|

市场调查报告书

商品编码

1644351

英国商业智慧:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)United Kingdom Business Intelligence - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

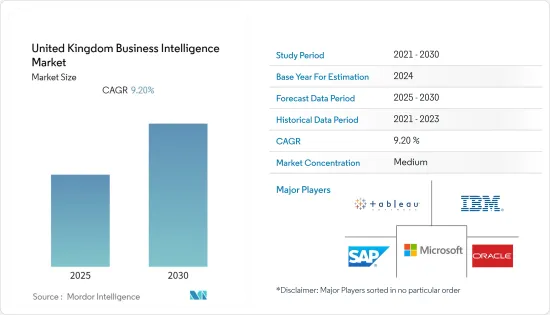

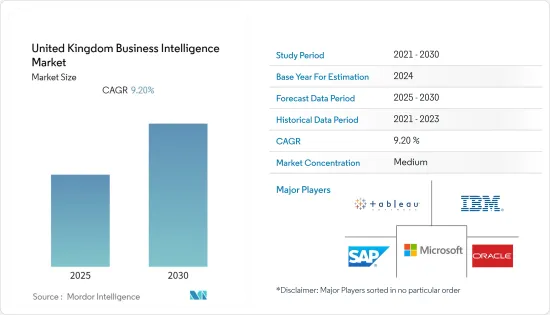

预计预测期内英国商业智慧市场复合年增长率将达到 9.2%。

主要亮点

- 英国政府与微软签署了一份新的为期三年的谅解备忘录,以帮助公共部门利用云端运算和商业应用的优势。据微软称,新的谅解备忘录名为《数位转型安排2021》(DTA21),将允许所有符合资格的公共部门组织以折扣和优惠条件存取 Microsoft 365、Azure、Dynamics 365 和 Power Platform 云端服务。

- 特定产业的分析和商业智慧使英国各地的企业能够根据客户偏好、促销反应、购买习惯、网路购物体验以及影响销售的模式和趋势发现详细的销售趋势。透过利用客户的购买习惯,企业可以确定如何留住有价值的客户并利用错失的销售机会。

- 透过深入了解这些全面的见解,该地区的企业可以确定需要加强哪些连结销售机会以及哪些产品最适合交叉销售。透过识别正在下滑的客户,公司可以在客户完全停止购买之前确定重新定位产品的最佳计划。销售经理可以确定最佳客户类型、在哪里找到他们,并确定最有效的获取和转换策略。

- 新冠疫情显着减缓了大多数公司的人工智慧投资。虽然人工智慧仍然是一个关键技术领域,但公司需要有效的方法来扩展他们的人工智慧实践,并利用人工智慧发展业务,以加速他们的人工智慧投资的投资回报。随着组织面临优化工作流程越来越大的压力,我们预计会看到更多公司转向其 BI 团队来管理和开发 AI/ML 模型。推动基于 BI 的新 AI 开发人员类别出现的关键因素有两个:首先,使用自动化平台等工具增强 BI 团队的能力比僱用专门的资料科学家更具扩充性和永续。其次,BI 团队比资料科学家更接近业务用例,这从工作模型的要求加速了生命週期。

- 公司经常聘请业务分析师担任 BI 和分析专家。透过将低薪员工转变为需求量大的抢手技能型员工,公司可以获益。然而,这往往是在薪资没有大幅增加的情况下实现的。分析和 BI 专业人员的薪水不断上涨将提高其技能水平,因为员工为提高技能所付出的额外努力将获得丰厚的财务回报。

英国商业智慧市场趋势

英国越来越多地采用物联网技术和先进的分析工具

- 分析和 BI 使公司能够深入了解单一交易以获得商机和成本问题的答案。透过检查当前和过去的现金流,企业可以根据其未来的财务状况做出决策。透过按地点细分收益,我们可以按分店计算出每条产品线的实力。例如,您可以从一个位置移除某种特色产品,并在另一个位置进一步推广它。可自订的仪表板可让企业主管追踪关键绩效指标 (KPI),以实现有效的财务管理和监控。

