|

市场调查报告书

商品编码

1644365

非洲软包装:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Africa Flexible Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

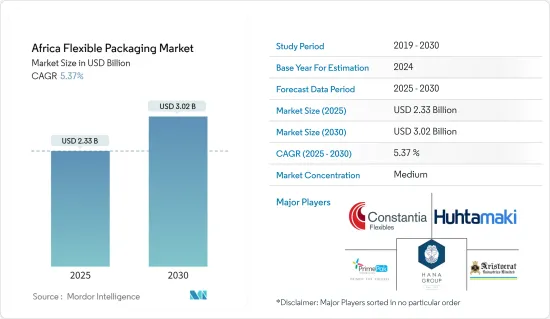

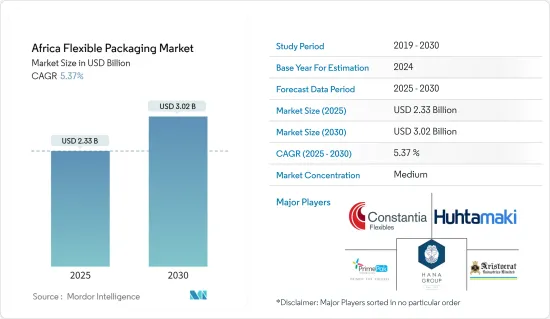

预计 2025 年非洲软包装市场规模为 23.3 亿美元,到 2030 年将达到 30.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.37%。

主要亮点

- 包装产业需求的激增和消费者对商品偏好的提升将推动未来几年非洲软包装市场的成长。随着消费者对包装的认知和互动不断演变,包装的永续性观念明显增强。这种转变导致传统硬质包装解决方案的衰落,为创新、永续的软包装选择让路。此外,人们对使用者友善包装和卓越产品保护的偏好日益增长,使得软包装作为可行且经济高效的选择越来越受到青睐。

- 非洲对初级食品的需求正在迅速成长。人口和收入的增加推动了这一需求,从而导致食品和饲料谷物、大豆、棉花和肉类的进口增加。此外,食品加工对于加强当地经济、将数百万小农户与供应商联繫起来以及提高农村收入至关重要,特别是在东部和南部非洲。随着都市化加速和人口成长,对加工食品的需求日益增长,为软包装市场创造了丰厚的利润。

- 技术创新为永续、客製化的软包装解决方案的发展铺平了道路,有助于推动市场大幅成长。在非洲,食品和消费品进口占该地区软包装市场的很大一部分。对包装和零售食品的需求不断增加,推动了市场成长。

- 此外,现代零售商日益主导该地区的通路分销。在过去两年中,埃及已经明显地从传统的杂货零售商和开放市场转向超级市场和大卖场。大卖场在这一领域处于领先地位,其金额份额显着增长,创造了经济的散装包装机会来推动市场发展。

- 然而,非洲国家正采取果断行动,禁止使用某些塑胶製品,防治污染。尼日利亚是全球塑胶污染的主要贡献者,每年排放超过250万吨塑胶废弃物。 2024 年 6 月,尼日利亚与其他非洲国家一道颁布了一次性塑胶禁令,表达了应对全球塑胶危机的决心。此举将对更广泛的软包装市场产生影响。

非洲软包装市场的趋势

预计袋装包装将占据主要市场占有率

- 袋装包装由于其无与伦比的便利性和便携性,很快就成为最受欢迎的选择。立式袋可保护内容物免受湿气、蒸气、气味、害虫、空气和光线的侵害。此外,消费者也被这些袋子的美观度和它们提供的额外便利性所吸引,例如喷口、拉炼和手柄。这些偏好推动了自立袋的流行。由于自立袋更轻、使用的材料更少,食品製造商可以享受比传统硬包装更优的运输成本优势。随着该地区的饮料行业越来越多地采用袋装包装,市场需求预计将增长。

- 硬质容器比柔性、可重新密封的立式袋消耗更多的石化燃料。值得注意的是,这些容器比柔性容器重六倍。此外,这些袋子上的多样化印刷选项可增强您的产品的美感,强化您的品牌形象并允许创新设计。此外,不断增长的技术创新带来了柔性发泡体、纸张和铝箔的引入,导致袋子製造明显不再使用传统塑胶原料。

- 创新正在推动袋子製造从塑料转向柔性发泡体、纸和铝箔的转变。此外,在亚洲和欧洲投资增加的推动下,非洲国家正在提高本地生产。因此,Lupin、Dr.Reddy's等外国公司已准备好提高生产能力。这一趋势将促进非洲对包括包装袋在内的医疗保健包装的需求。

