|

市场调查报告书

商品编码

1644355

光波长服务-市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Optical Wavelength Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

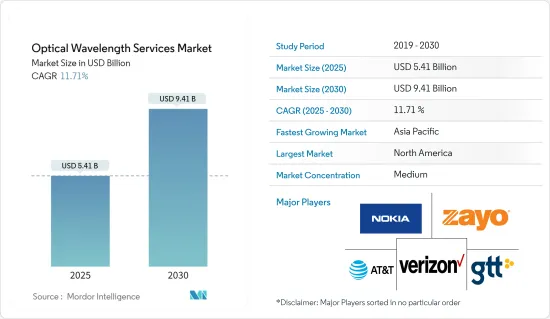

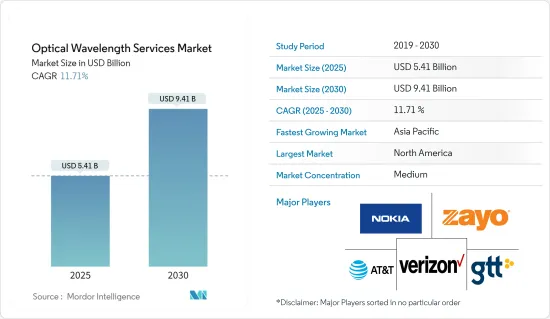

光波长服务市场规模预计在 2025 年为 54.1 亿美元,预计到 2030 年将达到 94.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 11.71%。

预计预测期内全球资料量将翻一番,这将更加需要关注每位元成本和功耗。将大波长延伸至远距可为最终用户提供更具成本效益和更有效率的服务。大波长还能显着提高网路频宽,为高清内容、5G 蜂窝网路、物联网、远端工作和其他应用提供必要的动力。

关键亮点

- 对 FTTH 系统的需求正在增加,网路连线的扩展不仅在都市区,而且在农村和偏远地区也在加速。这些投资将加剧有线电视公司之间的竞争,以提供更密集、更强大的无线网路和更高频宽的服务。

- 2023 年 2 月,富士通宣布推出超可靠光纤传输平台“1FINITY”,每波长的资料速率可达 1.2Terabit每秒 (Tbps)。该平台将有助于降低电力消耗,并将整个网路的二氧化碳排放减少 60%。

- 儘管在其网路上更广泛地部署 FTTH 具有许多好处,但通讯业者仍对安装额外光纤和最终用户光纤数据机的成本感到畏惧。随着产业转向 50G 和 100G 等需要调变解调器连贯技术的更高频宽,这个成本问题只会变得更加严重。

- 即使在 COVID-19 疫情之后,网路营运商仍在继续增加设备和容量,以支援远端工作、云端基础的服务、串流媒体视讯、物联网和 5G 无线技术。对资料和高速网路不断增长的需求,加上供应中断,促使网路解决方案供应商采用更长的波长来快速扩展容量,以解决流量瓶颈和缓慢的资料传输速度。

光波长服务市场趋势

10Gbps 以下频宽市场预计将占据较大市场占有率

- 需要频宽的应用程式需要高效能的连线。波长服务对于光纤传输技术的发展至关重要,使得单一光纤的容量能够达到100Gbps及以上的吞吐量。结合网路管理系统,该技术使通讯业者能够采用基于光纤的网路基础设施来满足未来的频宽需求。

- 在目前部署的基于单芯光纤的光纤网路中,可以透过增加每通道的位元率或增加给定传输频谱内的可用通道数量来提高资料传输速率。

- 连贯WDM技术是一种非常先进的光纤传输技术,具有许多优点,包括更高的位元率、更大的灵活性、更简单的DWDM线路系统和更好的光学性能。该技术推动了DWDM网路中经济高效、可靠的光纤传输的发展,将波长速度从前连贯时代的10Gb/s提高到100Gb/s、200Gb/s,甚至最新连贯光设备中的400Gb/s和800Gb/s。