- 此外,由于 BI资料包括储存在资料仓储中的历史资讯和从各种内部和外部来源收集的新资料,因此 BI 工具可以支援战略和战术性决策流程。各行各业越来越多地使用 BI 来解决低效率决策问题。然而,BI 和分析为业务决策者提供了真正的支援。但重要决策比业务决策更为复杂、更为广泛。需要更多的一般资讯、专家判断和创造力来了解情况并确定替代行动方案。

- 今年 12 月,商业风险情报公司 Sayari 被英国皇家商业服务局 (CCS) 选为 G-Cloud 13 框架的供应商,该框架是政府与云端基础服务提供者之间的合约。此次合作将使国家犯罪局 (NCA)、国防部 (MOD)、英国税务海关总署、严重诈骗办公室和英国财政部等部门和机构加速采用 Sayari 的商业风险情报平台。政府分析人员和调查人员团队将能够更快地获得填补资讯空白所需的难以找到的联繫。

- 去年 12 月,Celios Group 同意成为澳洲物联网供应商 Urban.io 在英国的首选分析合作伙伴。纽卡斯尔的一位资料分析和测试解决方案专家表示,可操作资料正在彻底改变现代组织的工作方式,并帮助他们挽回疫情期间损失的收入。

- 根据微软去年的物联网报告,英国25%的计划处于运用阶段,91%的专案已经采用了物联网。微软对四个行业的公司进行了调查,发现大多数公司都在采用物联网。每个产业处于利用阶段的计划比例相似,约占所有计划的四分之一,每个产业大约需要 13 个月才能达到此阶段。物联网很可能继续成为各行各业优先采用的技术。

预计 BFSI 部门将占据市场的大部分份额

- 在互联网、行动装置和应用程式兴起的推动下,当今的金融机构面临着不断变化的客户需求、日益激烈的竞争以及在高度动态的市场中严格治理和风险管理的需求。在这种背景下,商业智慧解决方案使金融机构能够分析大量客户资料,深入了解客户的银行需求和情绪,有助于改善产品和服务。

- BFSI 是一个资料主导的产业,透过 ATM 交易、现金交易、开户、网路银行、网路购物等产生大量资料。提供客製化和以客户为中心的服务和提案的需求正在推动 BFSI 行业对分析的需求。此外,BI也为银行和其他金融机构提供灵活透明的方法,以便更好地进行财务业务和决策。

- 人工智慧主导的商业智慧软体为金融机构(包括银行和投资公司)创造价值的主要方式有两种。报告和预测分析。

- 例如,SAS Visual Analytics 声称结合使用预测分析和自然语言处理来帮助银行为主要员工提供自助服务分析和互动式报告。对于银行来说,这种分析和报告可能与客户购买模式、贷款支付或客户体验有关。此类软体应用程式可协助 BFSI 机构制定获取客户的策略并找到那些不太可能违约的客户。

- 透过自动化填写电子表格的过程,商业智慧平台有助于近乎即时地提供全面的商业财务指标,大大减少资料收集和决策之间的延迟。透过更快的资料分析获得的见解可以带来潜在的节约并进一步提高业务效率。

- 根据英格兰银行的定义,多银行金融机构(MFI)是指所有获准在英国吸收存款的银行和建筑协会。截至今年5月,英国共有357家小额信贷机构开展运营,其中130家总部位于英国。如此庞大的银行数量为新兴银行提供了开发新产品和抢占市场占有率的机会。

英国商业智慧产业概况

由于许多中小型企业与大公司竞争,英国商业智慧市场集中度适中。大公司占有不成比例的市场占有率,并透过创新为新进入者带来激烈的竞争。市场的主要企业包括 SAS Institute Inc.、微软公司等。近期市场发展趋势如下:

- 2022 年 11 月:IBM 发布了商业智慧(BI) 和分析套件 Business Analytics Enterprise。新套件包括一个新的分析内容中心以及带有 Watson 的 Planning Analytics 和带有 Watson 的 Cognos Analytics 的更新版本,为跨多个部门的预算、报告和预测资料提供商业智慧工具。

- 2022 年 10 月: Oracle在其广泛的资料和分析解决方案组合中推出了一系列新产品,以帮助客户做出更快、更好的决策。 Oracle Fusion Analytics 中涵盖 CX、ERP、HCM 和 SCM 分析的新功能现在为决策者提供了一个预先建立的库,其中包含 2,000 多个最佳实践 KPI、仪表板和报告,以监控策略目标的绩效。最近的 Oracle Analytics Cloud (OAC) 计画旨在透过减少对 IT 的依赖来提高业务用户的工作效率,同时受益于 IT 开发的、精选的资料资产(包括集中式语义模型)。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

- 短期和中期影响将因最终用户公司而异

- 中小企业的采用率短期内将会下降

- 地理空间 BI 的成长将以现有模型为基础

- 提高 BI 在资料传播方面的采用率

- 随着情绪分析在辅助决策流程中变得越来越重要,社交 BI 的采用率也上升

- 英国在欧洲 BI 市场的地位

第五章 市场动态

- 市场驱动因素

- 英国越来越多地采用物联网技术和先进的分析工具

- 云端运算的迁移使小型企业能够利用资料来支援决策流程。

- 市场挑战

- 英国政府推动商业智慧应用的主要倡议

- 市场机会

- GDPR 对英国BI 产业的影响(将涵盖资料最小化和隐私等趋势)

- 英国BI 生态系统分析的现况(主要研究机构、学术计画和公共部门合作)

第六章 市场细分

- 按组织规模

- 小型和中型

- 大规模

- 按最终用户产业

- BFSI

- 资讯科技/通讯

- 零售和消费品

- 製造和物流

- 公共服务

- 其他最终用户产业

第七章 竞争格局

- 公司简介

- Microsoft Corporation

- SAP SE

- Tableau Software

- IBM Corporation

- SAS SE

- Oracle Corporation

- Tibco Software

第八章投资分析

第九章:未来市场展望

简介目录

Product Code: 71291

The United Kingdom Business Intelligence Market is expected to register a CAGR of 9.2% during the forecast period.

Key Highlights

- The UK government signed a new three-year memorandum of understanding (MOU) with Microsoft to help public sector organizations use and benefit from cloud computing and business applications. According to Microsoft, the new MOU is called the Digital Transformation Arrangement 2021 (DTA21), which allows all eligible public sector organizations to benefit from discounts and beneficial terms for Microsoft 365, Azure, Dynamics 365, and Power Platform cloud services.

- Industry-specific analytics and business intelligence enable companies in the united kingdom region to discover detailed sales trends based on their customers' preferences, reactions to promotions, purchasing habits, online shopping experiences, and patterns and trends which affect sales. Utilizing customer buying habits permits a company to decide how to retain valuable customers and take significant advantage of missed sales opportunities.

- By drilling down to such comprehensive insights, a company in the region could decide which link-sell opportunities to increase or which products are best for cross-selling. By identification of customers in decline, a business could determine the best plan to reposition the product before they stop buying altogether. Sales managers can identify the best type of customers, where to find them, and determine the most effective acquisition and conversion strategies.

- The COVID-19 pandemic considerably slowed down AI investments for most enterprises. Although AI is still one of the critical technology areas, organizations require an efficient way to scale their AI practices and use AI in business to accelerate ROI in AI investment. As organizations face more significant pressure to optimize their workflows, more companies will ask BI teams to manage and develop AI/ML models. The two critical factors that will drive this boost of a new BI-based AI developer class: First, enabling BI teams with tools such as automation platforms is more scalable and more sustainable than hiring dedicated data scientists; second, because BI teams are significantly closer to the business use-cases compared to data scientists, the lifecycle from the working model's requirement will be accelerated.

