|

市场调查报告书

商品编码

1644348

美国强化地板:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)US Laminate Flooring - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

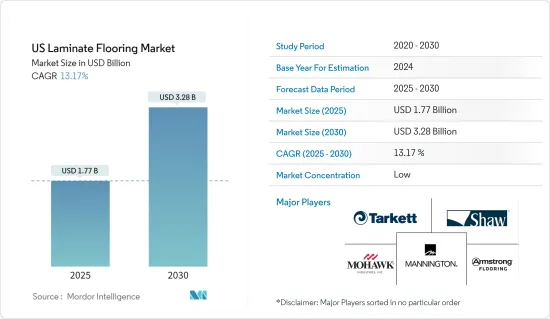

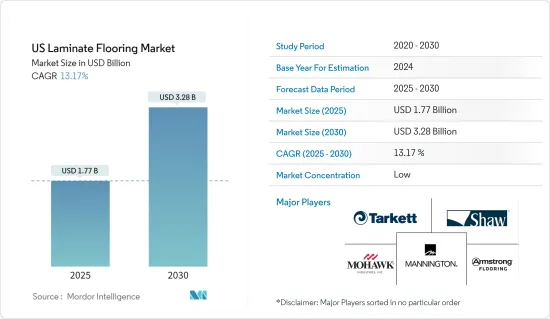

预计 2025 年美国强化地板市场规模为 17.7 亿美元,到 2030 年将达到 32.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 13.17%。

都市化、工业化和生活方式的改变促进了建筑业的成长,这是主要的市场驱动力。此外,强化木地板的采用也受到其耐用性、高光泽度、染色和纹理饰面的推动,使其成为商业和住宅领域的一个有吸引力选择。

机会在于对具有成本效益、低维护的地板解决方案的需求日益增长,而强化地板正好满足了这些要求。房地产开发投资的激增,加上对木质地板材料的偏好,为市场扩张提供了有利的条件。透过解决环境问题和提供永续的选择,强化木地板的技术创新为更积极的前景做出了贡献。

综上所述,美国强化地板市场可望在建设活动、创新产品供应和永续性考量的推动下实现动态。

美国强化地板市场的趋势

建筑业成长预示美国强化地板市场将成长

随着建设活动的活性化,新住宅、商业和工业建筑对地板材料的需求也随之增加。强化木地板以其耐用性、价格实惠和美观而闻名,是消费者和建筑商的热门选择。新住宅、公寓、办公室、零售和酒店设施的建设正在推动对强化地板产品的需求。强化木地板适用于各种用途,包括客厅、卧室、厨房、走廊和商业空间,是建筑商和业主的多功能选择。除了新建筑外,强化木地板在装修和改造计划中也很受欢迎。当住宅和企业希望更新和改善他们的房产时,强化木地板提供了一种经济有效的解决方案,可以提高美观性、耐用性和转售价值。

技术进步推动美国强化地板市场发展

利用这些技术,国内外製造商正在将此类别推向新的高度,推出具有全面创新的新产品和产品线。过去几年来,装饰和尺寸方面的技术进步彻底改变了超耐磨地板行业。许多技术进步已走到前台,使得强化木地板拥有多种光泽度,包括光滑、浮雕和手刮。

由于技术的进步,生产强化木地板变得更有效率和经济。例如,数位印刷技术的改进可以实现更逼真的形状和纹理,使强化地板具有真实木材或石材的外观。这导致强化木地板在美国越来越受欢迎。

强化地板生产技术的改进带来了更高品质的产品。强化地板具有更高的耐用性、防水性和抗刮伤性,使其成为住宅和商业地板的理想选择。

美国强化木地板产业概况

美国强化地板市场正在成长,竞争较少,许多竞争对手占据市场主导地位。随着新技术进步越来越强势地占领市场,并透过产品创新和流程自动化以众多技术进步改变市场,美国的强化地板市场竞争日益激烈,实力日渐增强。

主要市场相关人员正致力于提高生产能力,这有助于增加出口。虽然跨国连锁企业及其品牌如佛罗里达瓷砖、阿姆斯特朗等已家喻户晓,但美国的强化地板集团如道达尔、肖氏工业、莫霍克工业等在併购后都专注于加强创新和联盟,为强化地板产品提供更多的平台,从而引领美国强化地板市场迈向新的高度,预计在整个预测期内都将保持增长。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第 3 章总结

第四章 市场洞察与动态

- 市场概况

- 市场驱动因素

- 简化安装和维护

- 住宅和商业建筑的成长

- 市场限制

- 与替代地板的竞争

- 价值链分析

- 波特五力分析

- 购买者和消费者的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 洞察技术变革对市场的影响

- COVID-19 市场影响

第五章 市场区隔

- 按产品

- 高密度纤维板复合地板

- 中密度纤维板复合地板

- 按应用

- 住宅

- 商业的

- 产业

- 按分销管道

- 在线的

- 离线

第六章 竞争格局

- 公司简介

- Mohawk Industries Inc.