- 果汁、清洁剂和食用油等液体越来越倾向于使用袋装包装,这刺激了具有增强氧气阻隔性的包装袋的创新。这些改进对于保存和保护液体内容物免受污染至关重要。此外,相关人员之间的合作开发可回收且保持其关键功能的软包装袋正在推动市场成长。

- 2024年全球成长最快的20个国家名单中,非洲占有重要地位。这种成长可以归功于整个非洲大陆的政策制定者,他们一直热衷于引导经济多元化策略,特别是透过将投资引向关键的成长领域。国际货币基金组织进一步强调了该地区GDP的持续成长,显示该地区生产和製造业实力强劲,同时预测对软包装的需求将激增。

预计南非将占据主要市场占有率

- 南非拥有成熟的食品製造业和强大的消费市场。该国正应对国内经济成长放缓的问题。製造商面临的挑战是控制生产成本,同时持续满足稳定的消费者需求。对增强型包装解决方案的投资可能会增加,这将提高效率并更好地控製成本。

- 此外,南非食品製造商也瞄准出口市场。他们有望重视灵活的包装,以确保产品的一致性和品质并符合全球食品标准。南非政府也将食品和饮料业列为製造业最重要的组成部分。政府正在积极鼓励农业和农产品加工产业的进一步发展,这可以支持南非市场的成长。

- 美容产品包装越来越依赖软质塑胶包装来保护内容物免受氧化并延长其保质期。南非的化妆品产业正在努力应对该国景气衰退带来的障碍。 GDP成长明显放缓,高失业率和可支配所得下降的挑战日益加剧。因此,个人保健部门的市场成长预计将放缓。

- 南非储备银行报告称,南非季度消费支出呈成长趋势,这支持了电子商务的成长以及与该国零售业格局相符的软包装需求。

- 南非的经济成长和都市化使得加工速食和速食的取得量呈指数级增长。这种变化在城市中心最为明显,尤其是 12-24 岁的年轻人。他们不断变化的消费模式推动了对即食食品、食品和饮料以及便携式食品的需求,从而增加了对灵活包装解决方案(包括袋装和小袋装)的需求。

非洲软包装产业概况

非洲软包装市场适度整合,主要参与者包括: Hana Packaging Limited、PrimePak Industries Nigeria Ltd、Aristocrat Industries Ltd、Constantia Afripack Flexibles Ltd 和 Huhtamaki Group 占据了大部分市场份额。

- 2024 年 1 月 - Constantia Afripack Flexibles Ltd 与南非客户合作,凭藉其「舒适整理加工剂和阳光织物整理加工剂袋」荣获「包装材料和组件」类别的 WorldStar 包装奖。该奖项标誌着 Constantia Flexible 发展历程中的关键时刻。这款袋子采用 EcoLam 材料製成,这是一种创新的、可回收的单 PE 层压板,以其出色的印刷性而闻名。 EcoLam 由南非 Constantia Afripack 公司生产,采用取向聚乙烯 (OPE) 製成,采用特殊的挤压工艺,确保单一材料的无缝加工。

- 2023 年 12 月 - 非洲软包装解决方案供应商 Huhtamaki Group 已将其成长策略修改为 2030 年。更新后的策略强调提高核心业务的盈利,同时创新永续包装解决方案以进一步扩大规模。因此,这家食品包装製造商启动了一项三年计划,以加速策略实施并增强盈利。此举表明该公司专注于永续包装创新以保持竞争力。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 产业供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 微观经济因素对产业的影响

第五章 市场动态

- 市场驱动因素

- 便捷包装需求不断成长

- 延长保存期限和改变生活方式

- 市场挑战

- 环境和回收问题

第六章 市场细分

- 按材质

- 塑胶

- 纸

- 铝箔

- 按产品

- 包包

- 小袋

- 包装膜

- 其他产品

- 按最终用户

- 食物

- 饮料

- 美容与个人护理

- 居家护理

- 药品

- 其他最终用户

- 按国家

- 南非

- 奈及利亚

- 埃及

- 摩洛哥

- 肯亚

- 非洲其他地区

第七章 竞争格局

- 公司简介

- Hana Packaging Limited

- Sonnex Packaging Nigeria Ltd

- Colpak Pty Ltd

- PrimePak Industries Nigeria Ltd

- Aristocrat Industries Ltd

- CTP Flexibles Ltd

- Constantia Afripack Flexibles Ltd

- Huhtamaki Group

- Amcor Group

- Berry Global

第八章投资分析

第九章:市场的未来

The Africa Flexible Packaging Market size is estimated at USD 2.33 billion in 2025, and is expected to reach USD 3.02 billion by 2030, at a CAGR of 5.37% during the forecast period (2025-2030).