- CWDM和DWDM是解决资讯传输日益增长的频宽需求的两种不同方法。 DWDM 使用更多窄波长频宽或通道,而 CWDM 每个通道使用较宽的波长频宽。

- 根据英国政府批准的广播、通讯和邮政行业监管和竞争机构通讯 的数据,CWDM 使用的平均频宽约为 2.9μm。平均每人每月使用约2.9GB的资料,而且随着数位化的进步,这种需求只会增加。然而事实证明,10Gb/s 对于普通行动电话用户来说已经足够了。

- 2023 年 2 月,新加坡电信业者StarHub 推出了超高速宽频,速度和频宽比新加坡标准宽频服务快 10 倍。这项高速宽频服务增强了您家庭的连接能力,为线上游戏和闪电般的内容流提供最佳响应能力。

亚太地区可望占据主要市场占有率

- 北美和欧洲加起来仅占全球行动资料服务的四分之一,而印度和中国则占全球行动流量的近一半。印度已成为行动资料服务市场的主要企业,其行动资料消费量位居全球第一,达到每位用户每月 12GB。

- 此外,印度每季新增2,500万智慧型手机用户,使其成为行动资料服务的重要市场。预计到 2022 年,智慧型手机用户数量的激增将使每位用户每月的平均资料消耗量达到 19.5GB,这意味着对资料驱动应用程式和服务的需求将持续增长。这一发展凸显了印度作为全球行动资料市场主要参与企业的地位,为未来的进一步成长和创新提供了巨大的潜力。

- 行动资料服务的强劲成长也刺激了对 5G 设备的需求,私营部门在 5G 网路方面的支出导致印度此类设备的出货量强劲。据估计,印度目前5G设备出货量已超过7,000万台,预计到2027年私人无线网路投资将达到约2.5亿美元。这将鼓励通讯业者提供更强大的网路连线速度,进而推动光波长服务的成长。

- 新兴国家政府纷纷采取倡议,加速本国通讯基础设施的发展。亚太地区由于其廉价的劳动力和较高的工业 4.0 采用率,正成为越来越受欢迎的製造业地点。亚洲各国政府正积极推动新兴企业的发展,推出「中国製造2025」等计划,旨在支持中国製造业和工业4.0的更广泛应用。

光波长服务业概况

目前,光波长服务市场竞争激烈,但随着供应商计划推出新产品、建立合作伙伴关係和进行收购,预计该领域将会成长。该领域的市场领导包括 Zayo Group、Nokia、Century Link、Verizon Wireless、Century Link 和 Windstream Communications。与其他网路设定相比,光波长网路提供了一种可扩展的解决方案,可快速增加容量以解决资料速率慢和传输瓶颈问题。

2023 年 2 月,诺基亚宣布将与 GlobalConnect Fiber Networks 合作对其第六代超连贯光子服务引擎进行真实世界试验。此次试验的目标是使用单一波长在 118 公里的城域距离内达到 1.2Tb/s 的速度,在 2,019 公里的长距离内达到 800Gb/s 的速度。部署该技术可降低网路功耗高达 60%,并将网路总体拥有成本降低高达 50%。

2022 年 3 月,通讯网路供应商 Enet 与 EXA Infrastructure 签署合同,在都柏林与其遍布欧洲和北大西洋的资料中心之间建立新的高速资料中心间光纤网路连线。 International Wave计划旨在提供价格具竞争力、安全、快速且透明的资料间连线。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 评估新冠肺炎对各行业的影响

第五章 市场动态

- 市场驱动因素

- 网路需求不断成长

- 加速频宽频宽密集型

- 市场限制

- 增量频宽可用性有限

- 虚拟连线的需求不断增加

第六章 市场细分

- 按频宽

- 10Gbps 或更低

- 40Gbps

- 100Gbps

- 100Gbps 或更高

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 其他的

第七章 竞争格局

- 公司简介

- Nokia Corporation

- Zayo Group Holdings, Inc.

- Verizon Communications Inc.

- GTT Communications, Inc.

- AT&T Inc.

- Lumen Technologies Inc.

- T-Mobile US Inc.

