更清洁。

- 2021年,该地区液化天然气(LNG)出口总量为38亿立方公尺。天然气到液化天然气的转换可能会使用压缩机,预计该地区液化天然气出口的增加将对该地区的压缩机市场产生积极影响。

- 2022年2月,英国石油和天然气公司BP PLC与氢化学公司(HyCC)签署了共同开发契约,在荷兰鹿特丹港口区进一步开发一座250兆瓦的绿色氢工厂「H2-Fifty」。压缩机在氢气生产中起着关键作用,它透过减少氢气的体积并增加其压力来获得压缩氢气。

- 此外,2022 年 6 月,Neste Oyj 对芬兰 20 亿美元的鹿特丹炼油厂扩建计划做出了财务投资决策 (FID)。该计划将帮助这家芬兰石油精製和行销公司将其荷兰炼油厂的可再生产品生产能力从每年 140 万吨扩大至 270 万吨。

- 鑑于上述情况,预测期内,石油和天然气产业很可能主导欧洲压缩机市场。

俄罗斯可望主导市场

- 在俄罗斯,能源是国家经济的重要组成部分,贡献了国家收入的40%左右。此外,预计俄罗斯将在2021年及以后继续成为最大的能源出口国之一,因此很可能成为欧洲最大的压缩机市场。

- 食品生产和加工是俄罗斯经济的重要组成部分。俄罗斯的生活节奏快、包装食品易于储存且保质期较长,推动了对适合即食消费的产品的需求。

- 此外,天然气在发电中的份额不断增加是由于天然气价格下降以及此类电厂数量的增加,这可能会推动压缩机市场的发展。

- 近年来,日本的液化天然气出口量迅速成长。随着全球液化天然气市场的渗透率不断提高,预计中国将投资液化天然气产业基础设施,这将对压缩机市场产生直接影响。

- 2021 年俄罗斯的天然气产量为 7,017 亿立方米,高于 2020 年的 6,373 亿立方米。该国已经开始减少煤炭能源产出的使用,并以天然气作为补充,这可能会推动该国压缩机市场的发展。

- 2022年8月,俄罗斯石化公司西布尔宣布计划与中石化一起审查其阿穆尔天然气化工综合体(AGCC)的发展策略。此外,阿穆尔天然气化学综合体将成为世界上最大的聚合物生产设施之一。该厂建成后,年产聚乙烯230万吨、聚丙烯400吨。该设施将建在Amur region斯沃博德尼附近,靠近俄中边境。

- 总体而言,预计预测期内俄罗斯将主导欧洲压缩机市场。

欧洲压缩机产业概况

欧洲压缩机市场适度细分。该市场的主要企业(不分先后顺序)包括阿特拉斯·科普柯公司、西门子股份公司、苏尔寿股份公司、贝克休斯公司和 Aerzener Maschinenfabrik GmbH。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 2027 年市场规模及需求预测(十亿美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 类型

- 体积

- 移动

- 最终用户

- 石油和天然气

- 电力业

- 製造业

- 化学和石化工业

- 其他的

- 地区

- 俄罗斯

- 德国

- 英国

- 欧洲其他地区

第六章 竞争格局

- 合併、收购、合作及合资

- 主要企业策略

- 公司简介

- Siemens AG

- Baker Hughes Co.

- Trane Technologies PLC

- Atlas Copco AB

- Burckhardt Compression Holding AG

- General Electric Company

- Aerzener Maschinenfabrik GmbH

- Sulzer AG

第七章 市场机会与未来趋势

简介目录

Product Code: 71072

The Europe Compressor Market is expected to register a CAGR of greater than 4% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. However, the market has now reached pre-pandemic levels.

Key Highlights

- Over the long term, factors such as increasing demand for compressors from the chemical industry for application such as refrigeration is likely to drive the Europe compressor market.

- However, increasing the installation of renewable energy sources to provide power that does not use compressors is expected to restrain the Europe compressor market.

- Nevertheless, new technologies in compressors with higher efficiency than the present ones that save 20-50% more energy are expected to create several opportunities for the European compressor market in the future.

- Russia, due to its highest oil and gas refining capacity in the region, is expected to dominate the Europe compressor market. As of 2021, more than 30% of the total refining capacity in Europe was in Russia, where compressors are required for several purposes, such as transportation and LNG conversion of gas.