Key Highlights

- Surging demand from the packaging industry and a growing preference for consumer goods are poised to drive the growth of the flexible packaging market in Africa in the coming years. As consumer perceptions and interactions with packaging evolve, there is a notable shift toward sustainability. This shift is leading to a decline in traditional rigid packaging solutions, making way for innovative and sustainable flexible packaging options. Furthermore, the rising preference for user-friendly packaging and superior product protection underscores the growing traction of flexible packaging as a viable and cost-effective choice.

- Africa is witnessing a surge in demand for primary food items. Its growing population and rising incomes drive this demand, leading to increased imports of food and feed grains, soybean, cotton, and meat. Furthermore, food processing is pivotal in bolstering local economies, forging supplier connections for millions of small-scale farmers, and boosting rural incomes, especially in Eastern and Southern Africa. As urbanization accelerates and the population expands, the appetite for processed food continues growing, presenting a lucrative opportunity for the flexible packaging market.

- Innovations have paved the way for developing sustainable and tailored flexible packaging solutions, fueling a remarkable surge in the market. In Africa, the imports of food and consumer goods constitute a substantial portion of the region's flexible packaging market. The increasing demand for packaged and retail foods is boosting the market growth.

- Additionally, in the region's channel distribution, modern retailers are increasingly dominating. Over the past two years in Egypt, there has been a notable shift from traditional grocery retailers and open markets to supermarkets and hypermarkets. Leading the charge, hypermarkets have recorded significant growth in their value share, creating an opportunity for economical bulk packaging that would drive the market.

- However, African nations are taking decisive steps against pollution by banning specific plastic products. Nigeria is a leading contributor to global plastic pollution, producing over 2.5 million tons of plastic waste yearly. In June 2024, Nigeria, aligning with several other African nations, announced its commitment to combat the global plastic crisis by instituting a ban on single-use plastics. This move is poised to influence the broader flexible packaging market.

Africa Flexible Packaging Market Trends

The Pouches Segment is Expected to Hold Significant Market Share

- Pouch packaging is becoming the go-to choice for its unmatched convenience and portability. Stand-up pouches shield their contents from moisture, vapor, odors, pests, air, and light. Additionally, consumers are drawn to the aesthetic appeal and added conveniences of these pouches, such as spouts, zippers, and handles. These preferences are driving the popularity of stand-up pouches. Stand-up pouches, being lighter and using less material, also offer food producers a cost advantage in shipping compared to traditional rigid packaging. As the beverage industry in the region increasingly adopts pouches, market demand is poised for growth.

- Rigid containers consume more fossil fuels than flexible stand-up pouches equipped with zippers. Notably, these containers are six times heavier than their flexible counterparts. Additionally, the diverse printing options for these pouches enable innovative designs, enhancing the product's aesthetic appeal and reinforcing brand identity. Furthermore, rising innovations have introduced flexible foams, papers, and aluminum foils, marking a shift from traditional plastic raw materials in pouch manufacturing.

- Innovations are driving the shift from plastics to flexible foams, papers, and aluminum foils in pouch manufacturing. Additionally, African nations are ramping up local production, bolstered by rising investments from Asia and Europe. Consequently, foreign entities like Lupin and Dr. Reddy's are poised to enhance their production capacities. This trend is set to elevate the demand for healthcare packaging, encompassing pouches in Africa.

- The growing preference for pouch packaging in liquids like juices, detergents, and edible oils has spurred innovations in pouches with enhanced oxygen-barrier properties. These improvements are crucial in preserving and protecting the liquid contents from contamination. Furthermore, collaborations among stakeholders to develop recyclable flexible pouches while ensuring they retain their vital functionalities are bolstering market growth.

- Africa recorded a significant position on the list of the world's 20 fastest-growing economies in 2024. This growth can be attributed to the continent's policymakers, who have been diligently steering strategies toward economic diversification, particularly by channeling investments into pivotal growth sectors. Furthermore, the IMF highlighted a consistent upward trajectory in the region's GDP, showing robust support for its production and manufacturing landscape and an anticipated surge in demand for flexible packaging.