- Crown Castle Inc.

- Comcast Corporation

- Charter Communications

- Windstream Holdings, Inc.

- Colt Technology Services Group Limited

- Cox Communications

- Jaguar Network SAS

- CarrierBid Communications

- EUnetworks Group

- Telia Carrier

- Exascale Limited

第八章投资分析

第九章:市场的未来

The Optical Wavelength Services Market size is estimated at USD 5.41 billion in 2025, and is expected to reach USD 9.41 billion by 2030, at a CAGR of 11.71% during the forecast period (2025-2030).

Global data volumes projected to double during forecasted year, there is a growing need to focus on cost and power consumption per bit. Extending large wavelengths across longer distances can make services more cost-effective and efficient for end-users. Larger wavelengths also provide significant network bandwidth expansion, essential to power high-definition content, 5G cell networks, IoT, remote work, and other applications.

Key Highlights

- The demand for fiber-to-home (FTTH) systems is increasing, accelerating the deployment of network connections not just in urban areas but also in rural and remote locations. These investments lead to more robust competition among cable companies to create a denser, higher-performance wireless network and high wavelength services.

- In February 2023, Fujitsu launched the Ultra Optical System called 1FINITY, a hyper-reliable optical transport platform delivering extreme performance and scalability with data rates of 1.2 terabits per second (Tbps) on a single wavelength. This platform helps to reduce power consumption and achieve a 60% reduction of CO2 emissions throughout networks.

- Despite the benefits of implementing FTTH more extensively across networks, carriers are still discouraged by the cost of installing additional fiber and the end-users' optical modems. As the industry transitions to larger bandwidths, such as 50G and 100G, which require coherent technology in the modems, this cost issue will worsen.

- Even after the Covid-19 pandemic, network operators continue to add more gear and capacity to support remote work, cloud-based services, streaming video, IoT, and 5G wireless technology. This increasing demand for data and high-speed networks with uninterrupted supply drives Network Solution providers to adopt high wavelengths that can quickly scale up capacity to address traffic bottlenecks or combat slower data transfer speeds.

Optical Wavelength Services Market Trends

Less than 10 Gbps Bandwidth Segment is Expected to Hold Significant Market Share

- Bandwidth-intensive applications demand high-performance connectivity. Wavelength services are essential in developing fiber optic transmission technology and can increase a single fiber's capacity to a throughput of 100 Gbps and beyond. The technology combines network management systems to enable carriers to adopt optically-based network infrastructures to meet future bandwidth demands.

- In currently deployed optical networks based on single-core fibers, the data transmission rate can be increased by using either a larger per-channel bit rate or increasing the number of available channels within a particular transmission spectrum.

- Coherent WDM technology is a highly advanced optical transmission technology that offers numerous benefits, including higher bit rates, greater flexibility, simpler DWDM line systems, and better optical performance. This technology has enabled the development of cost-effective and highly reliable optical transport in DWDM networks, with wavelength speeds increasing from 10 Gb/s in the pre-coherent era to 100 Gb/s, 200 Gb/s, and now even 400 or 800 Gb/s with the latest coherent optical equipment.

- CWDM and DWDM are two different methods for addressing the increasing bandwidth requirements for information transmission. DWDM employs a larger number of narrower wavelength bands or channels, while CWDM uses broader wavelength bands per channel.

- According to the of Communications (Ofcom), the government-approved regulatory and competition authority for the broadcasting, telecommunications, and postal industries of the United Kingdom. The average person uses around 2.9GB of data per month, and this demand is continuously increasing with the evolution of digitalization. However, this confirms that 10Gb/s is more than enough for the average phone user.

- In February 2023, StarHub, the Singaporean telco, introduced ultra-speed broadband with up to 10 times the speed and bandwidth of standard broadband services in Singapore. This high-speed broadband service will significantly enhance household connectivity, providing optimal responsiveness for online gaming and lightning-fast content streaming.