- Enterprises often turn their business analysts into BI and analytics experts. The company benefits by converting a lower-salaried employee into a high-demand and highly sought-after skill. However, this is often done without a substantial salary increase. Increased pay for analytics and BI professionals would help raise skill levels because employees realize a considerable financial reward for any extra effort to improve their skills.

UK Business Intelligence Market Trends

Growing adoption of IoT-enabled technologies and Advanced Analytics tools in the UK

- Analytics and BI will allow businesses to drill down to individual transactions to get answers to revenue opportunities and cost concerns. By examining the incoming and outgoing finances of the present and past, a business can make decisions based on its future financial status. Breaking down revenue by location calculates the strength of product lines by branch. For instance, an enterprise could remove a speciality item from one place and increase its promotion in another. Customizing the dashboard allows enterprise executives to track key performance indicators (KPIs) to enable effective financial management and oversight.

- Additionally, BI data includes historical information stored in a data warehouse and new data collected from various internal and external sources, enabling BI tools to support strategic and tactical decision-making processes. The use of BI inefficient decision-making is augmenting its use across industries. However, BI and analytics provide substantial support to operational decision-makers. But critical decisions are more complex and broader than operational decisions; they require more general information, expert judgments, and creativity to make sense of situations and define alternative courses of action.

- In December this year, Sayari, a commercial risk intelligence firm, was recently selected by the United Kingdom Crown Commercial Service (CCS) as a supplier for the G-Cloud 13 Framework, a contract between the government and cloud-based service providers. The collaboration allows ministries such as the National Crime Agency (NCA), the Ministry of Defence (MOD), HM Revenue & Customs, the Serious Fraud Office, HM Treasury, and others to speed the adoption of Sayari's commercial risk intelligence platform. Teams of government analysts and investigators will have fast access to the difficult-to-find connections required to close information gaps.

- In December last year, Serios Group agreed to be the preferred UK analytics partner of Australian IoT supplier Urban.io, allowing businesses across the UK to decrease costs, develop efficiencies, and improve their sustainability. According to the Newcastle-based data analytics and testing solutions expert, actionable data is revolutionizing the way modern organizations work - and is assisting firms in recouping income lost during the pandemic.

- According to the Microsoft IoT report of the last year, 25% of projects are in the UK's usage phase, and 91% of IoT adopters. Microsoft conducted a study of businesses in all four industries, and the vast majority of them identified as IoT adopters. All sectors have a comparable percentage of projects in the use stage, representing about a quarter of all projects, and all industries require about 13 months to reach this point. IoT will continue to be prioritized across sectors.

BFSI Segment is Expected to Hold a Significant Share of the Market

- Owing to the internet and the proliferation of mobile devices and apps, financial institutions today face changing client demands, mounting competition, and the need for strict control and risk management in a highly dynamic market. In such scenarios, business intelligence solutions enable financial organizations to analyze immense amounts of customer data to gain insights about their customer's needs and sentiments regarding banking that can be used to improve products and services.

- BFSI is a data-driven industry with massive data generated through ATM transactions, cash transactions, account opening, internet banking, online shopping, and others. The need to deliver customized and customer-centric services and offers are driving the demand for analytics in the BFSI industry. Moreover, BI offers banking and other financial institutions a flexible and transparent approach to making better financial operations and decisions.

- Predominantly, there are two ways in which AI-driven business intelligence software could bring value to banks and financial institutions, including investment firms. These include report generation and predictive analytics.

- For instance, SAS Visual Analytics claims to help banks provide their lead staff with self-service analytics and interactive reports using a combination of predictive analytics and natural language processing. For banks, this analysis and reporting are related to customer buying patterns, loan payments, or customer experience. Such software applications can help BFSI institutions develop strategies for gaining customers or finding customers less likely to default on loans.