Europe Compressor Market Trends

Oil and Gas Industry Segment Expected to Dominate the Market

- Compressors are mechanical devices that increase the pressure of a gas by reducing its volume. They are widely used throughout the oil and gas industry. The oil and gas business's upstream, midstream, and downstream sectors require compression for numerous applications, such as transmission, storage, gas gathering, gas lift, gas injection, flash gas compression, and refrigeration.

- Several countries in Europe have targeted to phase out coal-based energy due to rising environmental concerns. Such a decision is likely to trigger more gas-based power in the country, which provides a cleaner energy source than coal.

- In 2021, the total liquefied natural gas (LNG) export from the region was 3.8 billion cubic meters (bcm). The conversion of the LNG from gas is likely to use compressors, and the increase in the LNG exports from the region is expected to positively impact the compressor market in the region.

- In February 2022, British oil and gas company BP PLC signed a joint development agreement with Hydrogen Chemistry Company (HyCC) to further develop H2-Fifty, a 250MW green hydrogen plant, in the port area of Rotterdam, Netherlands. The compressor plays a crucial role in hydrogen generation by increasing the pressure of hydrogen by reducing its volume resulting in compressed hydrogen.

- Moreover, in June 2022, Neste Oyj took a financial investment decision (FID) on USD 2 billion Rotterdam refinery expansion project in Finland. The project will help the Finnish oil refining and marketing company in growing the renewable products production capacity of its Dutch refinery from 1.4 million tons per annum of renewable products to 2.7 million tons per annum.

- Hence, owing to the above-mentioned points, the oil and gas industry segment is likely going to dominate the European compressor market during the forecast period.

Russia Expected to Dominate the Market

- In Russia, energy is an essential part of the country's economy, contributing to approximately 40% of state revenues. Furthermore, Russia is projected to remain among the top energy exporters in 2021 and beyond; because of this, it is likely to be the largest market for compressors in Europe.

- Food production and processing represent a crucial part of the Russian economy. The fast pace of life in the country, easy storage, and increased shelf life of packaged foods have led to an increased demand for products suitable for consumption on the go.

- Moreover, the growth in the share of natural gas in power generation is driven by low natural gas prices and an increasing number of such plants, which is likely going to drive the compressor market.

- In recent years the country is witnessing a sharp rise in LNG exports. With the increasing expansion into the world's LNG market, the country is expected to invest in the LNG industry infrastructure, which is likely to directly impact the compressor market.

- In 2021, the gas production in Russia was 701.7 billion cubic meters (bcm), which was higher than the production in 2020, 637.3 bcm. The country has already started reducing coal usage for energy generation and compensating it with natural gas, which is likely to drive the compressor market in the country.

- In August 2022, SIBUR, a Russian petrochemicals company, announced its plan to revise its strategy for developing the Amur Gas Chemical Complex (AGCC) with Sinopec. Also, Amur Gas Chemical Complex is set to be one of the world's largest polymer production facilities. Upon completion, the project will have a capacity of 2.3 MMtpy of polyethylene and 400 ktpy of polypropylene. The facility is to be located near Svobodny town in the Amur Region, close to the Russian-Chinese border.

- Hence, owing to the above-mentioned points, Russia is expected to dominate the Europe compressor market during the forecast period.

Europe Compressor Industry Overview

The European compressor market is moderately fragmented. Some of the key players in this market (in no particular order) include Atlas Copco AB, Siemens AG, Sulzer AG, Baker Hughes Co., and Aerzener Maschinenfabrik GmbH.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Positive Diplacement

- 5.1.2 Dynamic

- 5.2 End User

- 5.2.1 Oil and Gas Industry

- 5.2.2 Power Sector

- 5.2.3 Manufacturing Sector

- 5.2.4 Chemicals and Petrochemical Industry

- 5.2.5 Other End Users

- 5.3 Geography

- 5.3.1 Russia

- 5.3.2 Germany

- 5.3.3 United Kingdom

- 5.3.4 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Collaboration, and Joint Ventures

- 6.2 Strategies Adopted by Key Players

- 6.3 Company Profiles

- 6.3.1 Siemens AG

- 6.3.2 Baker Hughes Co.

- 6.3.3 Trane Technologies PLC

- 6.3.4 Atlas Copco AB

- 6.3.5 Burckhardt Compression Holding AG

- 6.3.6 General Electric Company

- 6.3.7 Aerzener Maschinenfabrik GmbH

- 6.3.8 Sulzer AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219