Asia Pacific is Expected to Hold Significant Market Share

- India and China are the two countries that account for nearly half of the world's mobile traffic, while North America and Europe together only account for a quarter of the global mobile data services. India, in particular, has emerged as a major player in the mobile data services market, with the highest mobile data consumption rate of 12 GB/user a month globally.

- Moreover, India witnesses a remarkable increase of 25 million new smartphone users every quarter, making it a crucial market for mobile data services. This surge in smartphone usage has led to an average data consumption rate of 19.5 GB per user per month in 2022, indicating a growing demand for data-driven applications and services. This trend highlights India's position as a key player in the global mobile data market, with enormous potential for further growth and innovation in the future.

- The strong growth of mobile data services has also fueled demand for 5G devices, with private enterprise spending on 5G networks leading to robust shipments of these devices in India. It is estimated that over 70 million 5G devices have been shipped to India, and the country's investment in private wireless networks is expected to reach approximately USD 250 million by 2027. This will encourage telecom providers to offer more powerful network connection speeds, which, in turn, will promote the growth of Optical Wavelength Services.

- Governments in developing nations are taking initiatives to encourage the development of communication infrastructure in their countries. The Asia-Pacific region, in particular, is becoming increasingly popular as a hub for manufacturing due to its cheap labor and high adoption rate of the Industry 4.0 movement. Governments in Asian countries are aggressively promoting the growth of new firms, with programs like "Made in China 2025" designed to broadly support Chinese manufacturing and the implementation of Industry 4.0.

Optical Wavelength Services Industry Overview

The Optical Wavelength Services Market currently experiences moderate competition, but this sector is expected to grow as vendors plan new product launches, partnerships, and acquisitions. Some of the market leaders in this segment include Zayo Group, Nokia, Century Link, Verizon Wireless, Century Link, and Windstream Communications. Compared to other network setups, optical wavelength networks offer a scalable solution that can quickly increase capacity to combat slower data transfer speeds or address traffic bottlenecks.

In February 2023, Nokia announced a collaboration with GlobalConnect fiber networks to conduct trials of its sixth-generation super-coherent Photonic Service Engine in real-world environments. These trials aim to achieve 1.2Tb/s over metro distances of 118km and 800Gb/s over a long-haul distance of 2,019km, both using a single wavelength. By deploying this technology, network power consumption can be reduced by up to 60%, and the total cost of network ownership can be reduced by up to 50%.

In March 2022, Enet, a telecom network provider, signed a contract with EXA Infrastructure to establish new high-speed datacentre-to-datacentre optical network connections between Dublin and data centers in Europe and the North Atlantic. This International Wave project aims to provide price-competitive, secure, high-speed, and transparent inter-datacentre connectivity.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assesment of Covid-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for the Internet

- 5.1.2 Accelerated Bandwidth-intensive Applications

- 5.2 Market Restraints

- 5.2.1 Limited Availability of Incremental Bandwidth

- 5.2.2 Increasing Demand for Virtual Connectivity

6 MARKET SEGMENTATION

- 6.1 By Bandwidth

- 6.1.1 Less than 10 Gbps

- 6.1.2 40 Gbps

- 6.1.3 100 Gbps

- 6.1.4 More Than 100 Gbps

- 6.2 Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia Pacific

- 6.2.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Nokia Corporation

- 7.1.2 Zayo Group Holdings, Inc.

- 7.1.3 Verizon Communications Inc.

- 7.1.4 GTT Communications, Inc.

- 7.1.5 AT&T Inc.

- 7.1.6 Lumen Technologies Inc.

- 7.1.7 T-Mobile US Inc.

- 7.1.8 Crown Castle Inc.

- 7.1.9 Comcast Corporation

- 7.1.10 Charter Communications

- 7.1.11 Windstream Holdings, Inc.

- 7.1.12 Colt Technology Services Group Limited

- 7.1.13 Cox Communications

- 7.1.14 Jaguar Network SAS

- 7.1.15 CarrierBid Communications

- 7.1.16 EUnetworks Group

- 7.1.17 Telia Carrier

- 7.1.18 Exascale Limited