South Africa is Expected to Hold Major Market Share

- South Africa boasts a sophisticated food manufacturing industry and a high consumer market. The nation grapples with sluggish domestic economic growth. Manufacturers are challenged to control production costs while consistently meeting steady consumer demand. There is potential for increased investment in enhanced packaging solutions, which could boost efficiencies and aid in managing expenses.

- Moreover, South African food manufacturers are targeting the export market. They are expected to emphasize flexible packaging that ensures product consistency and quality, aligning with global food standards. The South African government also prioritizes the food and beverages industry as the most significant component of its manufacturing sector. It actively encourages the further development of agriculture and the agro-processing industry, which may support market growth in South Africa.

- Beauty product packaging increasingly relies on flexible plastic packages, which safeguard contents from oxidation and extend shelf life. South Africa's cosmetics industry grapples with hurdles from the nation's economic downturn. The GDP growth has notably decelerated, and challenges mount with high unemployment rates and dwindling disposable income. As a result, the personal care segment anticipates a deceleration in growth in the market studied.

- The South African Reserve Bank reported that quarterly consumer spending in South Africa has been following a growth trajectory, which supports the demand for flexible packaging in line with the growth of e-commerce and the retail landscape in the country.

- South Africa's economic growth and urbanization have surged access to processed and fast food. This shift is notably evident in urban centers, especially among the youth aged 12 to 24. Their evolving consumption patterns are driving the demand for ready-to-eat meals, beverages, and on-the-go food items, increasing the need for flexible packaging solutions, including bag- and pouch-based options.

Africa Flexible Packaging Industry Overview

The African flexible packaging market is moderately consolidated, with significant players such as Hana Packaging Limited, PrimePak Industries Nigeria Ltd, Aristocrat Industries Ltd, Constantia Afripack Flexibles Ltd, and Huhtamaki Group occupying most of the market share. The regional companies are forming multiple partnerships and mergers to increase their market share.

- January 2024 - Constantia Afripack Flexibles Ltd, in partnership with a South African customer, received a WorldStar Packaging Award for its "Comfort Fabric Softener and Sunlight Fabric Softener Pouches" in the 'Packaging Materials and Components' category. This achievement stands as a pivotal moment in Constantia Flexibles' journey. The pouches feature EcoLam, an innovative, recyclable mono-PE laminate known for its superior printability. Produced at Constantia Afripack, Constantia Flexibles' facility in South Africa, EcoLam is crafted from oriented polyethylene (OPE) using a specialized extrusion process, ensuring seamless processing of the mono-material, showing the company's priority on material innovations.

- December 2023 - Huhtamaki Group, a provider of flexible packaging solutions in Africa, revised its growth strategy for 2030. The updated strategy emphasizes boosting profitability in its core business while innovating sustainable packaging solutions for further expansion. In line with this, the food packaging manufacturer initiated a three-year program to accelerate its strategy's implementation and bolster its profitability. This move shows the company's emphasis on sustainable packaging innovations to remain competitive.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of Microeconomic Factors on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 The Increased Demand for Convenient Packaging

- 5.1.2 Longer Shelf Life and Changing Lifestyle of People

- 5.2 Market Challenges

- 5.2.1 Concerns Related to the Environment and Recycling

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Plastic

- 6.1.2 Paper

- 6.1.3 Aluminium Foil

- 6.2 By Product

- 6.2.1 Bags

- 6.2.2 Pouches

- 6.2.3 Wraps and Films

- 6.2.4 Other Products

- 6.3 By End User

- 6.3.1 Food

- 6.3.2 Beverage

- 6.3.3 Beauty and Personal Care

- 6.3.4 Home Care

- 6.3.5 Pharmaceutical

- 6.3.6 Other End User

- 6.4 By Country

- 6.4.1 South Africa

- 6.4.2 Nigeria

- 6.4.3 Egypt

- 6.4.4 Morocco

- 6.4.5 Kenya

- 6.4.6 Rest of Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Hana Packaging Limited

- 7.1.2 Sonnex Packaging Nigeria Ltd

- 7.1.3 Colpak Pty Ltd

- 7.1.4 PrimePak Industries Nigeria Ltd

- 7.1.5 Aristocrat Industries Ltd

- 7.1.6 CTP Flexibles Ltd

- 7.1.7 Constantia Afripack Flexibles Ltd

- 7.1.8 Huhtamaki Group

- 7.1.9 Amcor Group

- 7.1.10 Berry Global