- Shaw Industries

- Florida Tile Inc.

- Tarkett SA

- Armstrong Flooring Inc

- Mannington Mills Inc

- Bruce flooring

- Kronotex USA

- FloorMuffler

- Moreland Company USA

第七章 市场机会与未来趋势

第八章 免责声明及发布者

The US Laminate Flooring Market size is estimated at USD 1.77 billion in 2025, and is expected to reach USD 3.28 billion by 2030, at a CAGR of 13.17% during the forecast period (2025-2030).

Urbanization, industrialization, and evolving lifestyles contribute to the growth of the construction industry, a major market driver. Additionally, the adoption of laminate flooring is spurred by its durability, high gloss, colored and textured finishes, making it an attractive choice in both commercial and residential sectors.

Opportunities lie in the increasing demand for cost-effective and low-maintenance flooring solutions, with laminate flooring meeting these criteria. The surge in investments in real estate development, coupled with a preference for wood-based floorings, presents a favorable landscape for market expansion. Technological innovations in laminate flooring, addressing environmental concerns and offering sustainable options, further contribute to the positive outlook.

In summary, the US laminate flooring market is poised for growth, with construction activities, innovative product offerings, and sustainability considerations driving market dynamics.

US Laminate Flooring Market Trends

Growing Constructions signifying Growth in United States Laminate Flooring Market

As construction activity rises, there is a corresponding increase in the demand for flooring materials to outfit newly built residential, commercial, and industrial properties. Laminate flooring, known for its durability, affordability, and aesthetic appeal, is a popular choice among consumers and builders alike. The construction of new homes, apartments, offices, retail spaces, and hospitality venues drives the demand for laminate flooring products. Laminate flooring is suitable for various applications, including living rooms, bedrooms, kitchens, hallways, and commercial spaces, making it a versatile option for builders and property owners. In addition to new construction, laminate flooring is also sought after in renovation and remodelling projects. As homeowners and businesses seek to update or improve their properties, laminate flooring offers a cost-effective solution for enhancing aesthetics, durability, and resale value.

Technological Advancements Driving Laminate Flooring Market of United States

Domestic and international manufacturers have capitalized on those technologies to help bring the category to new heights, launching new products and product lines that tout innovation across the board. Technological advances in decoration and size have transformed the laminate floor covering industry in the last few years. Many technological advancements have come to the forefront, yielding a variety of laminate flooring, including smooth, embossed, hand-scraped, and many more, with various levels of gloss.

The production of laminate flooring is becoming more efficient and economical thanks to technological improvements. For instance, improvements in digital printing technology enable more lifelike shapes and textures, giving laminate flooring a closer resemblance to real wood or stone. This has helped laminate flooring become more popular in the United States.

Improvements in laminate flooring production technology have resulted in higher-quality goods. Laminate flooring is a desirable alternative for both residential and commercial flooring because of improvements in durability, water resistance, and scratch resistance made possible by manufacturers.

US Laminate Flooring Industry Overview

The United States laminate flooring market is growing and moderately competitive, with many competitive players dominating the market. New innovations are grabbing the market more powerfully and transforming it with many technological advancements through product innovation and process automation, thus making the United States laminate flooring market very competitive and strong.

The key market players are focusing on improving their production capacity, which will help them increase exports. Multinational chains and their brands, such as Florida Tiles, Armstrong, and others, are widely known, but altogether, the United States laminate flooring groups such as Shaw Industries, Mohawk Industries, and many more after mergers and acquisitions have been focusing on tying up with enhanced technology innovations and offering more platforms for laminate flooring products, thus leading the United States laminate flooring market to new heights and expected to grow throughout the forecasted period.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of Study

2 RESEARCH METHODOLOGY

3 EXCEUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Installation And Maintenance Simplicity

- 4.2.2 Growing Residential And Commercial Construction

- 4.3 Market Restraints

- 4.3.1 Competition From Alternative Flooring Types

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Buyer/ Consumer

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Product

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Insights on impact of technology and innovation in the Market

- 4.7 Impact of COVID-19 on the market

5 MARKET SEGMENTATION

- 5.1 By Product

- 5.1.1 High-Density Fiberboard Laminated Flooring

- 5.1.2 Medium-Density Fiberboard Laminated Flooring

- 5.2 By Application

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.3 Industrial

- 5.3 By Distribution Channel

- 5.3.1 Online

- 5.3.2 Offline

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Mohawk Industries Inc.

- 6.1.2 Shaw Industries

- 6.1.3 Florida Tile Inc.

- 6.1.4 Tarkett S.A.

- 6.1.5 Armstrong Flooring Inc

- 6.1.6 Mannington Mills Inc

- 6.1.7 Bruce flooring

- 6.1.8 Kronotex USA

- 6.1.9 FloorMuffler

- 6.1.10 Moreland Company USA*