- A business intelligence platform can help automate the process of filling up spreadsheets, thus providing comprehensive business financial metrics in near-real-time and significantly shortening the delay between data collection and decision-making. The insights uncovered through quicker data analysis can lead to potential savings and even more operational efficiency gains.

- According Bank of England, Monetary Financial Institutions (MFI) are all banks and building societies in the United Kingdom that are permitted to accept deposits. As of May this year, 357 MFIs are operating in the United Kingdom, with 130 of them headquartered in the United Kingdom. Such a huge number of banks in operation would create an opportunity for the studied market players to develop new products and capture the market share.

UK Business Intelligence Industry Overview

The United Kingdom's business intelligence market concentration is medium due to the presence of many small and medium-sized companies competing with each other and with large enterprises. Large enterprises hold a prominent market share and give tuff competition to the new entrance players through innovations. Some key players in the market include SAS Institute Inc., Microsoft Corp., etc. Recent developments in the market are -

- November 2022: IBM released Business Analytics Enterprise, a business intelligence (BI) and analytics suite that it claims is meant to assist enterprises in breaking down data silos and hurdles to cooperation imposed by using disparate sets of analytics tools across different divisions. The new suite, which includes a new Analytics Content Hub and updated versions of Planning Analytics with Watson and Cognos Analytics with Watson, offers business intelligence tools for budgeting, reporting, and forecasting data across many divisions.

- October 2022: Oracle introduced a variety of new product advancements across its broad array of data and analytics solutions to help clients make faster, better decisions. Decision-makers now have a prebuilt library of more than 2,000 best-practice KPIs, dashboards, and reports to monitor performance against strategic goals, due to new capabilities in Oracle Fusion Analytics spanning CX, ERP, HCM, and SCM analytics. The most recent Oracle Analytics Cloud (OAC) improvements are intended to increase business users' productivity by reducing their dependency on IT while still benefiting from curated data assets developed by IT, such as the centralized semantic model.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

- 4.4.1 Near and medium-term impact to vary across end-user organizations

- 4.4.2 SME adoption to witness a decline in the near-term

- 4.4.3 Growth in Geo-spatial BI to build on the current models

- 4.4.4 Higher adoption of BI adoption for data dissemination

- 4.4.5 Social BI to witness higher adoption as organizations increasingly focus on sentiment analysis to aid decision making process

- 4.4.6 Current Positioning of the United Kingdom in the Europe BI Market

5 Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Growing adoption of IoT-enabled technologies and Advanced Analytics tools in the UK

- 5.1.2 Migration to the cloud has enabled SME's to leverage data to support their decision-making process

- 5.2 Market Challenges

- 5.2.1 Key initiatives undertaken by the UK government to promote BI adoption

- 5.3 Market Opportunities

- 5.3.1 Impact of GDPR on the BI Industry in the UK (Trends such as Data Minimization and Privacy to be covered)

- 5.3.2 Current BI Ecosystem Analysis Landscape in the UK (Major research institutes, academic programs, and collaborations with public agencies)

6 MARKET SEGMENTATION

- 6.1 By Organization Size

- 6.1.1 Small & Medium-Scale

- 6.1.2 Large-Scale

- 6.2 By End-user Vertical

- 6.2.1 BFSI

- 6.2.2 IT & Telecom

- 6.2.3 Retail & Consumer Goods

- 6.2.4 Manufacturing & Logistics

- 6.2.5 Public Services

- 6.2.6 Other End-user verticals

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Microsoft Corporation

- 7.1.2 SAP SE

- 7.1.3 Tableau Software

- 7.1.4 IBM Corporation

- 7.1.5 SAS SE

- 7.1.6 Oracle Corporation

- 7.1.7 Tibco Software

8 INVESTMENT ANALYSIS

9 FUTURE OUTLOOK OF THE MARKET

02-2729-4219

+886-2-2729-4219